In this digital age, where screens have become the dominant feature of our lives yet the appeal of tangible printed products hasn't decreased. Be it for educational use as well as creative projects or just adding some personal flair to your space, Agriculture Income Tax Deduction have proven to be a valuable resource. Here, we'll dive into the sphere of "Agriculture Income Tax Deduction," exploring what they are, where to get them, as well as how they can be used to enhance different aspects of your life.

Get Latest Agriculture Income Tax Deduction Below

Agriculture Income Tax Deduction

Agriculture Income Tax Deduction -

Example 1 Colorado Sheep Producer Jose raises sheep full time in the alpine meadows of Colorado Jose sells market lambs and wool shorn from the flock

Farmers with average turnover of less than EUR 82 800 USD 97 700 can reduce their taxable incomes by 87 for tax purposes Although similar to schemes applying to

Agriculture Income Tax Deduction encompass a wide variety of printable, downloadable materials available online at no cost. These resources come in many styles, from worksheets to templates, coloring pages and many more. The beauty of Agriculture Income Tax Deduction is in their versatility and accessibility.

More of Agriculture Income Tax Deduction

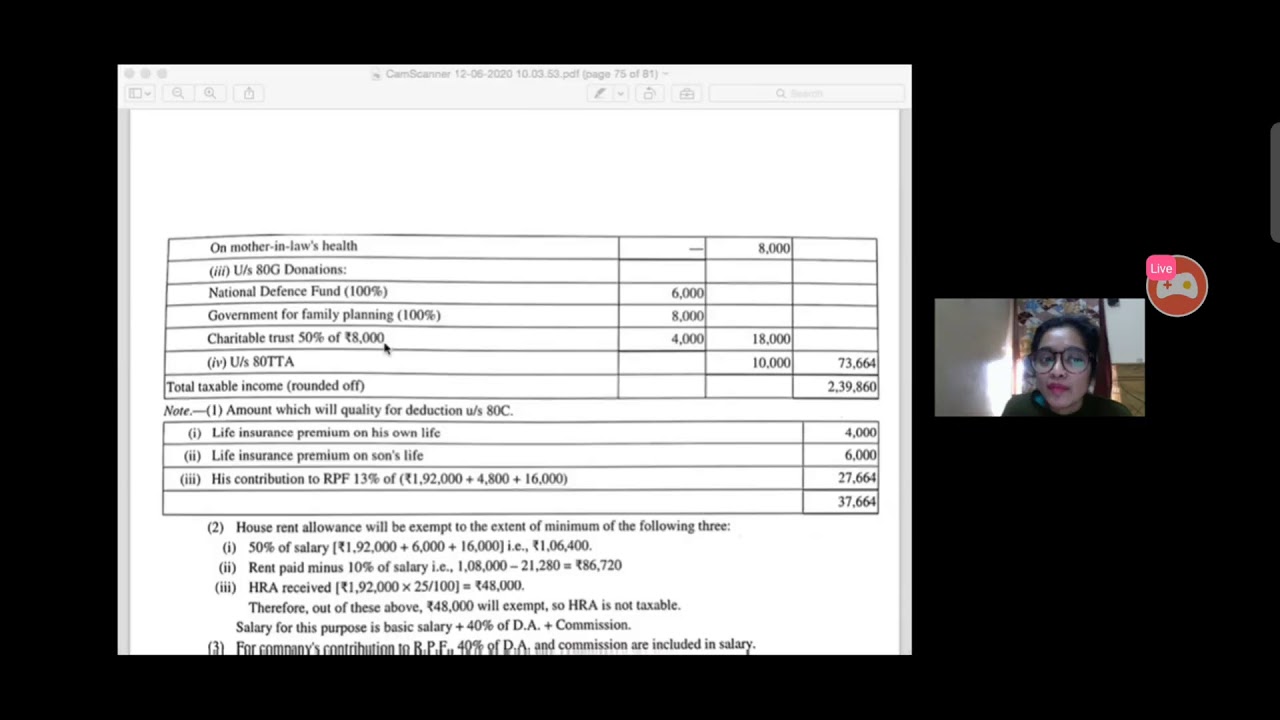

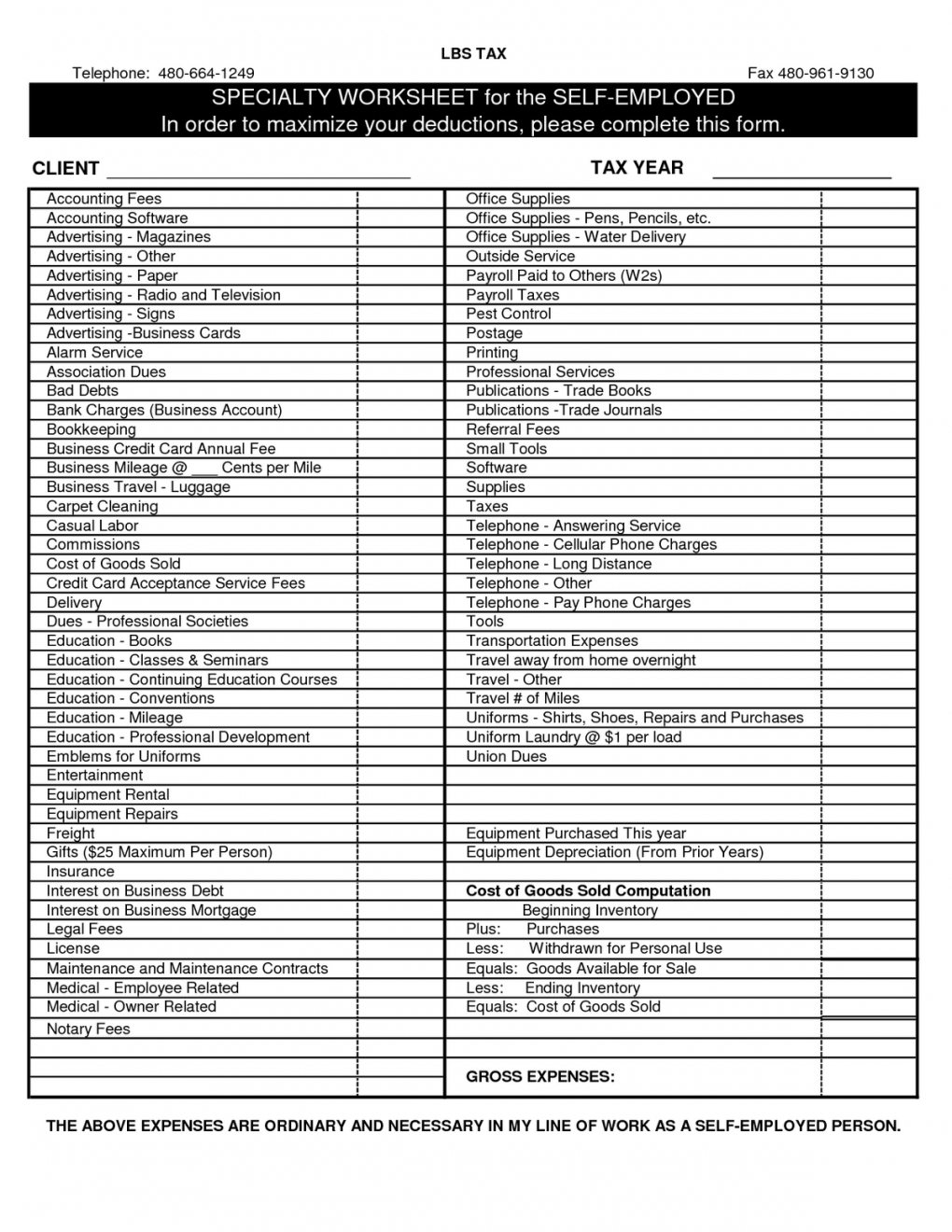

Deduction And Agriculture Of Income Income Tax Bcom YouTube

Deduction And Agriculture Of Income Income Tax Bcom YouTube

In the United States the most important tax advantages for agriculture under federal income tax is income averaging and the deductibility of certain capital expenditures

The following discussion looks at the definition of a farmer from an income tax perspective including the definitions of farm farming and farmers as found in the Internal Revenue

Printables that are free have gained enormous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Personalization It is possible to tailor printed materials to meet your requirements, whether it's designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Impact: Printing educational materials for no cost cater to learners from all ages, making them an essential source for educators and parents.

-

Easy to use: Quick access to an array of designs and templates cuts down on time and efforts.

