In this digital age, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. In the case of educational materials or creative projects, or simply adding an individual touch to your area, 30 Solar Tax Credit can be an excellent source. Through this post, we'll dive into the world "30 Solar Tax Credit," exploring the benefits of them, where they are available, and how they can improve various aspects of your lives.

Get Latest 30 Solar Tax Credit Below

30 Solar Tax Credit

30 Solar Tax Credit -

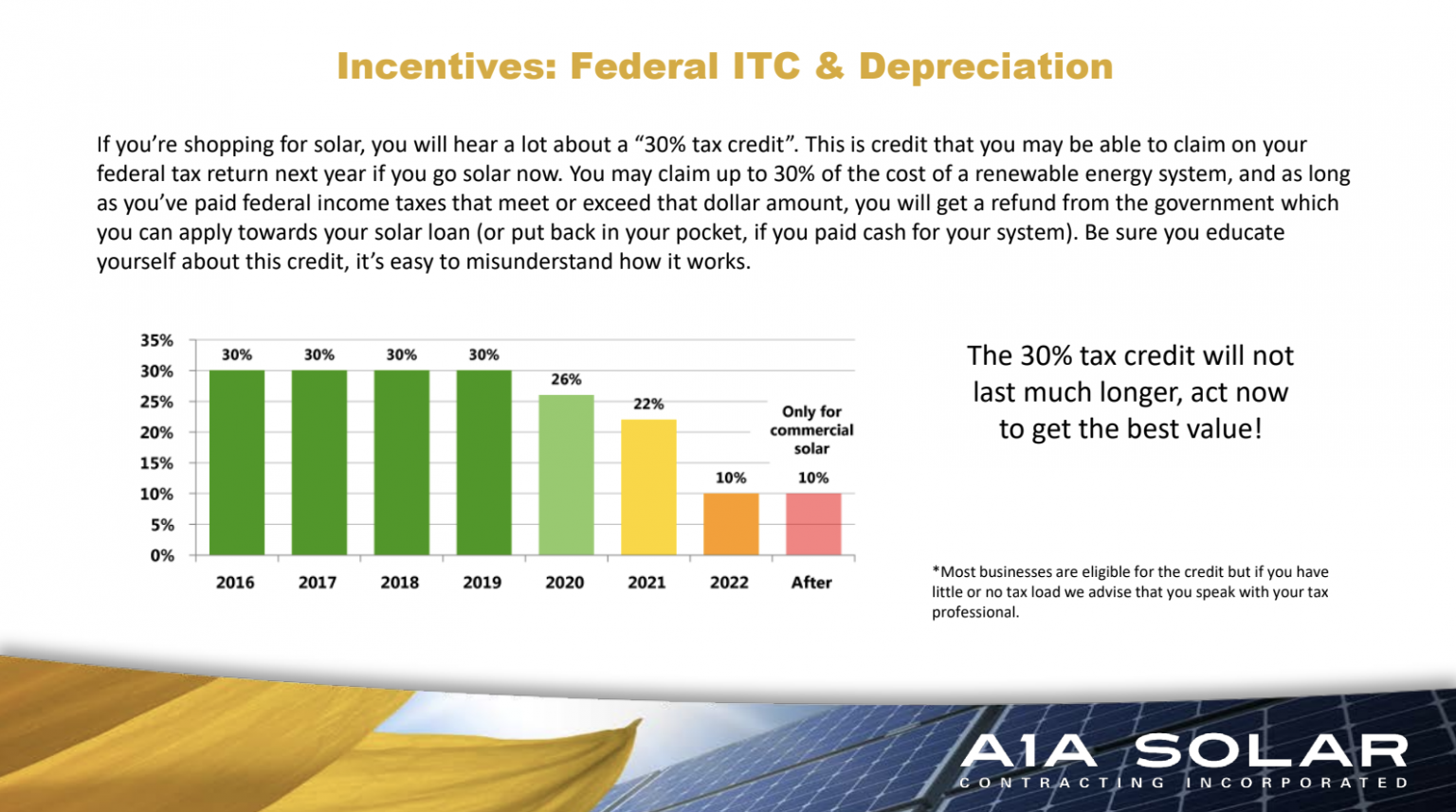

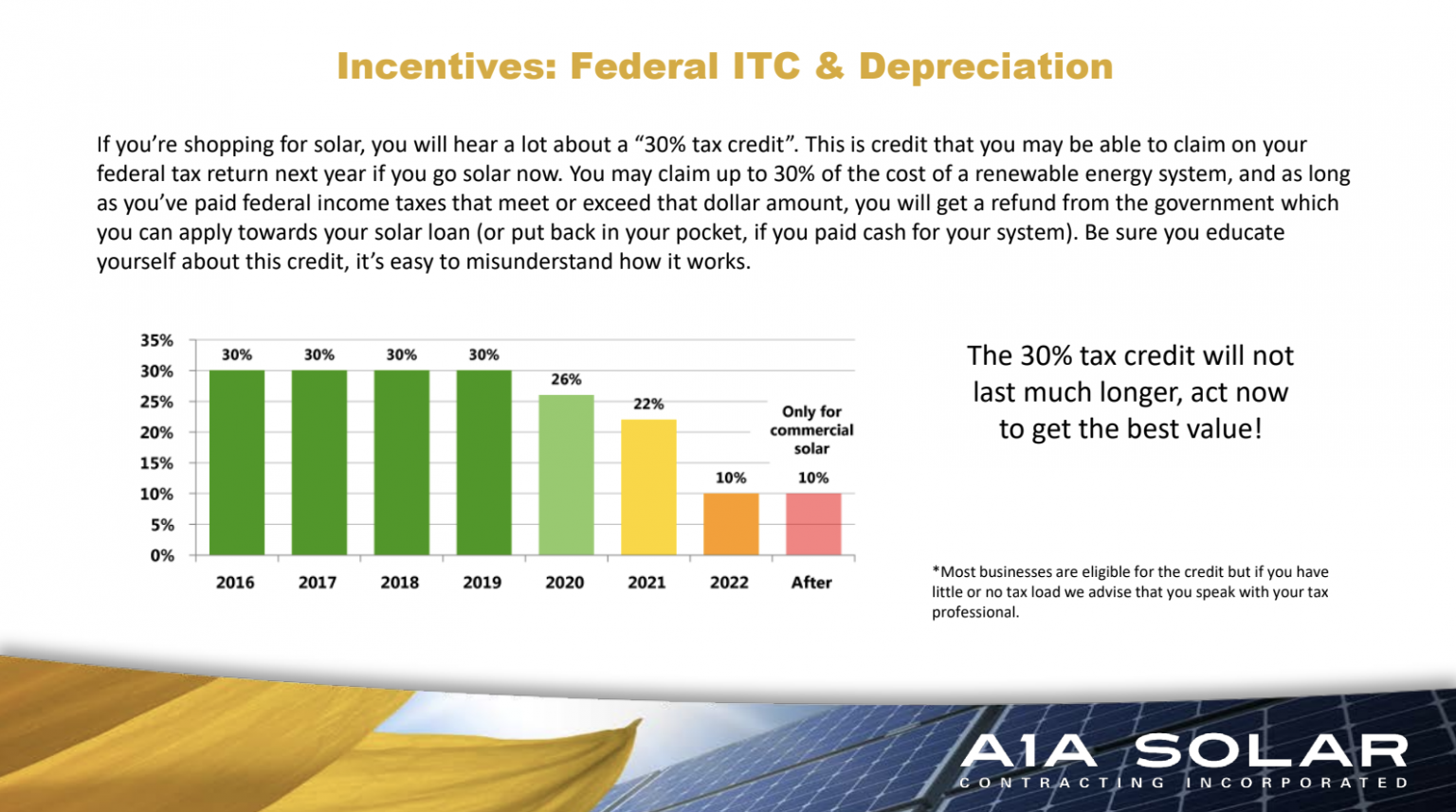

The bill calls for a 10 year extension at 30 of the cost of the installed equipment which will then step down to 26 in 2033 and 22 in 2034 The tax credit

