In the digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. For educational purposes for creative projects, simply to add some personal flair to your space, Are Vendor Reimbursements Taxable have become a valuable resource. This article will take a dive into the world of "Are Vendor Reimbursements Taxable," exploring what they are, where to get them, as well as how they can be used to enhance different aspects of your life.

Get Latest Are Vendor Reimbursements Taxable Below

Are Vendor Reimbursements Taxable

Are Vendor Reimbursements Taxable -

According to the IRS businesses who don t receive a W 9 from their vendors or the information required to correctly complete a 1099 should withhold 24 taxes from the vendor s pay until all necessary information is

Taxability of reimbursement has been a matter of considerable debate in India from the perspectives of both Direct Tax and Indirect Tax In addition Transfer Pricing rules may also

Printables for free cover a broad selection of printable and downloadable material that is available online at no cost. These materials come in a variety of types, like worksheets, templates, coloring pages, and much more. The appealingness of Are Vendor Reimbursements Taxable is their flexibility and accessibility.

More of Are Vendor Reimbursements Taxable

IRS BOOSTS STANDARD MILEAGE RATES FOR SECOND HALF OF 2022 DHW

IRS BOOSTS STANDARD MILEAGE RATES FOR SECOND HALF OF 2022 DHW

Out of pocket expenses often relate to activities that do not transfer a good or service to the customer For example a service provider that is entitled to reimbursement for employee

Are reimbursements taxable income Generally properly accounted reimbursements are not considered taxable income for the recipient

The Are Vendor Reimbursements Taxable have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Flexible: The Customization feature lets you tailor printables to fit your particular needs in designing invitations planning your schedule or even decorating your house.

-

Education Value The free educational worksheets can be used by students of all ages, making them an invaluable aid for parents as well as educators.

-

It's easy: Access to a variety of designs and templates can save you time and energy.

Where to Find more Are Vendor Reimbursements Taxable

Are CACFP Reimbursements Taxable Income Taking Care Of Business

Are CACFP Reimbursements Taxable Income Taking Care Of Business

A 1099 form is a tax form that a business is required to issue to contractors and self employed individuals who complete more than 600 worth of work for the business in a year If you work

Are Reimbursements Taxable Paying wages to employees always involves withholding and contributing taxes but with reimbursements it all revolves around accountable and non accountable plans That s because

We've now piqued your interest in Are Vendor Reimbursements Taxable we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Are Vendor Reimbursements Taxable designed for a variety motives.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Are Vendor Reimbursements Taxable

Here are some innovative ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home as well as in the class.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Are Vendor Reimbursements Taxable are a treasure trove filled with creative and practical information that meet a variety of needs and needs and. Their access and versatility makes them a wonderful addition to both professional and personal lives. Explore the vast world of Are Vendor Reimbursements Taxable and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can print and download these items for free.

-

Can I use free printables to make commercial products?

- It's contingent upon the specific rules of usage. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns when using Are Vendor Reimbursements Taxable?

- Some printables may come with restrictions on usage. Be sure to read the terms and conditions offered by the designer.

-

How do I print Are Vendor Reimbursements Taxable?

- You can print them at home with a printer or visit the local print shops for high-quality prints.

-

What software is required to open printables free of charge?

- Most printables come as PDF files, which is open with no cost software, such as Adobe Reader.

