Today, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons, creative projects, or just adding an element of personalization to your home, printables for free can be an excellent resource. Through this post, we'll dive into the world "Are Home Improvement Loans Tax Deductible," exploring what they are, where to locate them, and how they can be used to enhance different aspects of your life.

Get Latest Are Home Improvement Loans Tax Deductible Below

Are Home Improvement Loans Tax Deductible

Are Home Improvement Loans Tax Deductible -

Verkko Form 1098 Where To Deduct Home Mortgage Interest Refund of overpaid interest More than one borrower Principal residence Amount you can exclude Ordering rule Qualified Home Main home Who qualifies Reducing your home mortgage interest deduction Limit based on tax

Verkko 4 elok 2021 nbsp 0183 32 Tax credit for home improvement loans According to the IRS you can deduct the full amount of points in the year paid on your home improvement loan provided you meet the following six criteria Your loan is secured by your main house which is typically where you live most of the year

Printables for free cover a broad range of printable, free materials online, at no cost. They are available in a variety of forms, like worksheets coloring pages, templates and more. The great thing about Are Home Improvement Loans Tax Deductible lies in their versatility and accessibility.

More of Are Home Improvement Loans Tax Deductible

Credit Cards Personal Loans Are Home Improvement Loans Tax

Credit Cards Personal Loans Are Home Improvement Loans Tax

Verkko 3 helmik 2023 nbsp 0183 32 Home improvements that qualify as capital improvements are tax deductible but not until you sell your home

Verkko 7 toukok 2023 nbsp 0183 32 When making upgrades most homeowners ask Are home improvements tax deductible Broadly speaking no However there can be exceptions Home improvements can potentially reduce your tax burden such as capital improvements and upgrades related to medical care or energy efficiency

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor printed materials to meet your requirements whether it's making invitations, organizing your schedule, or even decorating your home.

-

Educational Value: The free educational worksheets are designed to appeal to students from all ages, making them a vital tool for parents and teachers.

-

It's easy: immediate access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Are Home Improvement Loans Tax Deductible

Are Home Improvement Loans Tax Deductible Remodeling Tips

Are Home Improvement Loans Tax Deductible Remodeling Tips

Verkko 17 elok 2023 nbsp 0183 32 Home improvement tax credits work differently than a deduction A credit can immediately reduce the amount of taxes you owe without adjusting your cost basis Once you calculate the dollar amount of taxes owed you can subtract your tax credits For example let s say you owe the IRS 1 000 on your 2022 taxes

Verkko 10 tammik 2023 nbsp 0183 32 In general home improvements are not tax deductible But there are a few exceptions Learn about certain tax breaks you could be eligible for Key takeaways Many home improvement projects don t qualify for tax deductions But some might qualify for a tax break or have other tax implications

If we've already piqued your interest in Are Home Improvement Loans Tax Deductible we'll explore the places you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety and Are Home Improvement Loans Tax Deductible for a variety applications.

- Explore categories such as the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning tools.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide variety of topics, that includes DIY projects to party planning.

Maximizing Are Home Improvement Loans Tax Deductible

Here are some unique ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings and birthdays.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Are Home Improvement Loans Tax Deductible are an abundance of useful and creative resources that can meet the needs of a variety of people and preferences. Their availability and versatility make them a great addition to each day life. Explore the vast collection of Are Home Improvement Loans Tax Deductible today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually completely free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use free printouts for commercial usage?

- It's contingent upon the specific terms of use. Always consult the author's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright problems with Are Home Improvement Loans Tax Deductible?

- Certain printables might have limitations on their use. Make sure to read the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using either a printer at home or in an in-store print shop to get higher quality prints.

-

What software do I require to open printables for free?

- The majority of printed documents are in the PDF format, and is open with no cost software such as Adobe Reader.

