In a world where screens have become the dominant feature of our lives, the charm of tangible printed items hasn't gone away. In the case of educational materials as well as creative projects or simply adding an element of personalization to your space, Air Conditioner Qualify For Energy Credit are now an essential source. In this article, we'll dive into the sphere of "Air Conditioner Qualify For Energy Credit," exploring their purpose, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest Air Conditioner Qualify For Energy Credit Below

Air Conditioner Qualify For Energy Credit

Air Conditioner Qualify For Energy Credit -

The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star requirements Windows and skylights must meet Energy Star

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

Air Conditioner Qualify For Energy Credit offer a wide array of printable materials online, at no cost. These printables come in different forms, including worksheets, templates, coloring pages and much more. The value of Air Conditioner Qualify For Energy Credit is their flexibility and accessibility.

More of Air Conditioner Qualify For Energy Credit

Does A Generator Qualify For Energy Credit Midwest Generator Solutions

Does A Generator Qualify For Energy Credit Midwest Generator Solutions

Energy efficient HVAC systems including furnaces boilers and central AC The 25C credit has an annual cap of 1 200 except heat pump Up to 600 each for a qualified air conditioner or gas furnace Up to 2 000 with a qualified heat pump heat pump water heater or boiler

To qualify for the tax credit follow these steps Purchase an eligible air conditioner Keep proof of purchase Complete the necessary IRS form during tax preparation Begin by purchasing an eligible air conditioner that meets IRS energy efficiency specifications particularly units with the ENERGY STAR label

Air Conditioner Qualify For Energy Credit have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization It is possible to tailor printing templates to your own specific requirements, whether it's designing invitations making your schedule, or even decorating your house.

-

Educational Benefits: The free educational worksheets are designed to appeal to students of all ages, making them a vital tool for teachers and parents.

-

An easy way to access HTML0: immediate access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Air Conditioner Qualify For Energy Credit

