In this age of electronic devices, where screens rule our lives yet the appeal of tangible printed products hasn't decreased. For educational purposes, creative projects, or simply to add personal touches to your home, printables for free have become an invaluable resource. Here, we'll dive deeper into "Arizona Property Tax Discount For Seniors," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Arizona Property Tax Discount For Seniors Below

Arizona Property Tax Discount For Seniors

Arizona Property Tax Discount For Seniors -

Form 140PTC provides a tax credit of up to 502 To claim a property tax credit you must file your claim or extension request by April 15 2020 You cannot claim this credit on an amended return if you file it after the due date

The property of the following Arizona residents may be exempt from property taxation up to a certain dollar amount which is adjusted annually to account for inflation Person with a total and permanent disability Widow or Widower Honorably discharged veteran with a service or nonservice connected disability

Arizona Property Tax Discount For Seniors cover a large variety of printable, downloadable materials that are accessible online for free cost. These resources come in many forms, like worksheets templates, coloring pages and more. One of the advantages of Arizona Property Tax Discount For Seniors lies in their versatility and accessibility.

More of Arizona Property Tax Discount For Seniors

AMC Announces New Incentive Scheme For Property Tax Dues

AMC Announces New Incentive Scheme For Property Tax Dues

Senior Value protection offers citizens the opportunity to freeze their property value for a period of time primarily based on income age and residency primary residence Criteria is based on state statute

You may be eligible for property tax postponement for low income seniors If so the property tax payment for your primary residence can be postponed until you sell the property or no longer live in the property

Arizona Property Tax Discount For Seniors have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Flexible: There is the possibility of tailoring designs to suit your personal needs, whether it's designing invitations and schedules, or even decorating your home.

-

Educational Benefits: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, which makes the perfect source for educators and parents.

-

Convenience: immediate access various designs and templates is time-saving and saves effort.

Where to Find more Arizona Property Tax Discount For Seniors

Property Tax Discount Package 2021 2022 YouTube

Property Tax Discount Package 2021 2022 YouTube

Purpose To freeze the application tax year Limited Property Value LPV of the primary residence owned by seniors based on income age and residency It is important to note that this program does not freeze your property taxes it freezes the

The Senior Property Valuation Protection Option Senior Freeze is available to residential homeowners 65 years of age or older who meet specific guidelines based on income ownership and residency Arizona Constitution Article 9 Section 18

Now that we've piqued your curiosity about Arizona Property Tax Discount For Seniors Let's look into where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Arizona Property Tax Discount For Seniors for various purposes.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning materials.

- This is a great resource for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad spectrum of interests, everything from DIY projects to planning a party.

Maximizing Arizona Property Tax Discount For Seniors

Here are some creative ways ensure you get the very most use of Arizona Property Tax Discount For Seniors:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Arizona Property Tax Discount For Seniors are a treasure trove of practical and imaginative resources which cater to a wide range of needs and needs and. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the world of Arizona Property Tax Discount For Seniors today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes they are! You can download and print these documents for free.

-

Can I make use of free printouts for commercial usage?

- It's based on the usage guidelines. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables might have limitations regarding their use. Make sure to read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home using the printer, or go to an in-store print shop to get high-quality prints.

-

What software do I need in order to open printables free of charge?

- The majority of printed documents are as PDF files, which can be opened with free programs like Adobe Reader.