Are Home Improvement Loans Tax Deductible

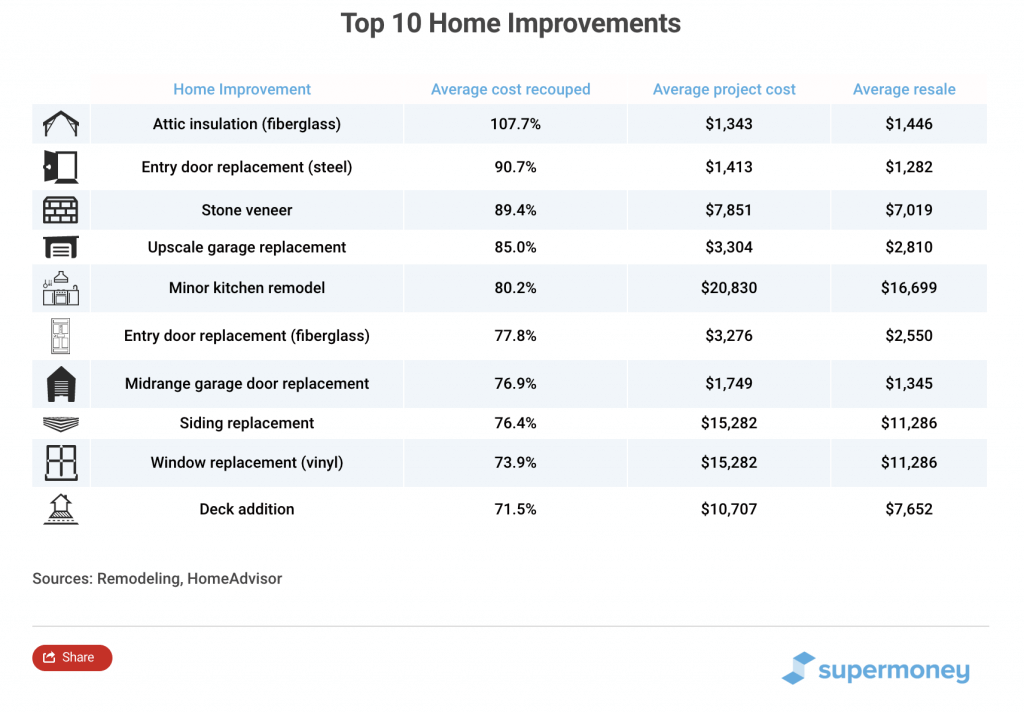

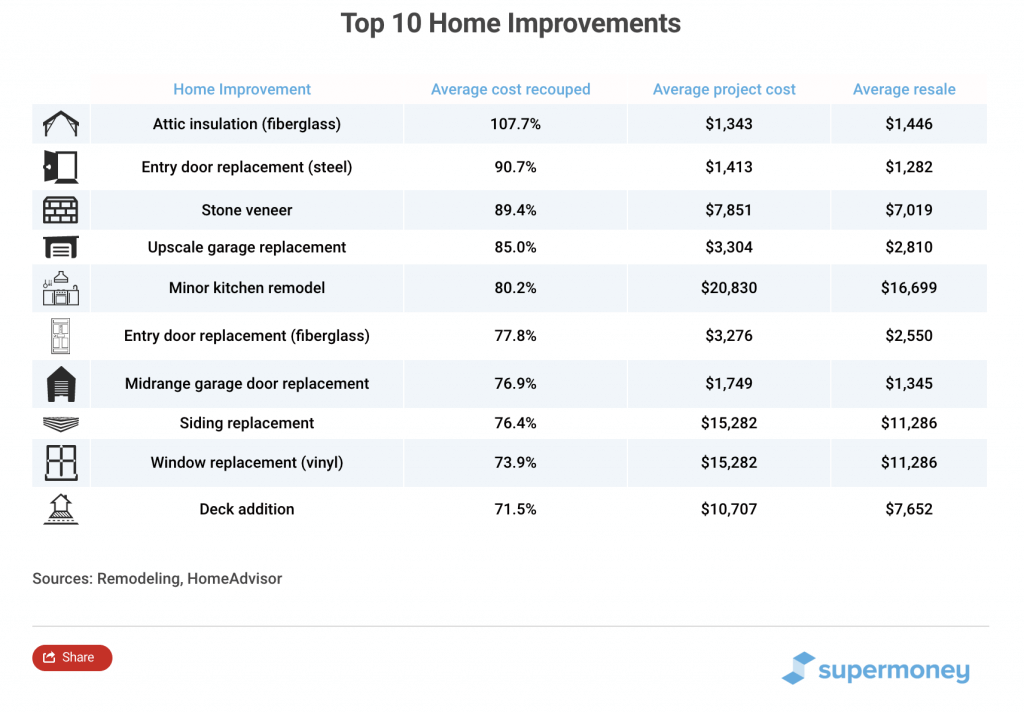

Are Home Improvement Loans Tax Deductible Not Always SuperMoney

Check more sample of Are Home Improvement Loans Tax Deductible below

Are Home Improvement Loans Tax Deductible In 2019 Loan Walls

Are Home Interest Loans Deductible From Taxes TurboTax Tax Tips Videos

Student Loan Tax Deduction Milliken Perkins Brunelle

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

4 Home Improvement Projects That Are Potentially Tax Deductible

/woman-spreads-drop-cloth-home-improvement-a499aa3306b34d8293b870d919301405.jpg)

Are Home Improvement Loans Interest Tax Deductible CountyOffice

https://www.supermoney.com/are-home-improvement-loans-tax-deduct…

Verkko 4 elok 2021 nbsp 0183 32 Tax credit for home improvement loans According to the IRS you can deduct the full amount of points in the year paid on your home improvement loan provided you meet the following six criteria Your loan is secured by your main house which is typically where you live most of the year

https://finance.yahoo.com/news/home-improvement-loans-tax-deductib…

Verkko 27 helmik 2023 nbsp 0183 32 Home improvement loans generally aren t eligible for federal tax deductions even when used for eligible renovations or property improvements Unlike home equity loans which can be

Verkko 4 elok 2021 nbsp 0183 32 Tax credit for home improvement loans According to the IRS you can deduct the full amount of points in the year paid on your home improvement loan provided you meet the following six criteria Your loan is secured by your main house which is typically where you live most of the year

Verkko 27 helmik 2023 nbsp 0183 32 Home improvement loans generally aren t eligible for federal tax deductions even when used for eligible renovations or property improvements Unlike home equity loans which can be

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

Are Home Interest Loans Deductible From Taxes TurboTax Tax Tips Videos

/woman-spreads-drop-cloth-home-improvement-a499aa3306b34d8293b870d919301405.jpg)

4 Home Improvement Projects That Are Potentially Tax Deductible

Are Home Improvement Loans Interest Tax Deductible CountyOffice

What Are Home Improvement Loans And How Do You Get One TheStreet

Are Home Improvement Loans Tax Deductible Not Always SuperMoney

Are Home Improvement Loans Tax Deductible Not Always SuperMoney

Are Home Improvement Expenses Tax Deductible YouTube