In this digital age, where screens have become the dominant feature of our lives The appeal of tangible printed materials hasn't faded away. Whether it's for educational purposes, creative projects, or simply to add an element of personalization to your area, Are Training Courses Tax Deductible Canada are now a vital resource. With this guide, you'll take a dive to the depths of "Are Training Courses Tax Deductible Canada," exploring the different types of printables, where to get them, as well as how they can improve various aspects of your lives.

Get Latest Are Training Courses Tax Deductible Canada Below

Are Training Courses Tax Deductible Canada

Are Training Courses Tax Deductible Canada -

This is not deductible directly as an expense but must be reflected as an eligible capital expenditure and amortized Eligible capital expenditures account are classified under CCA Class 14 1 with a CCA rate of 5 This means that you can deduct 5 per year of the total training expense

You must meet specific requirements to claim the Canada Training Credit on your tax return Most importantly you must be at least 26 years old and have a valid Social Insurance Number To claim the credit you would have to have accumulated a Canada Training Credit limit in a previous tax year

Are Training Courses Tax Deductible Canada cover a large assortment of printable, downloadable content that can be downloaded from the internet at no cost. These resources come in many formats, such as worksheets, coloring pages, templates and much more. The value of Are Training Courses Tax Deductible Canada is their flexibility and accessibility.

More of Are Training Courses Tax Deductible Canada

Is Real Estate Course Tuition Tax Deductible S Ehrlich

Is Real Estate Course Tuition Tax Deductible S Ehrlich

To assist Canadians with the expense of qualified training fees the government of Canada offers the Canada training credit CTC a refundable tax credit For courses you took during the year you can

You may be able to claim both the Canada training credit and the tuition tax credit in the same year However in calculating your tuition tax credit your eligible tuition and fees paid for the year will be reduced by the Canada training credit you claim in that year How do I find out if I am eligible for this credit

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: Your HTML0 customization options allow you to customize printing templates to your own specific requirements for invitations, whether that's creating them to organize your schedule or decorating your home.

-

Educational Impact: Free educational printables can be used by students of all ages, making them an invaluable tool for parents and teachers.

-

Easy to use: immediate access many designs and templates helps save time and effort.

Where to Find more Are Training Courses Tax Deductible Canada

Are Training Costs Tax Deductible For The Self Employed

Are Training Costs Tax Deductible For The Self Employed

If you were required to take some training and you spend more than 100 at a recognize school then you could claim tuition Otherwise it could be as other expenses maybe You have to show that you were required to pay for that to have work and it is a cost of doing business

Eligible Canadians will receive up to 250 each year to cover 50 of training expenses from colleges universities and qualified education institutions like PNC Learning The lifetime maximum credit is 5 000 to

We hope we've stimulated your interest in Are Training Courses Tax Deductible Canada Let's see where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Are Training Courses Tax Deductible Canada for various motives.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a broad range of topics, all the way from DIY projects to party planning.

Maximizing Are Training Courses Tax Deductible Canada

Here are some creative ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets for teaching at-home also in the classes.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are Training Courses Tax Deductible Canada are a treasure trove with useful and creative ideas that cater to various needs and desires. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the endless world of Are Training Courses Tax Deductible Canada today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Are Training Courses Tax Deductible Canada truly absolutely free?

- Yes you can! You can download and print these documents for free.

-

Can I use the free printables in commercial projects?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright rights issues with Are Training Courses Tax Deductible Canada?

- Certain printables might have limitations on use. Always read the terms of service and conditions provided by the designer.

-

How can I print Are Training Courses Tax Deductible Canada?

- You can print them at home using a printer or visit an in-store print shop to get superior prints.

-

What program do I require to open printables free of charge?

- The majority of printed documents are in PDF format. They is open with no cost programs like Adobe Reader.

Are Home Renovations Tax Deductible In Canada RooHome

Are Moving Expenses Tax Deductible In Canada

.png)

