In this age of electronic devices, in which screens are the norm but the value of tangible printed material hasn't diminished. For educational purposes such as creative projects or simply to add an element of personalization to your space, Arkansas State Tax Credits have become a valuable resource. For this piece, we'll dive to the depths of "Arkansas State Tax Credits," exploring the benefits of them, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Arkansas State Tax Credits Below

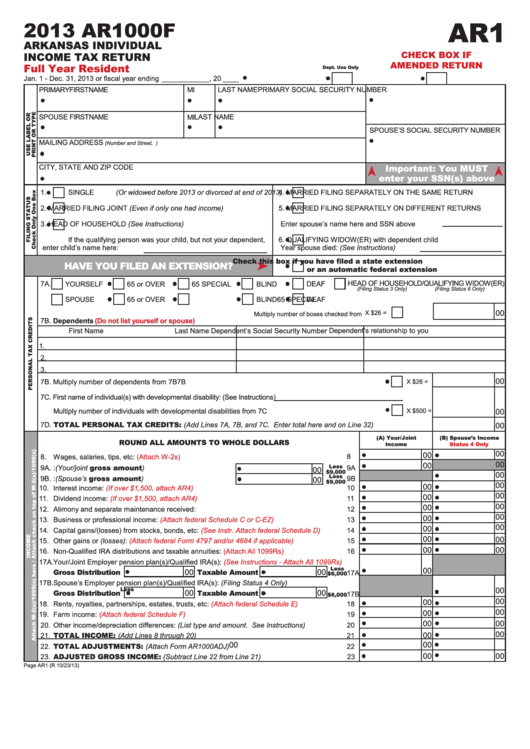

Arkansas State Tax Credits

Arkansas State Tax Credits -

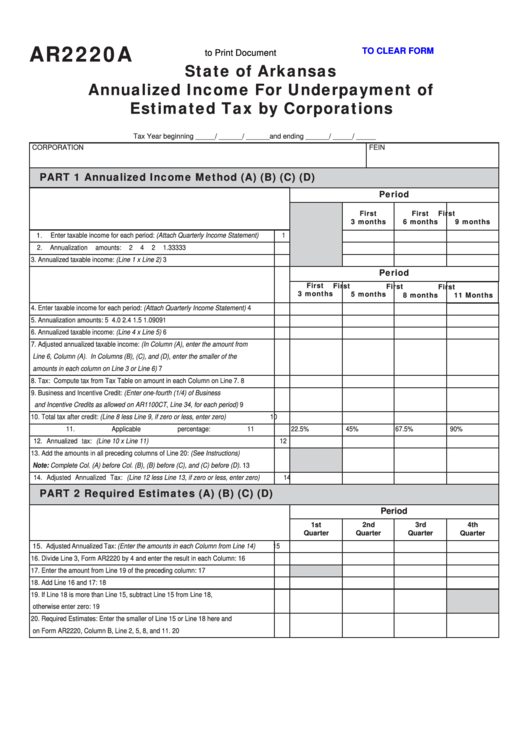

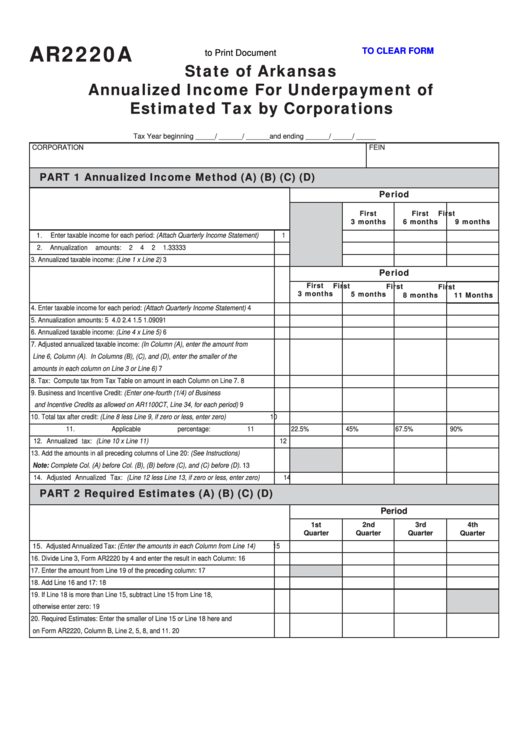

The State of Arkansas allows you to use certain tax credits to lower or offset your tax liability If you qualify for these credits they can be used to the extent of your tax liability

The credit may not exceed an eligible taxpayer s income tax due Unused income tax credits may be carried forward for three years The Office of Tax Credits Special

The Arkansas State Tax Credits are a huge variety of printable, downloadable resources available online for download at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and much more. The appealingness of Arkansas State Tax Credits lies in their versatility as well as accessibility.

