Today, where screens have become the dominant feature of our lives yet the appeal of tangible printed materials isn't diminishing. If it's to aid in education in creative or artistic projects, or simply adding some personal flair to your home, printables for free are now a useful resource. This article will take a dive through the vast world of "80c Tax Exemption Calculation," exploring what they are, how you can find them, and what they can do to improve different aspects of your daily life.

Get Latest 80c Tax Exemption Calculation Below

80c Tax Exemption Calculation

80c Tax Exemption Calculation -

Section 80C is a tax saving provision under the Indian Income Tax Act 1961 It allows taxpayers to claim deductions on specified investments and expenses such as Public Provident Fund PPF Employee Provident Fund EPF National Savings Certificate NSC Tax Saving Fixed Deposits children s tuition fees etc

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c for FY 2020 21 AY 2021 22

80c Tax Exemption Calculation encompass a wide assortment of printable, downloadable materials available online at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and more. One of the advantages of 80c Tax Exemption Calculation is in their versatility and accessibility.

More of 80c Tax Exemption Calculation

INCOME TAX DEDUCTION 80C YouTube

INCOME TAX DEDUCTION 80C YouTube

Section 80 C Find out the Investments and payments that are eligible for 80C deductions Compare the popular 80C investments in terms of risk returns lock in

So let us understand the calculation of Deduction under section 80C 80CCC 80CCD These sections allow a taxpayer to claim the deduction for the amount paid by him for the life insurance and PF Schemes Following are some examples of the Calculation of Deduction under Section 80C 80CCC and 80CCD

The 80c Tax Exemption Calculation have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: You can tailor printed materials to meet your requirements be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Education Value Printing educational materials for no cost cater to learners of all ages, making the perfect tool for parents and educators.

-

Easy to use: instant access a variety of designs and templates helps save time and effort.

Where to Find more 80c Tax Exemption Calculation

EP5 80C TAX Tax

EP5 80C TAX Tax

Here are the available exemptions You can claim a deduction of upto 20 of gross income under Section 80CCD 1 but within the overall limit of Rs 1 5 lakh under Section 80CCE Additional tax deductions of upto Rs 50 000 under Section 80CCD 1B This deduction is over and above the limit of Rs 1 5 of Section 80CCE

PPF Section 80C Last updated on January 18th 2024 Under the Income Tax Act taxpayers are allowed to reduce their total tax liability by investing in certain sectors or making specific expenses The government has attached a taxation benefit to encourage investment in these sectors

If we've already piqued your interest in printables for free and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of 80c Tax Exemption Calculation for various applications.

- Explore categories like furniture, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets as well as flashcards and other learning tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a broad array of topics, ranging starting from DIY projects to planning a party.

Maximizing 80c Tax Exemption Calculation

Here are some ideas in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Utilize free printable worksheets to reinforce learning at home for the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

80c Tax Exemption Calculation are an abundance of innovative and useful resources that cater to various needs and interest. Their access and versatility makes them an invaluable addition to every aspect of your life, both professional and personal. Explore the wide world of 80c Tax Exemption Calculation right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes they are! You can print and download these files for free.

-

Can I use the free printables to make commercial products?

- It is contingent on the specific usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns when using 80c Tax Exemption Calculation?

- Some printables may have restrictions concerning their use. Make sure you read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in an in-store print shop to get higher quality prints.

-

What software will I need to access printables free of charge?

- The majority of printed documents are in PDF format. They can be opened using free software such as Adobe Reader.

