In this digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes project ideas, artistic or just adding personal touches to your space, Arkansas Personal Property Tax Return are now an essential resource. For this piece, we'll take a dive deep into the realm of "Arkansas Personal Property Tax Return," exploring what they are, how to get them, as well as how they can improve various aspects of your daily life.

Get Latest Arkansas Personal Property Tax Return Below

Arkansas Personal Property Tax Return

Arkansas Personal Property Tax Return -

Change an address Amend a return Make a payment Store banking information for use during payment submission View tax period financial information tax penalty interest credits balance etc View payments received View recent account activity View correspondence from the department

All personal property should be reported to the county assessor every year between January 1 and May 31 to avoid a late assessment penalty of 10 Check with your local

Arkansas Personal Property Tax Return cover a large range of downloadable, printable resources available online for download at no cost. They come in many kinds, including worksheets templates, coloring pages, and more. The appeal of printables for free is in their variety and accessibility.

More of Arkansas Personal Property Tax Return

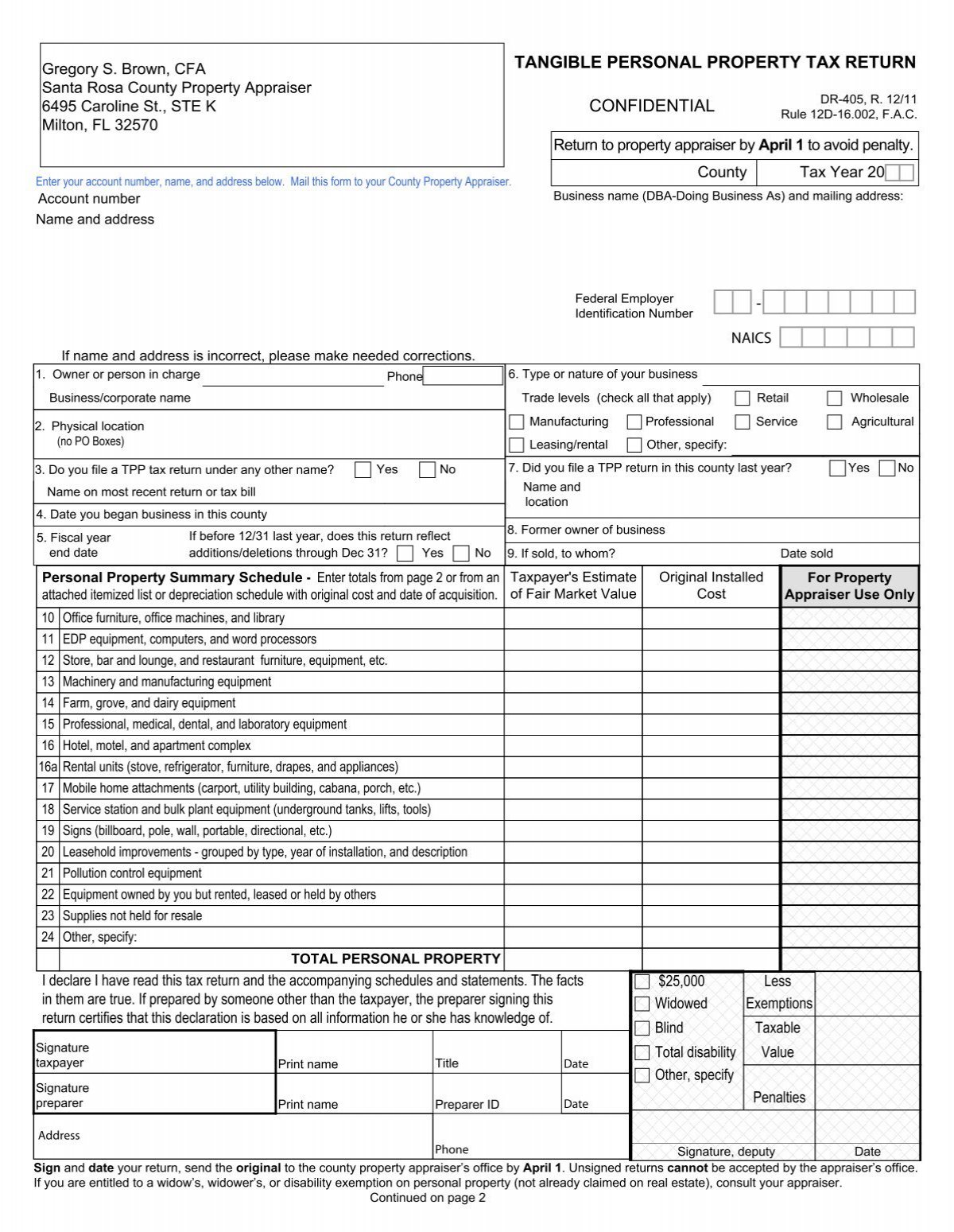

2009 Tangible Personal Property Tax Return Kentucky Department Of

2009 Tangible Personal Property Tax Return Kentucky Department Of

ACD Commercial Personal Property Rendition Form Optional Bar Code PPAN On Each Page COMMERCIAL PERSONAL PROPERTY RENDITION FORM A County Arkansas 20 Business Information Owner Information or affirm that this is a true and complete list of all the personal property that by law I am required to list for

By Eleanor Wheeler May 3 2021 Have you assessed your personal property this year Arkansans are required to report their personal property every year to the county assessor by May 31 Doing so after May 31 means paying a 10 late assessment penalty Ready to assess

Arkansas Personal Property Tax Return have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization: The Customization feature lets you tailor printed materials to meet your requirements such as designing invitations to organize your schedule or even decorating your home.

-

