In the age of digital, where screens rule our lives and the appeal of physical printed items hasn't gone away. Whatever the reason, whether for education in creative or artistic projects, or just adding the personal touch to your space, Bc Sales Tax Credit Turbotax have become an invaluable resource. This article will take a dive deep into the realm of "Bc Sales Tax Credit Turbotax," exploring their purpose, where to find them, and how they can add value to various aspects of your daily life.

Get Latest Bc Sales Tax Credit Turbotax Below

Bc Sales Tax Credit Turbotax

Bc Sales Tax Credit Turbotax -

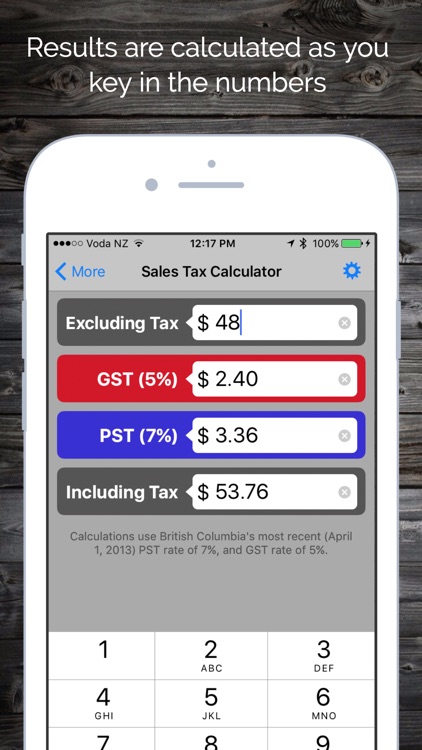

If you are eligible for the BC Sales Tax Credit TurboTax will automatically include the credit and show it on two different summaries Line 479 of the Detailed Tax Summary and on the British Columbia Tax Credits Summary

The BC sales tax credit is a tax benefit designed to help low income individuals and families offset the provincial sales tax they pay on eligible goods and services You can claim the BC sales tax credit if you were a BC resident on December 31 of the tax year and met any of these requirements

Printables for free cover a broad range of printable, free items that are available online at no cost. These resources come in many kinds, including worksheets templates, coloring pages and many more. The great thing about Bc Sales Tax Credit Turbotax lies in their versatility as well as accessibility.

More of Bc Sales Tax Credit Turbotax

A Comprehensive Guide To BC Sales Tax Credit Eligibility

A Comprehensive Guide To BC Sales Tax Credit Eligibility

TurboTax Darlene New Member You would say YES and make the claim This is a Sales tax credit for low income families so based on your income the program will calculate if you are eligible for the credit The credit is from zero to a maximum claim of 75 October 30 2019 10 39 AM 0 Reply How do I claim the BC Sales tax credit

February 3 2022 Andrew Adolph Tax Credits The BC Sales Tax Credit is a tax benefit for low income residents of British Columbia Although this credit is small it s worth claiming if you qualify Keep reading to learn more What Is

Bc Sales Tax Credit Turbotax have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Customization: We can customize the design to meet your needs for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes them an invaluable resource for educators and parents.

-

Easy to use: You have instant access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Bc Sales Tax Credit Turbotax

