In this age of electronic devices, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects hasn't waned. In the case of educational materials or creative projects, or simply to add a personal touch to your space, 2024 Tax Credits are now a vital source. This article will take a dive through the vast world of "2024 Tax Credits," exploring the different types of printables, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest 2024 Tax Credits Below

2024 Tax Credits

2024 Tax Credits -

The Get ready page on IRS gov outlines steps taxpayers can take now to make filing easier in 2024 Here s what s new and what to consider before filing next year IRS Online Account enhancements

New Tax changes for Businesses and Individuals should know as per Finance Act 13 of 2023 Finance Act 13 of 2023 is finally here and it is packed with the following changes Corporate Income Tax Corporate Income Tax rate has been revised up to 24 with effect from w e f 1 January 2024

Printables for free cover a broad assortment of printable items that are available online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages, and much more. The value of 2024 Tax Credits lies in their versatility and accessibility.

More of 2024 Tax Credits

Energy Tax Credits Predicting The Tax Credit Marketplace Of 2024 And

Energy Tax Credits Predicting The Tax Credit Marketplace Of 2024 And

Some of the most popular tax credits fall into five categories If you qualify you can claim these 2023 tax credits on the tax return you file in 2024

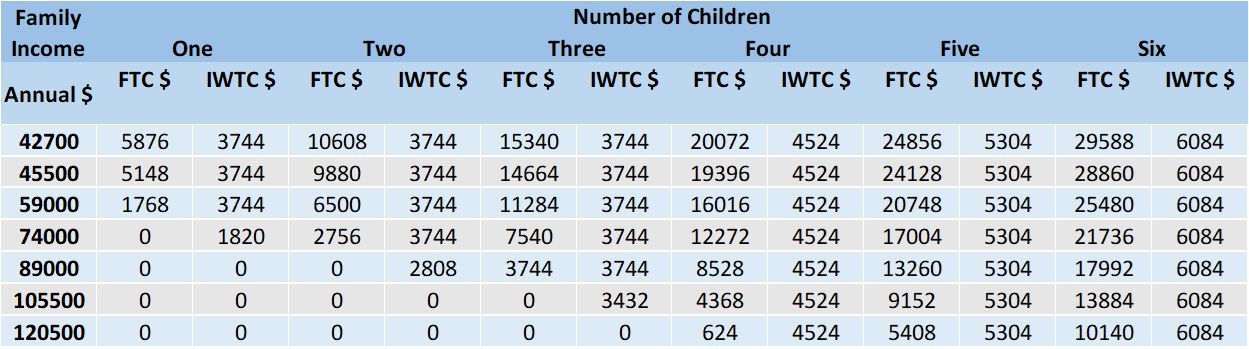

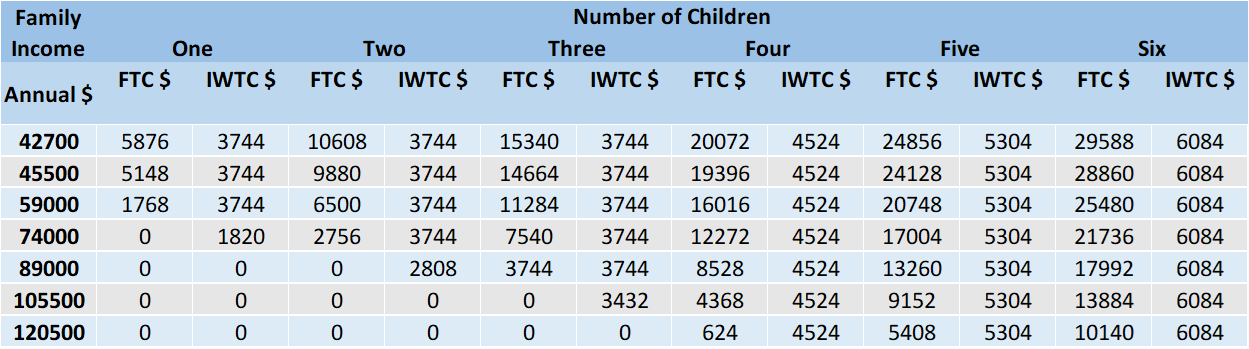

The tax year 2024 maximum Earned Income Tax Credit amount is 7 830 for qualifying taxpayers who have three or more qualifying children an increase of from 7 430 for tax year 2023 The revenue procedure contains a table providing maximum EITC amount for other categories income thresholds and phase outs