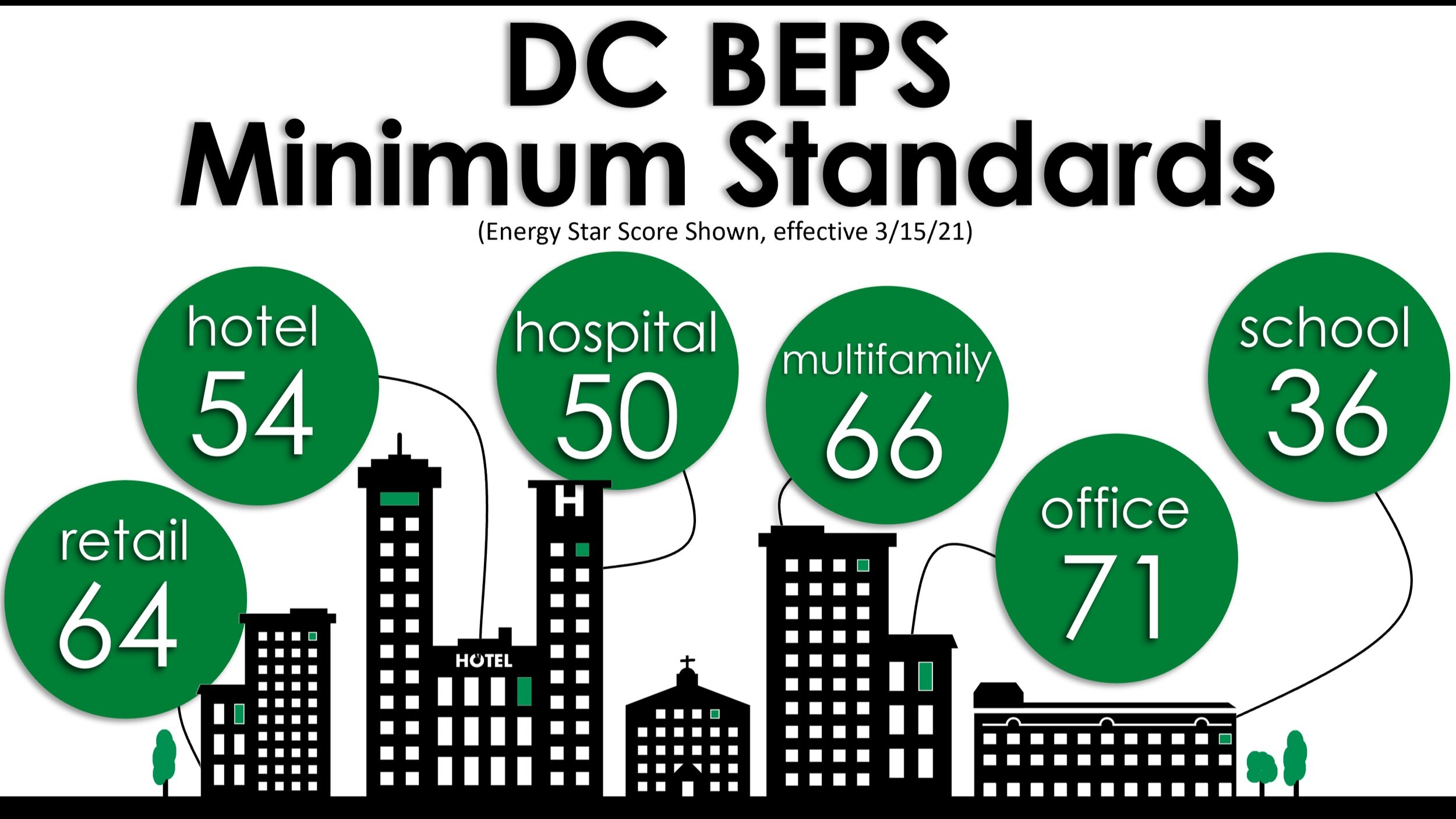

What Is DC BEPS Building Energy Performance Standard Era

What Is DC BEPS Building Energy Performance Standard Era

The amended Energy Efficient Home Improvement Credit which begins in 2023 and extends through 2032 increases the tax credits as high as 600 for qualified air conditioner or gas furnace and up to 2000 for qualified heat pump heat pump water heater or boiler

Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps 300 for ENERGY STAR certified heat pumps

We've now piqued your interest in printables for free, let's explore where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Air Conditioner Qualify For Energy Credit to suit a variety of purposes.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast spectrum of interests, including DIY projects to party planning.

Maximizing Air Conditioner Qualify For Energy Credit

Here are some ideas create the maximum value of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

Air Conditioner Qualify For Energy Credit are a treasure trove of practical and imaginative resources that meet a variety of needs and passions. Their access and versatility makes them a fantastic addition to each day life. Explore the many options of Air Conditioner Qualify For Energy Credit today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes they are! You can download and print these resources at no cost.

-

Can I utilize free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues when you download Air Conditioner Qualify For Energy Credit?

- Certain printables may be subject to restrictions regarding usage. Make sure you read the conditions and terms of use provided by the author.

-

How can I print printables for free?

- Print them at home using printing equipment or visit a local print shop to purchase top quality prints.

-

What program do I require to view printables that are free?

- A majority of printed materials are in the PDF format, and can be opened with free software like Adobe Reader.

