In this age of technology, in which screens are the norm and the appeal of physical printed products hasn't decreased. In the case of educational materials in creative or artistic projects, or just adding personal touches to your area, Are Professional Membership Dues Tax Deductible are now an essential resource. With this guide, you'll take a dive to the depths of "Are Professional Membership Dues Tax Deductible," exploring their purpose, where they are available, and how they can enhance various aspects of your life.

Get Latest Are Professional Membership Dues Tax Deductible Below

Are Professional Membership Dues Tax Deductible

Are Professional Membership Dues Tax Deductible -

Generally speaking dues and subscriptions that are directly related to your profession or trade can be deducted as ordinary and necessary expenses on your taxes This includes professional organization memberships trade association fees industry specific publications or newsletters and even certain licensing fees

In general if the nonprofit provides services of value as part of the membership program your dues will not be tax deductible What membership dues are tax deductible There are several types of membership

Are Professional Membership Dues Tax Deductible provide a diverse assortment of printable, downloadable materials online, at no cost. These materials come in a variety of kinds, including worksheets templates, coloring pages, and more. One of the advantages of Are Professional Membership Dues Tax Deductible is in their versatility and accessibility.

More of Are Professional Membership Dues Tax Deductible

Are Nonprofit Membership Dues Tax Deductible Sapling

Are Nonprofit Membership Dues Tax Deductible Sapling

Dues used for lobbying If a tax exempt organization notifies you that part of the dues or other amounts you pay to the organization are used to pay nondeductible lobbying expenses you can t deduct that part download the free IRS2Go app or call 888 227 7669 for information on free tax return preparation MilTax Members of the U S Armed

Employment related professional association dues or fees are allowable as tax deductions if they meet the guidelines established by the IRS Internal Revenue Service You must know how the dues will be utilized by the association to calculate what portion of the dues can be a tax deduction

Are Professional Membership Dues Tax Deductible have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: You can tailor designs to suit your personal needs when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Educational Benefits: Downloads of educational content for free can be used by students of all ages, which makes them an essential resource for educators and parents.

-

Accessibility: Quick access to the vast array of design and templates can save you time and energy.

Where to Find more Are Professional Membership Dues Tax Deductible

Are Union Dues Tax Deductible

Are Union Dues Tax Deductible

Membership dues may not be deducted if they are for membership in an organization for which contributions are not deductible in general Contributions to charities religious organizations educational institutions and other organizations exempt under Internal Revenue Code section 501 c 3 are typically deductible

For instance membership dues paid to business leagues trade associations chambers of commerce boards of trade real estate boards professional organizations and civic or public service organizations are deductible These include bar associations medical associations or the Kiwanis Rotary and Lions clubs

Since we've got your interest in Are Professional Membership Dues Tax Deductible we'll explore the places you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Are Professional Membership Dues Tax Deductible for all uses.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates at no cost.

- These blogs cover a wide range of interests, from DIY projects to party planning.

Maximizing Are Professional Membership Dues Tax Deductible

Here are some ideas create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to build your knowledge at home or in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are Professional Membership Dues Tax Deductible are a treasure trove of innovative and useful resources that cater to various needs and desires. Their accessibility and versatility make them a fantastic addition to both professional and personal lives. Explore the wide world of Are Professional Membership Dues Tax Deductible now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can download and print these documents for free.

-

Can I utilize free printing templates for commercial purposes?

- It depends on the specific terms of use. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may come with restrictions regarding their use. Be sure to check the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home with either a printer at home or in an area print shop for high-quality prints.

-

What program do I require to open printables that are free?

- The majority are printed with PDF formats, which can be opened using free software such as Adobe Reader.

