In this age of electronic devices, with screens dominating our lives The appeal of tangible printed material hasn't diminished. If it's to aid in education in creative or artistic projects, or just adding some personal flair to your home, printables for free are now an essential resource. The following article is a dive to the depths of "Agricultural Land Income Tax Exemption," exploring their purpose, where to get them, as well as how they can improve various aspects of your lives.

Get Latest Agricultural Land Income Tax Exemption Below

Agricultural Land Income Tax Exemption

Agricultural Land Income Tax Exemption -

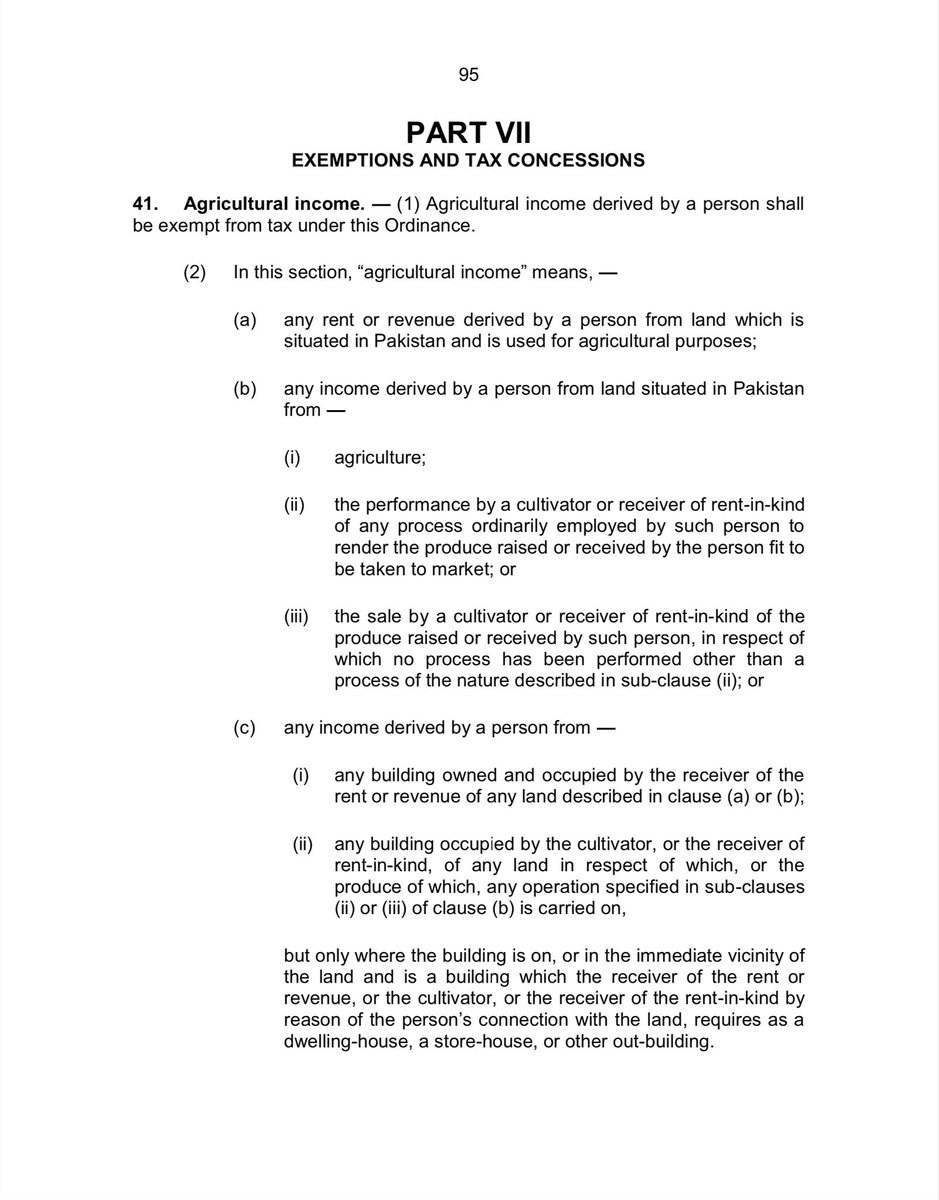

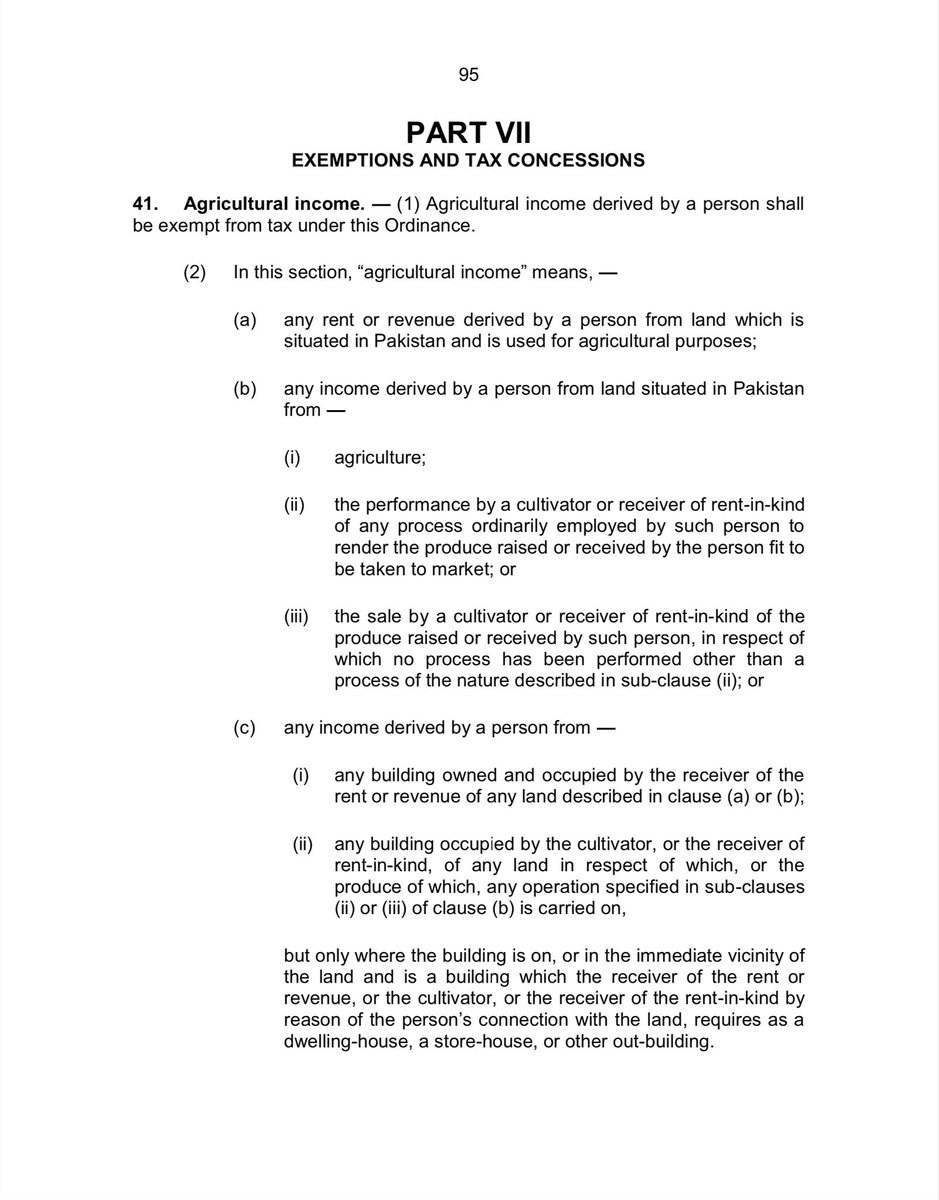

Agriculture Income is exempt up to 400 000 as per the Act The Punjab Agricultural Income Tax Act 1997 Agricultural Income Definition under Income Tax Ordinance 2001 a any rent or revenue derived by a person from land which is situated in Pakistan and is used for agricultural purposes

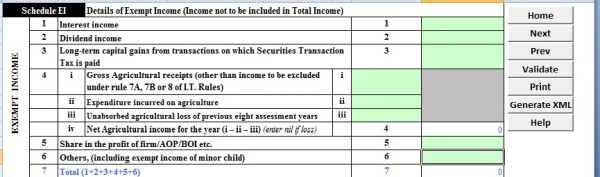

Amount of exemption from Capital Gains u s 54B If cost of new Agricultural Land is equal or greater than capital gains then entire capital gains is exempt Moreover if cost of new Agricultural Land is less than capital gains capital gains to the extent of thecost of new agricultural land is exempt

Agricultural Land Income Tax Exemption provide a diverse assortment of printable, downloadable documents that can be downloaded online at no cost. These resources come in various forms, like worksheets templates, coloring pages, and more. The attraction of printables that are free is in their variety and accessibility.