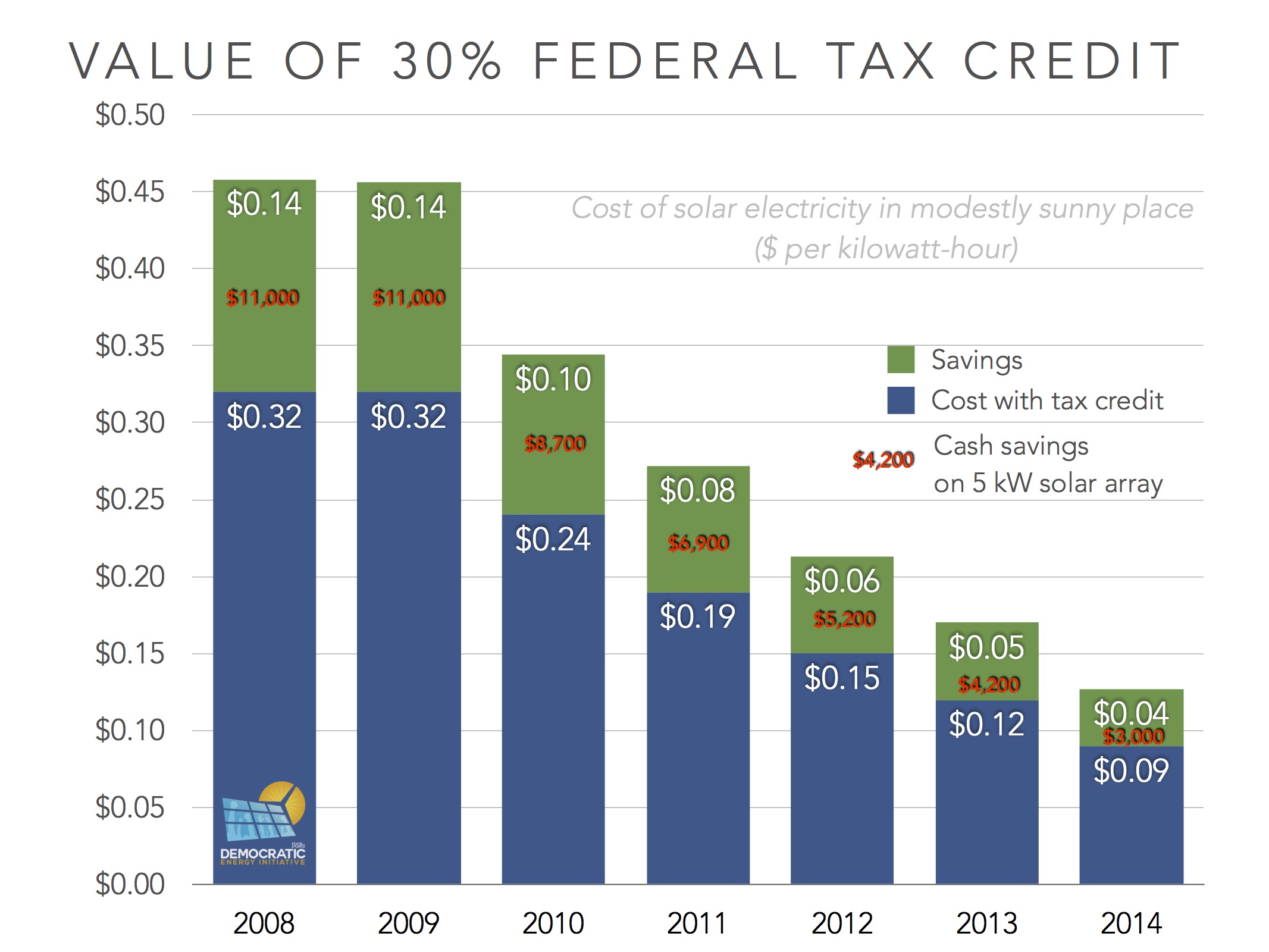

The Residential Clean Energy Credit is a dollar for dollar tax credit worth 30 of the total cost of solar and or battery storage expenditures As a non refundable