Where to Find more Agriculture Income Tax Deduction

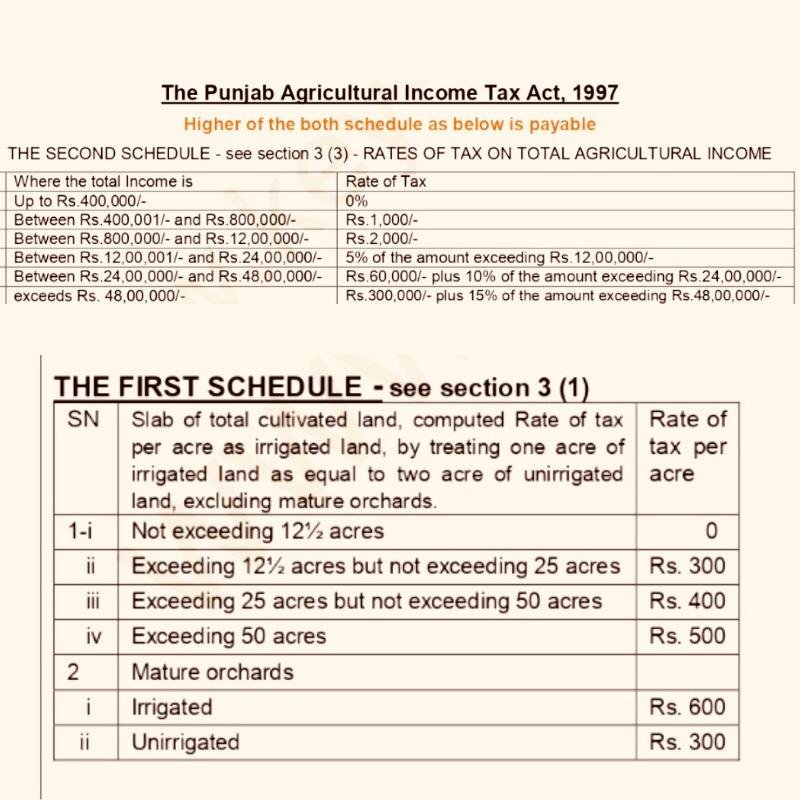

Tax On Agricultural Income In Pakistan Latest Tax Financial News

Tax On Agricultural Income In Pakistan Latest Tax Financial News

Reduction in Tax Brackets old 15 25 now 12 22 Increased child tax credit old 1000 now 2000 Higher standard deduction old 12 600 now 25 900 Federal