The 2024 Tax Credits have gained huge popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization: You can tailor the design to meet your needs be it designing invitations planning your schedule or even decorating your house.

-

Educational Value Downloads of educational content for free can be used by students of all ages, making them an essential device for teachers and parents.

-

The convenience of Fast access an array of designs and templates will save you time and effort.

Where to Find more 2024 Tax Credits

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

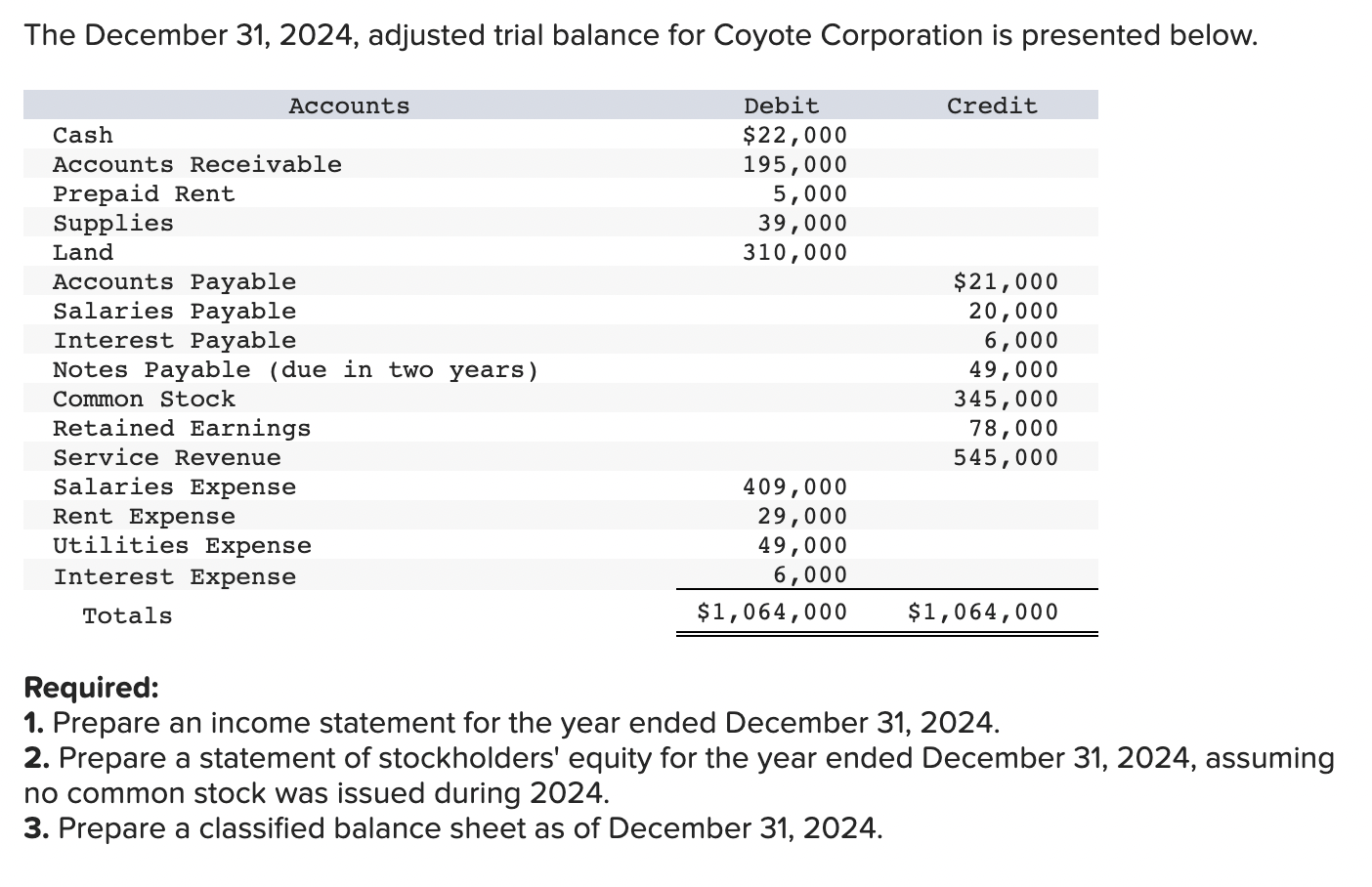

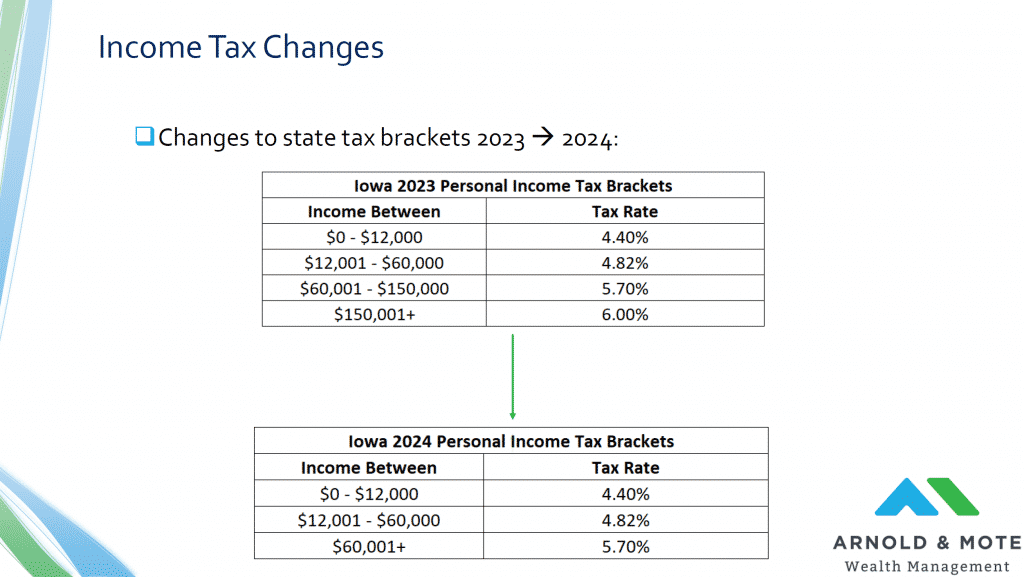

The federal income tax has seven tax rates in 2024 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 609 350 for single filers and above 731 200 for married couples filing jointly

As a result tax credits are generally more valuable but less common than deductions Top tax credits and deductions for 2024 There are numerous tax credits and deductions though many are only available to qualifying filers Some of the most common deductions include Child Tax Credit CTC

In the event that we've stirred your interest in 2024 Tax Credits Let's look into where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of 2024 Tax Credits for various reasons.

- Explore categories such as furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching materials.

- Ideal for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide selection of subjects, that includes DIY projects to planning a party.

Maximizing 2024 Tax Credits

Here are some fresh ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

2024 Tax Credits are an abundance filled with creative and practical information that satisfy a wide range of requirements and hobbies. Their availability and versatility make them a valuable addition to both personal and professional life. Explore the wide world that is 2024 Tax Credits today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can download and print the resources for free.

-

Are there any free printing templates for commercial purposes?