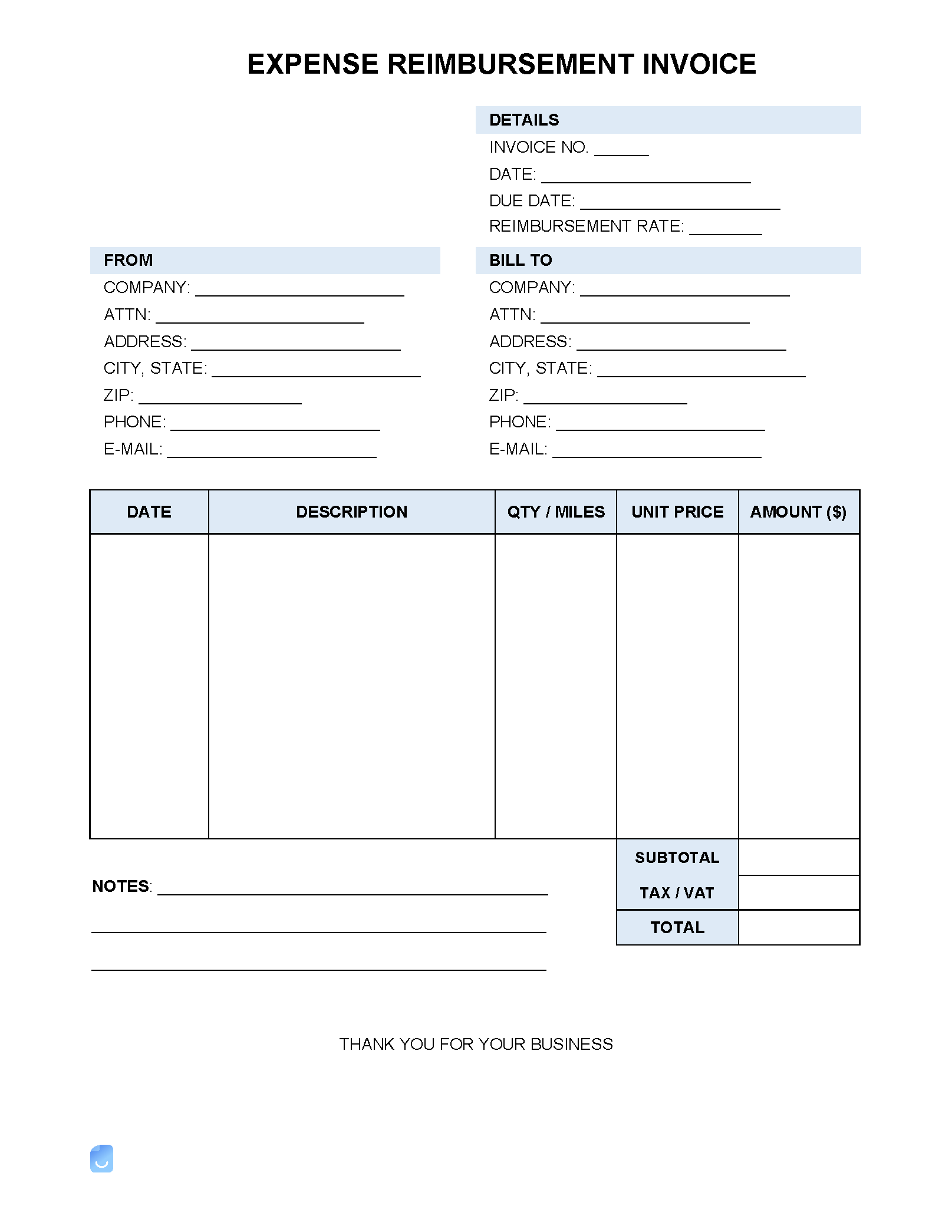

Expense Reimbursement Invoice Template Invoice Maker

Are Health Care Reimbursements Taxable AZexplained

Check more sample of Are Vendor Reimbursements Taxable below

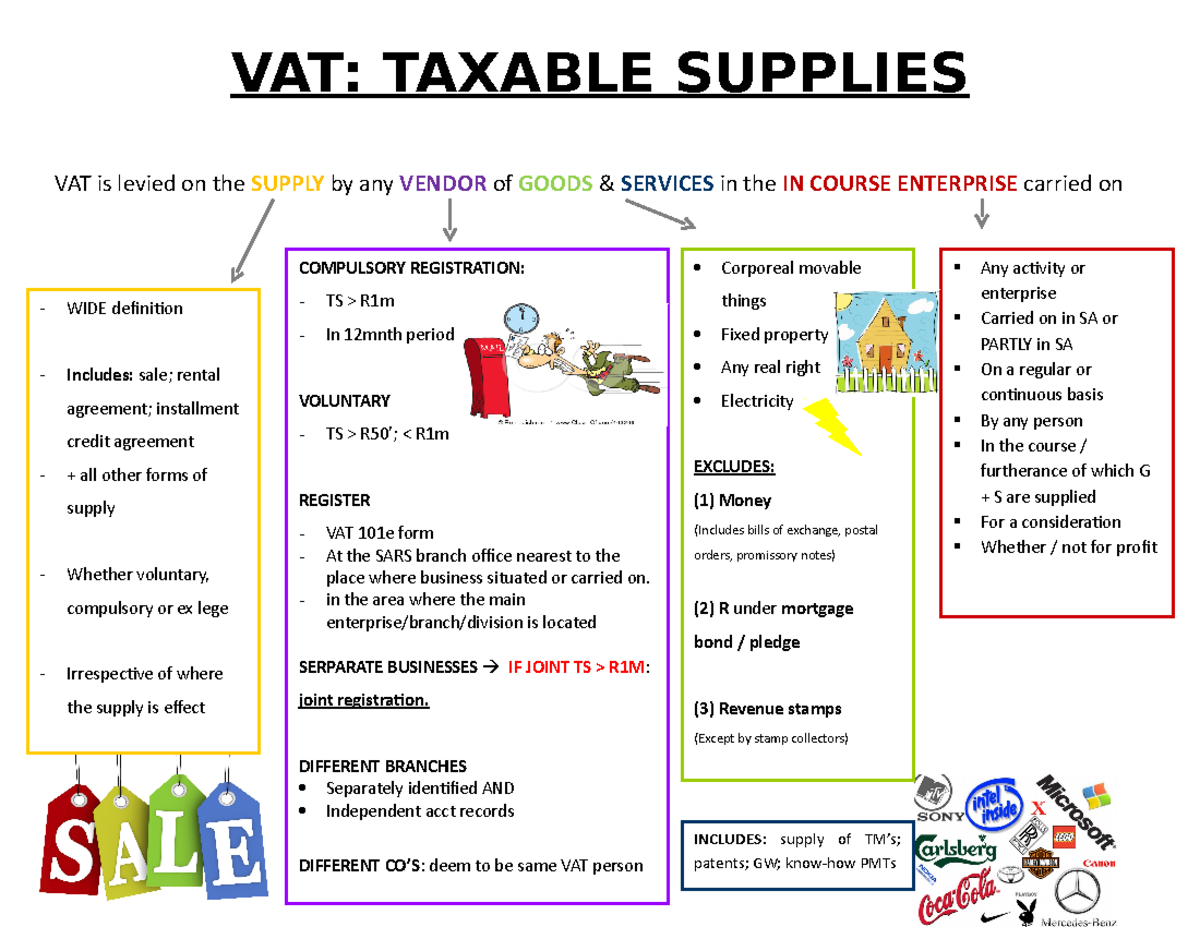

VAT summary taxable supplies VAT TAXABLE SUPPLIES VAT Is Levied On

Are Reimbursements Taxable How To Handle Tax Benefits For

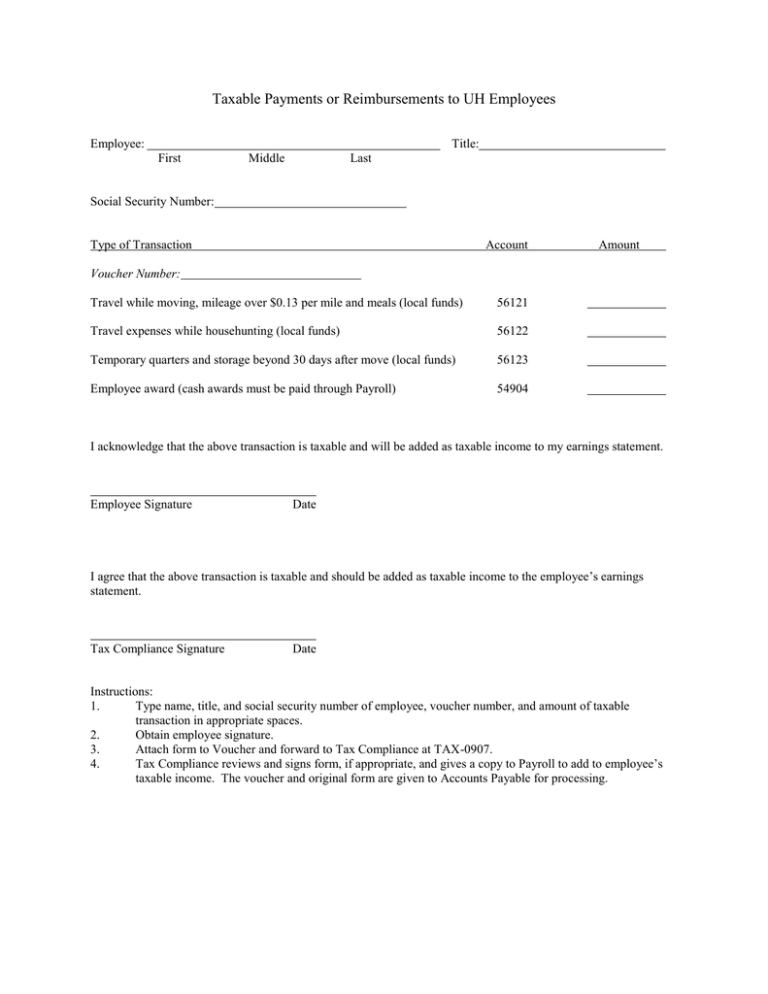

Taxable Payments Or Reimbursements To UH Employees

Are SECA And Income Tax Reimbursements Taxable

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

Are There Red Flags For The IRS In Travel Nursing Pay BluePipes Blog

https://www.pwc.in/assets/pdfs/publications/2018/...

Taxability of reimbursement has been a matter of considerable debate in India from the perspectives of both Direct Tax and Indirect Tax In addition Transfer Pricing rules may also

https://greenleafaccounting.com/should_…

If your client reimburses you for expenses and includes those reimbursements on the 1099 MISC form then simply deduct those expenses on your own tax return In the event that your client does NOT include those

Taxability of reimbursement has been a matter of considerable debate in India from the perspectives of both Direct Tax and Indirect Tax In addition Transfer Pricing rules may also

If your client reimburses you for expenses and includes those reimbursements on the 1099 MISC form then simply deduct those expenses on your own tax return In the event that your client does NOT include those

Are SECA And Income Tax Reimbursements Taxable

Are Reimbursements Taxable How To Handle Tax Benefits For

Taxable And Nontaxable Income Lefstein Suchoff CPA Associates

Are There Red Flags For The IRS In Travel Nursing Pay BluePipes Blog

Are QSEHRA Reimbursements Taxable

Are Travel Reimbursements Taxable A Comprehensive Guide The

Are Travel Reimbursements Taxable A Comprehensive Guide The

Are Travel Reimbursements Taxable A Comprehensive Guide The