In the digital age, when screens dominate our lives however, the attraction of tangible printed objects hasn't waned. No matter whether it's for educational uses, creative projects, or simply to add a personal touch to your space, Adoption Expenses Tax Deductible 2022 have proven to be a valuable source. Here, we'll take a dive into the sphere of "Adoption Expenses Tax Deductible 2022," exploring what they are, where they can be found, and how they can be used to enhance different aspects of your life.

Get Latest Adoption Expenses Tax Deductible 2022 Below

Adoption Expenses Tax Deductible 2022

Adoption Expenses Tax Deductible 2022 -

Qualified expenses must be solely put toward adoption costs meaning funds allowed as a credit or deduction under any other provision in the tax law cannot be applied toward the adoption tax credit Qualifying expenses must be accrued in a

The adoption tax credit lets families who were in the adoption process during 2022 claim up to 14 890 in eligible adoption expenses for each eligible child Taxpayers can apply the credit to international domestic private and public foster care adoptions

Printables for free include a vast selection of printable and downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and more. The great thing about Adoption Expenses Tax Deductible 2022 is their versatility and accessibility.

More of Adoption Expenses Tax Deductible 2022

Are Education Expenses Tax Deductible 2021 AZexplained

Are Education Expenses Tax Deductible 2021 AZexplained

1 How much is the adoption tax credit For adoptions finalized in 2023 tax returns claimed in 2024 the maximum amount a family can receive as credit is 15 950 per adopted child For adoptions finalized in 2022 tax returns claimed in 2023 the maximum amount a family can receive as credit is 14 890 per adopted child 2

The maximum credit amount allowed for adoptions is 14 890 per child for 2022 and 15 950 per child in 2023 In addition the adoption tax credit is no longer refundable meaning that to

The Adoption Expenses Tax Deductible 2022 have gained huge popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Modifications: They can make printing templates to your own specific requirements whether it's making invitations and schedules, or even decorating your home.

-

Educational Value Printing educational materials for no cost provide for students from all ages, making them a useful aid for parents as well as educators.

-

The convenience of Access to numerous designs and templates will save you time and effort.

Where to Find more Adoption Expenses Tax Deductible 2022

Claiming Adoption Expenses Canada 2022 TurboTax Canada Tips

Claiming Adoption Expenses Canada 2022 TurboTax Canada Tips

The adoption tax credit lets families who were in the adoption process during 2022 claim up to 14 890 in eligible adoption expenses for each eligible child Taxpayers can apply the credit to international domestic private and public foster care adoptions

If you paid adoption expenses in 2023 you might qualify for a credit of up to 15 950 for each child you adopted The credit amount depends on your income The credit is reduced if your adjusted gross income AGI is more than 201 010 You can t get the credit if

If we've already piqued your curiosity about Adoption Expenses Tax Deductible 2022 Let's see where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Adoption Expenses Tax Deductible 2022 for various objectives.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast variety of topics, starting from DIY projects to party planning.

Maximizing Adoption Expenses Tax Deductible 2022

Here are some creative ways of making the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Print worksheets that are free for teaching at-home, or even in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Adoption Expenses Tax Deductible 2022 are an abundance of creative and practical resources that satisfy a wide range of requirements and pursuits. Their accessibility and versatility make them a great addition to your professional and personal life. Explore the endless world of Adoption Expenses Tax Deductible 2022 now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Adoption Expenses Tax Deductible 2022 really cost-free?

- Yes they are! You can download and print these materials for free.

-

Can I make use of free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Some printables may come with restrictions on use. Make sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home with printing equipment or visit a local print shop for superior prints.

-

What program do I need in order to open printables at no cost?

- The majority are printed in the PDF format, and can be opened with free software, such as Adobe Reader.

