In this digital age, where screens rule our lives and the appeal of physical printed material hasn't diminished. In the case of educational materials project ideas, artistic or just adding an element of personalization to your home, printables for free are now a vital resource. With this guide, you'll take a dive into the world "2023 Federal Tax Credit For Solar Panels," exploring the benefits of them, where they are available, and how they can be used to enhance different aspects of your lives.

Get Latest 2023 Federal Tax Credit For Solar Panels Below

2023 Federal Tax Credit For Solar Panels

2023 Federal Tax Credit For Solar Panels -

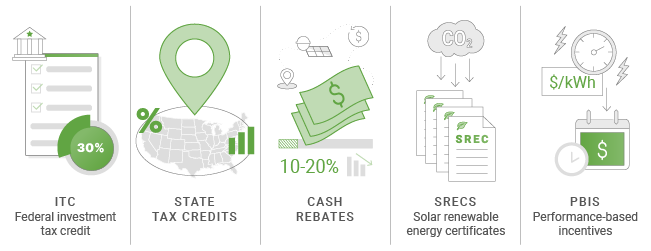

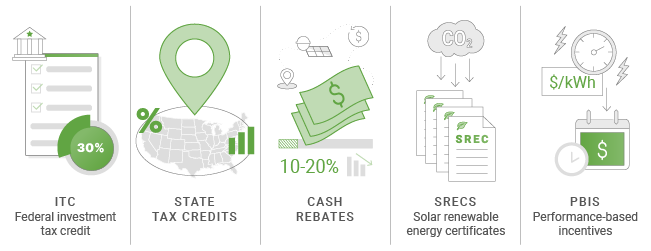

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

2023 Federal Tax Credit For Solar Panels offer a wide variety of printable, downloadable items that are available online at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages and more. The great thing about 2023 Federal Tax Credit For Solar Panels lies in their versatility as well as accessibility.

More of 2023 Federal Tax Credit For Solar Panels

Federal Tax Credit For Solar Panels In 2023

Federal Tax Credit For Solar Panels In 2023

IRS Tax Tip 2023 68 May 16 2023 Homeowners who make improvements like replacing old doors and windows installing solar panels or upgrading a hot water heater may qualify for home energy tax credits They should know what these credits can do for them and be careful of exaggerated claims companies trying to get their business may make

The Investment Tax Credit ITC or solar federal tax credit is a nationwide incentive for homeowners and business owners who install solar panels The credit is worth 30 of your

2023 Federal Tax Credit For Solar Panels have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization Your HTML0 customization options allow you to customize printed materials to meet your requirements when it comes to designing invitations or arranging your schedule or decorating your home.

-

Educational Value: Printables for education that are free are designed to appeal to students of all ages, making them a useful device for teachers and parents.

-

Convenience: immediate access an array of designs and templates can save you time and energy.

Where to Find more 2023 Federal Tax Credit For Solar Panels

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

Aug 8 2024 Americans claimed more than 8 billion in climate friendly tax credits under the Inflation Reduction Act last year according to new data released by the Treasury Department a

Since we've got your interest in 2023 Federal Tax Credit For Solar Panels, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of 2023 Federal Tax Credit For Solar Panels to suit a variety of goals.

- Explore categories like decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, everything from DIY projects to party planning.

Maximizing 2023 Federal Tax Credit For Solar Panels

Here are some unique ways how you could make the most of 2023 Federal Tax Credit For Solar Panels:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free for teaching at-home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

2023 Federal Tax Credit For Solar Panels are an abundance of useful and creative resources that cater to various needs and pursuits. Their access and versatility makes them an invaluable addition to any professional or personal life. Explore the endless world of 2023 Federal Tax Credit For Solar Panels today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes they are! You can print and download these files for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on the terms of use. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright problems with 2023 Federal Tax Credit For Solar Panels?

- Some printables may come with restrictions concerning their use. Be sure to check the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in an in-store print shop to get superior prints.

-

What program must I use to open printables free of charge?

- A majority of printed materials are in PDF format. These can be opened using free software such as Adobe Reader.

10 FAQs About The Federal Solar Tax Credit Answered

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Check more sample of 2023 Federal Tax Credit For Solar Panels below

Congress Extends Federal Tax Credit For Solar Panels Through 2024 A

Federal Tax Credit For Solar Power

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

How To Get Free Solar Panels Installed In Pennsylvania October 2023

https://www.energy.gov/eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

https://www.energy.gov/sites/default/files/2023-03/...

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Yes Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Federal Tax Credit For Solar Power

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

How To Get Free Solar Panels Installed In Pennsylvania October 2023

Federal Solar Tax Credit In New London County Connecticut

Solar Rebates And Incentives EnergySage

Solar Rebates And Incentives EnergySage

How Does The Federal Solar Tax Credit Work In 2022 And Beyond