More of Agricultural Land Income Tax Exemption

Capital Gain On Sale Of Agricultural Land Tax Exemptions

Capital Gain On Sale Of Agricultural Land Tax Exemptions

The Federal Board of Revenue FBR will not charge tax on agricultural property excluding farmhouses under section 7E of the Income Tax Ordinance 2001 Through circular number 3 of 2023

Exemption from Section 54B for sale of agricultural land Agricultural income is tax exempt but it is indirectly subject to taxation Understand agricultural income tax in India including exemptions limits and calculations with examples Know how to show agriculture income in your tax return

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization Your HTML0 customization options allow you to customize print-ready templates to your specific requirements whether it's making invitations making your schedule, or even decorating your house.

-

Educational Use: Free educational printables can be used by students of all ages, making them an invaluable tool for teachers and parents.

-

The convenience of Fast access numerous designs and templates is time-saving and saves effort.

Where to Find more Agricultural Land Income Tax Exemption

How To Calculate Exempt Amount Under Section 54 B Urban Agricultural

How To Calculate Exempt Amount Under Section 54 B Urban Agricultural

The transfer of rural agricultural land is exempt from taxes without any conditions whereas the transfer of urban agricultural land is only exempt if the capital gains from the transfer are invested in new agricultural land as per Section 54B of the Income tax Act

Agricultural income tax Liability to pay agriculture income tax 8 Assessment and collection of agriculture income tax CHAPTER IV MISCELLANEOUS 9 Penalty for concealment of cultivated land 10 Penalty for concealment of agricultural income etc 11 Imposition of penalty 12 Refund 13 Exemption 14 Maintenance of accounts 15

We hope we've stimulated your interest in Agricultural Land Income Tax Exemption Let's find out where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Agricultural Land Income Tax Exemption for all needs.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free, flashcards, and learning tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a broad selection of subjects, all the way from DIY projects to party planning.

Maximizing Agricultural Land Income Tax Exemption

Here are some ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, and decorations for special events like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Agricultural Land Income Tax Exemption are a treasure trove of useful and creative resources catering to different needs and preferences. Their access and versatility makes them an essential part of your professional and personal life. Explore the world that is Agricultural Land Income Tax Exemption today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Agricultural Land Income Tax Exemption truly for free?

- Yes you can! You can print and download these documents for free.

-

Can I download free templates for commercial use?

- It's determined by the specific terms of use. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables may have restrictions regarding usage. Always read these terms and conditions as set out by the creator.

-

How do I print Agricultural Land Income Tax Exemption?

- Print them at home with your printer or visit any local print store for superior prints.

-

What program will I need to access printables free of charge?

- The majority of printables are in PDF format. They is open with no cost software such as Adobe Reader.

What Is Agricultural Literacy Updated 2022

Sale Proceeds Of Rural Agricultural Land Income From Other Sources

Check more sample of Agricultural Land Income Tax Exemption below

Monopoly Income Tax Rules Explained Monopoly Land

Can You Benefit From An Agricultural Tax Exemption Houseopedia

Agriculture Land And Income Tax Confusing Yet Clear

Mubariz Siddiqui On Twitter Correction There Is A Provincial Tax On

Capital Gain On Sale Of Land Tax Exemption Rules Capital Gain

Income From Sale Of Agricultural Land When Will Be Exempt From Income

https://taxguru.in/income-tax/taxability-sale...

Amount of exemption from Capital Gains u s 54B If cost of new Agricultural Land is equal or greater than capital gains then entire capital gains is exempt Moreover if cost of new Agricultural Land is less than capital gains capital gains to the extent of thecost of new agricultural land is exempt

https://taxationpk.com/how-to-claim-agricultural...

Section 41 of the Income Tax Ordinance offers a crucial exemption for agricultural income but understanding its scope and nuances is essential for farmers and landowners alike This article delves into the specifics of this exemption providing a comprehensive guide to its application and implications Exempting the Fruits of the Land

Amount of exemption from Capital Gains u s 54B If cost of new Agricultural Land is equal or greater than capital gains then entire capital gains is exempt Moreover if cost of new Agricultural Land is less than capital gains capital gains to the extent of thecost of new agricultural land is exempt

Section 41 of the Income Tax Ordinance offers a crucial exemption for agricultural income but understanding its scope and nuances is essential for farmers and landowners alike This article delves into the specifics of this exemption providing a comprehensive guide to its application and implications Exempting the Fruits of the Land

Mubariz Siddiqui On Twitter Correction There Is A Provincial Tax On

Can You Benefit From An Agricultural Tax Exemption Houseopedia

Capital Gain On Sale Of Land Tax Exemption Rules Capital Gain

Income From Sale Of Agricultural Land When Will Be Exempt From Income

Delhi High Court Agricultural Land Capital Gain Income Tax

Agricultural Income Tax Provisions Under The Income Tax Act

Agricultural Income Tax Provisions Under The Income Tax Act

Compulsory Acquisition Of Agricultural Land Land May Be With In Urban