Today, where screens dominate our lives The appeal of tangible printed items hasn't gone away. In the case of educational materials in creative or artistic projects, or simply adding the personal touch to your home, printables for free are now an essential source. Through this post, we'll dive in the world of "80c Deduction Conditions," exploring the benefits of them, where they are, and how they can be used to enhance different aspects of your life.

What Are 80c Deduction Conditions?

Printables for free include a vast assortment of printable documents that can be downloaded online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and many more. One of the advantages of 80c Deduction Conditions is their versatility and accessibility.

80c Deduction Conditions

80c Deduction Conditions

80c Deduction Conditions -

[desc-5]

[desc-1]

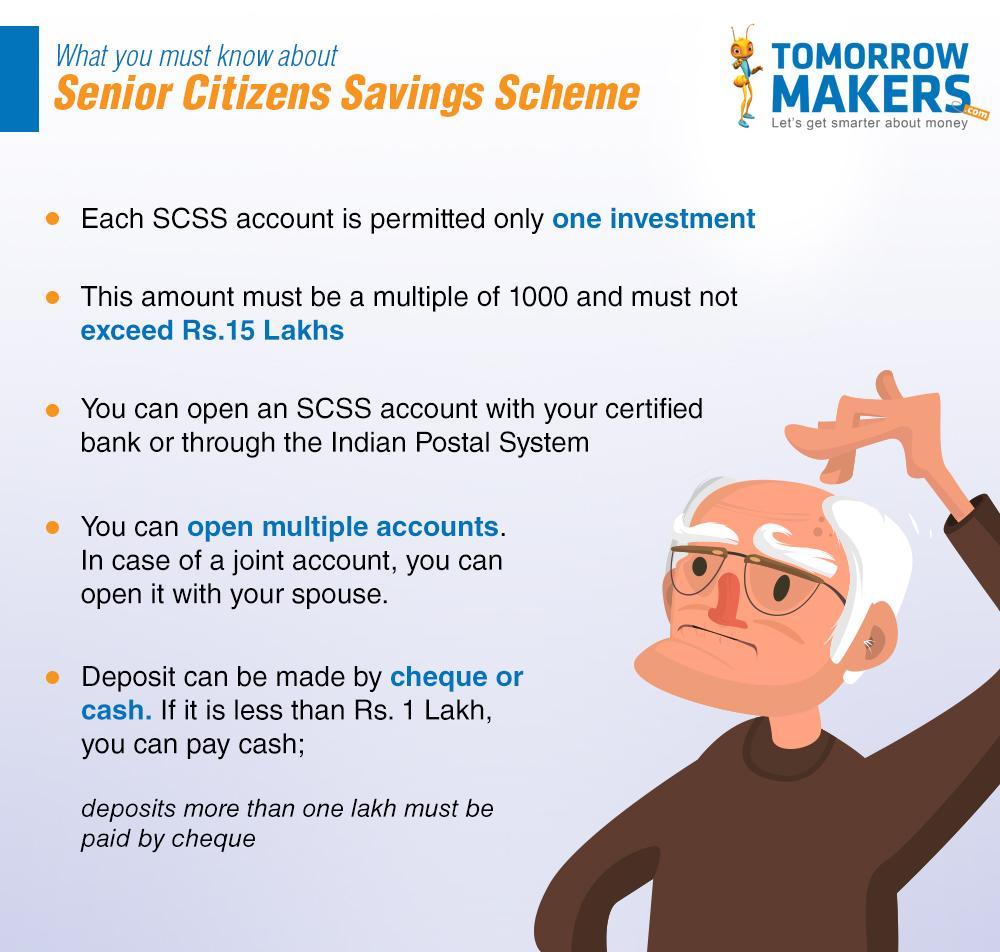

Tax Information Deductions On Section 80C 80CCC 80CCD

Tax Information Deductions On Section 80C 80CCC 80CCD

[desc-4]

[desc-6]

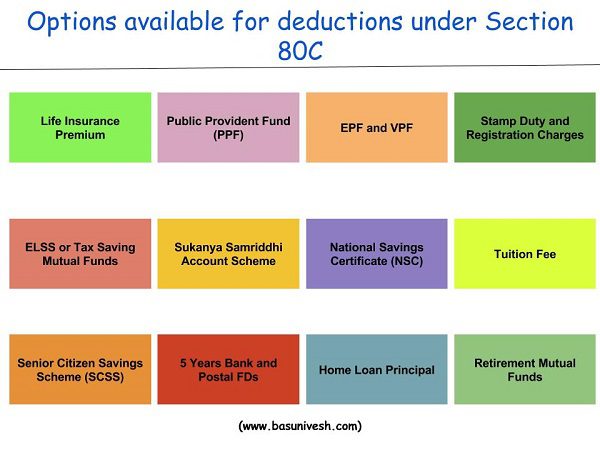

List Of Deductions Under Section 80C Finserv MARKETS

List Of Deductions Under Section 80C Finserv MARKETS

[desc-9]

[desc-7]

