In a world in which screens are the norm yet the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses in creative or artistic projects, or simply to add an individual touch to your area, Are Reimbursement Taxable can be an excellent resource. With this guide, you'll dive into the world "Are Reimbursement Taxable," exploring their purpose, where to get them, as well as how they can be used to enhance different aspects of your life.

Get Latest Are Reimbursement Taxable Below

Are Reimbursement Taxable

Are Reimbursement Taxable -

In this guide we ll give you the rundown on how to report employee expenses what is and isn t taxable and how to handle paperwork for employee reimbursements But first a quick chart to help with this breakdown

Are reimbursements taxable When you give money to an employee you typically have to withhold and contribute taxes on the payment So are reimbursed expenses taxable Well it depends The IRS expense reimbursement guidelines have two types of plans accountable and nonaccountable

Are Reimbursement Taxable include a broad assortment of printable items that are available online at no cost. These resources come in many kinds, including worksheets templates, coloring pages and many more. The value of Are Reimbursement Taxable lies in their versatility and accessibility.

More of Are Reimbursement Taxable

Is Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

When a reimbursement is paid to an employee or the business it must be properly recorded for it to be considered nontaxable For instance on an employee s pay stub a reimbursement must be noted as such and not merely included among the

If a reimbursement plan is deemed accountable the reimbursements are not considered taxable income to the employee However if a reimbursement plan is deemed as nonaccountable the reimbursements are considered taxable income and the employer is required to report it on the employee s W 2 form

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization There is the possibility of tailoring the templates to meet your individual needs when it comes to designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: Education-related printables at no charge cater to learners of all ages, which makes these printables a powerful resource for educators and parents.

-

The convenience of The instant accessibility to various designs and templates helps save time and effort.

Where to Find more Are Reimbursement Taxable

Is Tuition Reimbursement Taxable A Guide ClearDegree

Is Tuition Reimbursement Taxable A Guide ClearDegree

In general reimbursements are not taxable to the employee because you re simply paying back them back for money they spent on company related expenses It s often best to set up an accountable plan as described below so that the expense can be treated as a

When employees are reimbursed under a non accountable plan the payments will be included as taxable income but may be deductible as an itemized deduction on their personal income tax return

In the event that we've stirred your interest in Are Reimbursement Taxable and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Are Reimbursement Taxable to suit a variety of objectives.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs are a vast range of topics, from DIY projects to planning a party.

Maximizing Are Reimbursement Taxable

Here are some innovative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets to build your knowledge at home and in class.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Are Reimbursement Taxable are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and pursuits. Their availability and versatility make these printables a useful addition to each day life. Explore the vast world of Are Reimbursement Taxable today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can download and print these materials for free.

-

Can I utilize free printables for commercial purposes?

- It's based on specific rules of usage. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables could have limitations on their use. Check the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in an in-store print shop to get the highest quality prints.

-

What program do I require to view printables that are free?

- The majority are printed in the PDF format, and is open with no cost software such as Adobe Reader.

Reimbursement And Disbursement Of Expenses In UAE VAT Whether Taxable

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Check more sample of Are Reimbursement Taxable below