Educational Value Printables for education that are free cater to learners of all ages. This makes them a valuable device for teachers and parents.

-

It's easy: Instant access to many designs and templates is time-saving and saves effort.

Where to Find more Arkansas Personal Property Tax Return

Maricopa County Personal Property Tax Form CountyForms

Maricopa County Personal Property Tax Form CountyForms

Why do we pay personal property taxes in Arkansas Personal property taxes are a law that spans back to 1874 The law has changed in the time since but why do we pay these taxes and

Taxes not paid by Oct 15 are also subject to a 10 percent penalty The deadline to assess personal property taxes in Arkansas is May 31 and now there are more ways to take care of this yearly requirement

After we've peaked your interest in Arkansas Personal Property Tax Return Let's take a look at where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Arkansas Personal Property Tax Return suitable for many goals.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- It is ideal for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a broad array of topics, ranging including DIY projects to planning a party.

Maximizing Arkansas Personal Property Tax Return

Here are some new ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Arkansas Personal Property Tax Return are a treasure trove of practical and innovative resources that satisfy a wide range of requirements and desires. Their accessibility and versatility make them an essential part of both personal and professional life. Explore the plethora of Arkansas Personal Property Tax Return today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Arkansas Personal Property Tax Return truly free?

- Yes you can! You can print and download these files for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It is contingent on the specific rules of usage. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables might have limitations regarding their use. Check the terms and conditions offered by the designer.

-

How can I print printables for free?

- You can print them at home using the printer, or go to an in-store print shop to get better quality prints.

-

What software do I need in order to open printables free of charge?

- The majority of PDF documents are provided in the format PDF. This can be opened with free software like Adobe Reader.