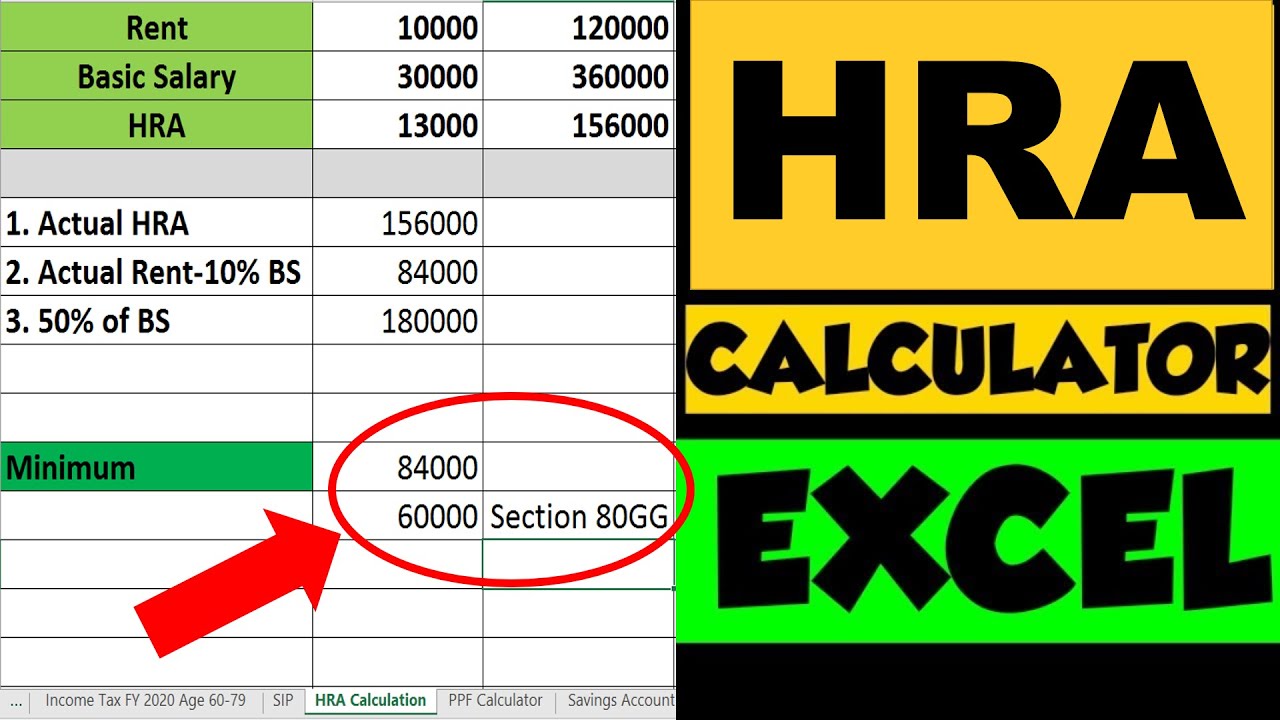

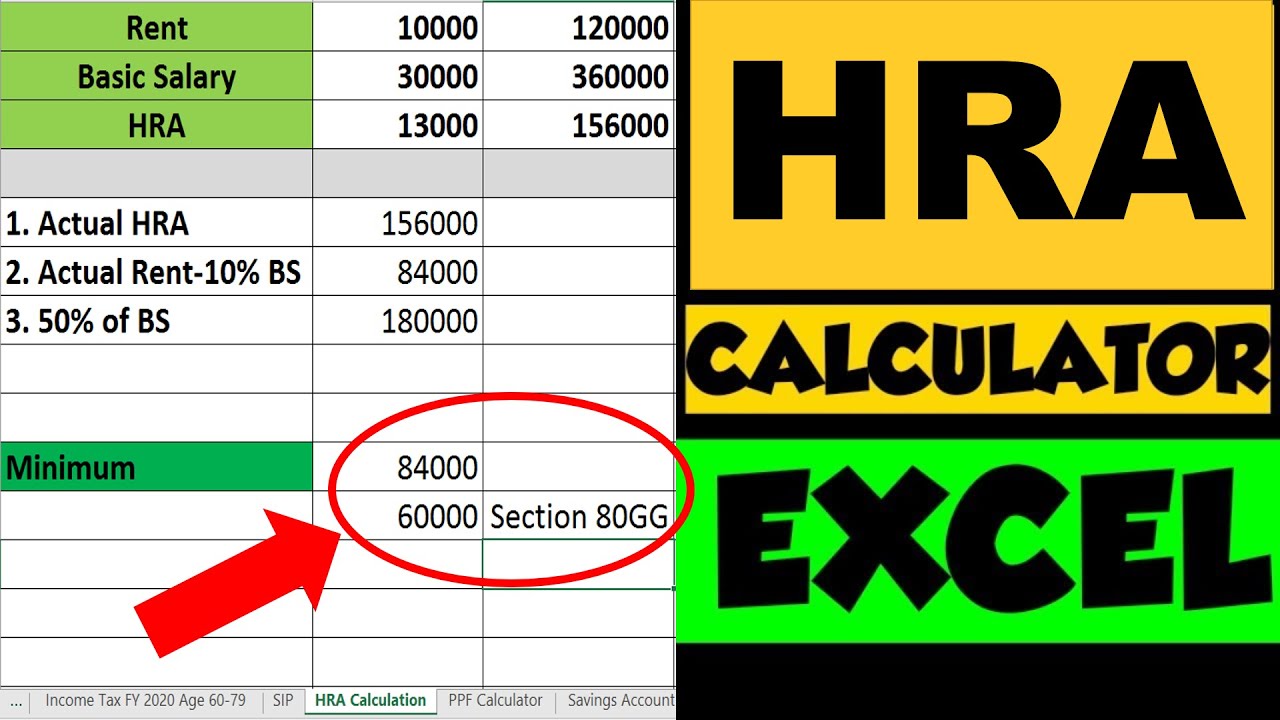

HRA Calculation Formula On Salary Change How HRA Exemption Is

Income Tax Slab For FY 2022 23 What You Need To Know

Check more sample of 80c Tax Exemption Calculation below

Section 80C Deductions List To Save Income Tax FinCalC Blog

Tax Planning For Salary Employees 2022 With Tax Calculation

80C Best Tax Deduction Section

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Stamp Duty And Registration Charges Deduction U s 80C

