In this age of electronic devices, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes such as creative projects or simply adding an individual touch to the area, 80g Deduction Tax Guru can be an excellent source. In this article, we'll dive in the world of "80g Deduction Tax Guru," exploring their purpose, where they can be found, and what they can do to improve different aspects of your lives.

Get Latest 80g Deduction Tax Guru Below

80g Deduction Tax Guru

80g Deduction Tax Guru -

Denial of Sections 80G 12A Registration Kerala HC directs reconsideration of Application April 12 2024 834 Views 0 comment Print Kerala High Court overturns rejection of Snehatheeram Charitable Trust s application for 80G certificate under Income Tax Act 1961 orders reconsideration Full judgment analysis

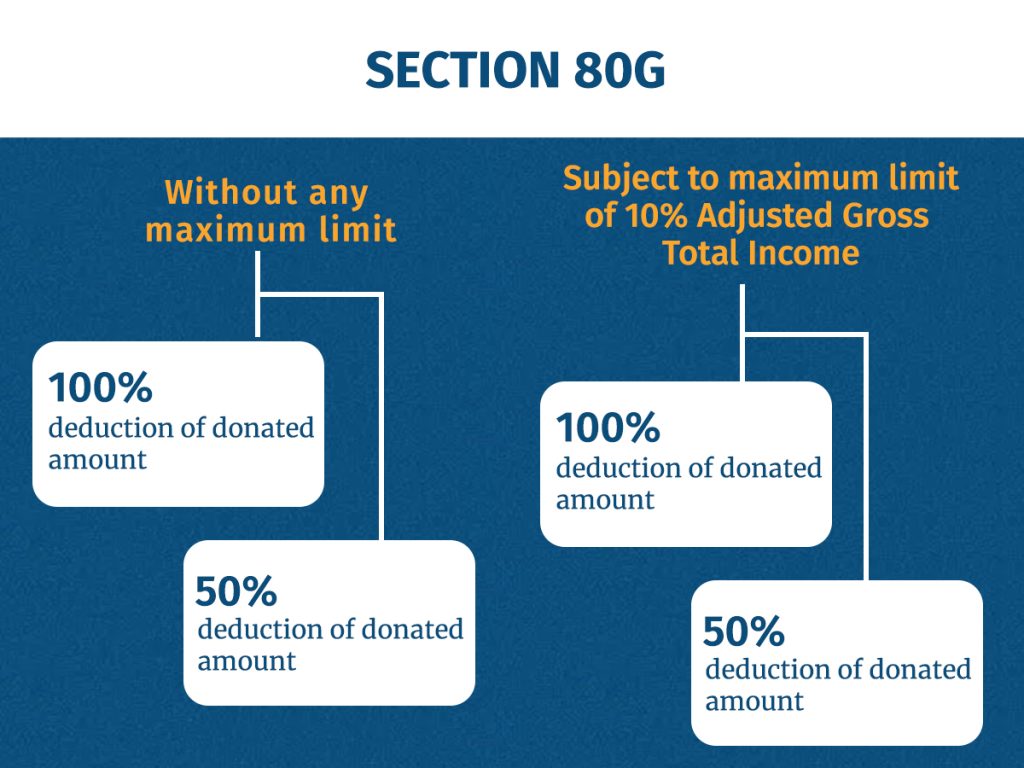

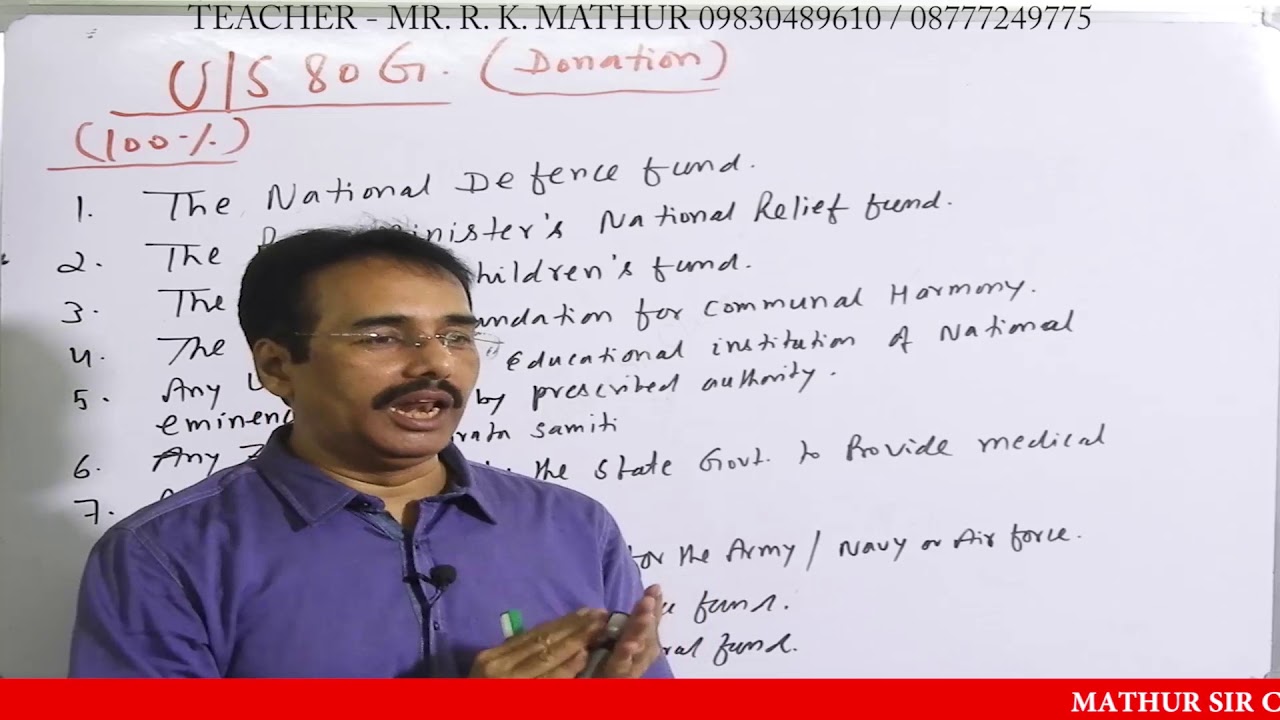

1 What is section 80g Section 80g provides deduction towards contribution donations made by the any type of assessee to specific funds or charitable institutions 2 What is the adjusted gross total income for 80g Adjusted gross total income can be calculated by applying the following formula 3 Is 80g part of 80c

80g Deduction Tax Guru include a broad range of printable, free materials available online at no cost. They are available in numerous types, such as worksheets coloring pages, templates and much more. The beauty of 80g Deduction Tax Guru is their versatility and accessibility.

More of 80g Deduction Tax Guru

ShedTheTax Tax Deduction With Charity U S 80G Explained By CA Vitesh

ShedTheTax Tax Deduction With Charity U S 80G Explained By CA Vitesh

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax deductions in Section 80G apart from Section 80C

Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section 80G can be claimed on the amount donated to eligible institutions or funds

80g Deduction Tax Guru have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: The Customization feature lets you tailor the templates to meet your individual needs whether you're designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Printing educational materials for no cost can be used by students of all ages, making these printables a powerful source for educators and parents.

-

The convenience of The instant accessibility to many designs and templates, which saves time as well as effort.

Where to Find more 80g Deduction Tax Guru

Section 80G Deductions On Donations

Section 80G Deductions On Donations