Are Expense Reimbursements Taxable Workest

Are Reimbursements Taxable How To Handle

What Is Educational Assistance Is Education Reimbursement Taxable

Is A Car Allowance Or Mileage Reimbursement Taxable Income

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

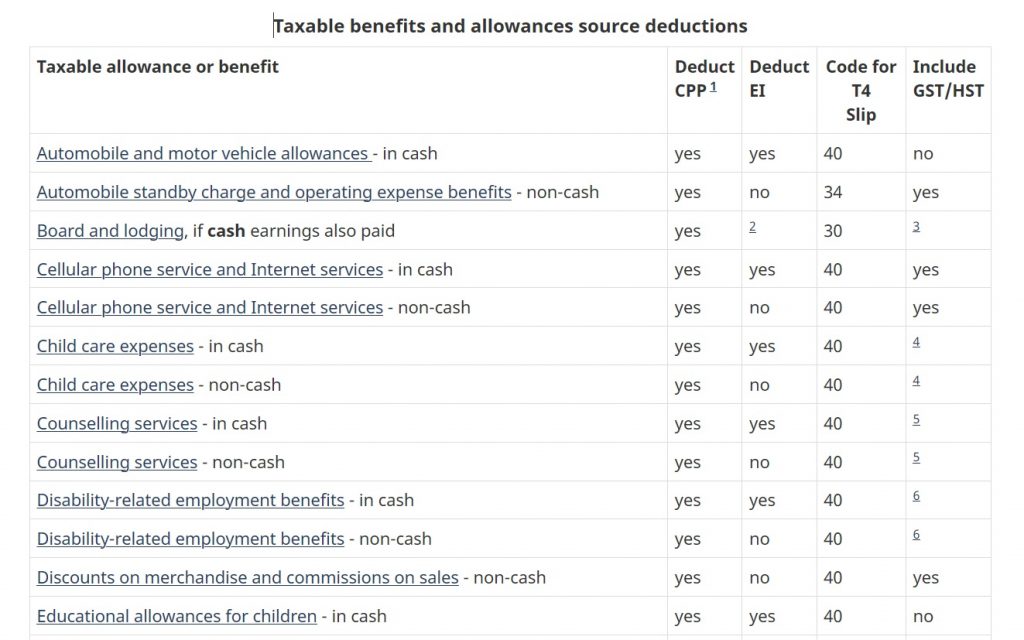

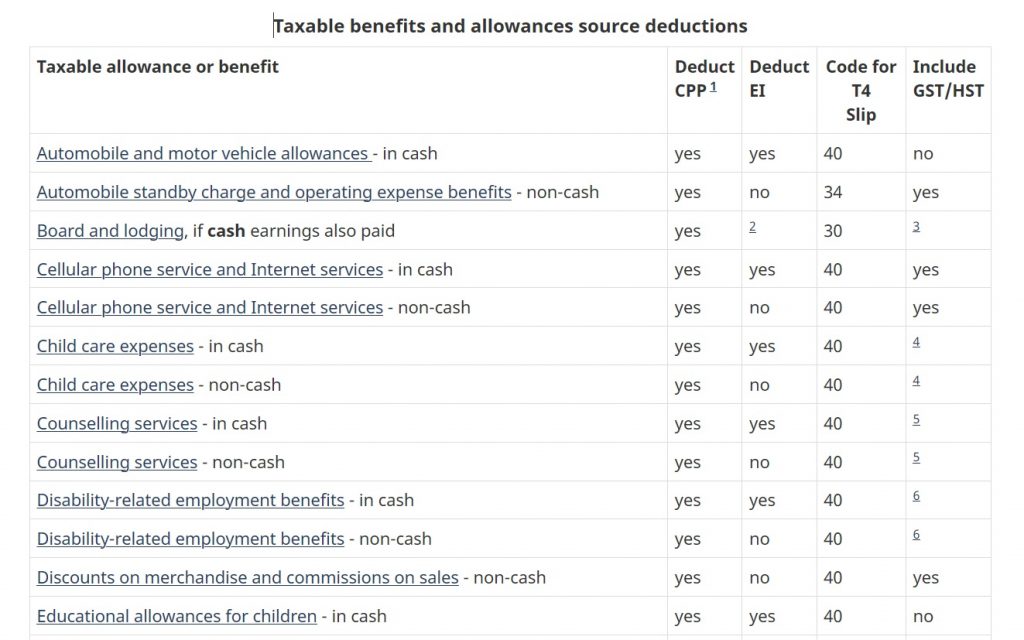

Helpful Resources For Calculating Canadian Employee Taxable Benefits

https://www.patriotsoftware.com/blog/payroll/are...

Are reimbursements taxable When you give money to an employee you typically have to withhold and contribute taxes on the payment So are reimbursed expenses taxable Well it depends The IRS expense reimbursement guidelines have two types of plans accountable and nonaccountable

https://www.irs.gov/publications/p525

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

Are reimbursements taxable When you give money to an employee you typically have to withhold and contribute taxes on the payment So are reimbursed expenses taxable Well it depends The IRS expense reimbursement guidelines have two types of plans accountable and nonaccountable

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable

Is A Car Allowance Or Mileage Reimbursement Taxable Income

Are Reimbursements Taxable How To Handle

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Is A Mileage Reimbursement Taxable

28 PDF MEDICAL REIMBURSEMENT TAXABLE OR NOT PRINTABLE DOWNLOAD ZIP

28 PDF MEDICAL REIMBURSEMENT TAXABLE OR NOT PRINTABLE DOWNLOAD ZIP

GST Reimbursement Of Toll Charge Liable To Include In The Value Of