In a world where screens have become the dominant feature of our lives The appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education or creative projects, or simply to add an individual touch to the area, 2023 Federal Tax Deduction For Seniors have become an invaluable resource. We'll take a dive into the world "2023 Federal Tax Deduction For Seniors," exploring the benefits of them, where to locate them, and how they can enrich various aspects of your life.

Get Latest 2023 Federal Tax Deduction For Seniors Below

2023 Federal Tax Deduction For Seniors

2023 Federal Tax Deduction For Seniors -

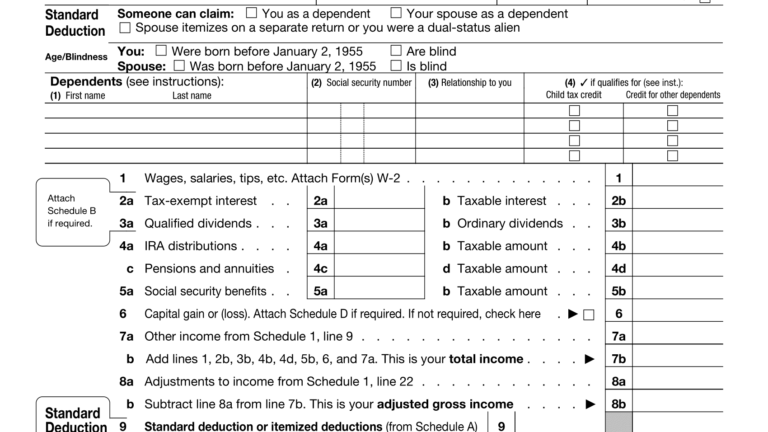

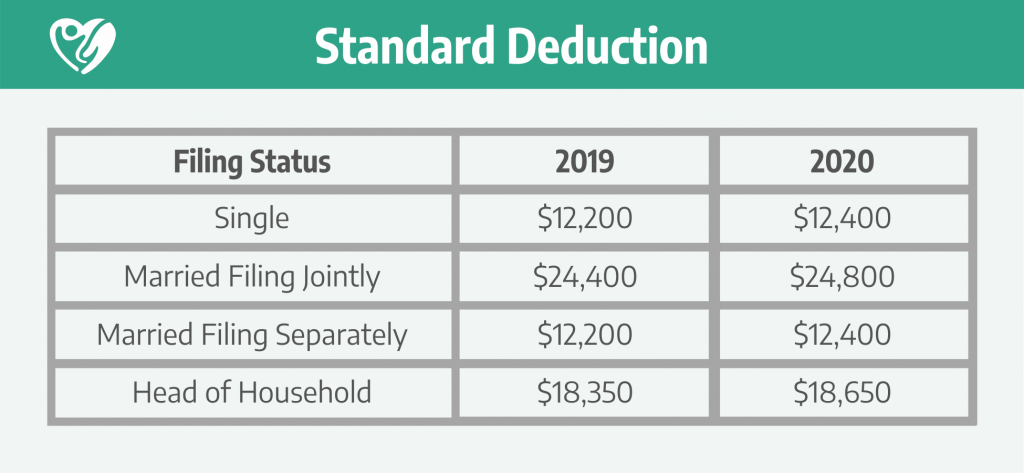

Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard Deduction

Taxpayers 65 and older qualify for an additional standard deduction reducing their taxable income The extra deduction amount differs based on filing status and whether the taxpayer or spouse

2023 Federal Tax Deduction For Seniors encompass a wide range of printable, free documents that can be downloaded online at no cost. These materials come in a variety of kinds, including worksheets coloring pages, templates and more. The great thing about 2023 Federal Tax Deduction For Seniors is their versatility and accessibility.

More of 2023 Federal Tax Deduction For Seniors

Top Tax Breaks And Deductions For Seniors Hello Krystof

Top Tax Breaks And Deductions For Seniors Hello Krystof

The additional standard deduction for someone who is 65 or older will rise to 1 500 per person from 1 400 in 2022 if that senior is unmarried the additional deduction

Taxpayers who are blind or at least age 65 can claim an additional standard deduction of 1 500 per person for 2023 up from the 1 400 in tax year 2022 or 1 850 if they are unmarried and not a surviving spouse

2023 Federal Tax Deduction For Seniors have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Flexible: There is the possibility of tailoring printables to your specific needs such as designing invitations or arranging your schedule or even decorating your house.

-

Education Value Educational printables that can be downloaded for free provide for students of all ages. This makes them a useful device for teachers and parents.

-

Simple: Instant access to various designs and templates is time-saving and saves effort.

Where to Find more 2023 Federal Tax Deduction For Seniors

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

For tax year 2023 you re considered 65 if you were born before Jan 2 1959 the IRS said If you or your spouse were also legally blind by year s end or have a doctor s note

Deduction for taxpayers who are blind or age 65 or older as well as special rules that limit the standard deduction available to dependents In addition this section helps you decide whether

Now that we've ignited your interest in 2023 Federal Tax Deduction For Seniors, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of 2023 Federal Tax Deduction For Seniors designed for a variety uses.

- Explore categories like interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- The blogs covered cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing 2023 Federal Tax Deduction For Seniors

Here are some creative ways for you to get the best of 2023 Federal Tax Deduction For Seniors:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

2023 Federal Tax Deduction For Seniors are an abundance of useful and creative resources which cater to a wide range of needs and hobbies. Their availability and versatility make these printables a useful addition to each day life. Explore the vast array of 2023 Federal Tax Deduction For Seniors to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can print and download these resources at no cost.