More of Arkansas State Tax Credits

Arkansas State Tax Exemption Form ExemptForm

Arkansas State Tax Exemption Form ExemptForm

An Arkansas tax bill signed by Gov Sarah Huckabee Sanders cuts taxes for corporations and individual taxpayers and provides a temporary non refundable tax

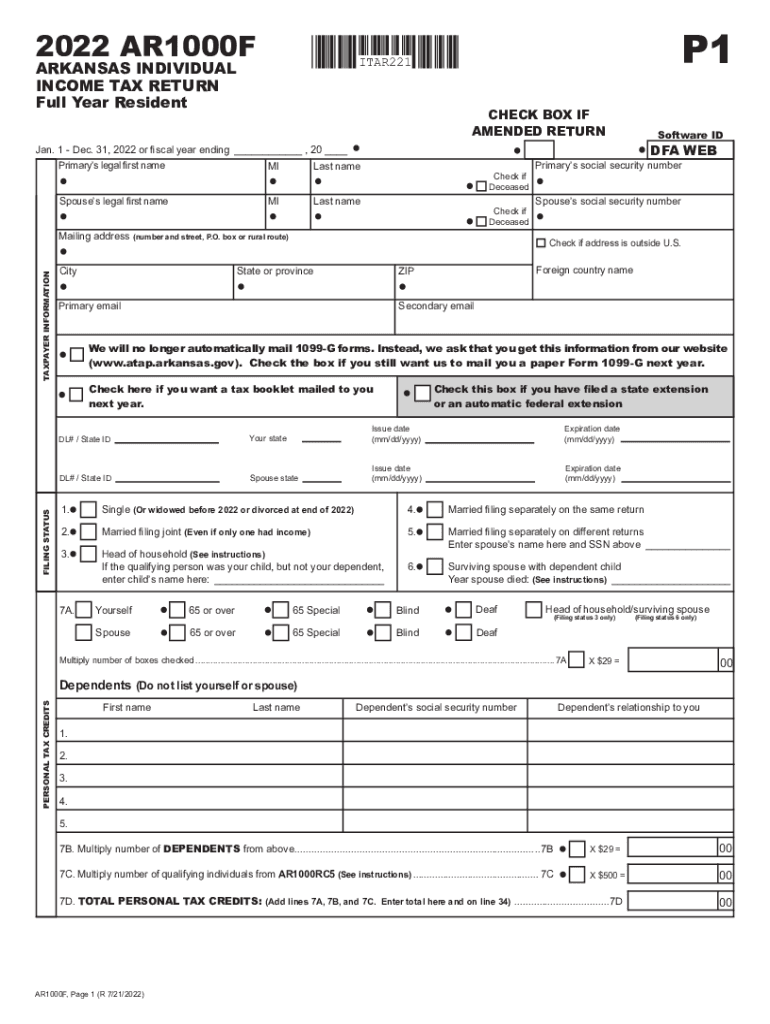

The inflationary relief tax credit is only for 2022 income taxes and you must be an Arkansas resident for all of 2022 It matched Arkansas tax rules with federal law on income tax deductions for

Arkansas State Tax Credits have gained immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: We can customize the templates to meet your individual needs whether you're designing invitations and schedules, or decorating your home.

-

Educational Worth: Free educational printables cater to learners of all ages, making them a valuable tool for parents and teachers.

-

Affordability: instant access a plethora of designs and templates can save you time and energy.

