In the age of digital, when screens dominate our lives and the appeal of physical printed materials isn't diminishing. For educational purposes as well as creative projects or just adding the personal touch to your space, 80c Education Fees Deduction have become an invaluable source. Here, we'll dive in the world of "80c Education Fees Deduction," exploring what they are, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest 80c Education Fees Deduction Below

80c Education Fees Deduction

80c Education Fees Deduction -

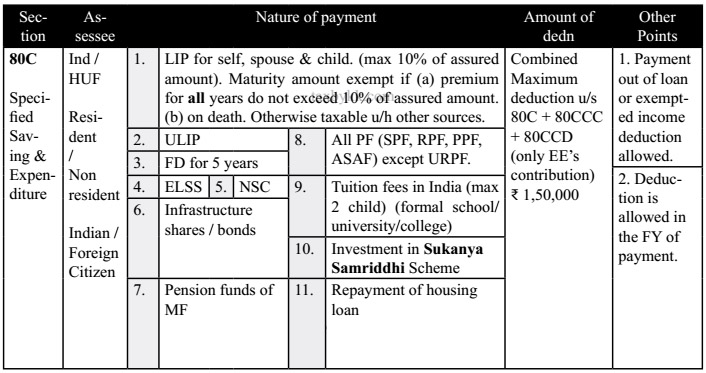

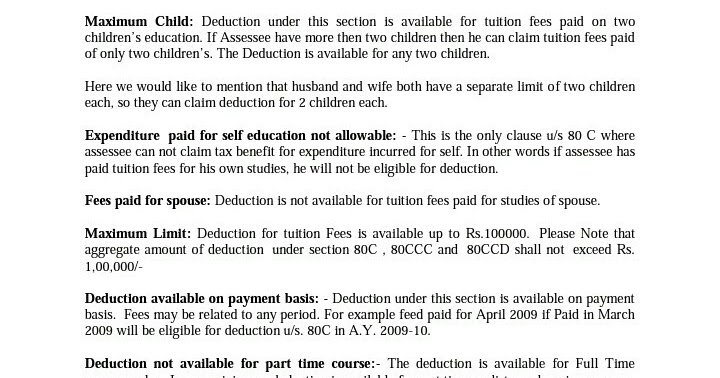

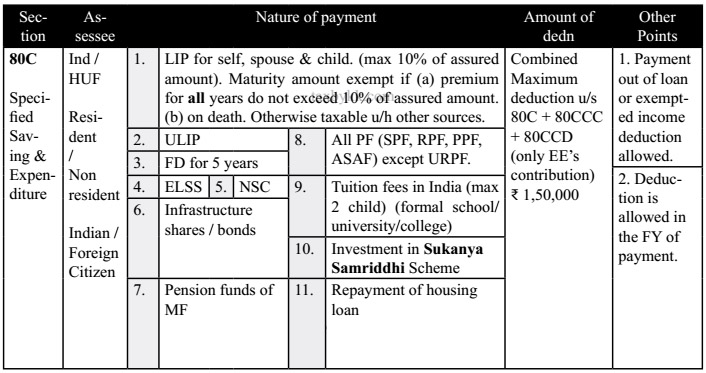

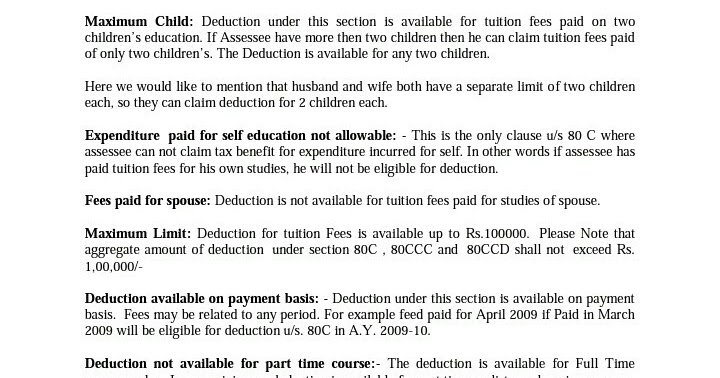

The actual total fee paid by a parent in a financial year for the education of his children is allowed to be claimed as a deduction under Section 80C However the maximum total

Deduction on Tuition Fees under section 80C A parent can claim a deduction on the actual amount paid as tuition fees to a university college school or

The 80c Education Fees Deduction are a huge collection of printable materials that are accessible online for free cost. The resources are offered in a variety types, like worksheets, coloring pages, templates and many more. The great thing about 80c Education Fees Deduction is in their variety and accessibility.