Ky Tangible Property Tax Return 2021 Fill Online Printable Fillable

Business Personal Property Tax Return Augusta Georgia Property Tax

Check more sample of Arkansas Personal Property Tax Return below

Business Personal Property Tax Return YouTube

Don t Wait Till The Last Minute Annual Report Personal Property Tax

Confidential Tangible Personal Property Tax Return QPublic

Why Do We Pay Personal Property Taxes In Arkansas Flipboard

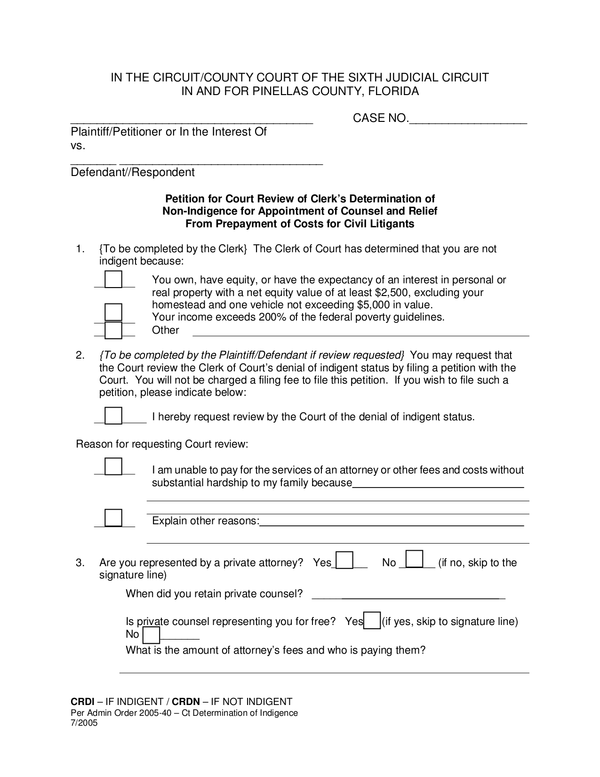

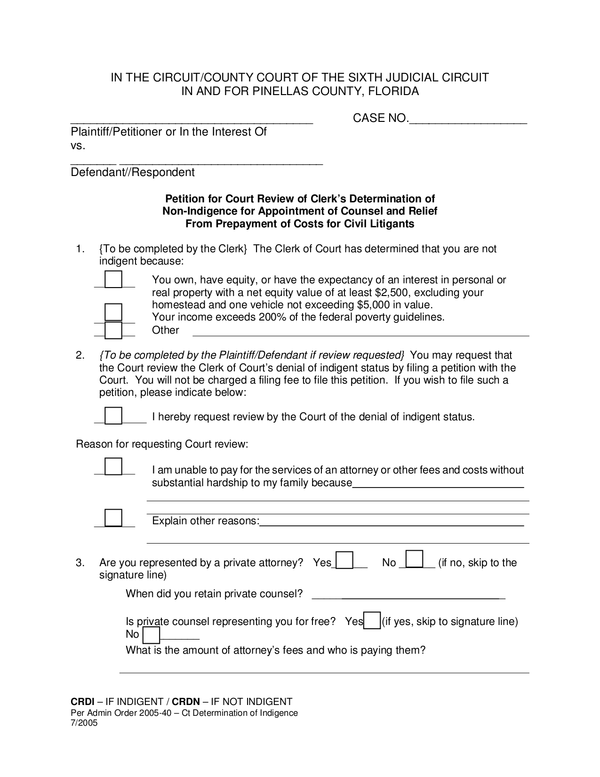

Pinellas County Clerk Of Court Probate Forms CountyForms

How To Assess Your Personal Property Tax In Arkansas

https://www. arkansasassessment.com /personal...

All personal property should be reported to the county assessor every year between January 1 and May 31 to avoid a late assessment penalty of 10 Check with your local

https://www. arkansasassessment.com /personal-property

Personal Property is assessed annually and it s value determined as of January 1 of each assessment year Personal Property should be itemized and reported to the assessor by May 31 to avoid a late assessment penalty of 10 Check with your local assessor to see if online assessment is available in your county

All personal property should be reported to the county assessor every year between January 1 and May 31 to avoid a late assessment penalty of 10 Check with your local

Personal Property is assessed annually and it s value determined as of January 1 of each assessment year Personal Property should be itemized and reported to the assessor by May 31 to avoid a late assessment penalty of 10 Check with your local assessor to see if online assessment is available in your county

Why Do We Pay Personal Property Taxes In Arkansas Flipboard

Don t Wait Till The Last Minute Annual Report Personal Property Tax

Pinellas County Clerk Of Court Probate Forms CountyForms

How To Assess Your Personal Property Tax In Arkansas

Why We Pay Personal Property Taxes In Arkansas Thv11

Jones Roth Personal Property Tax Return Preparation YouTube

Jones Roth Personal Property Tax Return Preparation YouTube

County Personal Property Taxes Due Oct 15 Across Arkansas KLRT