Arizona Property Records Search Owners Title Tax And Deeds InfoTracer

PMC Discontinues 40 Property Tax Discount For Self occupied Homes

Check more sample of Arizona Property Tax Discount For Seniors below

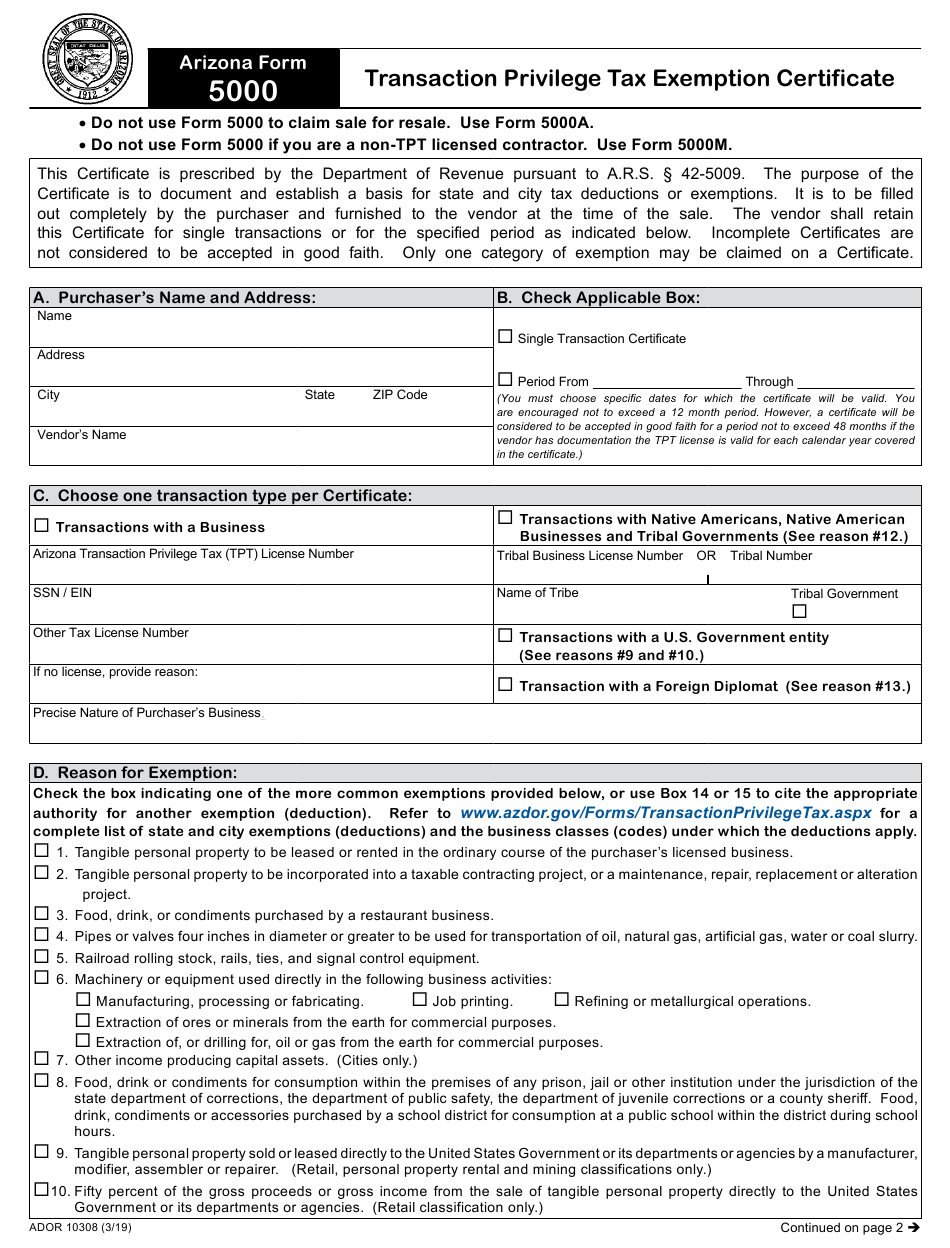

Arizona Property Tax Exemption For Churches And Religious Nonprofits

Arizona Property Records Search Owners Title Tax And Deeds InfoTracer

Discount For Seniors

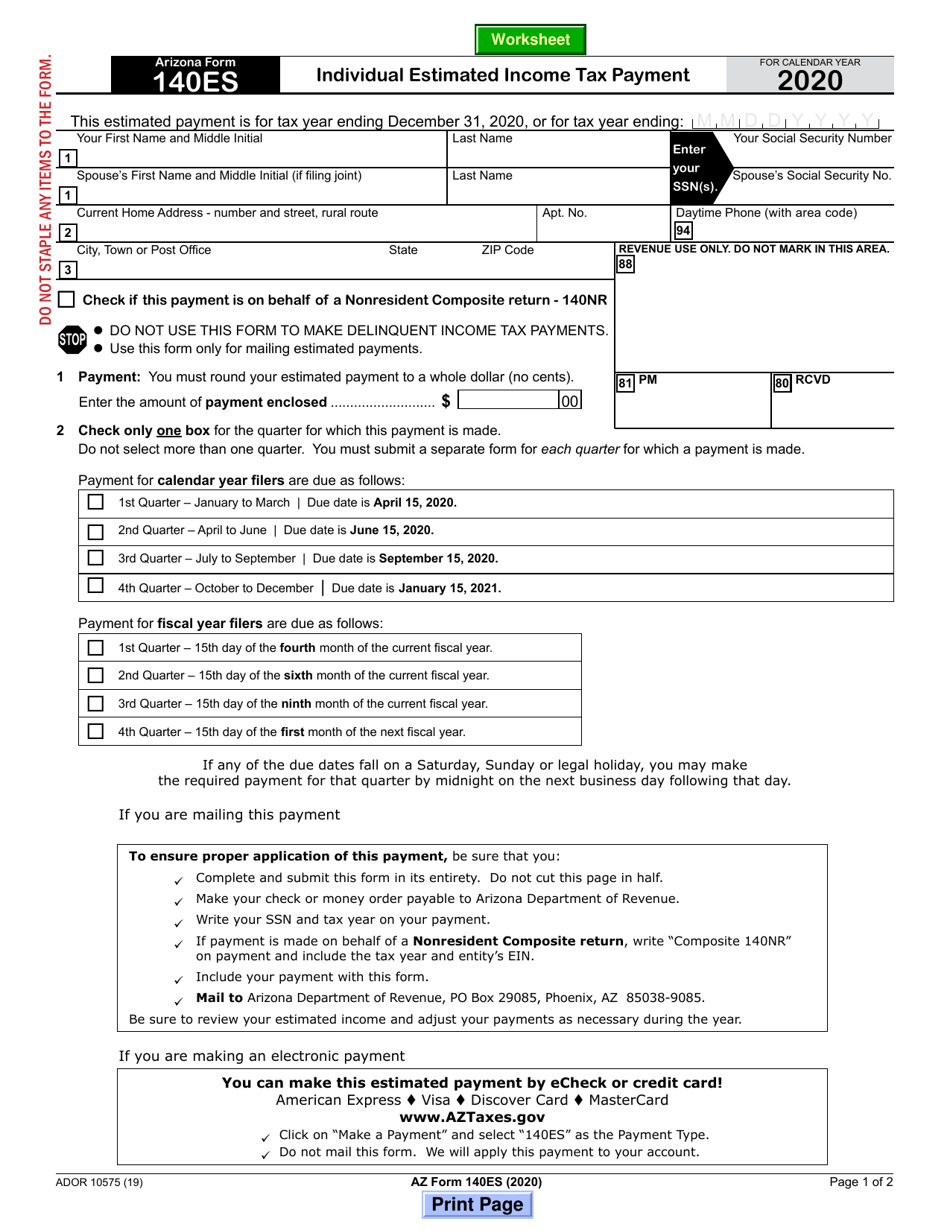