Where to Find more Arkansas State Tax Credits

Arkansas State Tax Forms Printable Printable Forms Free Online

Arkansas State Tax Forms Printable Printable Forms Free Online

Apply for Federal Tax Credits Forms should be completed and returned online beginning August 15 2023 Pictured is the before right and after of the ca 1902 Queen Anne style Judson Millard House at 1410 South

Taxpayers who file a joint income tax return and have a net income up to 202 000 can receive an income tax credit between 20 300 depending on their 2022 net income

After we've peaked your curiosity about Arkansas State Tax Credits We'll take a look around to see where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection with Arkansas State Tax Credits for all objectives.

- Explore categories such as the home, decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning tools.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a broad array of topics, ranging starting from DIY projects to party planning.

Maximizing Arkansas State Tax Credits

Here are some creative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to enhance your learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Arkansas State Tax Credits are a treasure trove of useful and creative resources which cater to a wide range of needs and hobbies. Their availability and versatility make these printables a useful addition to both professional and personal life. Explore the vast world of Arkansas State Tax Credits now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can download and print these tools for free.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular terms of use. Always verify the guidelines provided by the creator before using their printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may come with restrictions on use. Be sure to read the terms and conditions set forth by the creator.

-

How can I print Arkansas State Tax Credits?

- Print them at home using printing equipment or visit a local print shop for better quality prints.

-

What program is required to open printables free of charge?

- Many printables are offered as PDF files, which is open with no cost software, such as Adobe Reader.

W4 Printable Forms 2022 Printable Explained 2022 W 4 Form

US Payroll Tax Guide Arkansas

Check more sample of Arkansas State Tax Credits below

2022 Form AR DFA AR1000F Fill Online Printable Fillable Blank

Arkansas Income Tax Forms Fillable Printable Forms Free Online

Filing An Arkansas State Tax Return Things To Know Credit Karma

Free ARKANSAS AR4EC PDF 419KB 1 Page s

Payroll Builder Timeclock Online Payroll Service Articles Arkansas

Arkansas Income Tax Forms Fillable Printable Forms Free Online

https://www.dfa.arkansas.gov/excise-tax/tax...

The credit may not exceed an eligible taxpayer s income tax due Unused income tax credits may be carried forward for three years The Office of Tax Credits Special