30 Solar Tax Credit encompass a wide range of printable, free materials available online at no cost. These resources come in many forms, like worksheets coloring pages, templates and more. The benefit of 30 Solar Tax Credit is their flexibility and accessibility.

More of 30 Solar Tax Credit

The Federal Solar Tax Credit Extension Can We Win If We Lose

The Federal Solar Tax Credit Extension Can We Win If We Lose

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

As written in the Inflation Reduction Act of 2022 the tax credit will begin at 30 and step down to 26 in 2033 and 22 in 2034

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

The ability to customize: There is the possibility of tailoring printed materials to meet your requirements when it comes to designing invitations and schedules, or decorating your home.

-

Educational Value Printables for education that are free are designed to appeal to students of all ages, making them an essential instrument for parents and teachers.

-

Convenience: Access to many designs and templates saves time and effort.

Where to Find more 30 Solar Tax Credit

30 Federal Solar Investment Tax Credit Sol Luna Solar

30 Federal Solar Investment Tax Credit Sol Luna Solar

The Residential Clean Energy Credit formerly known as the ITC is a tax credit worth 30 of the gross cost of your solar project parts labor the whole chalupa with no maximum incentive amount

If you buy and install a solar energy system at your home by the end of 2032 you are eligible for a federal tax credit for 30 percent of the cost including the

Now that we've piqued your interest in printables for free Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of reasons.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning tools.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- These blogs cover a wide range of interests, from DIY projects to party planning.

Maximizing 30 Solar Tax Credit

Here are some new ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home also in the classes.

3. Event Planning

- Create invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

30 Solar Tax Credit are a treasure trove of practical and innovative resources which cater to a wide range of needs and preferences. Their availability and versatility make them a wonderful addition to both professional and personal life. Explore the many options of 30 Solar Tax Credit now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these documents for free.

-

Can I use the free printables for commercial use?

- It's based on the usage guidelines. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may contain restrictions on use. Make sure you read these terms and conditions as set out by the author.

-

How can I print 30 Solar Tax Credit?

- You can print them at home with a printer or visit a print shop in your area for higher quality prints.

-

What program is required to open printables that are free?

- The majority of printables are as PDF files, which can be opened with free software such as Adobe Reader.

30 Solar Tax Credit Expires Soon YouTube

It s Not Doomsday But Neither Is Ending The Solar Tax Credit Good Policy

Check more sample of 30 Solar Tax Credit below

When Does Solar Tax Credit End SolarProGuide 2022

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Don t Forget To Claim Your Solar Tax Credits Solar Industry

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

A Guide To The 30 Solar Tax Credit Green Ridge Solar

30 Solar Tax Credit What Is It And How Much Can You Actually Save

https://www. solar.com /learn/federal-solar-tax-credit-steps-down

The Residential Clean Energy Credit is a dollar for dollar tax credit worth 30 of the total cost of solar and or battery storage expenditures As a non refundable

https://www. energy.gov /eere/solar/hom…

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems

The Residential Clean Energy Credit is a dollar for dollar tax credit worth 30 of the total cost of solar and or battery storage expenditures As a non refundable

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

A Guide To The 30 Solar Tax Credit Green Ridge Solar

30 Solar Tax Credit What Is It And How Much Can You Actually Save

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Benefits Of The Solar Investment Tax Credit For The Everyday Consumer

Benefits Of The Solar Investment Tax Credit For The Everyday Consumer

Claim Your 30 Solar Tax Credit Now To Save Big A M Sun Solar