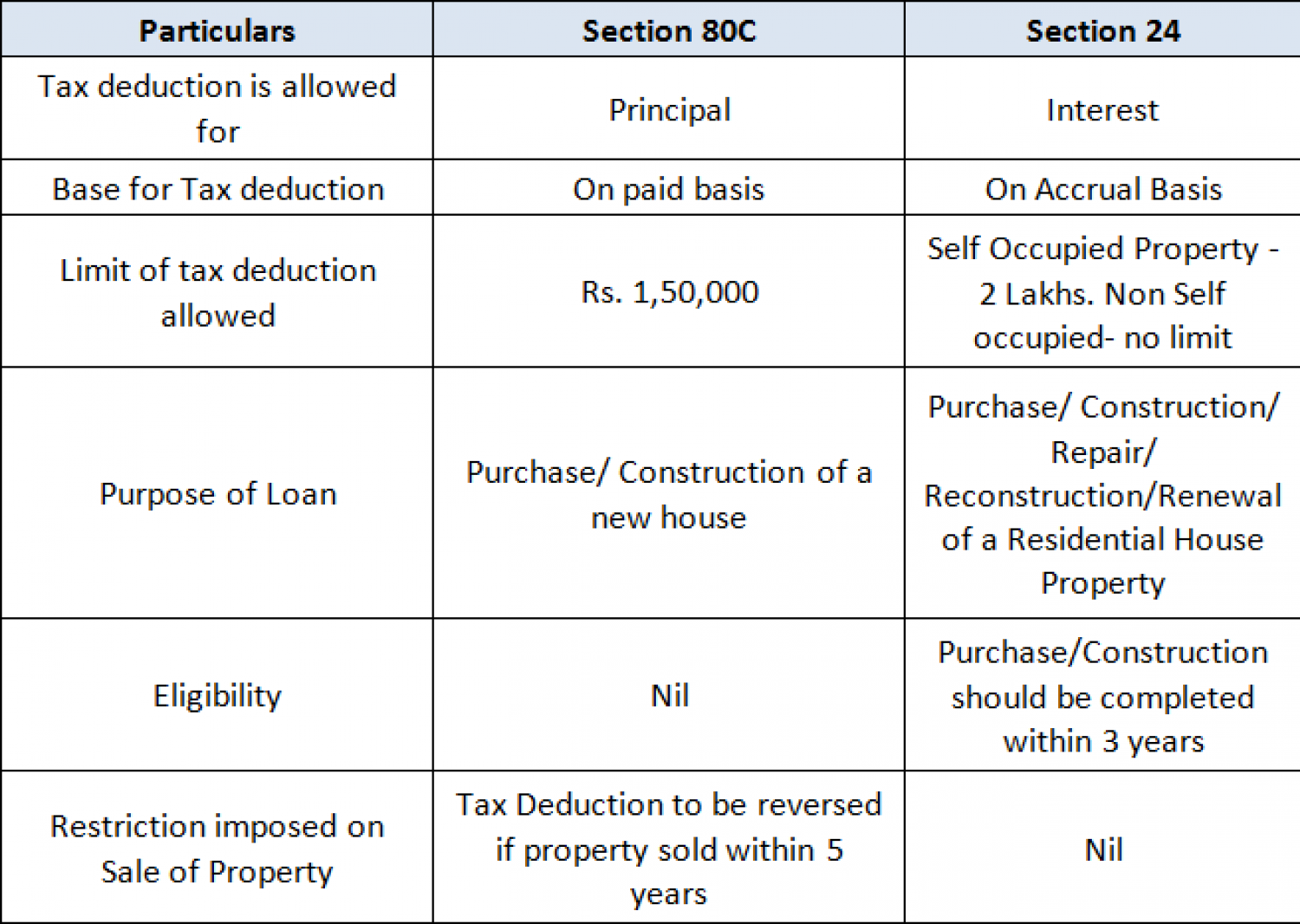

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Deduction Under Section 80C Of Income Tax Act Deduction Under Chapter

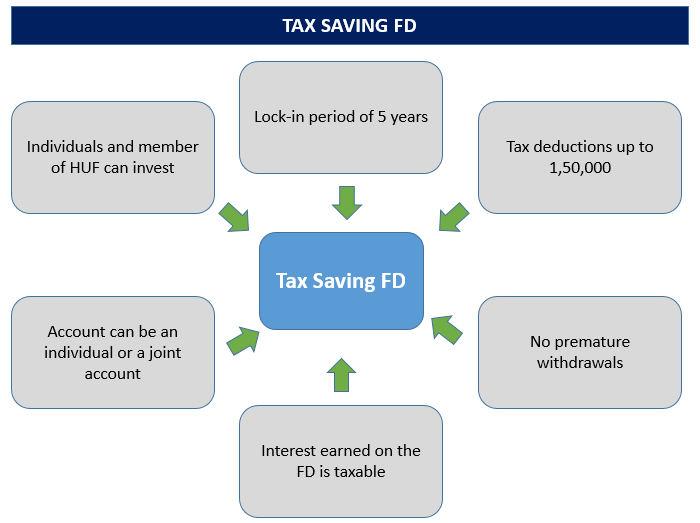

Benefits Of Tax Savings On Fixed Deposit Under Section 80c Deduction

Section 80C Deduction Investment When To Claim

Section 80C Deduction For School College Education Fees

List Of Deductions Under Section 80C Bajaj Markets

List Of Deductions Under Section 80C Bajaj Markets

Section 80C Deduction Income Tax Act IndiaFilings