Check more sample of Are Training Courses Tax Deductible Canada below

Are Medical Expenses Tax Deductible In Canada Sun Life

Explainer Why Are Donations To Some Charities Tax deductible

13 Tax Deductible Expenses Business Owners Need To Know About CPA

Advisorsavvy Are Financial Advisor Fees Tax Deductible In Canada

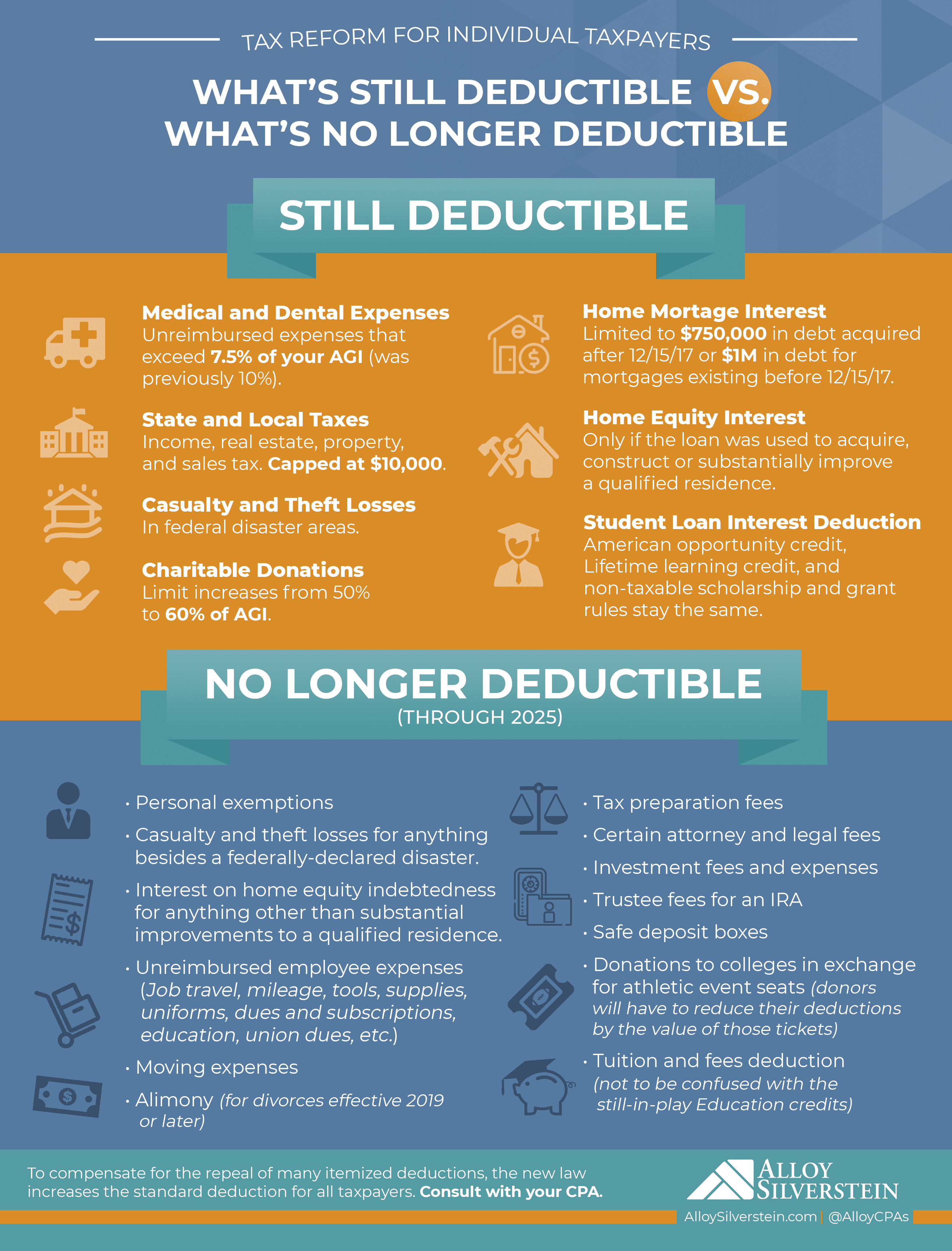

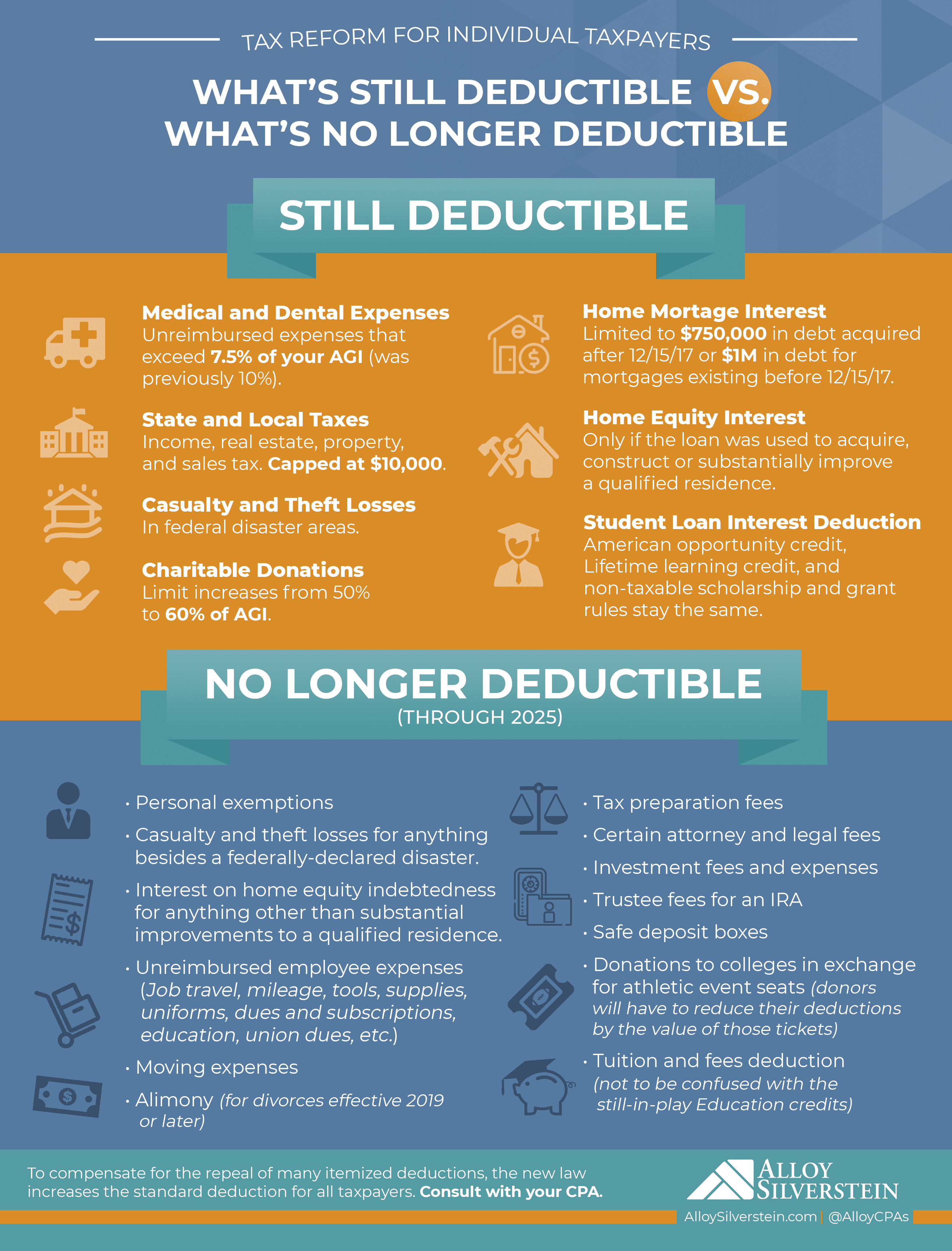

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Are First Aid Courses Tax Deductible FirstAidPro

https://cpaguide.ca/canada-training-credit

You must meet specific requirements to claim the Canada Training Credit on your tax return Most importantly you must be at least 26 years old and have a valid Social Insurance Number To claim the credit you would have to have accumulated a Canada Training Credit limit in a previous tax year

https://help.wealthsimple.com/hc/en-ca/articles/...

You may only claim the cost of your training courses if one of the following situations applies the course qualifies for the tuition credit in other words it was at a designated educational institution and you received a T2202 for the fees

You must meet specific requirements to claim the Canada Training Credit on your tax return Most importantly you must be at least 26 years old and have a valid Social Insurance Number To claim the credit you would have to have accumulated a Canada Training Credit limit in a previous tax year

You may only claim the cost of your training courses if one of the following situations applies the course qualifies for the tuition credit in other words it was at a designated educational institution and you received a T2202 for the fees

Advisorsavvy Are Financial Advisor Fees Tax Deductible In Canada

Explainer Why Are Donations To Some Charities Tax deductible

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Are First Aid Courses Tax Deductible FirstAidPro

