In the digital age, where screens rule our lives however, the attraction of tangible printed products hasn't decreased. Whatever the reason, whether for education as well as creative projects or simply adding a personal touch to your home, printables for free have become an invaluable source. For this piece, we'll dive through the vast world of "2023 First Time Home Buyer Tax Credit Act," exploring the benefits of them, where they are, and ways they can help you improve many aspects of your daily life.

Get Latest 2023 First Time Home Buyer Tax Credit Act Below

2023 First Time Home Buyer Tax Credit Act

2023 First Time Home Buyer Tax Credit Act -

The U S federal government offered a tax credit program to first time homebuyers including those who hadn t owned a home in three years from 2008 2010 In his 2024 State of the Union

The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation over the next five years here s how big the tax credit can get 2024 Maximum tax credit of 15 000

2023 First Time Home Buyer Tax Credit Act encompass a wide assortment of printable documents that can be downloaded online at no cost. They are available in numerous forms, like worksheets coloring pages, templates and many more. The beauty of 2023 First Time Home Buyer Tax Credit Act is their flexibility and accessibility.

More of 2023 First Time Home Buyer Tax Credit Act

How To Qualify For First Time Home Buyer Tax Credit TaxesTalk

How To Qualify For First Time Home Buyer Tax Credit TaxesTalk

The First Time Homebuyer Act of 2024 commonly called the 15 000 First Time Home Buyer Tax Credit gives first time home buyers a tax credit that can be applied toward down payment and closing costs at settlement or issued as a cash payment from the U S Treasury The program s minimum eligibility standards include

The 2023 plan is part of the DASH Decent Affordable Safe Housing for All Act which is officially U S Senate Bill 680 Under the proposal First time home buyers would get a tax credit of 20 of a home s purchase price with a maximum of 15 000

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization: They can make printed materials to meet your requirements when it comes to designing invitations making your schedule, or decorating your home.

-

Educational Worth: The free educational worksheets are designed to appeal to students from all ages, making them a vital tool for parents and educators.

-

An easy way to access HTML0: Fast access numerous designs and templates reduces time and effort.

Where to Find more 2023 First Time Home Buyer Tax Credit Act

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

How The Proposed 15 000 First Time Home Buyer Tax Credit Works PMR Loans

Introduced in the House of Representatives in April by Rep Earl Blumenauer and Rep Jimmy Panetta the First Time Homebuyer Act would establish a refundable tax credit of 10 of a home s

The First Time Homebuyer Tax Credit Act would support home ownership among lower and middle income Americans by establishing a refundable tax credit worth up to 10 of a home s purchase price to a maximum of 15 000 for first time homebuyers

We hope we've stimulated your curiosity about 2023 First Time Home Buyer Tax Credit Act Let's find out where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of motives.

- Explore categories such as the home, decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Great for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a wide range of interests, that includes DIY projects to party planning.

Maximizing 2023 First Time Home Buyer Tax Credit Act

Here are some ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

2023 First Time Home Buyer Tax Credit Act are a treasure trove of useful and creative resources designed to meet a range of needs and passions. Their availability and versatility make them a fantastic addition to your professional and personal life. Explore the vast world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes, they are! You can download and print these resources at no cost.

-

Can I use free printables for commercial purposes?

- It's determined by the specific usage guidelines. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may come with restrictions on usage. Make sure to read the terms and regulations provided by the designer.

-

How do I print 2023 First Time Home Buyer Tax Credit Act?

- You can print them at home with any printer or head to a local print shop for better quality prints.

-

What program is required to open printables for free?

- The majority are printed in the PDF format, and can be opened with free software, such as Adobe Reader.