- It's dependent on the particular usage guidelines. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables could be restricted concerning their use. Check the conditions and terms of use provided by the creator.

-

How do I print 2024 Tax Credits?

- Print them at home with your printer or visit an area print shop for premium prints.

-

What software do I require to view printables free of charge?

- Many printables are offered in PDF format. They is open with no cost programs like Adobe Reader.

EV Tax Credits All The 2023 And 2024 Electric Cars And Trucks That Get

Franking Credit Refund 2023 Atotaxrates info

Check more sample of 2024 Tax Credits below

Tesla Says Model 3 Model Y Tax Credits Likely To Be Reduced By 2024

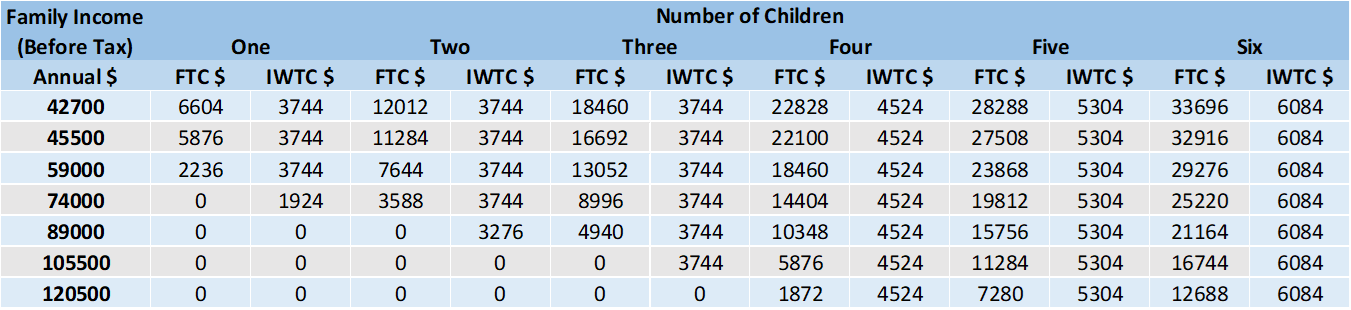

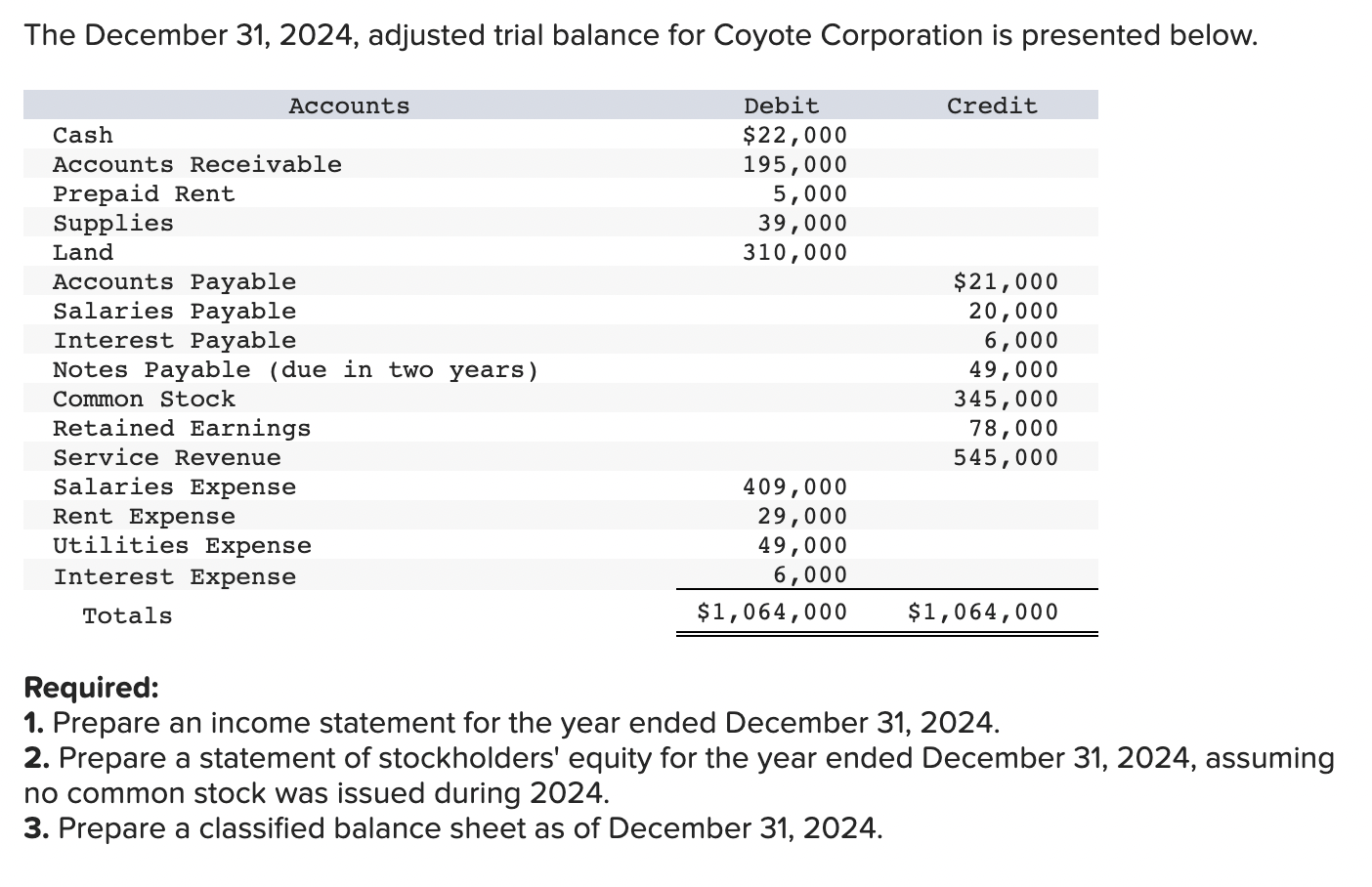

Solved The December 31 2024 Adjusted Trial Balance For Chegg

Tax Season Start Date 2023 2024

Payroll Tax Withholding Calculator 2023 SallieJersey

Some Might See A Bigger 2024 Tax Refund After Inflation Adjustments

Federal Solar Tax Credits For Businesses Department Of Energy

http://lucent.co.zw/tax/zimbabwe-2024-new-tax-changes-as...