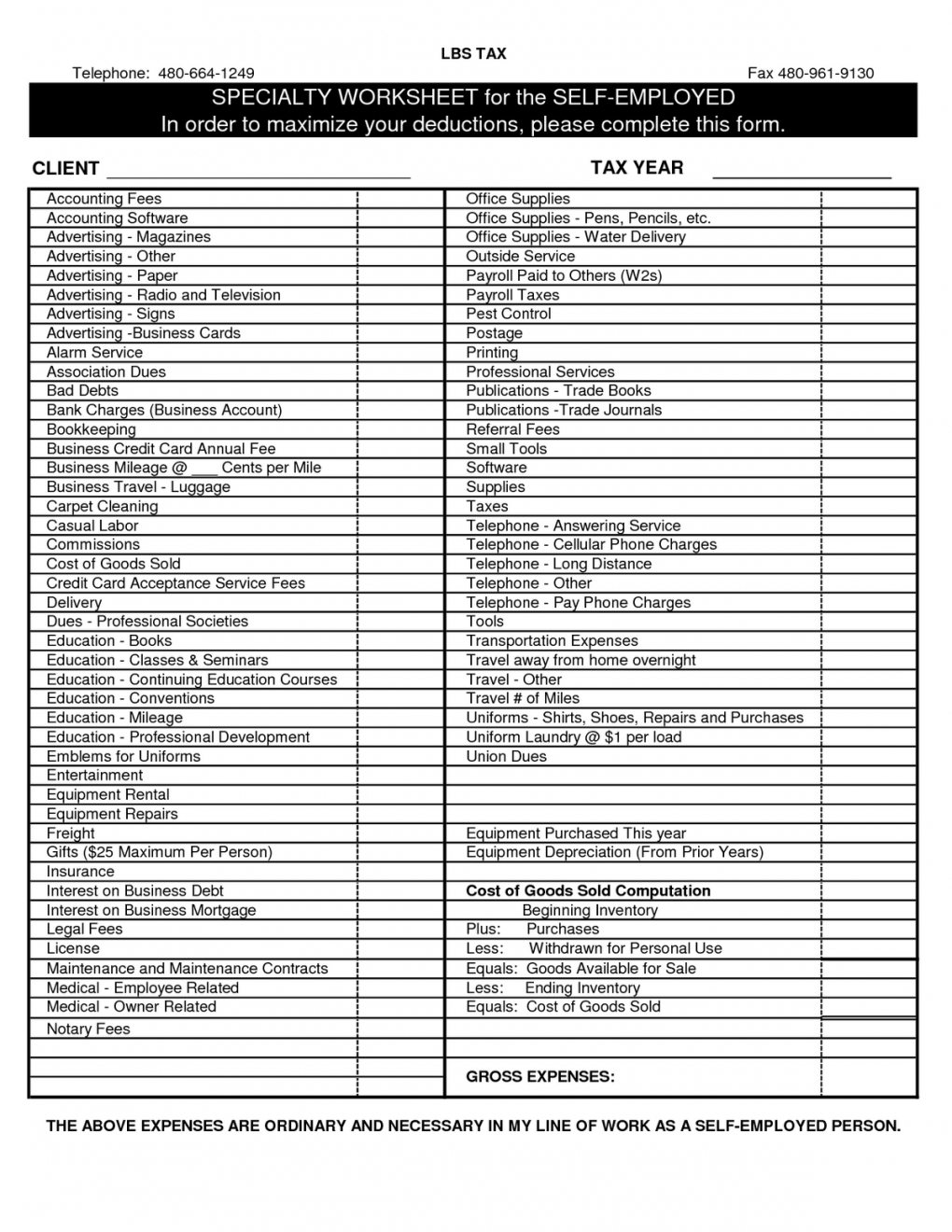

Farmer tax deductions are critical in reducing taxable income directly impacting the financial health of a farming enterprise These deductions range from

Since we've got your curiosity about Agriculture Income Tax Deduction we'll explore the places you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection in Agriculture Income Tax Deduction for different goals.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs are a vast range of topics, ranging from DIY projects to party planning.

Maximizing Agriculture Income Tax Deduction

Here are some ideas how you could make the most of Agriculture Income Tax Deduction:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Utilize free printable worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Agriculture Income Tax Deduction are a treasure trove of useful and creative resources that cater to various needs and pursuits. Their access and versatility makes these printables a useful addition to each day life. Explore the many options of Agriculture Income Tax Deduction right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can download and print these materials for free.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular conditions of use. Always check the creator's guidelines before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables could have limitations on their use. Be sure to check the terms and conditions offered by the creator.

-

How can I print printables for free?

- You can print them at home using either a printer or go to a print shop in your area for better quality prints.

-

What program do I need to open printables that are free?

- A majority of printed materials are in the PDF format, and can be opened with free software like Adobe Reader.

Agriculture Income In Income Tax Agriculture Income Tax Return Filing

How To File Agriculture Income Tax Return 2021 Tax Return For

Check more sample of Agriculture Income Tax Deduction below

Agriculture Income In Income Tax Agriculture Income In Income Tax In

Agriculture Income Tax Why Farmer s Income Tax Free

Taxing Agricultural Income Archives Civilspedia

3 AGRICULTURE INCOME STANDARD DEDUCTION UNDER SALARY INCOME YouTube

Farm Income And Expense Spreadsheet Download Pertaining To Farm Expense

Agriculture Income In Income Tax Agriculture Income Tax Return Filing

https://www.oecd-ilibrary.org/sites/3f966048-en/...

Farmers with average turnover of less than EUR 82 800 USD 97 700 can reduce their taxable incomes by 87 for tax purposes Although similar to schemes applying to

https://www.taxfyle.com/blog/farm-tax-write-offs

Maximize farm savings with IRS approved deductions tax write offs Learn to deduct agricultural expenses like fertilizer property tax consult tax pros and file

Farmers with average turnover of less than EUR 82 800 USD 97 700 can reduce their taxable incomes by 87 for tax purposes Although similar to schemes applying to

Maximize farm savings with IRS approved deductions tax write offs Learn to deduct agricultural expenses like fertilizer property tax consult tax pros and file

3 AGRICULTURE INCOME STANDARD DEDUCTION UNDER SALARY INCOME YouTube

Agriculture Income Tax Why Farmer s Income Tax Free

Farm Income And Expense Spreadsheet Download Pertaining To Farm Expense

Agriculture Income In Income Tax Agriculture Income Tax Return Filing

Cherish Childhood Memories Quotes

Sindh Mulls Halving Agriculture Income Tax Exemption Pakistan DAWN COM

Sindh Mulls Halving Agriculture Income Tax Exemption Pakistan DAWN COM

DR Ambedkar s Views On Agriculture Income Tax