First Time Home Buyer Tax Credit USDA LOANS USDA Home Loan USDA

Does The Government Help First Time Home Buyers KnowYourGovernment

Check more sample of 2023 First Time Home Buyer Tax Credit Act below

Biden s 25 000 First Time Home Buyer Tax Credit Downpayment Toward

Who Qualifies For Biden s 15 000 First Time Home Buyer Tax Credit

First Time Home Buyer Tax Credit So Many Opinions What To Do About It

The IRS Is Cracking Down On First Time Home Buyer Tax Credit Fraud

First Time Home Buyer Tax Credit Ended But Help Exists Trending Home News

First Time Home Buyer Tax Credit 2009 Highlights HomesMSP Real

https://homebuyer.com/learn/15000-first-time-home...

The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation over the next five years here s how big the tax credit can get 2024 Maximum tax credit of 15 000

https://www.irs.gov/publications/p530

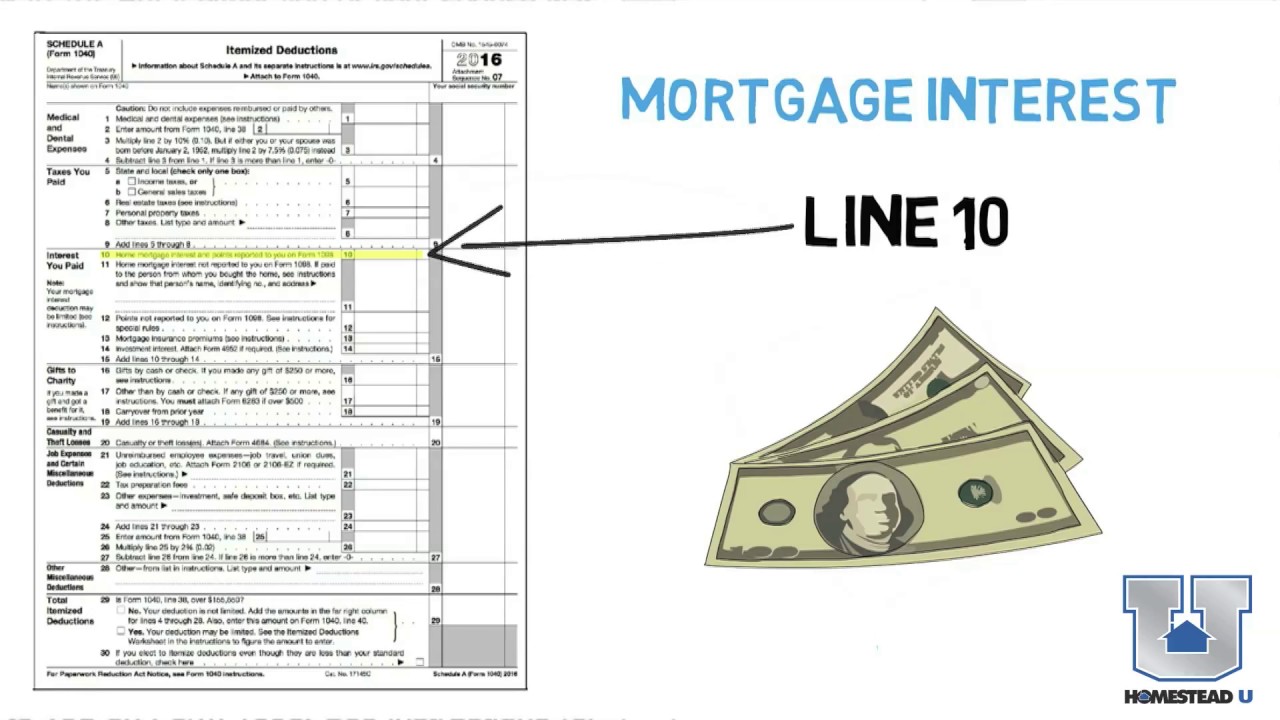

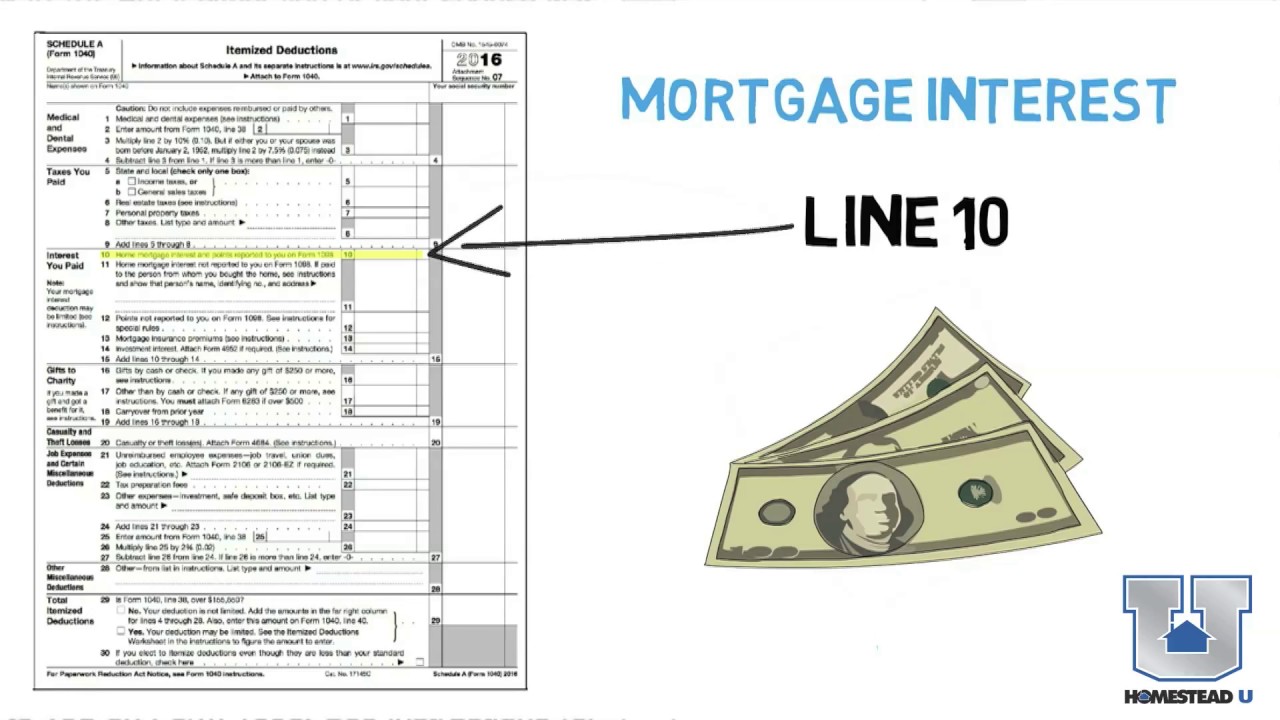

Repayment of first time homebuyer credit Generally you must repay any credit you claimed for a home you bought if you bought the home in 2008 See Form 5405 and its instructions for details and for exceptions to the repayment rule Home equity loan interest

The First Time Homebuyer Act pays eligible first time buyers a tax refund of 10 of a home s purchase price up to 15 000 and makes annual adjustments for inflation Assuming 3 percent inflation over the next five years here s how big the tax credit can get 2024 Maximum tax credit of 15 000

Repayment of first time homebuyer credit Generally you must repay any credit you claimed for a home you bought if you bought the home in 2008 See Form 5405 and its instructions for details and for exceptions to the repayment rule Home equity loan interest

The IRS Is Cracking Down On First Time Home Buyer Tax Credit Fraud

Who Qualifies For Biden s 15 000 First Time Home Buyer Tax Credit

First Time Home Buyer Tax Credit Ended But Help Exists Trending Home News

First Time Home Buyer Tax Credit 2009 Highlights HomesMSP Real

Home Buyer Tax Credit Can I Sell The Homestead To My Children

First Time Home Buyer Tax Preparation YouTube

First Time Home Buyer Tax Preparation YouTube

Biden s 15 000 First Time Home Buyer Tax Credit Explained YouTube