New Tax changes for Businesses and Individuals should know as per Finance Act 13 of 2023 Finance Act 13 of 2023 is finally here and it is packed with the following changes Corporate Income Tax Corporate Income Tax rate has been revised up to 24 with effect from w e f 1 January 2024

https://www.zimra.co.zw/domestic-taxes/tax-tables

RTGS 2022 January July 2022 Tax Tables RTGS 2022 January July 2022 Tax Tables pdf Download

New Tax changes for Businesses and Individuals should know as per Finance Act 13 of 2023 Finance Act 13 of 2023 is finally here and it is packed with the following changes Corporate Income Tax Corporate Income Tax rate has been revised up to 24 with effect from w e f 1 January 2024

RTGS 2022 January July 2022 Tax Tables RTGS 2022 January July 2022 Tax Tables pdf Download

Payroll Tax Withholding Calculator 2023 SallieJersey

Solved The December 31 2024 Adjusted Trial Balance For Chegg

Some Might See A Bigger 2024 Tax Refund After Inflation Adjustments

Federal Solar Tax Credits For Businesses Department Of Energy

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

New Home Construction Tax Credits 2023 2024 Building The Future WICZ

New Home Construction Tax Credits 2023 2024 Building The Future WICZ

Why Advisors Should Get A Leg Up On The 2024 Tax Season Right Now