In this digital age, when screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. Whether it's for educational purposes project ideas, artistic or just adding an individual touch to your space, Are Business Rebates Taxable have become a valuable source. The following article is a dive into the world "Are Business Rebates Taxable," exploring the different types of printables, where to get them, as well as ways they can help you improve many aspects of your life.

Get Latest Are Business Rebates Taxable Below

Are Business Rebates Taxable

Are Business Rebates Taxable -

Publication 525 2022 Taxable and Nontaxable Income Internal Revenue Service Employer Provided Group Term Life Insurance Repaid wages subject to Additional Medicare Tax Year of deduction or credit Preparing and filing your tax return Using online tools to help prepare your return Employers can register to use Business

Rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

Are Business Rebates Taxable offer a wide array of printable documents that can be downloaded online at no cost. These materials come in a variety of types, like worksheets, templates, coloring pages, and more. The appeal of printables for free is in their versatility and accessibility.

More of Are Business Rebates Taxable

Forbes On Twitter Are State Tax Refunds And Rebates Federally Taxable

Forbes On Twitter Are State Tax Refunds And Rebates Federally Taxable

The IRS and the courts agree that rebates paid by nonsellers are not excludable reasoning that only the seller can agree to a price adjustment Although the IRS appears to be moving toward allowing most seller paid rebates as exclusions it is now insisting that even accrual taxpayers delay the exclusion until the rebate is paid

The rebates are based on a percentage of Taxpayers credit card purchases usually 1 and reduced by fees charged by Company e g administrative and marketing The percentage of Taxpayers credit card purchases less fees equals the amount of the rebate to which Taxpayers are entitled X

Are Business Rebates Taxable have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization This allows you to modify printables to your specific needs in designing invitations and schedules, or even decorating your house.

-

Educational Value Free educational printables cater to learners of all ages. This makes them a valuable tool for parents and educators.

-

It's easy: You have instant access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Are Business Rebates Taxable

Ma Tax Rebates Electric Cars 2023 Carrebate

Ma Tax Rebates Electric Cars 2023 Carrebate

Generally business expenses are deductible against business income If you spend 500 on something for your business you can deduct 500 on your business taxes But credit card rewards

Business expenses are generally tax deductible by the owner of the business and that changes the impact that a card reward has Just as the IRS treats the reward as a discount for personal

Now that we've ignited your interest in printables for free Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Are Business Rebates Taxable designed for a variety uses.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing or flashcards as well as learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for free.

- These blogs cover a broad variety of topics, including DIY projects to party planning.

Maximizing Are Business Rebates Taxable

Here are some innovative ways that you can make use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print worksheets that are free to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Are Business Rebates Taxable are an abundance of innovative and useful resources catering to different needs and hobbies. Their availability and versatility make these printables a useful addition to any professional or personal life. Explore the endless world of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually cost-free?

- Yes you can! You can download and print these documents for free.

-

Does it allow me to use free printables to make commercial products?

- It is contingent on the specific conditions of use. Always check the creator's guidelines prior to printing printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may come with restrictions in their usage. Make sure to read the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using your printer or visit an in-store print shop to get better quality prints.

-

What software do I need to open printables that are free?

- A majority of printed materials are as PDF files, which can be opened using free software, such as Adobe Reader.