A Group Of Canadians Wants Gym Memberships To Be Made Tax Deductible

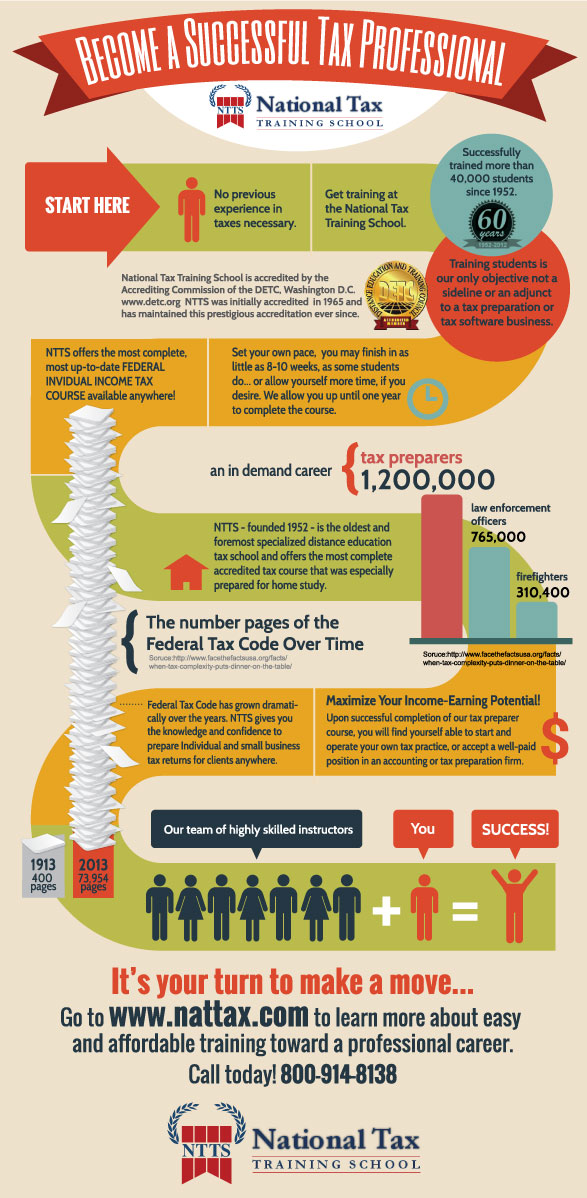

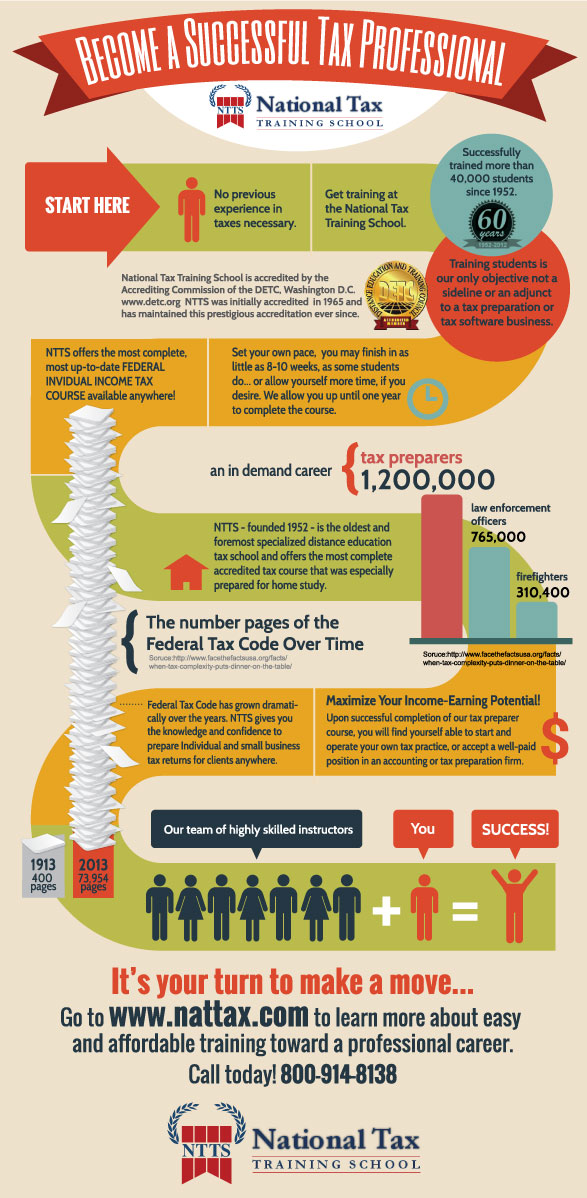

Tax courses National Tax Training School

Tax courses National Tax Training School

Tax Deductible Home Renovations In Canada