In this age of technology, with screens dominating our lives, the charm of tangible, printed materials hasn't diminished. If it's to aid in education project ideas, artistic or just adding a personal touch to your home, printables for free are now an essential source. We'll take a dive through the vast world of "Accrued Market Discount Tax Treatment," exploring what they are, where they can be found, and how they can be used to enhance different aspects of your lives.

Get Latest Accrued Market Discount Tax Treatment Below

Accrued Market Discount Tax Treatment

Accrued Market Discount Tax Treatment -

The tax treatment of accrued market discount depends on whether you hold the bond as a capital asset or as part of your trade or business For individuals accrued market discount is generally treated as ordinary income and is subject to taxation at your ordinary income tax rate

1 Introduction to Accrued Market Discount 2 Understanding the Tax Treatment of Accrued Market Discount 3 Reporting Accrued Market Discount on Your Income Tax Return 4 Calculating the Taxable Amount of Accrued Market Discount 5 Strategies for Minimizing the Tax Impact of

Accrued Market Discount Tax Treatment provide a diverse assortment of printable items that are available online at no cost. They are available in numerous forms, like worksheets templates, coloring pages, and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Accrued Market Discount Tax Treatment

Accrued Director Fee And Tax Treatment

Accrued Director Fee And Tax Treatment

The tax treatment of accrued market discounts can vary depending on the type of debt instrument the holding period and the investor s tax status Here are some key points to consider For individuals According to the U S Tax code individuals are generally required to report accrued market discounts as taxable

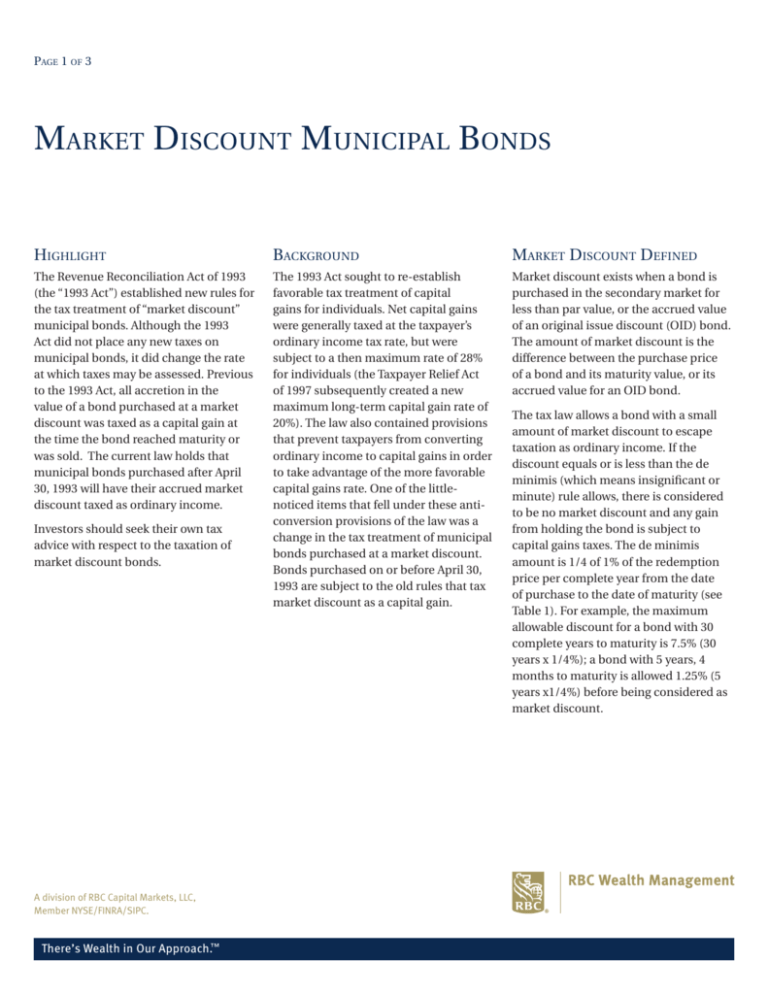

Market discount on a tax exempt bond is not tax exempt If you bought the bond after April 30 1993 you can choose to accrue the market discount over the period you own the bond and include it in your income currently as taxable interest

Accrued Market Discount Tax Treatment have gained a lot of recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements whether it's making invitations planning your schedule or even decorating your home.

-

Educational Impact: Free educational printables provide for students of all ages. This makes these printables a powerful aid for parents as well as educators.

-

It's easy: Instant access to many designs and templates reduces time and effort.