Section 80G Deduction Overview The Income Tax Act of India allows taxpayers to claim tax deductions for the donations made to prescribed funds of charitable organizations Taxpayers can show the donations as deductions while filing ITR and enjoy tax benefits on their income

Last updated on January 18th 2024 Section 80G of income tax act allows tax deductions on donations made to certain organizations and relief funds This deduction encourages taxpayers to donate and avail the satisfaction of giving back to the community along with a reduction in their tax liability INDEX

Now that we've ignited your curiosity about 80g Deduction Tax Guru We'll take a look around to see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in 80g Deduction Tax Guru for different reasons.

- Explore categories such as home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free or flashcards as well as learning tools.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates, which are free.

- These blogs cover a wide spectrum of interests, starting from DIY projects to planning a party.

Maximizing 80g Deduction Tax Guru

Here are some ideas to make the most of 80g Deduction Tax Guru:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

80g Deduction Tax Guru are an abundance of fun and practical tools designed to meet a range of needs and preferences. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the vast collection of 80g Deduction Tax Guru today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can print and download these tools for free.

-

Can I utilize free printables for commercial uses?

- It's based on specific usage guidelines. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding their use. Be sure to check the terms and condition of use as provided by the author.

-

How do I print 80g Deduction Tax Guru?

- Print them at home using the printer, or go to a local print shop for the highest quality prints.

-

What software is required to open printables for free?

- Most printables come in PDF format. These is open with no cost software like Adobe Reader.

Donate Under Section 80G Of Income Tax Receive Deduction

Section 80G Of IT Act Tax Deduction On Donations To Charity

Check more sample of 80g Deduction Tax Guru below

Income Tax Deduction On Donation Who Is Eligible For Deduction U s 80G

Deduction Under Section 80G Section 80G Of Income Tax Act Deduction

Income Tax Planning All About 80G Deduction YouTube

What Is Section 80G Tax Deductions On Your Donations Deduction U s

Tax Deduction For Donation Under Section 80G Cash Donation Limit Of

Section 80g Deduction 80g Section 80g Of Income Tax Act 2020 21

https://taxguru.in/income-tax/deduction-section...

