Today, where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. In the case of educational materials and creative work, or simply adding an individual touch to your area, 7500 Ev Tax Credit Explained are now a vital source. Here, we'll take a dive deeper into "7500 Ev Tax Credit Explained," exploring the benefits of them, where they can be found, and how they can enhance various aspects of your lives.

Get Latest 7500 Ev Tax Credit Explained Below

7500 Ev Tax Credit Explained

7500 Ev Tax Credit Explained -

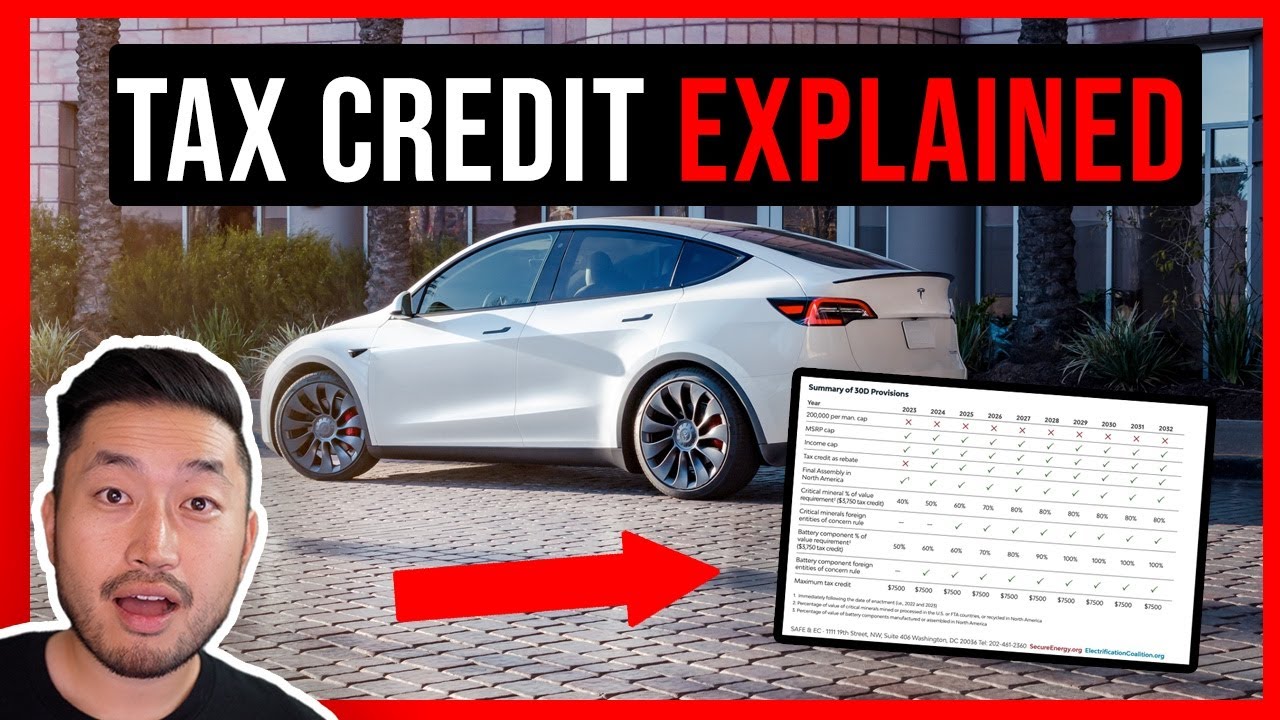

How the federal EV tax credit can save you 7 500 on a new plug in vehicle Written by Tim Levin Aug 31 2021 8 07 AM PDT 2021 Volkswagen ID 4 crossover Volkswagen The federal tax credit for

For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Justin

7500 Ev Tax Credit Explained cover a large range of printable, free material that is available online at no cost. They come in many forms, including worksheets, templates, coloring pages, and more. The appeal of printables for free is in their variety and accessibility.

More of 7500 Ev Tax Credit Explained

UAW Suggests EV Tax Credit Should Only Apply To US Built Cars

UAW Suggests EV Tax Credit Should Only Apply To US Built Cars

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models

It also amends the Qualified Plug in Electric Drive Motor Vehicle Credit also known as IRC 30D which gave consumers up to 7 500 in tax credits for buying a battery electric

7500 Ev Tax Credit Explained have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor print-ready templates to your specific requirements whether you're designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value: Printables for education that are free can be used by students of all ages, making them a useful tool for parents and teachers.

-

An easy way to access HTML0: immediate access the vast array of design and templates is time-saving and saves effort.

Where to Find more 7500 Ev Tax Credit Explained

The Inflation Reduction Act EV Tax Credits Explained History Computer

The Inflation Reduction Act EV Tax Credits Explained History Computer

What is the Inflation Reduction Act s EV tax credit Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for

Qualifying clean energy vehicle buyers are eligible for a tax credit of up to 7 500 Internal Revenue Service Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles

In the event that we've stirred your curiosity about 7500 Ev Tax Credit Explained We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in 7500 Ev Tax Credit Explained for different needs.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets with flashcards and other teaching tools.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- The blogs are a vast variety of topics, ranging from DIY projects to party planning.

Maximizing 7500 Ev Tax Credit Explained

Here are some inventive ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

7500 Ev Tax Credit Explained are an abundance of practical and innovative resources catering to different needs and pursuits. Their availability and versatility make them an essential part of each day life. Explore the vast world that is 7500 Ev Tax Credit Explained today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are 7500 Ev Tax Credit Explained truly gratis?

- Yes you can! You can print and download the resources for free.

-

Are there any free printables in commercial projects?

- It's based on the rules of usage. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables may be subject to restrictions in use. Be sure to review these terms and conditions as set out by the author.

-

How do I print 7500 Ev Tax Credit Explained?

- You can print them at home using the printer, or go to a print shop in your area for the highest quality prints.

-

What program do I need to open printables that are free?

- A majority of printed materials are in PDF format, which can be opened using free software, such as Adobe Reader.

TESLA EV TAX CREDIT EXPLAINED YouTube

7 500 EV Tax Credit In The Works Here s Why You Probably Won t Get

Check more sample of 7500 Ev Tax Credit Explained below

Here Are The Electric Vehicles That Are Eligible For The 7 500 Federal

California EV Tax Credit Explained 2022 2023

Kia s EV 7 500 Tax Credit Also Free 1 000 Hours Of Charge Time In

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

Build Back Better EV Tax Credit Explained An EXCITING Announcement

Electric Vehicle Tax Credit Save 7 500 With These EV s Today ZEV

https://www.npr.org/2023/01/07/1147209505

For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Justin

https://turbotax.intuit.com/tax-tips/going-green/...

The electric vehicle tax credit also known as the EV tax credit is a nonrefundable credit meant to lower the cost of qualifying plug in electric or other clean vehicles The credit is worth between 2 500 and 7 500 for the 2022 tax year and eligibility for claiming the credit depends on the number of electric vehicles sold by the

For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible Justin

The electric vehicle tax credit also known as the EV tax credit is a nonrefundable credit meant to lower the cost of qualifying plug in electric or other clean vehicles The credit is worth between 2 500 and 7 500 for the 2022 tax year and eligibility for claiming the credit depends on the number of electric vehicles sold by the

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

California EV Tax Credit Explained 2022 2023

Build Back Better EV Tax Credit Explained An EXCITING Announcement

Electric Vehicle Tax Credit Save 7 500 With These EV s Today ZEV

7500 EV Tax Credit Survives New House Tax Bill Kia Soul Ford Focus

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

The Minnesota EV Rebate Explained