Where to Find more Accrued Market Discount Tax Treatment

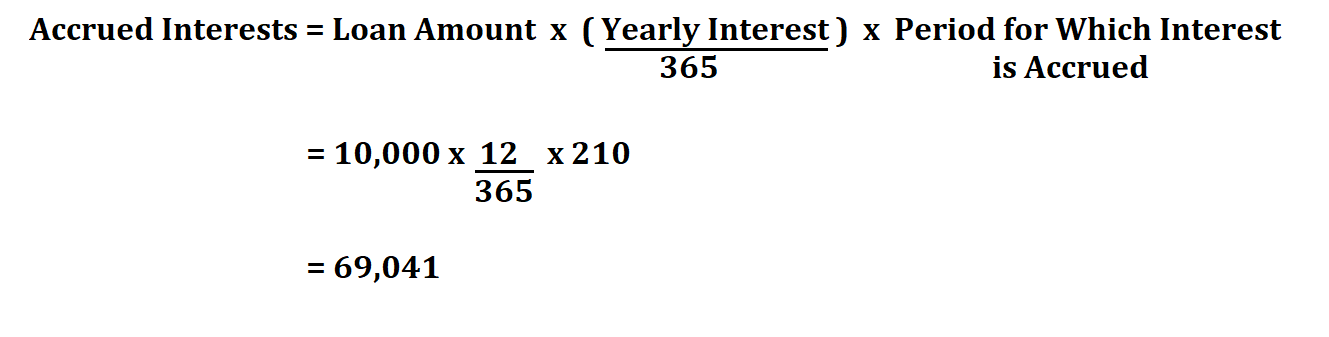

What Is Accrued Interest How To Calculate Accrued Interest Market

What Is Accrued Interest How To Calculate Accrued Interest Market

Accrued market discount is generally determined on a straight line ratable basis from the date of acquisition to the date of maturity The calculation is based on the number of days and accrues daily This results in the first dollars received by the taxpayer being taxable as ordinary income

Unlike OID market discount is not subject to taxation annually Accreted market discount only becomes taxable in the year the bond is sold or redeemed Also unlike OID market discount is taxable income regardless of the tax exempt nature of a bond s interest income

We hope we've stimulated your interest in Accrued Market Discount Tax Treatment Let's find out where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection in Accrued Market Discount Tax Treatment for different objectives.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free for flashcards, lessons, and worksheets. tools.

- Great for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a broad range of topics, that range from DIY projects to party planning.

Maximizing Accrued Market Discount Tax Treatment

Here are some ideas in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Accrued Market Discount Tax Treatment are a treasure trove of creative and practical resources which cater to a wide range of needs and interest. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the vast array of Accrued Market Discount Tax Treatment right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really for free?

- Yes they are! You can download and print these items for free.

-

Does it allow me to use free printables to make commercial products?

- It is contingent on the specific terms of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with Accrued Market Discount Tax Treatment?

- Certain printables may be subject to restrictions regarding their use. Be sure to read the terms and conditions set forth by the author.

-

How can I print printables for free?

- Print them at home using the printer, or go to an area print shop for better quality prints.

-

What program is required to open printables for free?

- Many printables are offered in PDF format. They can be opened using free software like Adobe Reader.