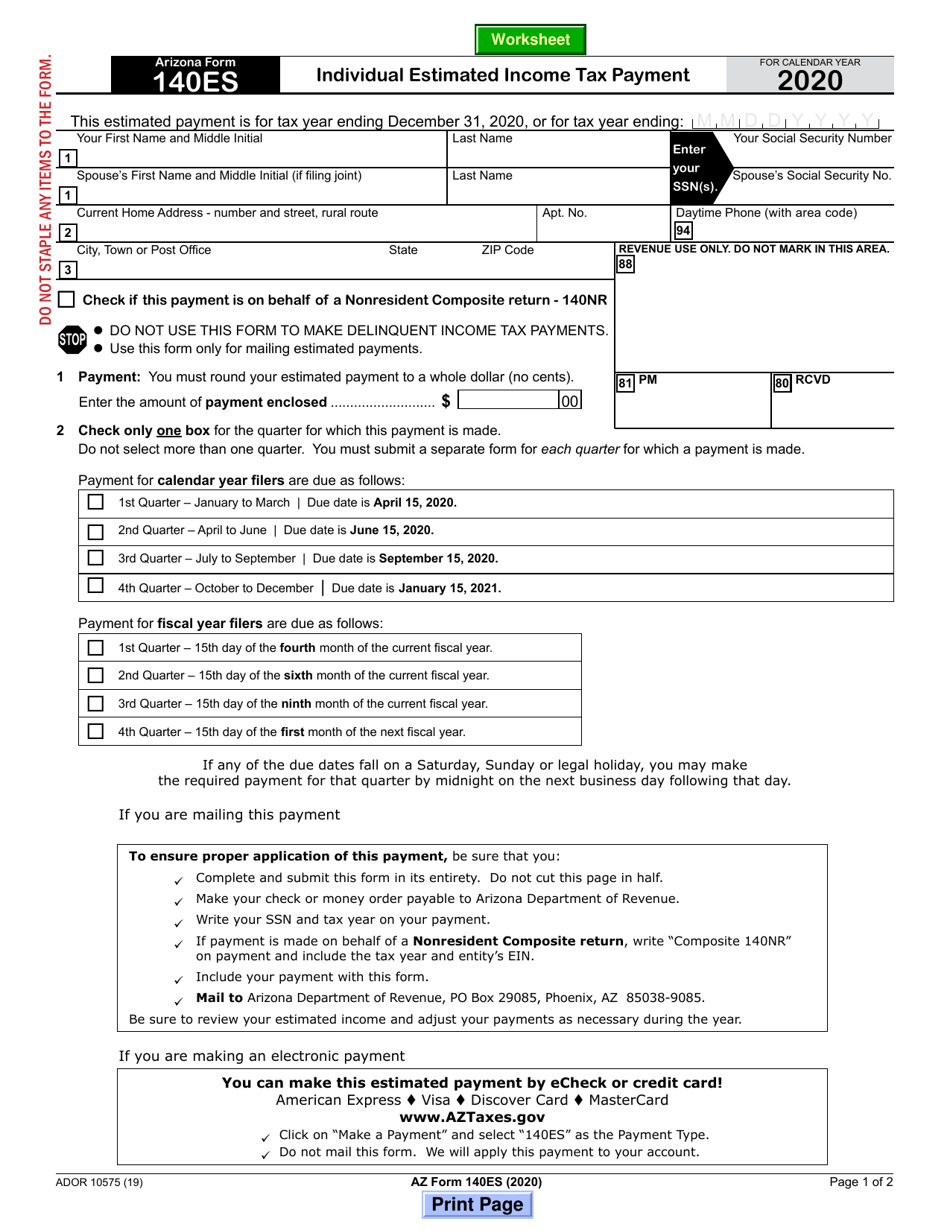

Printable Arizona Tax Form 140 Printable Forms Free Online

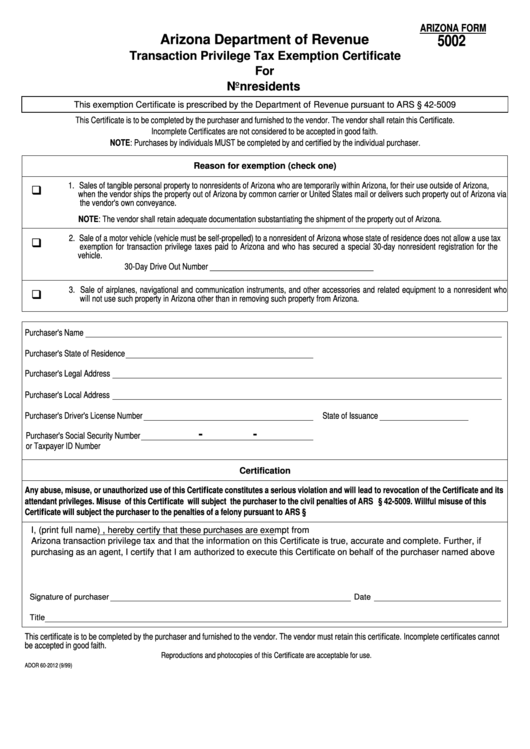

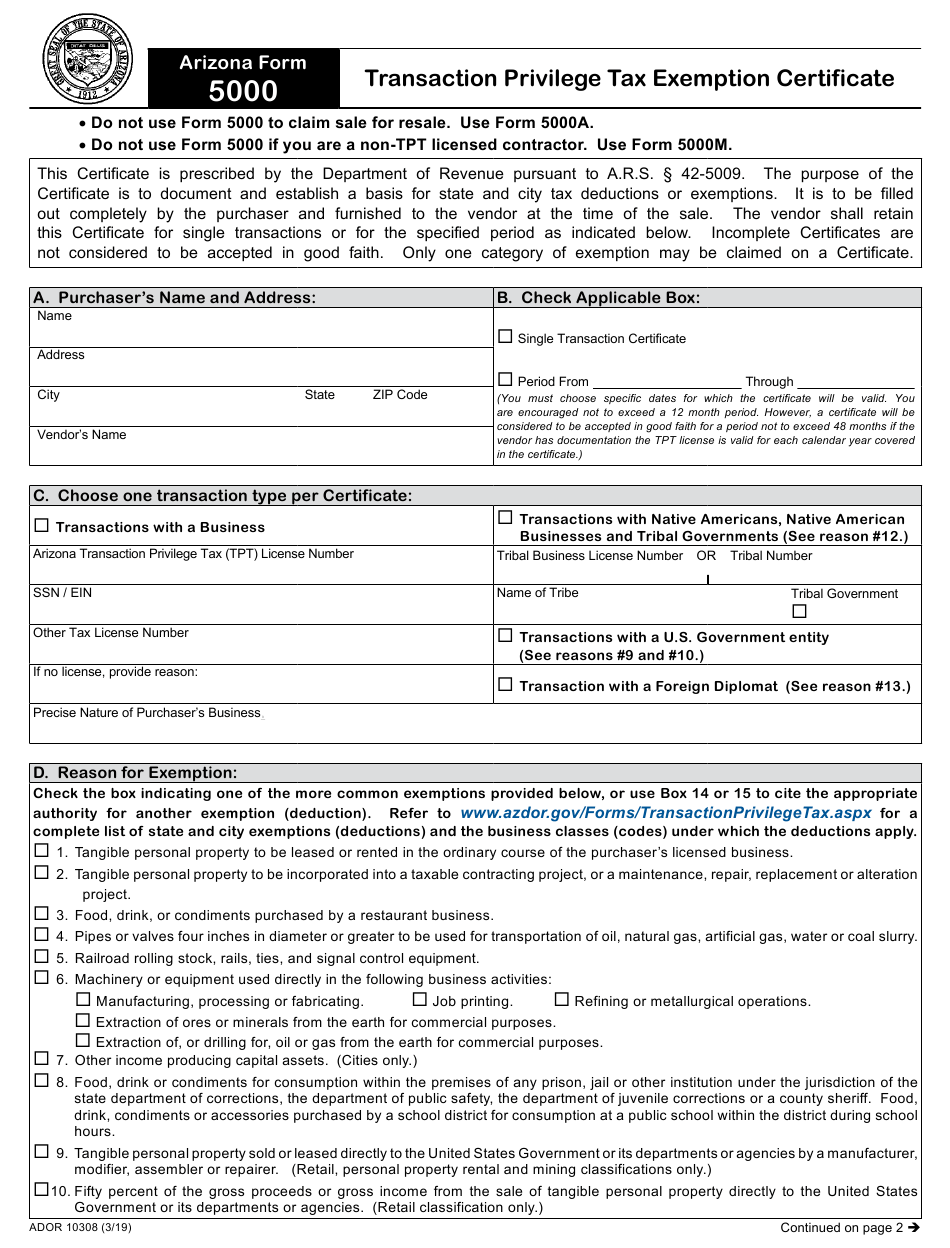

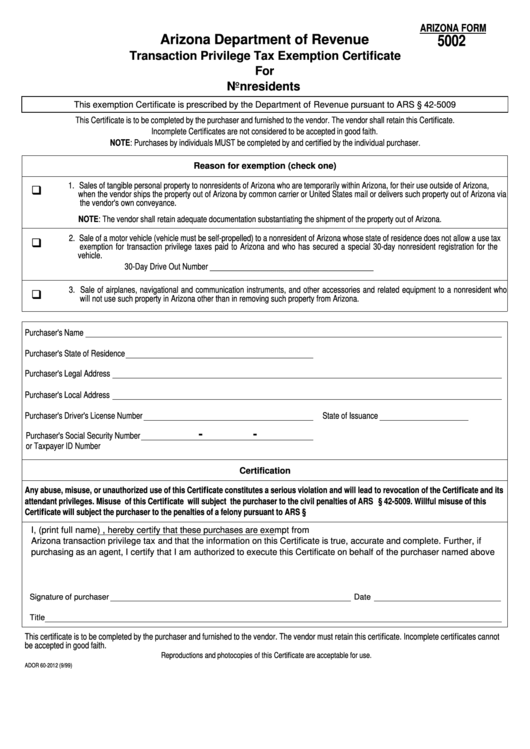

Fillable Arizona Form 5002 Transaction Privilege Tax Exemption

Arizona Property Records Search Owners Title Tax And Deeds InfoTracer

https://azdor.gov/sites/default/files/2023-03/...

The property of the following Arizona residents may be exempt from property taxation up to a certain dollar amount which is adjusted annually to account for inflation Person with a total and permanent disability Widow or Widower Honorably discharged veteran with a service or nonservice connected disability

https://azdor.gov/forms/property-tax-forms/senior...

This form is used to apply for the Senior Property Valuation Protection Option also referred to as the senior freeze

The property of the following Arizona residents may be exempt from property taxation up to a certain dollar amount which is adjusted annually to account for inflation Person with a total and permanent disability Widow or Widower Honorably discharged veteran with a service or nonservice connected disability

This form is used to apply for the Senior Property Valuation Protection Option also referred to as the senior freeze

Printable Arizona Tax Form 140 Printable Forms Free Online

Arizona Property Records Search Owners Title Tax And Deeds InfoTracer

Fillable Arizona Form 5002 Transaction Privilege Tax Exemption

Arizona Property Records Search Owners Title Tax And Deeds InfoTracer

Property Tax Discount For Low Income PROFRTY

Take The Confusion Out Of Understanding Arizona Property Tax Dates

Take The Confusion Out Of Understanding Arizona Property Tax Dates

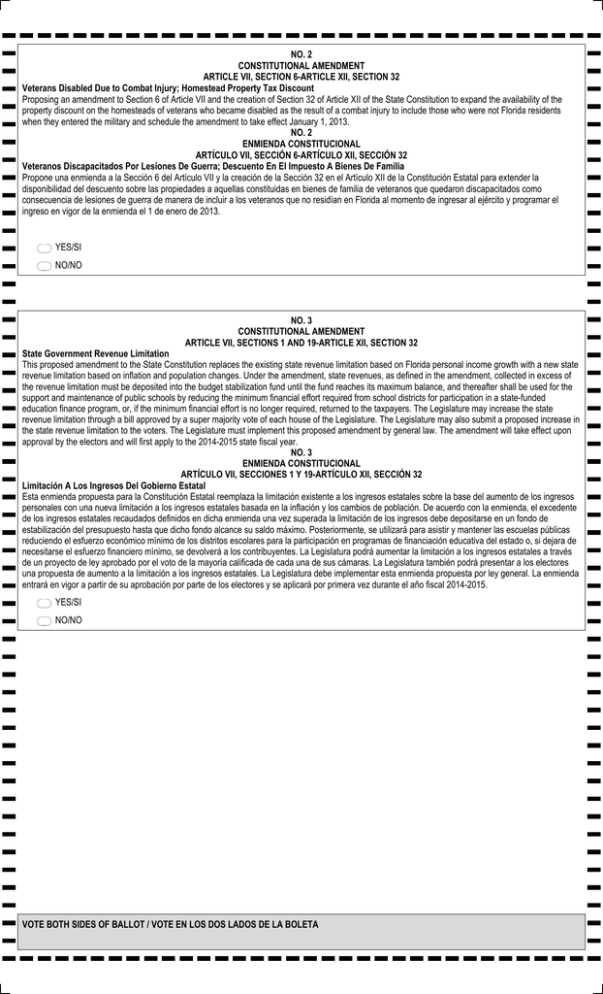

Test Ballot Print Document