-

Do I have the right to use free printables for commercial purposes?

- It's all dependent on the usage guidelines. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with 2023 Federal Tax Deduction For Seniors?

- Some printables could have limitations in their usage. You should read the terms of service and conditions provided by the designer.

-

How can I print printables for free?

- You can print them at home with your printer or visit an in-store print shop to get high-quality prints.

-

What software must I use to open printables for free?

- The majority of PDF documents are provided in PDF format, which can be opened using free software such as Adobe Reader.

Common Health Medical Tax Deductions For Seniors In 2022 In 2022

2022 Us Tax Brackets Irs

Check more sample of 2023 Federal Tax Deduction For Seniors below

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

2023 Standard Deduction The Berkshire Edge

Top Six Tax Deductions For Seniors And Retirees Accutaxinc

2021 Taxes For Retirees Explained Cardinal Guide

What Is The Standard Federal Tax Deduction Ericvisser

IRS Releases Key 2021 Tax Information standarddeduction2021

https://www.kiplinger.com/taxes/extra …

Taxpayers 65 and older qualify for an additional standard deduction reducing their taxable income The extra deduction amount differs based on filing status and whether the taxpayer or spouse

https://www.usatoday.com/.../standard-deductions-2023

Taxpayers who are age 65 or older can claim an additional standard deduction which is added to the regular standard deduction For the 2024 tax year for forms you file in

Taxpayers 65 and older qualify for an additional standard deduction reducing their taxable income The extra deduction amount differs based on filing status and whether the taxpayer or spouse

Taxpayers who are age 65 or older can claim an additional standard deduction which is added to the regular standard deduction For the 2024 tax year for forms you file in

2021 Taxes For Retirees Explained Cardinal Guide

2023 Standard Deduction The Berkshire Edge

What Is The Standard Federal Tax Deduction Ericvisser

IRS Releases Key 2021 Tax Information standarddeduction2021

Standard Deduction 2020 TAX

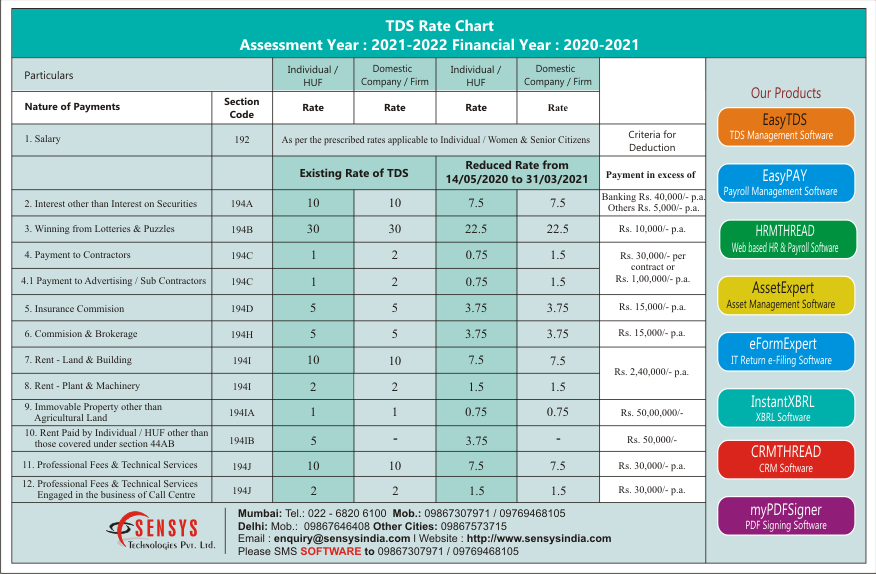

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

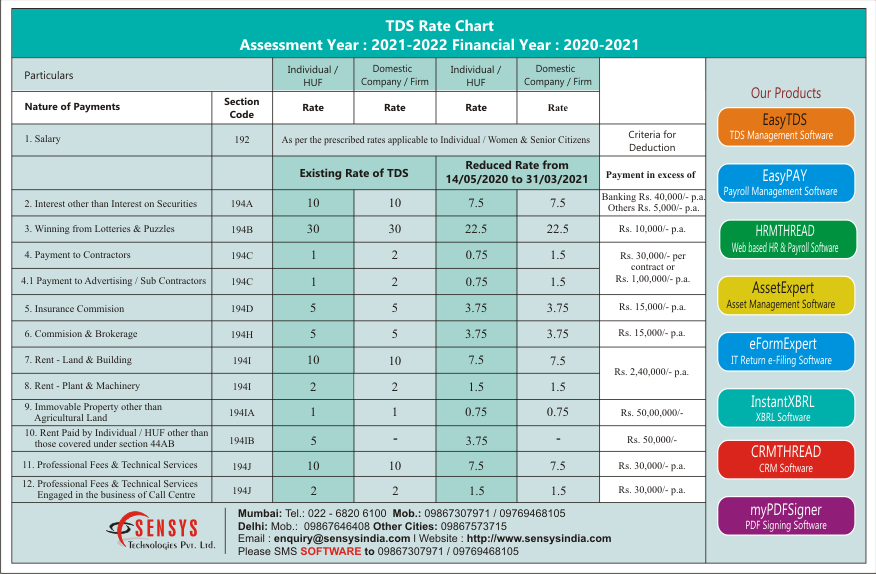

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

The 2023 Tax Brackets By Income Modern Husbands