More of 80c Education Fees Deduction

Learn About Tuition Fees Deduction What Is Tuition Fees 80c Under

Learn About Tuition Fees Deduction What Is Tuition Fees 80c Under

Synopsis When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax benefit under section 80C of the Income tax Act

Section 80C of the Income Tax Act 1961 Act provides for a deduction of up to INR 1 5 lakh from the total taxable income of Individuals and Hindu Undivided Families HUFs

80c Education Fees Deduction have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: This allows you to modify print-ready templates to your specific requirements whether it's making invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Printing educational materials for no cost can be used by students of all ages. This makes them an invaluable instrument for parents and teachers.

-

Simple: Instant access to an array of designs and templates cuts down on time and efforts.

Where to Find more 80c Education Fees Deduction

Section 80C Deduction For School College Education Fees

Section 80C Deduction For School College Education Fees

Maximum Deduction 80C Investment made in Equity Linked Saving Schemes PPF SPF RPF payments made towards Life Insurance Premiums principal sum of a

In the context of the same Section 80C of the Income Tax Act 1961 allows for deduction for expenditure incurred towards education of children by the assessee a

We've now piqued your curiosity about 80c Education Fees Deduction, let's explore where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with 80c Education Fees Deduction for all needs.

- Explore categories such as decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free, flashcards, and learning materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a wide range of interests, from DIY projects to planning a party.

Maximizing 80c Education Fees Deduction

Here are some ways create the maximum value use of 80c Education Fees Deduction:

1. Home Decor

- Print and frame stunning art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets to enhance learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

80c Education Fees Deduction are a treasure trove of innovative and useful resources that meet a variety of needs and interests. Their availability and versatility make them a great addition to any professional or personal life. Explore the many options of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can download and print these items for free.

-

Does it allow me to use free printables to make commercial products?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may come with restrictions on usage. You should read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit the local print shop for more high-quality prints.

-

What software will I need to access printables free of charge?

- A majority of printed materials are in PDF format. They can be opened using free programs like Adobe Reader.

Tuition Fees Deduction Under Section 80C School Fees Deduction In 80C

INCOME TAX DEDUCTION 80C YouTube

Check more sample of 80c Education Fees Deduction below

Section 80C Deduction For Tuition School Education Fees

Deduction From Gross Total Income Section 80C To 80U Graphical Table

School Or College Fees Deduction Under Income Tax Section 80C Of

School Fees Deduction Under 80c

TEACHERS NEWS TN Deduction U s 80C For Tuition school Fees Paid For

Tuition Fees Deduction Under Section 80c

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Deduction on Tuition Fees under section 80C A parent can claim a deduction on the actual amount paid as tuition fees to a university college school or

https://tax2win.in/guide/tution-fees-deduction-under-section-80c

Individual Assesses only This Tax deduction can only be claimed by individual assesses and not by HUF Hindu Undivided Family or Corporates Limit The

Deduction on Tuition Fees under section 80C A parent can claim a deduction on the actual amount paid as tuition fees to a university college school or

Individual Assesses only This Tax deduction can only be claimed by individual assesses and not by HUF Hindu Undivided Family or Corporates Limit The

School Fees Deduction Under 80c

Deduction From Gross Total Income Section 80C To 80U Graphical Table

TEACHERS NEWS TN Deduction U s 80C For Tuition school Fees Paid For

Tuition Fees Deduction Under Section 80c

Tuition And Fees Deduction Vs Education Credit What Are The

Tuition Fees Deduction India

Tuition Fees Deduction India

How To Claim Tax Benefit On Tuition Fees Under Section 80C Children