Are Assisted Living Expenses Tax Deductible In 2021 Vallie Harrell

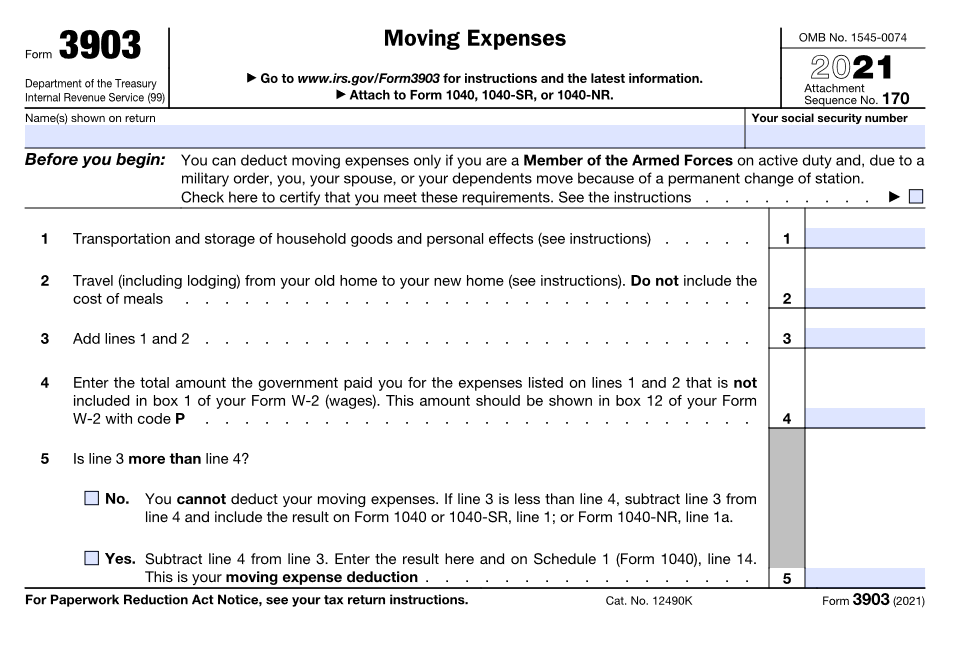

Are Moving Expenses Tax Deductible In 2022

Check more sample of Adoption Expenses Tax Deductible 2022 below

Claiming Adoption Related Expenses 2022 TurboTax Canada Tips

Are Dental Expenses Tax Deductible Maybe

Adoption Credit ADKF

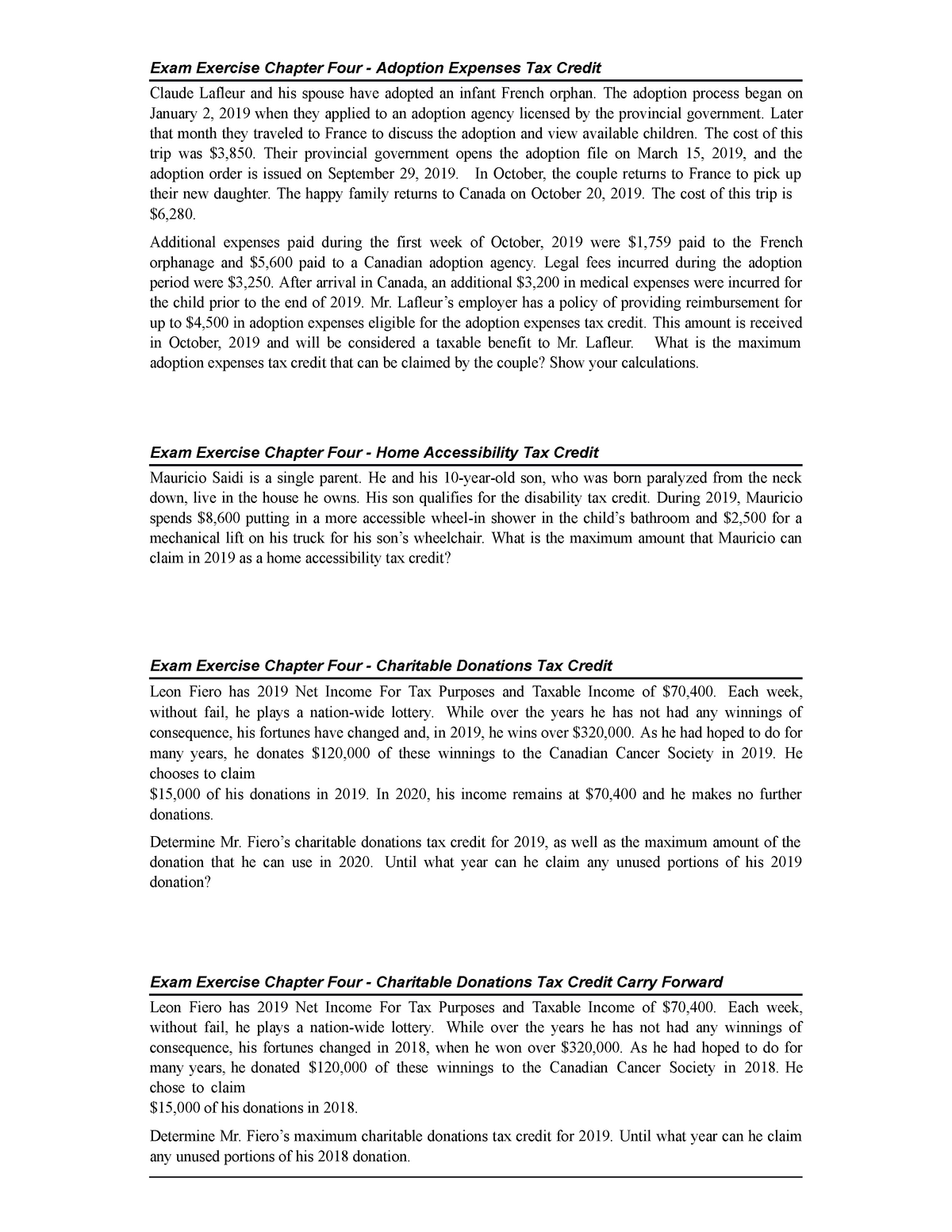

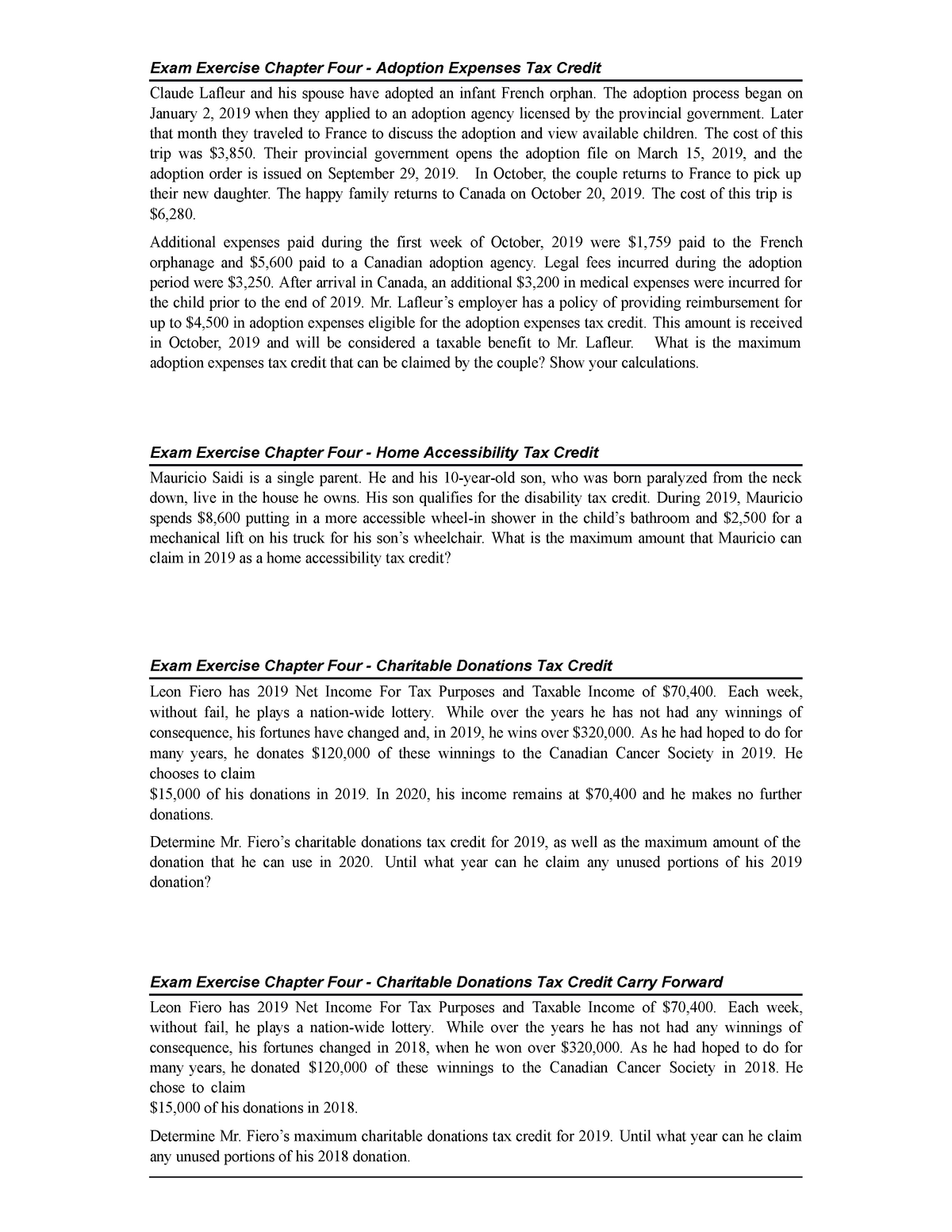

ACCT226 Chapter 4 Exam Exercise 4 Exam Exercise Chapter Four

The Adoption Tax Credit Helps Families With Adoption Related Expenses

Small Business Tax Deductions Deductible Expenses

https://www.irs.gov/newsroom/the-adoption-tax...

The adoption tax credit lets families who were in the adoption process during 2022 claim up to 14 890 in eligible adoption expenses for each eligible child Taxpayers can apply the credit to international domestic private and public foster care adoptions

https://www.irs.gov/newsroom/understanding-the-adoption-tax-credit

IRS Tax Tip 2022 09 January 18 2022 Taxpayers who adopted or started the adoption process in 2021 may qualify for the adoption credit This credit can be applied to international domestic private and public foster care adoption Taxpayers who

The adoption tax credit lets families who were in the adoption process during 2022 claim up to 14 890 in eligible adoption expenses for each eligible child Taxpayers can apply the credit to international domestic private and public foster care adoptions

IRS Tax Tip 2022 09 January 18 2022 Taxpayers who adopted or started the adoption process in 2021 may qualify for the adoption credit This credit can be applied to international domestic private and public foster care adoption Taxpayers who

ACCT226 Chapter 4 Exam Exercise 4 Exam Exercise Chapter Four

Are Dental Expenses Tax Deductible Maybe

The Adoption Tax Credit Helps Families With Adoption Related Expenses

Small Business Tax Deductions Deductible Expenses

Are Child Care Expenses Tax Deductible ATC Income Tax

Are Moving Expenses Tax Deductible

Are Moving Expenses Tax Deductible

What Are Tax Deductible Expenses Business Advice