1 What is section 80g Section 80g provides deduction towards contribution donations made by the any type of assessee to specific funds or charitable institutions 2 What is the adjusted gross total income for 80g Adjusted gross total income can be calculated by applying the following formula 3 Is 80g part of 80c

https://taxguru.in/income-tax/deductions-80g-donation.html

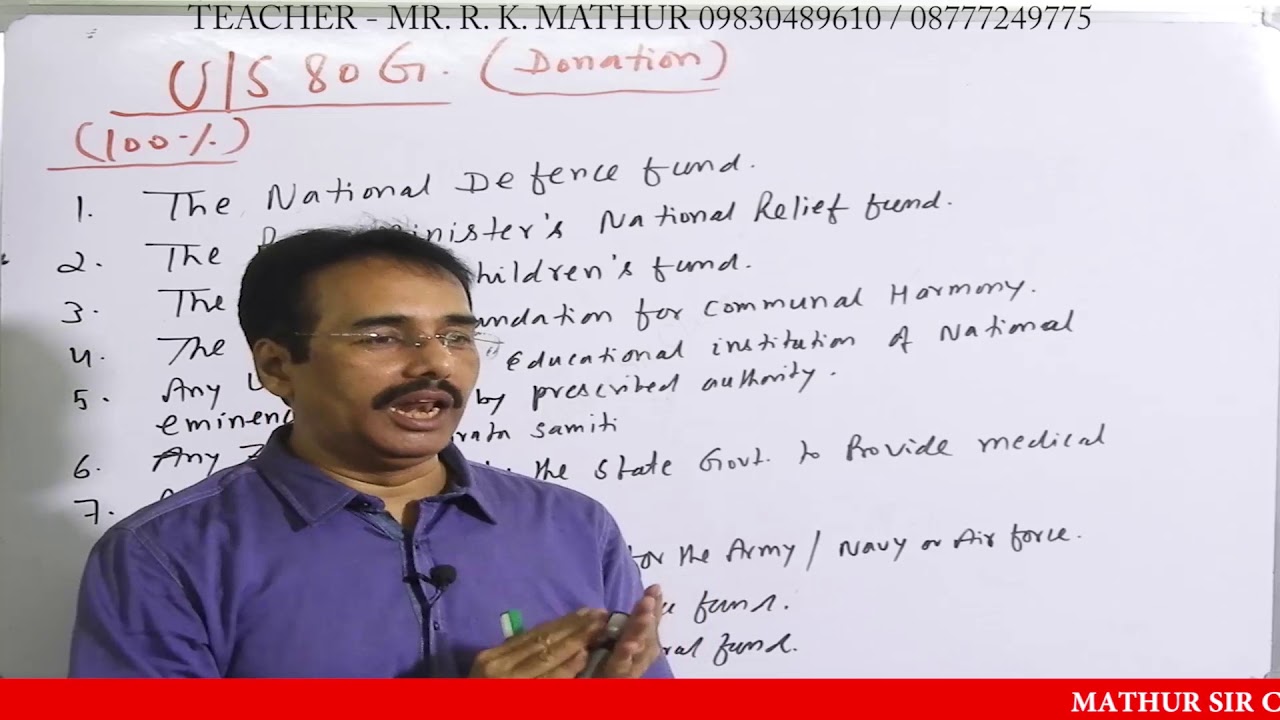

The various donations specified in section 80G are eligible for deduction up to either 100 or 50 with or without restriction as provided in section 80G Donations with 100 deduction without any qualifying limit National Defence Fund set up by the Central Government Prime Minister s National Relief Fund National Foundation for Communal

1 What is section 80g Section 80g provides deduction towards contribution donations made by the any type of assessee to specific funds or charitable institutions 2 What is the adjusted gross total income for 80g Adjusted gross total income can be calculated by applying the following formula 3 Is 80g part of 80c

The various donations specified in section 80G are eligible for deduction up to either 100 or 50 with or without restriction as provided in section 80G Donations with 100 deduction without any qualifying limit National Defence Fund set up by the Central Government Prime Minister s National Relief Fund National Foundation for Communal

What Is Section 80G Tax Deductions On Your Donations Deduction U s

Deduction Under Section 80G Section 80G Of Income Tax Act Deduction

Tax Deduction For Donation Under Section 80G Cash Donation Limit Of

Section 80g Deduction 80g Section 80g Of Income Tax Act 2020 21

The 80G Certificate And Tax Exemption For Nonprofits Vakilsearch Blog

The Process To Claim Tax Deduction Under Section 80G Has Changed Here

The Process To Claim Tax Deduction Under Section 80G Has Changed Here

Deduction Under Chapter 6A Of Income Tax Act Section 80G Donation