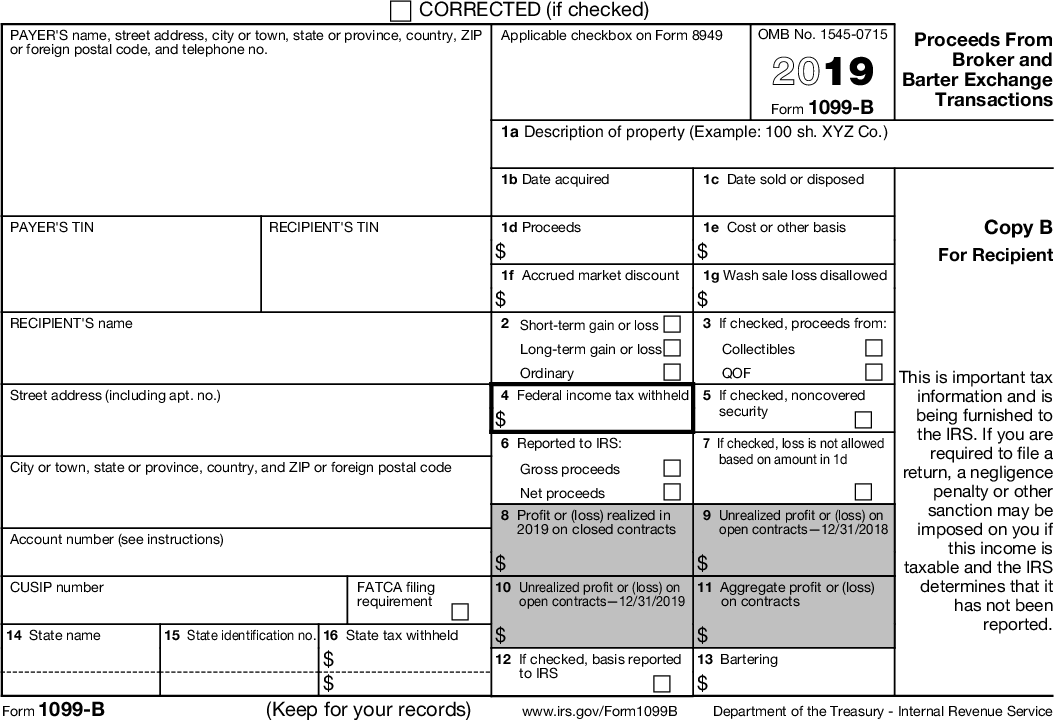

Form 1099 B

Market Discount Municipal Bonds

Check more sample of Accrued Market Discount Tax Treatment below

How To Calculate Accrued Interest

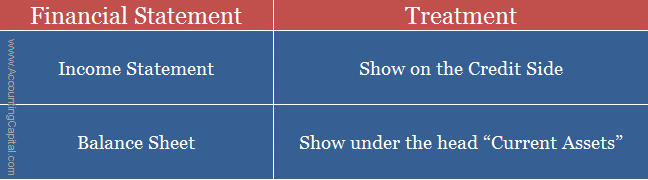

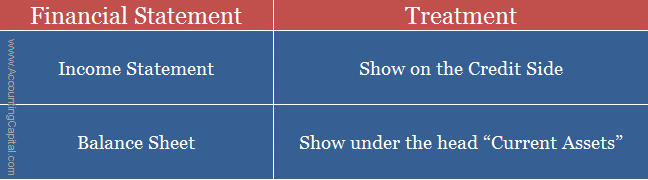

What Is The Journal Entry For Accrued Income Accounting Capital

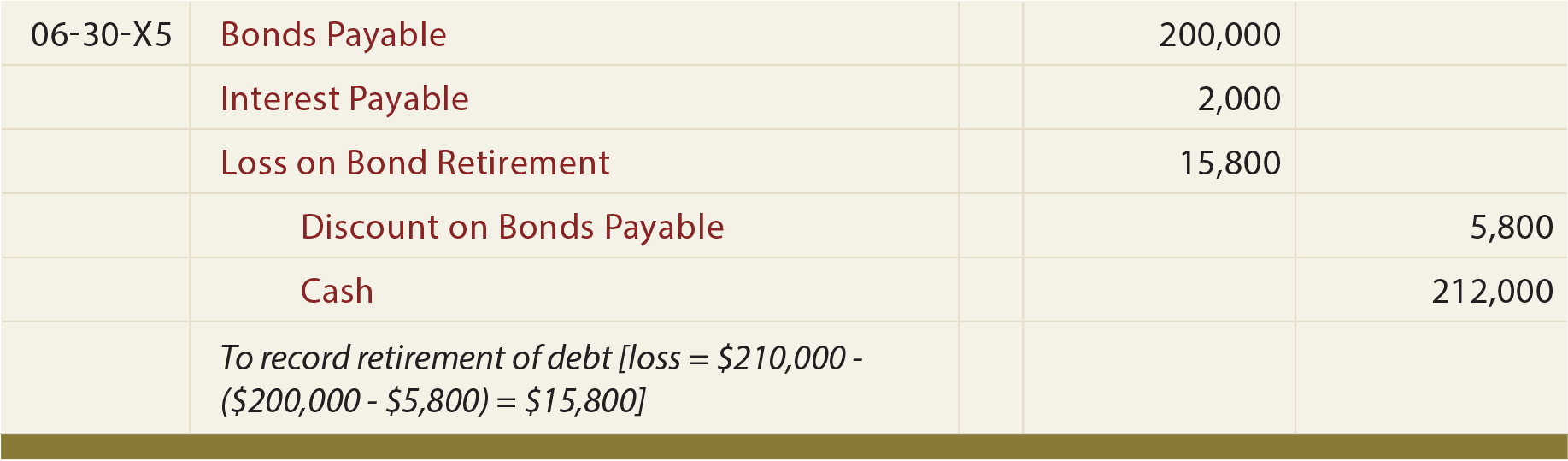

How To Calculate Discount On Bonds Payable Haiper

Accrued Income Definition Accounting Treatment Accountant Skills

Solved Which Of The Following Types Of Interest Income Is Not Taxed

Dividends Declared Journal Entry Double Entry Bookkeeping

https://fastercapital.com/content/The-Tax...

1 Introduction to Accrued Market Discount 2 Understanding the Tax Treatment of Accrued Market Discount 3 Reporting Accrued Market Discount on Your Income Tax Return 4 Calculating the Taxable Amount of Accrued Market Discount 5 Strategies for Minimizing the Tax Impact of

https://www.investopedia.com/terms/a/accruedmarketdiscount.asp

The accrued market discount is the portion of any price rise caused by the steady increase in bond value This rise in price is different than that which occurs in regular coupon bonds as a

1 Introduction to Accrued Market Discount 2 Understanding the Tax Treatment of Accrued Market Discount 3 Reporting Accrued Market Discount on Your Income Tax Return 4 Calculating the Taxable Amount of Accrued Market Discount 5 Strategies for Minimizing the Tax Impact of

The accrued market discount is the portion of any price rise caused by the steady increase in bond value This rise in price is different than that which occurs in regular coupon bonds as a

Accrued Income Definition Accounting Treatment Accountant Skills

What Is The Journal Entry For Accrued Income Accounting Capital

Solved Which Of The Following Types Of Interest Income Is Not Taxed

Dividends Declared Journal Entry Double Entry Bookkeeping

Solved 66 A 3 year Corporate Bond With The Coupon Rate Of Chegg

Ratable Accrual Method AwesomeFinTech Blog

Ratable Accrual Method AwesomeFinTech Blog

Accrued Income Definition Accounting Treatment Accountant Skills