Are ACA Rebates Taxable HealthPlanRate Healthplanrate

Are Idaho s Tax Rebates Taxable

Check more sample of Are Business Rebates Taxable below

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc

Are 2022 Tax Rebates Considered taxable Income YouTube

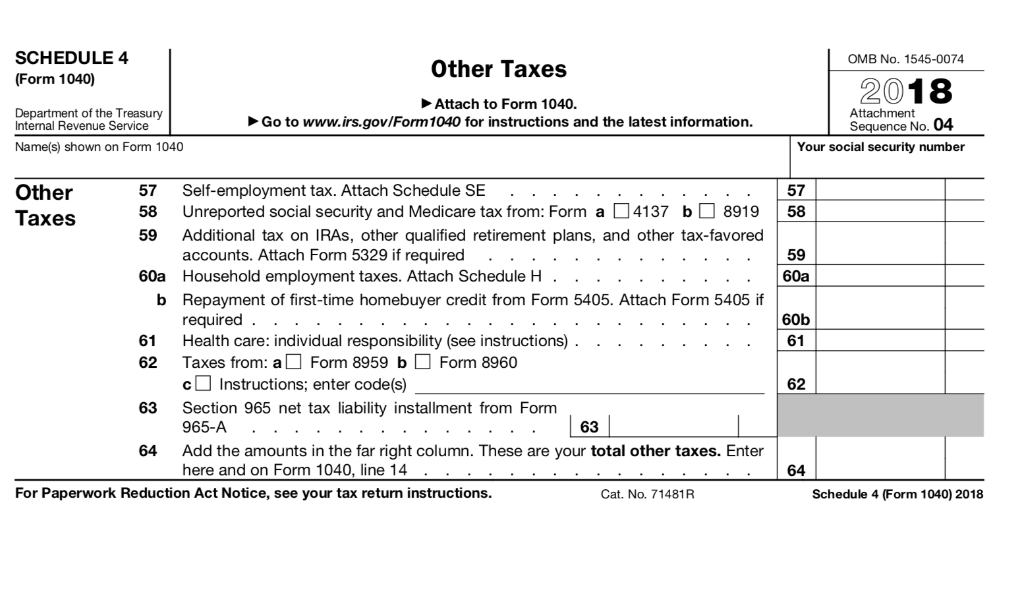

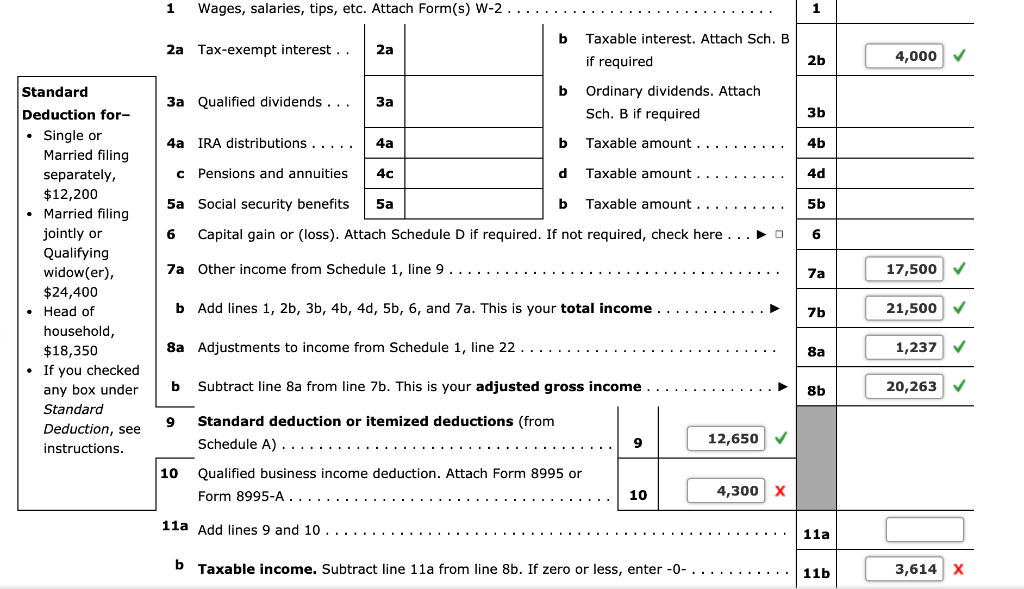

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://donotpay.com/learn/are-rebates-taxable

Rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

https://www.hackyourtax.com/taxing-rebates-points-rewards

Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on your purchase later Here s what the IRS has to say Taxpayers will make purchases with the credit cards and as a result of those purchases will be entitled to receive

Rebates taxable A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on your purchase later Here s what the IRS has to say Taxpayers will make purchases with the credit cards and as a result of those purchases will be entitled to receive

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Are Buyer Agent Commission Rebates Taxable In NYC Buyers Agent Nyc

Solved Janice Morgan Age 24 Is Single And Has No Chegg

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2022 Tax Brackets JeanXyzander

IRS Says California Most State Tax Rebates Aren T Considered Taxable

IRS Says California Most State Tax Rebates Aren T Considered Taxable

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates