In the age of digital, with screens dominating our lives and the appeal of physical printed material hasn't diminished. Whether it's for educational purposes as well as creative projects or simply adding an individual touch to the space, Arkansas Earned Income Tax Credit are now a useful resource. In this article, we'll take a dive into the world "Arkansas Earned Income Tax Credit," exploring their purpose, where they are, and how they can enrich various aspects of your lives.

Get Latest Arkansas Earned Income Tax Credit Below

Arkansas Earned Income Tax Credit

Arkansas Earned Income Tax Credit -

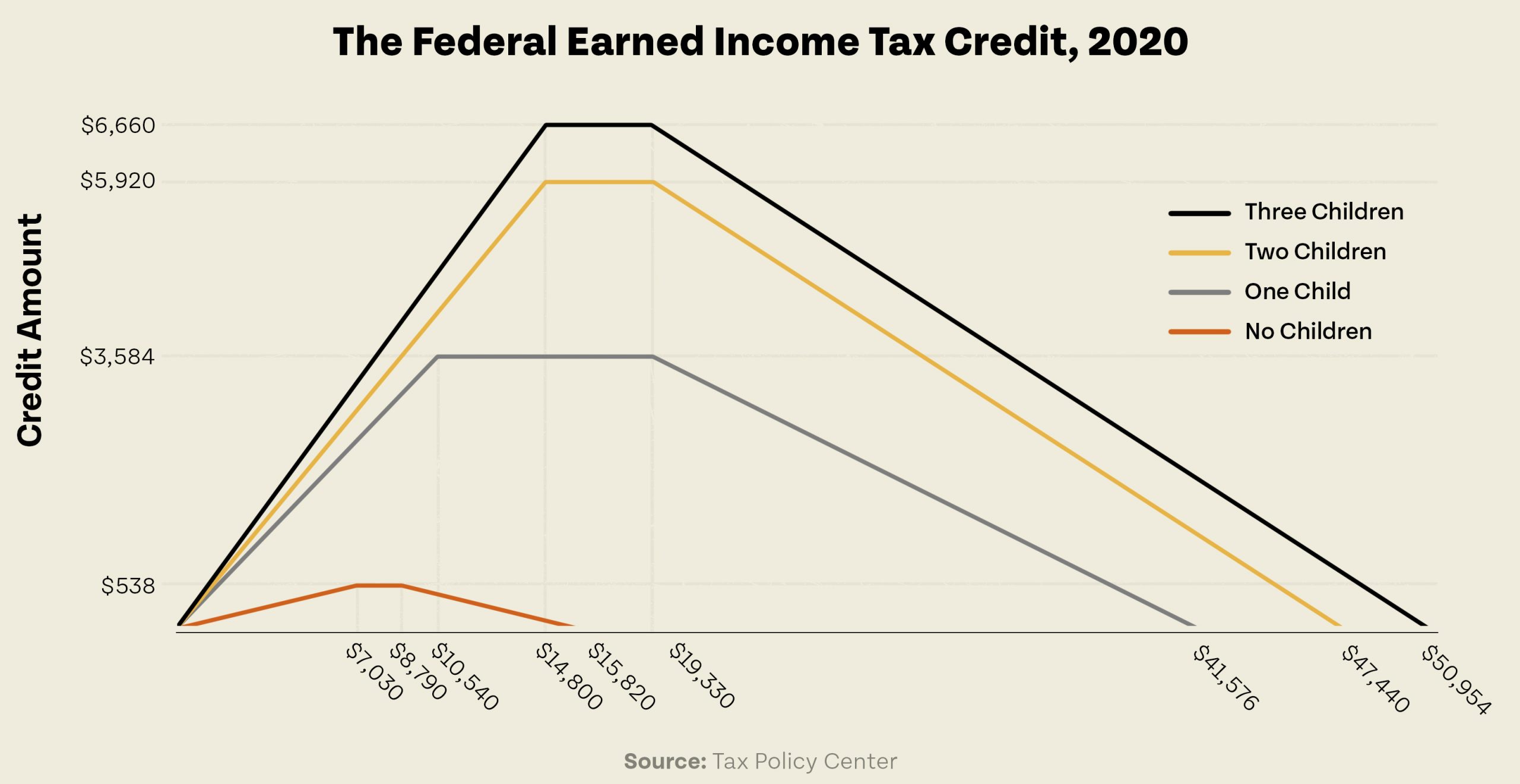

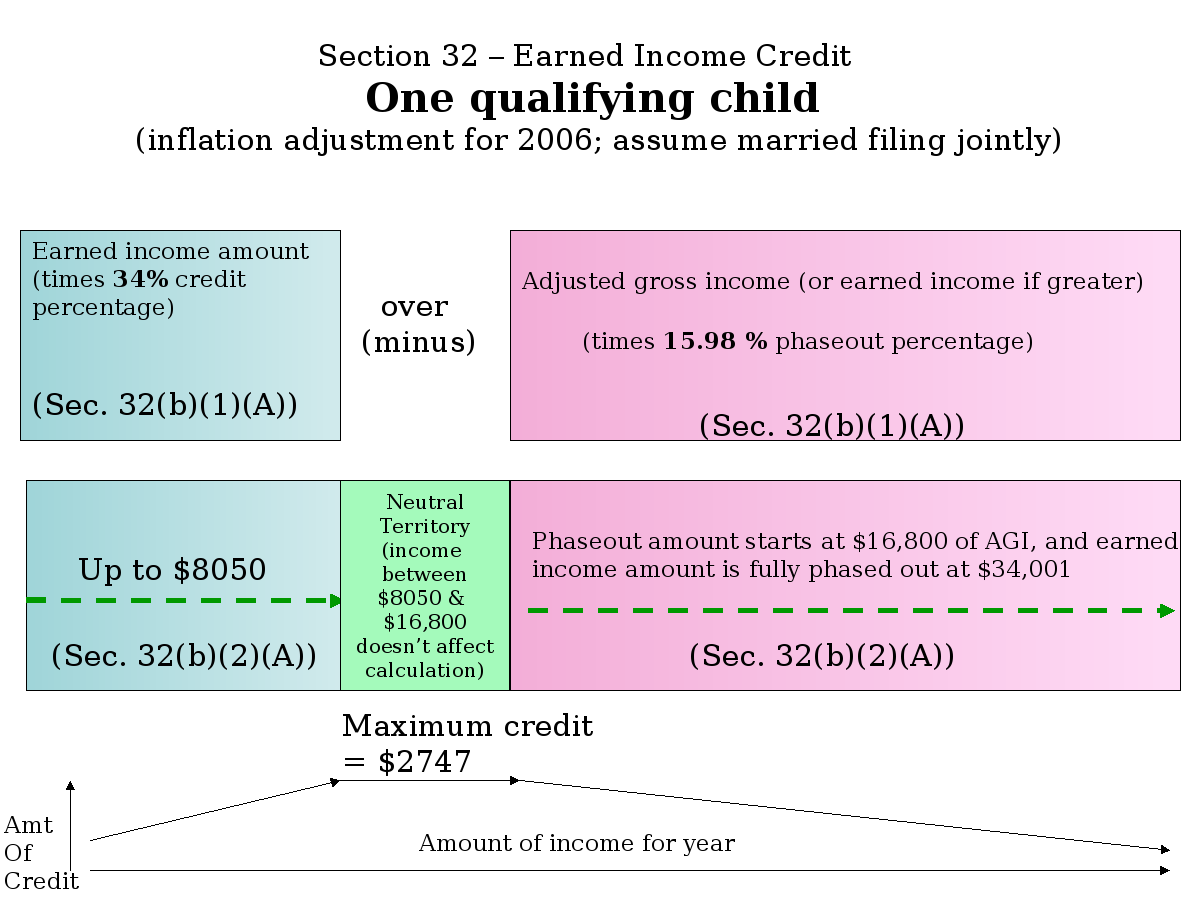

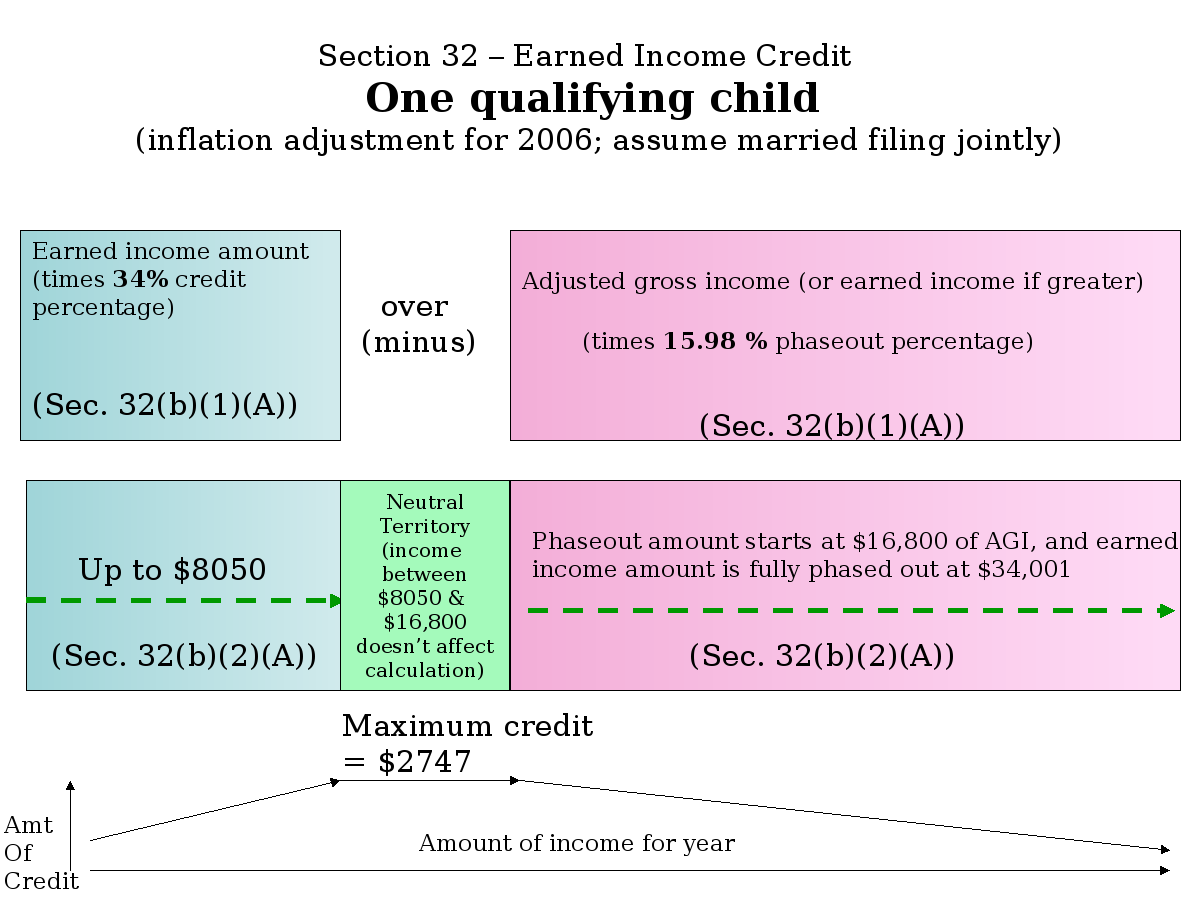

EARNED INCOME TAX CREDIT EITC can reduce the amount of tax you owe and may give you a refund To qualify you must meet certain earned income requirements and eligibility rules and file a tax return

Inflationary Relief Income Tax credit Act 1 of the Third Extraordinary Session of 2022 Allows for a full year Arkansas resident having a net income up to 101 000 an additional tax credit Additional Tax Credit for Qualified Individuals Act 1 of Second Extraordinary session of 2021

Printables for free include a vast range of downloadable, printable material that is available online at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and much more. The great thing about Arkansas Earned Income Tax Credit is in their variety and accessibility.

More of Arkansas Earned Income Tax Credit

Earned Income Tax Credit 2023 Federal Tax Credits

Earned Income Tax Credit 2023 Federal Tax Credits

Find if you qualify for the Earned Income Tax Credit EITC with or without qualifying children or relatives on your tax return Low to moderate income workers with qualifying children may be eligible to claim the Earned Income Tax Credit EITC if certain qualifying rules apply to them

The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Customization: This allows you to modify print-ready templates to your specific requirements in designing invitations and schedules, or even decorating your house.

-

Educational Benefits: These Arkansas Earned Income Tax Credit provide for students of all ages, which makes the perfect aid for parents as well as educators.

-

An easy way to access HTML0: Access to many designs and templates can save you time and energy.

Where to Find more Arkansas Earned Income Tax Credit

Earned Income Tax Credit What It Is And Other Important Details

Earned Income Tax Credit What It Is And Other Important Details

The Tax tables below include the tax rates thresholds and allowances included in the Arkansas Tax Calculator 2024 Arkansas provides a standard Personal Exemption tax credit of 29 00 in 2024 per qualifying filer and qualifying dependent s

For individuals filers that have a net income of up to 101 000 a taxpayer can receive an income tax credit between 10 and 150 depending on their 2022 net income Taxpayers who file a joint income tax return and have a net income up to 202 000 can receive an income tax credit between 20 300 depending on their 2022 net income

We've now piqued your interest in printables for free Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Arkansas Earned Income Tax Credit designed for a variety reasons.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs covered cover a wide spectrum of interests, including DIY projects to planning a party.

Maximizing Arkansas Earned Income Tax Credit

Here are some fresh ways in order to maximize the use of Arkansas Earned Income Tax Credit:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Arkansas Earned Income Tax Credit are a treasure trove of creative and practical resources catering to different needs and preferences. Their accessibility and versatility make them a fantastic addition to any professional or personal life. Explore the endless world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I use free printables for commercial uses?

- It's dependent on the particular usage guidelines. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Are there any copyright issues in Arkansas Earned Income Tax Credit?

- Certain printables might have limitations in their usage. Be sure to review the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home with either a printer at home or in any local print store for high-quality prints.

-

What program is required to open printables for free?

- The majority of printables are with PDF formats, which is open with no cost software like Adobe Reader.

This Is Earned Income Tax Credit Awareness Day

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

Check more sample of Arkansas Earned Income Tax Credit below

Earned Income Credit Calculator 2021 DannielleThalia

Earned Income Tax Credit EITC What It Is And Who Qualifies Quakerpedia

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income Free

Free Tax Assistance At New Bedford City Hall On February 19th New

Are You Eligible For The Earned Income Tax Credit The Village

Building On The Success Of The Earned Income Tax Credit

https://www.dfa.arkansas.gov/income-tax/individual...

Inflationary Relief Income Tax credit Act 1 of the Third Extraordinary Session of 2022 Allows for a full year Arkansas resident having a net income up to 101 000 an additional tax credit Additional Tax Credit for Qualified Individuals Act 1 of Second Extraordinary session of 2021

https://dfa.mysites.io/.../earned-income-tax-credit

General Information on the Federal EITC Credit The Earned Income Tax Credit or the EITC is a refundable federal income tax credit for low to moderate income working individuals and families Congress originally approved the tax credit legislation in 1975 in part to offset the burden of social security taxes and to provide an incentive to

Inflationary Relief Income Tax credit Act 1 of the Third Extraordinary Session of 2022 Allows for a full year Arkansas resident having a net income up to 101 000 an additional tax credit Additional Tax Credit for Qualified Individuals Act 1 of Second Extraordinary session of 2021

General Information on the Federal EITC Credit The Earned Income Tax Credit or the EITC is a refundable federal income tax credit for low to moderate income working individuals and families Congress originally approved the tax credit legislation in 1975 in part to offset the burden of social security taxes and to provide an incentive to

Free Tax Assistance At New Bedford City Hall On February 19th New

Earned Income Tax Credit EITC What It Is And Who Qualifies Quakerpedia

Are You Eligible For The Earned Income Tax Credit The Village

Building On The Success Of The Earned Income Tax Credit

Why Tax Credits For Working Families Matter

Custom Essay Amazonia fiocruz br

Custom Essay Amazonia fiocruz br

Arkansas Tax Forms And Instructions For 2019 Form AR1000F