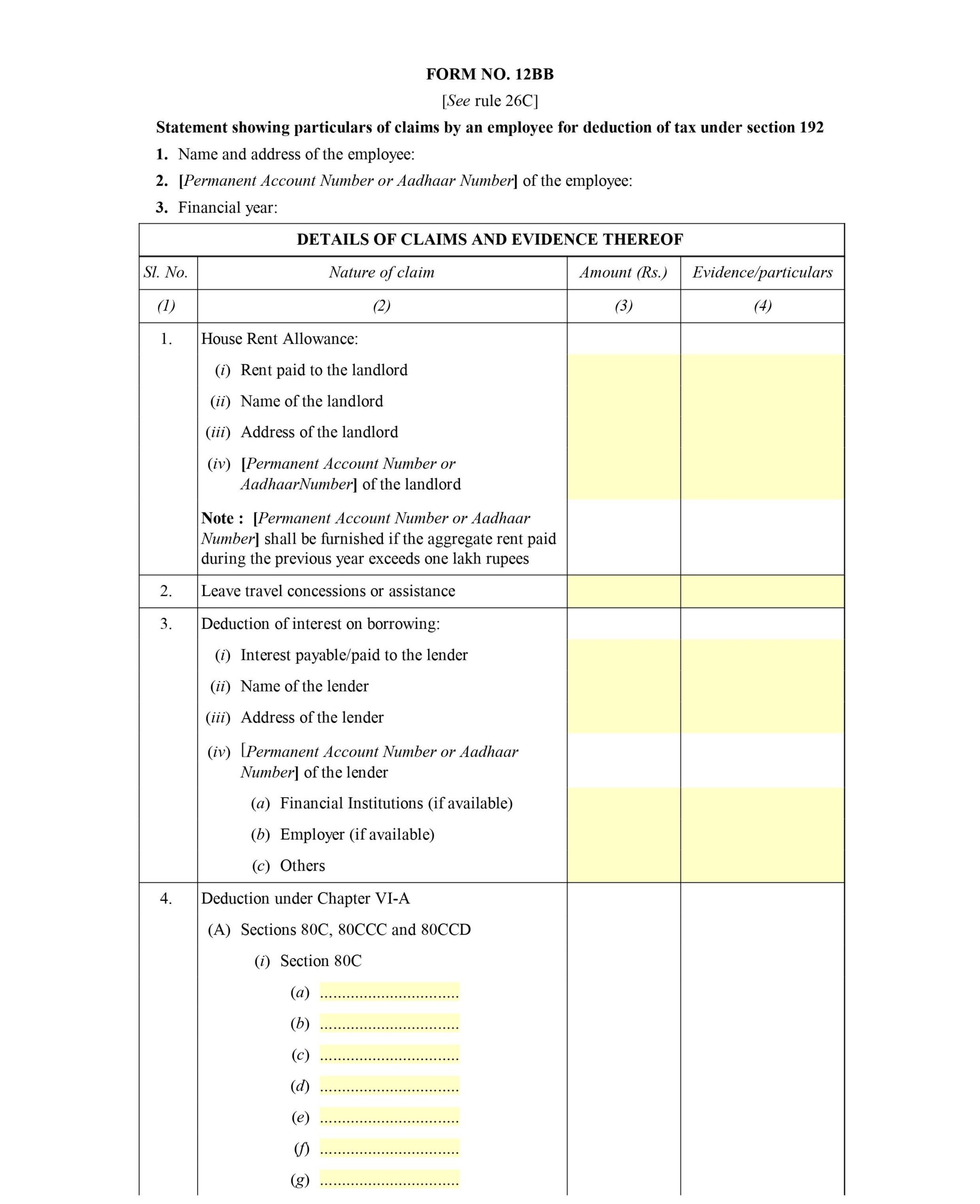

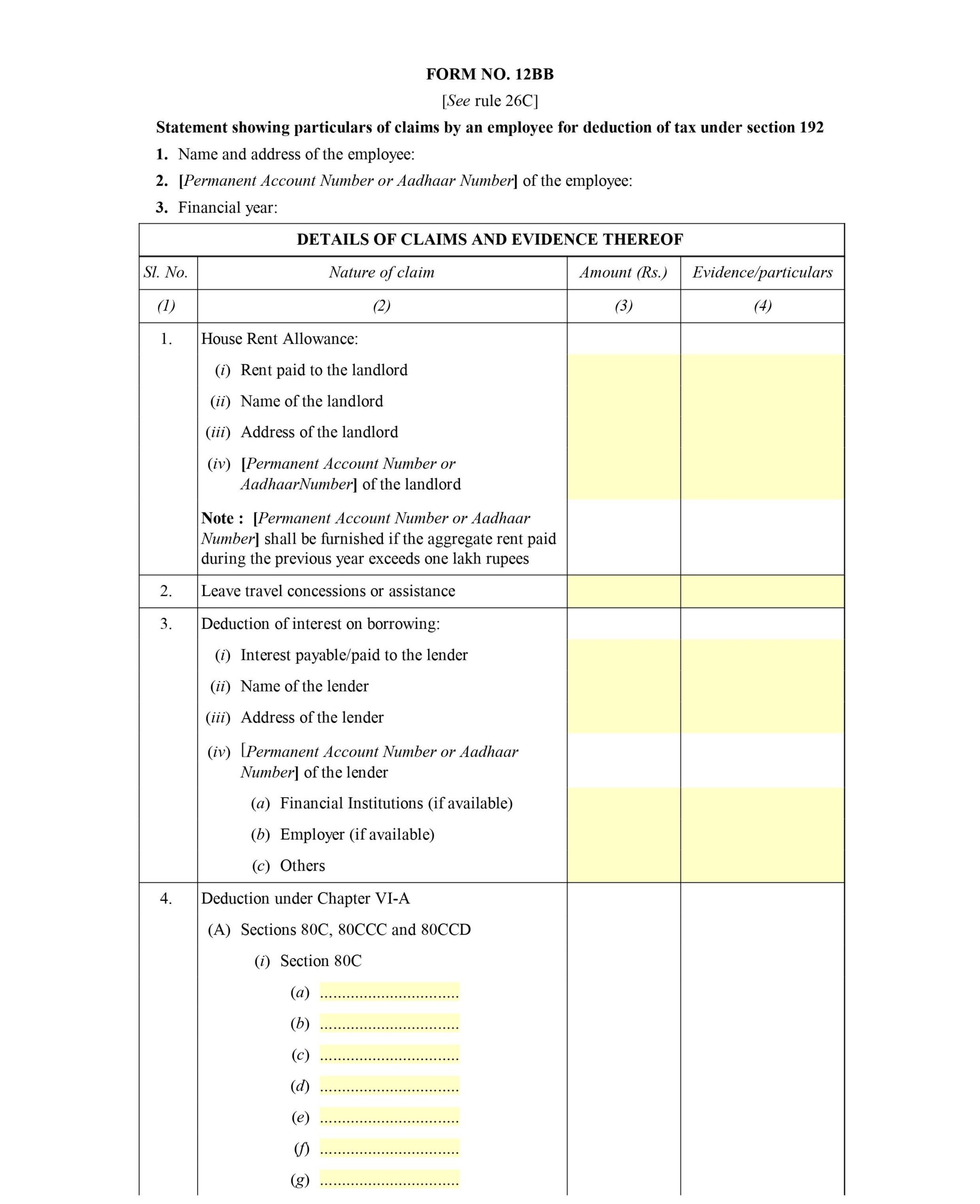

PDF Investment Declaration Form PDF Download

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c for FY 2020 21 AY 2021 22

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Maximum Limit Rs 1 50 lakh every financial year Please note that the aggregate deduction amount under Sections 80C 80CCC and 80CCD is restricted to Rs 1 50 000 for a taxpayer Maximum Age No minimum age Tuition fee meaning Only payment made towards full time education of the child

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c for FY 2020 21 AY 2021 22

Maximum Limit Rs 1 50 lakh every financial year Please note that the aggregate deduction amount under Sections 80C 80CCC and 80CCD is restricted to Rs 1 50 000 for a taxpayer Maximum Age No minimum age Tuition fee meaning Only payment made towards full time education of the child

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Tax Planning For Salary Employees 2022 With Tax Calculation

Stamp Duty And Registration Charges Deduction U s 80C

PDF Investment Declaration Form PDF Download

.jpg)

GiveForSociety NGO

Exemption In Lieu Of 80C Tax Benefits

Exemption In Lieu Of 80C Tax Benefits

Income Tax 80c Deduction Fy 2021 22 TAX