In this digital age, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. Be it for educational use as well as creative projects or just adding an extra personal touch to your space, Are Home Appliances Tax Deductible are now a vital source. This article will dive in the world of "Are Home Appliances Tax Deductible," exploring what they are, where to locate them, and what they can do to improve different aspects of your life.

Get Latest Are Home Appliances Tax Deductible Below

Are Home Appliances Tax Deductible

Are Home Appliances Tax Deductible -

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

Are Home Appliances Tax Deductible encompass a wide variety of printable, downloadable materials online, at no cost. These resources come in many types, like worksheets, templates, coloring pages, and many more. The great thing about Are Home Appliances Tax Deductible is their flexibility and accessibility.

More of Are Home Appliances Tax Deductible

Are Home Improvements Tax Deductible LendingTree

Are Home Improvements Tax Deductible LendingTree

All qualifying capital improvements are tax deductible However you can t claim the deduction until you sell the home

Neither are most appliance purchases including major kitchen appliances such as stoves or refrigerators But see the section on energy efficiency deductions below Capital improvements

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor designs to suit your personal needs whether it's making invitations making your schedule, or decorating your home.

-

Educational Value Printing educational materials for no cost cater to learners of all ages, which makes them a vital tool for parents and educators.

-

An easy way to access HTML0: Quick access to various designs and templates will save you time and effort.

Where to Find more Are Home Appliances Tax Deductible

What Expenses Are Tax Deductible When Selling A House Home Selling

What Expenses Are Tax Deductible When Selling A House Home Selling

In general household appliances are not tax deductible unless they were purchased as a business asset or expense For example landlords can typically claim kitchen equipment as a necessary business expense Office

In this blog post we will delve into the intricacies of tax deductions and credits related to home appliances We will explore which types of appliances may qualify the purpose of their use

Since we've got your interest in Are Home Appliances Tax Deductible we'll explore the places they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Are Home Appliances Tax Deductible for all uses.

- Explore categories like design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, including DIY projects to planning a party.

Maximizing Are Home Appliances Tax Deductible

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home also in the classes.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Are Home Appliances Tax Deductible are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and hobbies. Their accessibility and versatility make them a valuable addition to the professional and personal lives of both. Explore the world of Are Home Appliances Tax Deductible right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes they are! You can print and download these files for free.

-

Can I use the free printables for commercial purposes?

- It's based on specific conditions of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright problems with Are Home Appliances Tax Deductible?

- Certain printables may be subject to restrictions regarding their use. Check the terms and regulations provided by the author.

-

How can I print Are Home Appliances Tax Deductible?

- You can print them at home with any printer or head to a print shop in your area for high-quality prints.

-

What software do I need in order to open Are Home Appliances Tax Deductible?

- The majority of printed documents are in the format PDF. This can be opened using free software like Adobe Reader.

Medical Appliances Tax Relief Oliver Niland Co Chartered

Are Appliances Tax Deductible

Check more sample of Are Home Appliances Tax Deductible below

Are Home Improvements Tax Deductible Rayne Water

Are Homeschool Expenses Tax Deductible Intrepid Eagle Finance

Are Home Improvements Tax Deductible

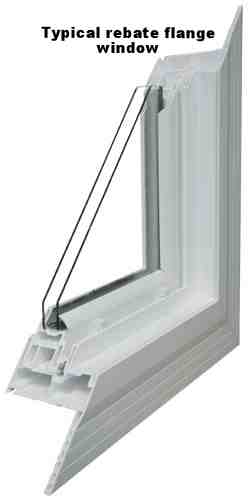

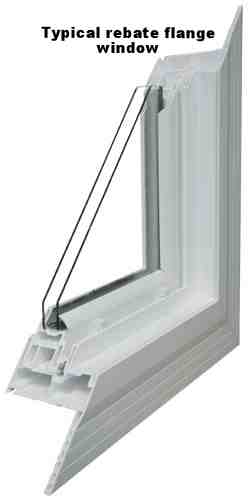

Replacement Windows Rebates Window Replacement

HomeDepot 16x9 The Home Depot Has Arrived At ShopMyExchang Flickr

Are Greensboro Home Insurance Deductibles Tax Deductible

https://www.irs.gov › credits-deductions › energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

https://ttlc.intuit.com › turbotax-support › en-us › ...

You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many state and

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

You can t claim Energy Star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return But many state and

Replacement Windows Rebates Window Replacement

Are Homeschool Expenses Tax Deductible Intrepid Eagle Finance

HomeDepot 16x9 The Home Depot Has Arrived At ShopMyExchang Flickr

Are Greensboro Home Insurance Deductibles Tax Deductible

Are New Home Appliances Tax Deductible All That You Need To Know

2 Bed Flat For Sale In Glen Court Little Haven Haverfordwest SA62

2 Bed Flat For Sale In Glen Court Little Haven Haverfordwest SA62

Are New Home Appliances Tax Deductible All That You Need To Know