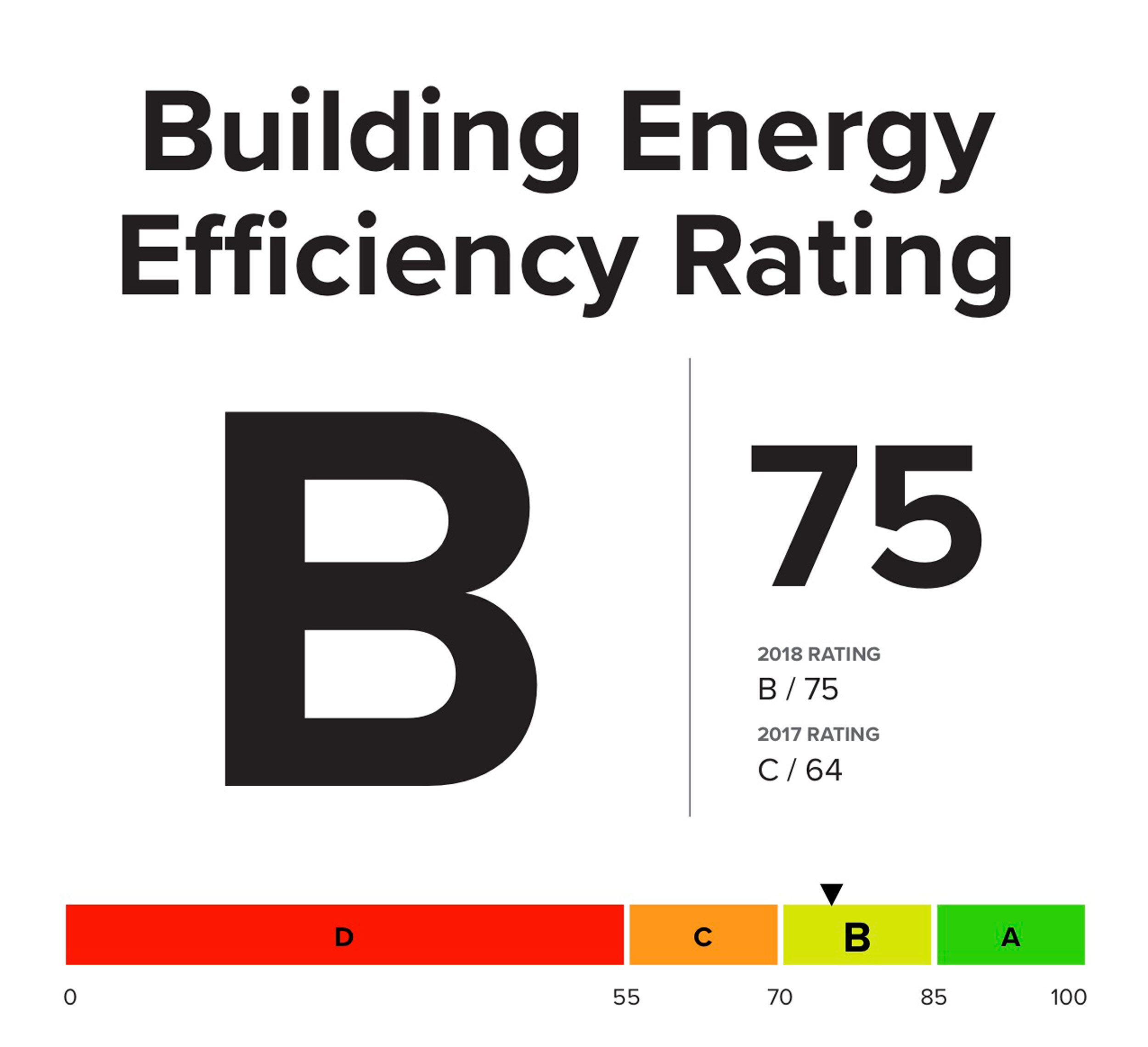

Understanding New York City s Building Energy Efficiency Rating System

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Check more sample of Air Conditioner Qualify For Energy Credit below

