In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. For educational purposes and creative work, or simply adding an individual touch to your area, 80d Deduction Limit In New Tax Regime have proven to be a valuable resource. In this article, we'll take a dive into the world "80d Deduction Limit In New Tax Regime," exploring their purpose, where they can be found, and how they can be used to enhance different aspects of your lives.

Get Latest 80d Deduction Limit In New Tax Regime Below

80d Deduction Limit In New Tax Regime

80d Deduction Limit In New Tax Regime -

Can I Claim Section 80C Deduction Under Revised New Tax Regime No if you opt for the new tax regime you will not be allowed any tax benefit under section 80C Also one can claim the

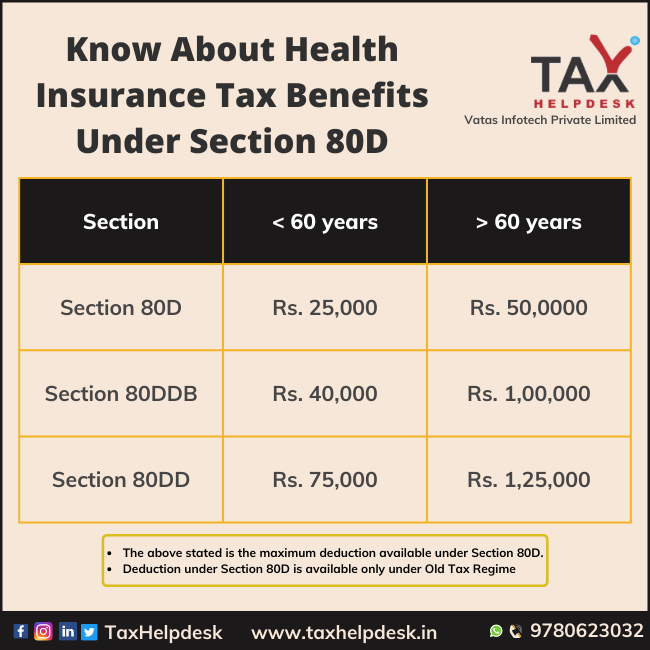

Under Section 80D if a person is a senior citizen 60 years or above then the maximum deduction limit for the Health Insurance premiums paid is Rs 50 000 This helps them manage medical costs efficiently

The 80d Deduction Limit In New Tax Regime are a huge array of printable content that can be downloaded from the internet at no cost. These resources come in many styles, from worksheets to coloring pages, templates and much more. One of the advantages of 80d Deduction Limit In New Tax Regime lies in their versatility as well as accessibility.

More of 80d Deduction Limit In New Tax Regime

Know About Health Insurance Tax Benefits Under Section 80D

Know About Health Insurance Tax Benefits Under Section 80D

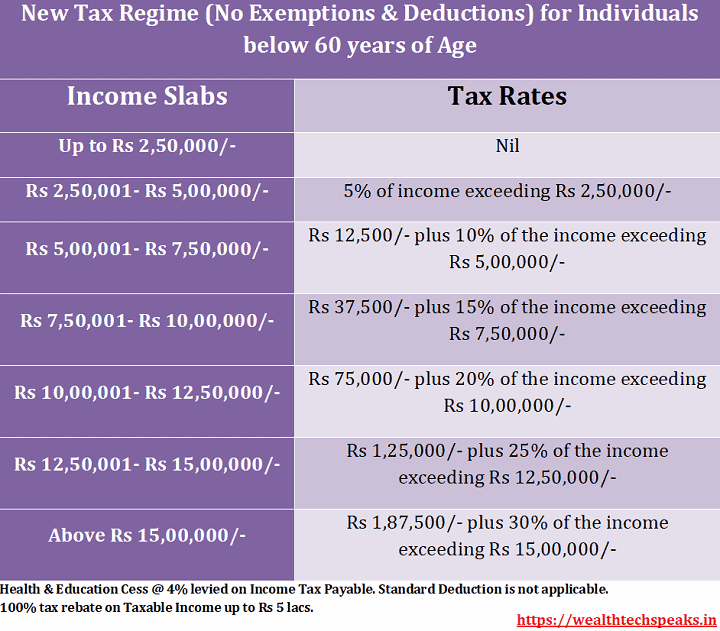

Individuals above 60 years but less than 80 years of age are not required to pay tax upto Rs 3 lakh of income Individuals above 80 years are not required to pay tax upto Rs 5 lakh of income The basic exemption limit for all

Yes under Section 80D taxpayers can avail of tax deduction up to INR 25 000 per year for medical premium paid for self family and dependent who are under 60 years of age

Print-friendly freebies have gained tremendous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Flexible: Your HTML0 customization options allow you to customize printables to fit your particular needs such as designing invitations planning your schedule or even decorating your home.

-

Educational Value Education-related printables at no charge offer a wide range of educational content for learners from all ages, making these printables a powerful aid for parents as well as educators.

-

Accessibility: The instant accessibility to various designs and templates helps save time and effort.

Where to Find more 80d Deduction Limit In New Tax Regime

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Section 80D of the Income tax Act of 1961 allows for the deduction of certain medical expenses and premiums for health insurance policies from your taxes The limit under

Note that the new tax regime has removed nearly 70 tax deductions that were earlier allowed in the old regime For example you can not claim tax saving benefits on expenses related to

In the event that we've stirred your interest in printables for free Let's find out where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of 80d Deduction Limit In New Tax Regime designed for a variety applications.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Ideal for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a wide selection of subjects, that range from DIY projects to party planning.

Maximizing 80d Deduction Limit In New Tax Regime

Here are some ways to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or festive decorations to decorate your living spaces.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

80d Deduction Limit In New Tax Regime are a treasure trove of useful and creative resources for a variety of needs and interests. Their accessibility and flexibility make them an essential part of both personal and professional life. Explore the endless world of 80d Deduction Limit In New Tax Regime today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes you can! You can download and print these files for free.

-

Are there any free printables to make commercial products?

- It's dependent on the particular usage guidelines. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations concerning their use. Make sure you read the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home using either a printer at home or in an area print shop for premium prints.

-

What software do I need in order to open printables free of charge?

- Many printables are offered as PDF files, which can be opened using free software such as Adobe Reader.

Budget 2023 Standard Deduction Introduced In New Tax Regime How

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

Check more sample of 80d Deduction Limit In New Tax Regime below

Section 80D Deduction In Respect Of Health Or Medical Insurance

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Difference Between Old Vs New Tax Regime Which Is Better Vrogue

80d 80dd 80ddb Deduction For AY 2022 23 I 80D I 80DD I 80DDB Maximum

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Deduction Under Section 80D Ultimate Guide

https://taxguru.in/income-tax/section-80…

Under Section 80D if a person is a senior citizen 60 years or above then the maximum deduction limit for the Health Insurance premiums paid is Rs 50 000 This helps them manage medical costs efficiently

https://economictimes.indiatimes.com/wealth/tax/...

Tax saving via section 80D for FY 2023 24 Here s all you need to know about claiming deduction under Section 80D to save income tax This deduction is available under

Under Section 80D if a person is a senior citizen 60 years or above then the maximum deduction limit for the Health Insurance premiums paid is Rs 50 000 This helps them manage medical costs efficiently

Tax saving via section 80D for FY 2023 24 Here s all you need to know about claiming deduction under Section 80D to save income tax This deduction is available under

80d 80dd 80ddb Deduction For AY 2022 23 I 80D I 80DD I 80DDB Maximum

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Deduction Under Section 80D Ultimate Guide

Section 80D Deduction Limit For AY 2021 22 New Tax Route

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Standard Deduction 2020 Self Employed Standard Deduction 2021