In the digital age, in which screens are the norm The appeal of tangible printed objects hasn't waned. In the case of educational materials, creative projects, or simply adding an extra personal touch to your space, 30 Federal Solar Tax Credit Extended have proven to be a valuable resource. For this piece, we'll dive deeper into "30 Federal Solar Tax Credit Extended," exploring what they are, where to get them, as well as how they can be used to enhance different aspects of your daily life.

Get Latest 30 Federal Solar Tax Credit Extended Below

30 Federal Solar Tax Credit Extended

30 Federal Solar Tax Credit Extended -

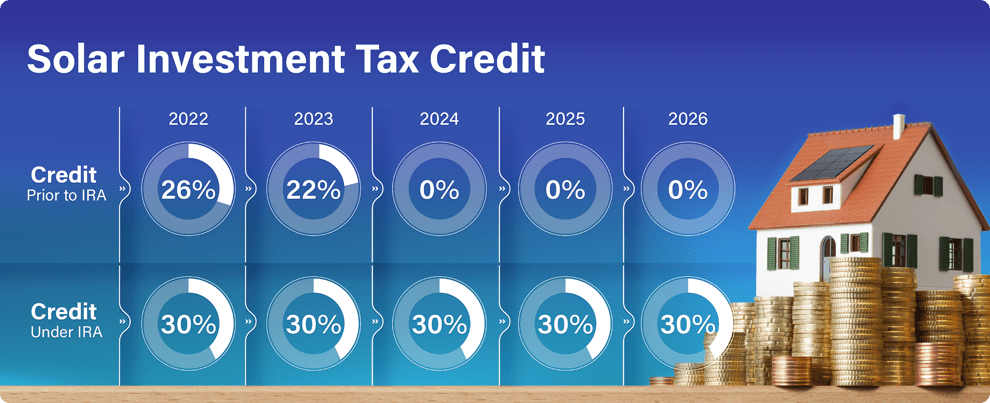

The Inflation Reduction Act expanded the federal solar tax credit to 30 until 2032 We ll show you exactly how to take advantage of it

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for

30 Federal Solar Tax Credit Extended cover a large collection of printable materials online, at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and many more. The great thing about 30 Federal Solar Tax Credit Extended is their versatility and accessibility.

More of 30 Federal Solar Tax Credit Extended

Solar Tax Credit Calculator KareenRoabie

Solar Tax Credit Calculator KareenRoabie

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy

If you install solar energy equipment in your home anytime in the year of 2022 through the end of 2032 you re entitled to a credit on your federal taxes equal to 30 of the cost of eligible

30 Federal Solar Tax Credit Extended have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Individualization It is possible to tailor the templates to meet your individual needs whether you're designing invitations or arranging your schedule or decorating your home.

-

Educational value: Free educational printables cater to learners of all ages, making them a great resource for educators and parents.

-

Accessibility: Instant access to numerous designs and templates is time-saving and saves effort.

Where to Find more 30 Federal Solar Tax Credit Extended

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar from 2022 to 2032 That s 30 of the gross amount paid for the system and its installation You will need four IRS tax

A1 The following residential clean energy expenditures are eligible for a Residential Clean Energy Property Credit of 30 of the cost solar electric property expenditures solar

After we've peaked your interest in printables for free Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with 30 Federal Solar Tax Credit Extended for all reasons.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- These blogs cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing 30 Federal Solar Tax Credit Extended

Here are some innovative ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

30 Federal Solar Tax Credit Extended are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and preferences. Their accessibility and flexibility make these printables a useful addition to every aspect of your life, both professional and personal. Explore the vast collection of 30 Federal Solar Tax Credit Extended now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes, they are! You can print and download these tools for free.

-

Can I utilize free printouts for commercial usage?

- It depends on the specific rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may have restrictions in use. Always read these terms and conditions as set out by the author.

-

How can I print printables for free?

- You can print them at home with the printer, or go to an in-store print shop to get the highest quality prints.

-

What software do I need to run 30 Federal Solar Tax Credit Extended?

- The majority of printed documents are in PDF format. These is open with no cost software such as Adobe Reader.

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

Check more sample of 30 Federal Solar Tax Credit Extended below

Enphase Encharge Battery Best Solar Battery Storage

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

Solar Tax Credit Extended Robco

Green Collar Living In The Mountain State 30 Federal Tax Credit

26 Federal Tax Credit Extended Stateline Solar

Federal Solar Tax Credit Extended The New Mexico Solar Energy Association

https://www.energy.gov › eere › solar › a…

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for

https://home.treasury.gov › news › press-releases

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy

Green Collar Living In The Mountain State 30 Federal Tax Credit

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

26 Federal Tax Credit Extended Stateline Solar

Federal Solar Tax Credit Extended The New Mexico Solar Energy Association

Federal Solar Tax Credit What It Is How To Claim It For 2023

Could The Federal Solar Tax Credit Be Repealed

Could The Federal Solar Tax Credit Be Repealed

Federal Tax Credit For Solar FederalProTalk