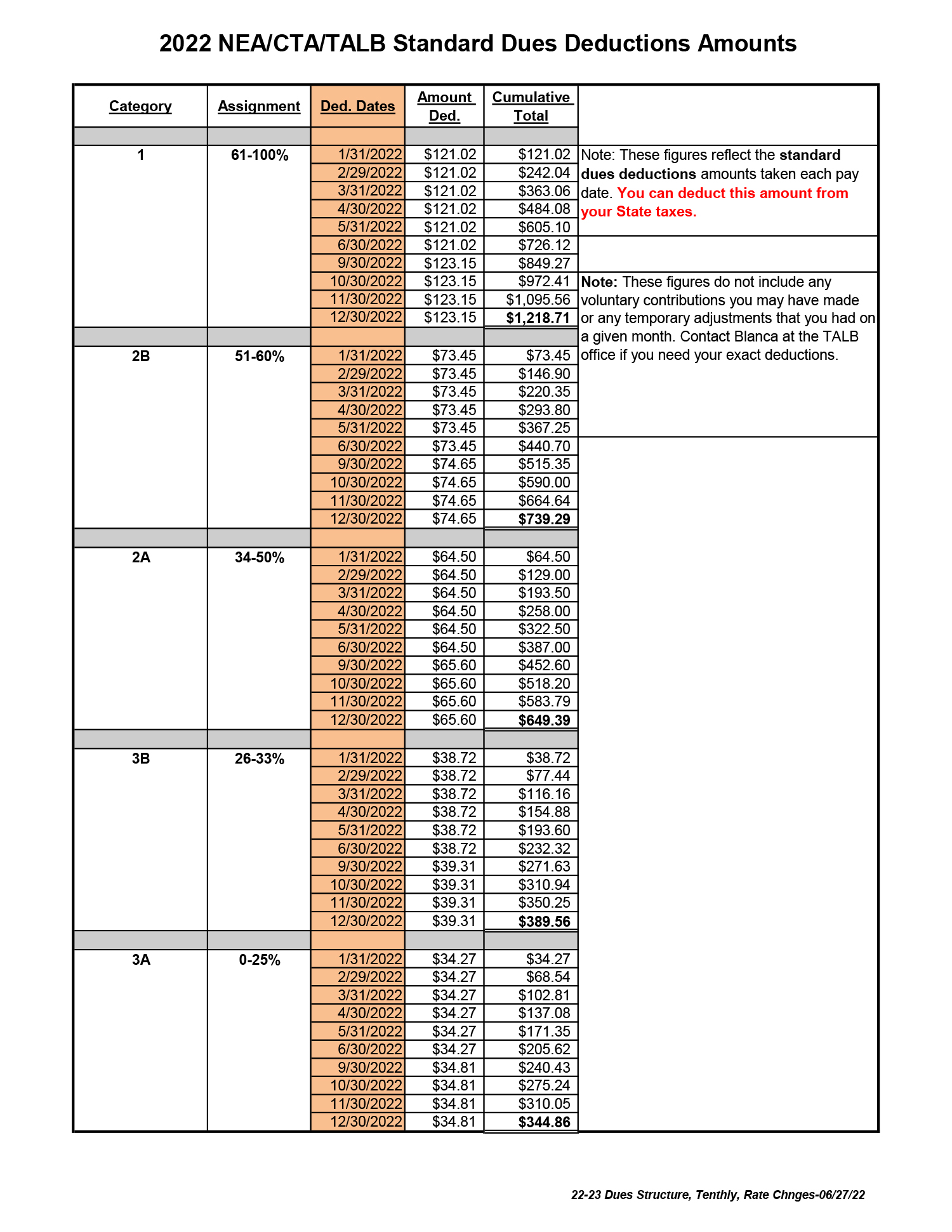

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Freelancers Tax Deductions You Might Be Missing Fearlessflyer

Check more sample of Are Professional Membership Dues Tax Deductible below

Membership How To Join International Society Of Deliverance Ministers

Are Union Dues Tax Deductible Pasquesi Sheppard LLC

Membership Dues Invoice Template Invoice Maker

Are Professional Conferences Tax Deductible

Are Union Dues Tax Deductible IRS

Are Union Dues Tax Deductible

https://www.bonterratech.com/blog/membership-dues-tax-deductible

In general if the nonprofit provides services of value as part of the membership program your dues will not be tax deductible What membership dues are tax deductible There are several types of membership

https://ttlc.intuit.com/community/tax-credits...

Dues to professional organizations may be deductible as an employee business expense subject to the 2 floor if the membership helps you carry out the duties of your job See the link to the excellent answer by TurboTaxHelena below

In general if the nonprofit provides services of value as part of the membership program your dues will not be tax deductible What membership dues are tax deductible There are several types of membership

Dues to professional organizations may be deductible as an employee business expense subject to the 2 floor if the membership helps you carry out the duties of your job See the link to the excellent answer by TurboTaxHelena below

Are Professional Conferences Tax Deductible

Are Union Dues Tax Deductible Pasquesi Sheppard LLC

Are Union Dues Tax Deductible IRS

Are Union Dues Tax Deductible

Are Union Dues Tax Deductible What You Need To Know

Job Search Expenses That Are Tax Deductible

Job Search Expenses That Are Tax Deductible

Are Union Dues Tax Deductible Where Is My US Tax Refund