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

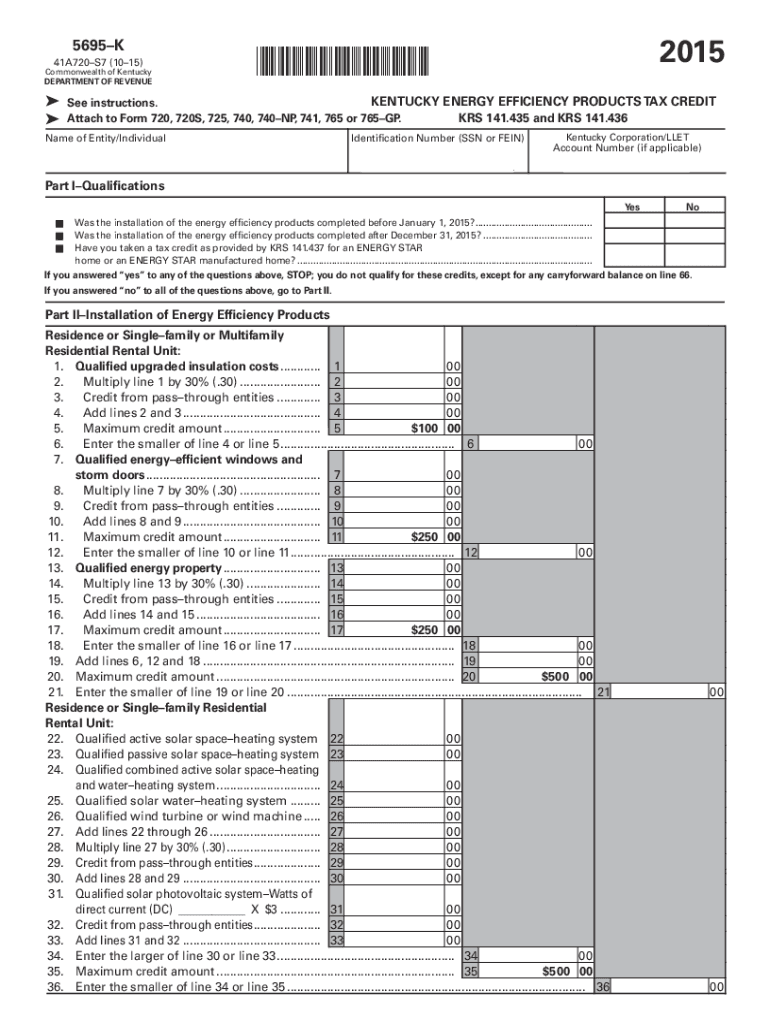

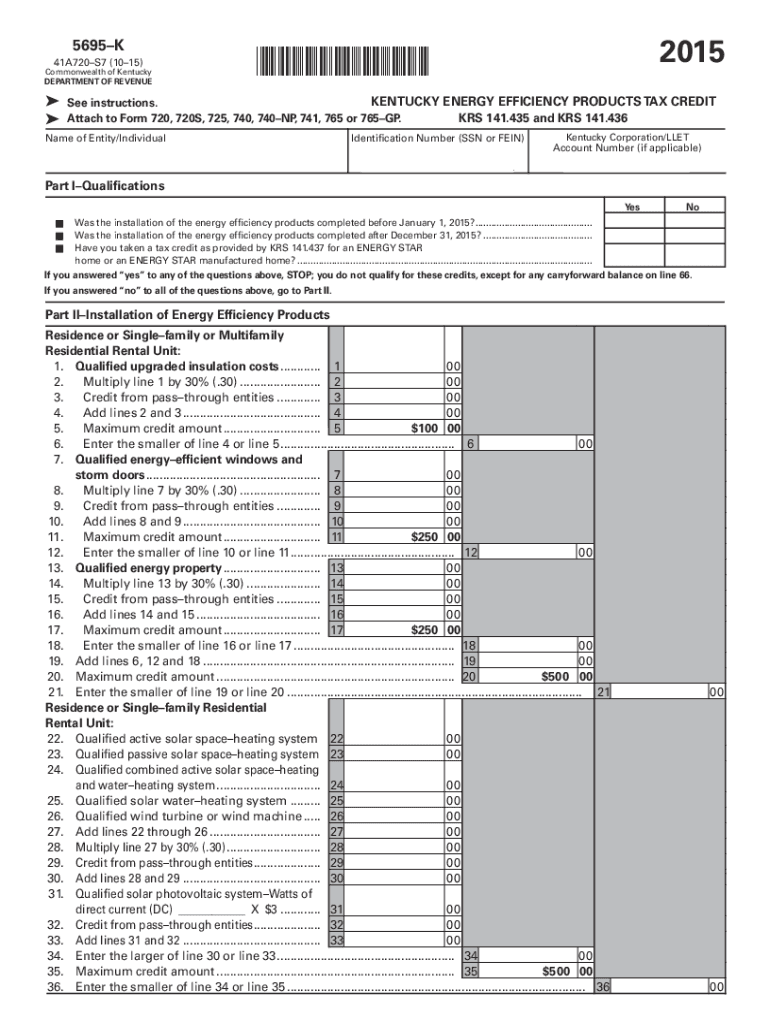

Form 5695 Fill Out And Sign Printable PDF Template SignNow

Does A Home Generator Qualify For Energy Credit

Financing Energy Efficient Homes Department Of Energy

Fujitsu General Mini Split Systems Qualify For Energy Star 2019 Most

Do Air Conditioners Qualify For Residential Energy Credit

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Financing Energy Efficient Homes Department Of Energy

Form 5695 Fill Out And Sign Printable PDF Template SignNow

Fujitsu General Mini Split Systems Qualify For Energy Star 2019 Most

Do Air Conditioners Qualify For Residential Energy Credit

Duke Energy Heat Pump Rebate In Florida PumpRebate

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

What You Need To Know To Qualify For A 2 000 Tax Credit For Installing