In this day and age in which screens are the norm, the charm of tangible, printed materials hasn't diminished. If it's to aid in education as well as creative projects or simply adding an element of personalization to your area, 2020 Recovery Rebate Credit Amounts have become a valuable resource. This article will dive into the sphere of "2020 Recovery Rebate Credit Amounts," exploring the benefits of them, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest 2020 Recovery Rebate Credit Amounts Below

2020 Recovery Rebate Credit Amounts

2020 Recovery Rebate Credit Amounts -

How long will it take to get a refund If you are eligible for a refund of your 2020 income tax then the amount you receive for the Recovery Rebate Credit will be included as part of your 2020 tax refund It will not be issued separately

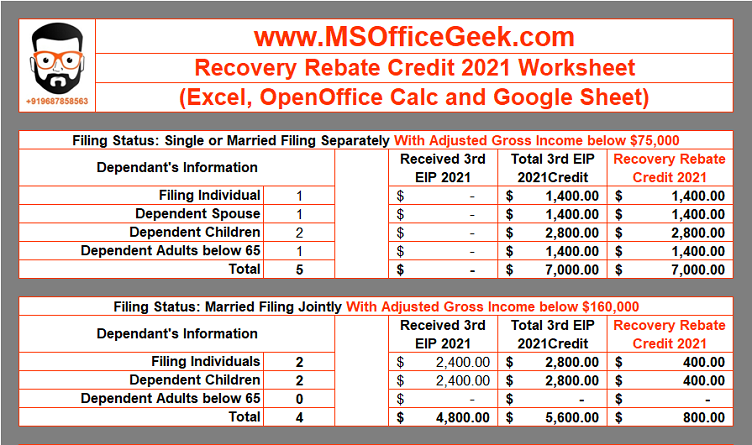

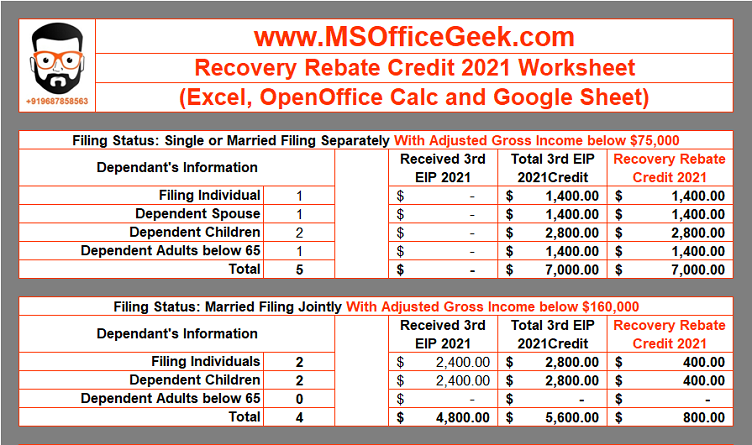

Anyone claiming a 2020 Recovery Rebate Credit needs to know their first and second Economic Impact Payment amounts to correctly calculate the credit Spouses filing a joint return for 2020 need to know the payment amounts for both spouses in order to claim the credit

Printables for free cover a broad range of printable, free items that are available online at no cost. They are available in numerous kinds, including worksheets templates, coloring pages, and many more. The appealingness of 2020 Recovery Rebate Credit Amounts is their flexibility and accessibility.

More of 2020 Recovery Rebate Credit Amounts

Recovery Rebate Credit Worksheet YouTube

Recovery Rebate Credit Worksheet YouTube

The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim the RRC on your 2020 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Tax Return for Seniors

All eligible individuals are entitled to a payment or credit of up to 1 200 for individuals or 2 400 for married couples filing jointly Eligible individuals also receive 500 for each qualifying child Tax preparers will need to be aware of available resources to assist clients in calculating the allowable recovery rebate credit

2020 Recovery Rebate Credit Amounts have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization This allows you to modify printing templates to your own specific requirements be it designing invitations and schedules, or even decorating your house.

-

Educational Benefits: Education-related printables at no charge can be used by students of all ages, making them a valuable tool for parents and educators.

-

It's easy: immediate access various designs and templates helps save time and effort.

Where to Find more 2020 Recovery Rebate Credit Amounts

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2020 Calculator KwameDawson

You received 1 200 plus 500 for each qualifying child you had in 2020 or You re filing a joint return for 2020 and together you and your spouse received 2 400 plus 500 for each qualifying child you had in 2020 And for EIP 2 You received 600 plus 600 for each qualifying child you had in 2020 or

The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult based on household adjusted gross income AGI plus

In the event that we've stirred your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in 2020 Recovery Rebate Credit Amounts for different reasons.

- Explore categories like the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free for flashcards, lessons, and worksheets. tools.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates free of charge.

- The blogs covered cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing 2020 Recovery Rebate Credit Amounts

Here are some new ways that you can make use use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home for the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

2020 Recovery Rebate Credit Amounts are a treasure trove of innovative and useful resources which cater to a wide range of needs and preferences. Their accessibility and flexibility make them an essential part of every aspect of your life, both professional and personal. Explore the vast collection of 2020 Recovery Rebate Credit Amounts today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can print and download these items for free.

-

Can I utilize free printables for commercial purposes?

- It's dependent on the particular terms of use. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables could be restricted regarding usage. Check the terms and conditions offered by the author.

-

How can I print 2020 Recovery Rebate Credit Amounts?

- Print them at home using either a printer at home or in an in-store print shop to get top quality prints.

-

What software do I need to open printables for free?

- The majority of printables are with PDF formats, which can be opened with free software, such as Adobe Reader.

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Form Printable Rebate Form

Check more sample of 2020 Recovery Rebate Credit Amounts below

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

The Recovery Rebate Credit Calculator ShauntelRaya

2020 Recovery Rebate Credit FAQs Updated Again Elmbrook Tax Accounting

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

The Recovery Rebate Credit Calculator MollieAilie

https://www.irs.gov/newsroom/2020-recovery-rebate...

Anyone claiming a 2020 Recovery Rebate Credit needs to know their first and second Economic Impact Payment amounts to correctly calculate the credit Spouses filing a joint return for 2020 need to know the payment amounts for both spouses in order to claim the credit

https://www.irs.gov/newsroom/recovery-rebate-credit

Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible individuals claim the credit Do Not claim any missing first or second payments on your 2021 tax return

Anyone claiming a 2020 Recovery Rebate Credit needs to know their first and second Economic Impact Payment amounts to correctly calculate the credit Spouses filing a joint return for 2020 need to know the payment amounts for both spouses in order to claim the credit

Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible individuals claim the credit Do Not claim any missing first or second payments on your 2021 tax return

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

The Recovery Rebate Credit Calculator ShauntelRaya

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

The Recovery Rebate Credit Calculator MollieAilie

Everything You Need To Know About The Recovery Rebate Credit SaverLife

Recovery Rebate Credit 2020 Calculator KwameDawson Recovery Rebate

Recovery Rebate Credit 2020 Calculator KwameDawson Recovery Rebate

Recovery Rebate Credit 2023