https://www.dfa.arkansas.gov/income-tax/individual-income-tax/faq

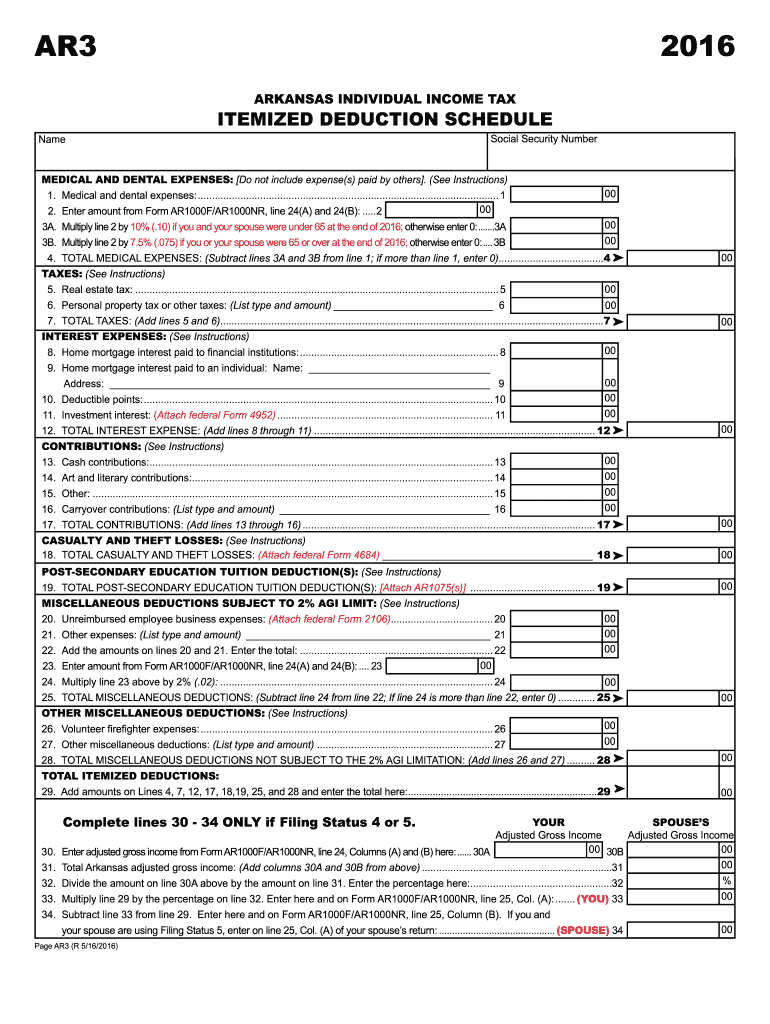

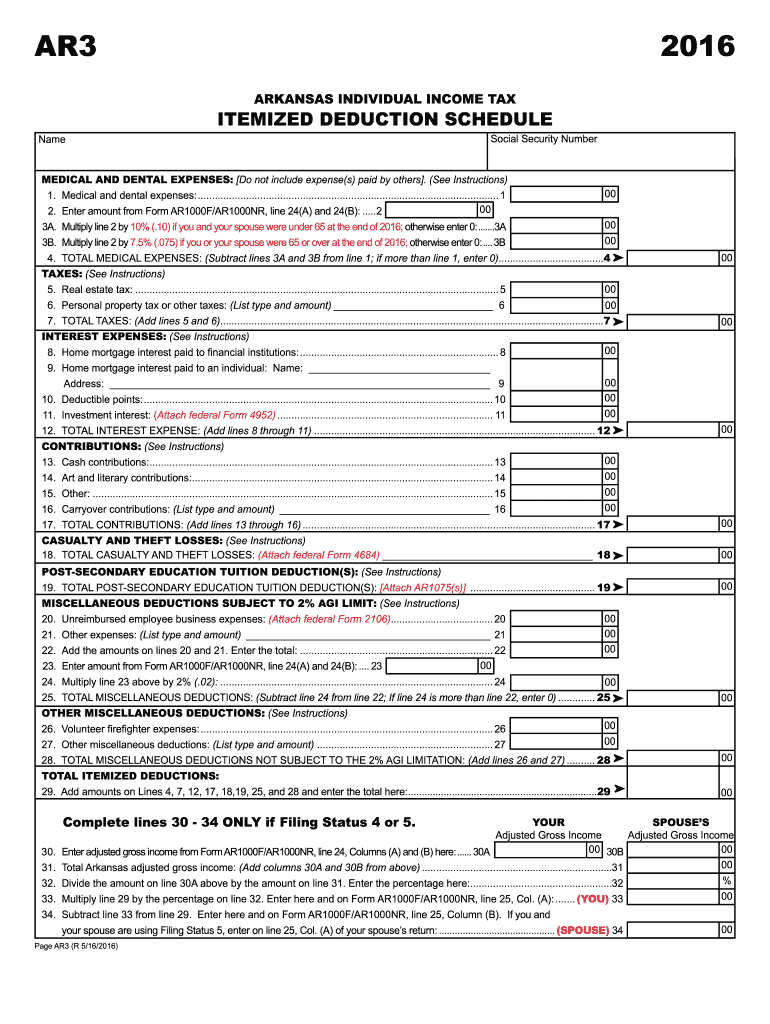

502 Capital Gains Tax 12 29 2020 503 Tax Credits General 12 29 2020 504 Child Care Credit 12 29 2020 505 Other State Tax Credit 12 29 2020 506 Business and

The credit may not exceed an eligible taxpayer s income tax due Unused income tax credits may be carried forward for three years The Office of Tax Credits Special

502 Capital Gains Tax 12 29 2020 503 Tax Credits General 12 29 2020 504 Child Care Credit 12 29 2020 505 Other State Tax Credit 12 29 2020 506 Business and

Free ARKANSAS AR4EC PDF 419KB 1 Page s

Arkansas Income Tax Forms Fillable Printable Forms Free Online

Payroll Builder Timeclock Online Payroll Service Articles Arkansas

Arkansas Income Tax Forms Fillable Printable Forms Free Online

Arkansas Capital Corp Awarded 35M In New Markets Tax Credits

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

Arkansas State Tax Rates 2014 2015 Tax Rates 2014