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

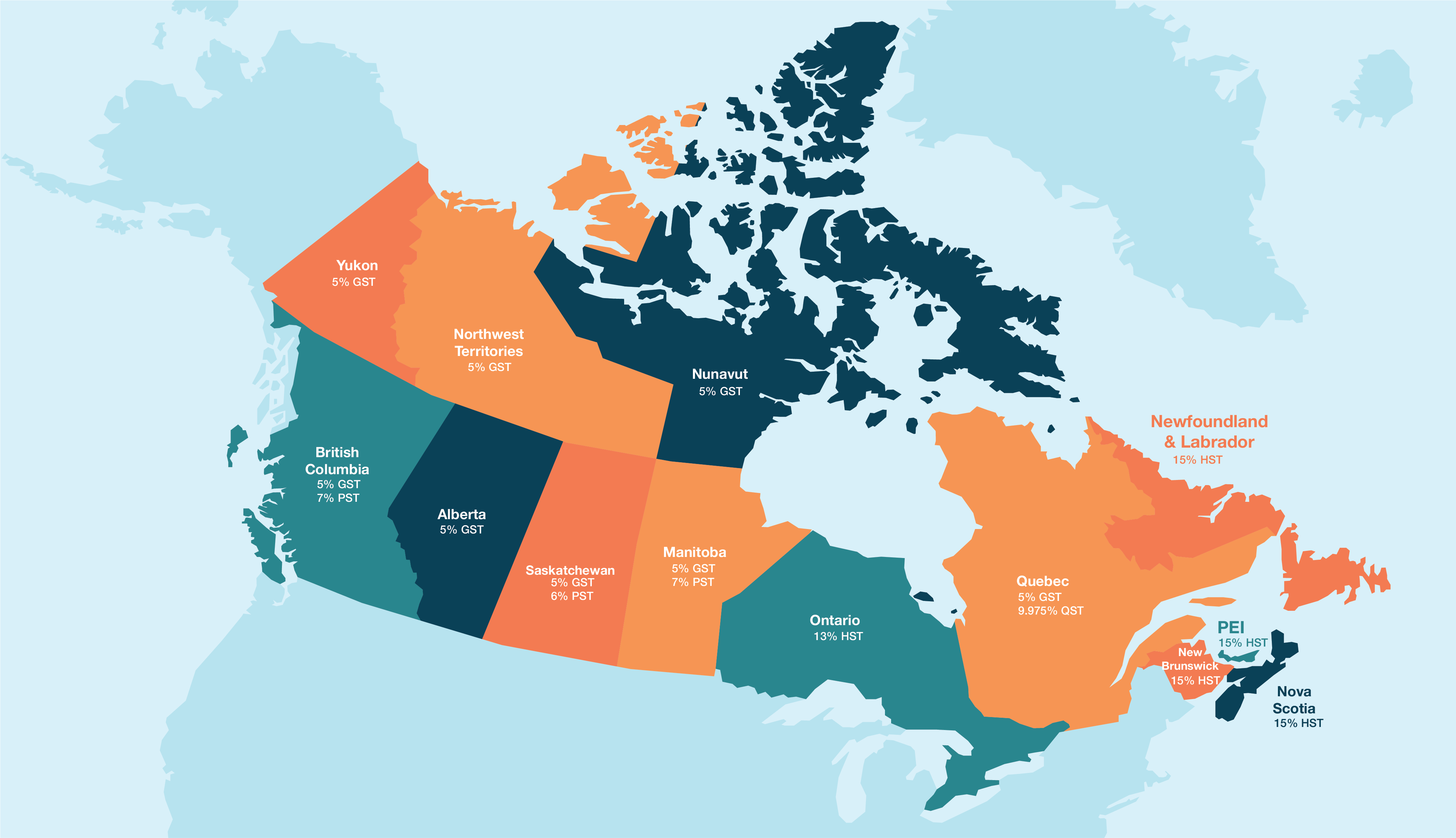

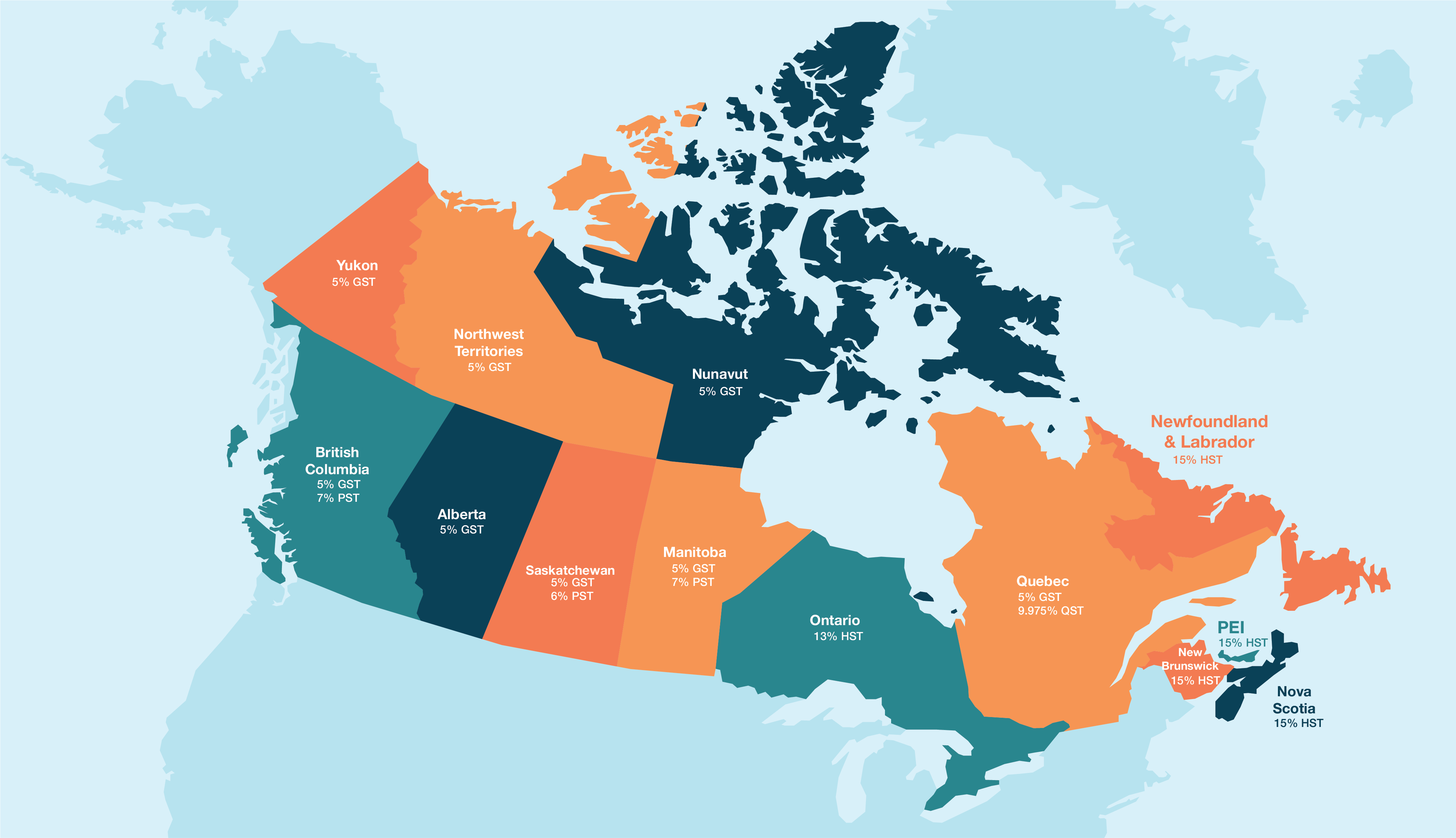

Start filing 3 Minute Read What is the GST HST Credit The Goods and Services Tax Harmonized Sales Tax GST HST credit is intended to help low to modest income Canadians offset the tax they pay on consumer goods and services The Canada Revenue Agency pays out the GST HST credit quarterly to qualifying individuals and

TurboTax HelpIntuit Can I claim the sales tax deduction SOLVED by TurboTax 7981 Updated December 12 2023 If you re itemizing you get to choose between deducting your state and local income taxes or your state and local sales taxes You cannot claim both and you can t claim either one if you re taking the standard deduction

Now that we've ignited your curiosity about Bc Sales Tax Credit Turbotax Let's see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection and Bc Sales Tax Credit Turbotax for a variety applications.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Bc Sales Tax Credit Turbotax

Here are some fresh ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars or to-do lists. meal planners.

Conclusion

Bc Sales Tax Credit Turbotax are an abundance of practical and imaginative resources which cater to a wide range of needs and passions. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the endless world of Bc Sales Tax Credit Turbotax to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes, they are! You can download and print these materials for free.

-

Do I have the right to use free printables for commercial purposes?

- It's determined by the specific rules of usage. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues in Bc Sales Tax Credit Turbotax?

- Certain printables could be restricted in use. Check the terms of service and conditions provided by the designer.

-

How do I print Bc Sales Tax Credit Turbotax?

- You can print them at home using the printer, or go to an in-store print shop to get more high-quality prints.

-

What software is required to open printables at no cost?

- The majority are printed in PDF format. These is open with no cost software such as Adobe Reader.

Charging Customers PST In British Columbia

Qu bec Property Owners RL 31 Slips And The Solidarity Tax Credit

Check more sample of Bc Sales Tax Credit Turbotax below

Advance Child Tax Credit Turbotax

TurboTax 2022 Form 1040 Earned Income Credit EIC YouTube

Solar Panel Tax Credit TurboTax 2022 YouTube

Pre i Mokra ov Letm Income Tax Calculator Bc Norma Kamera Drevo

Canadian Sales Tax Registration Requirements Crowe Soberman LLP

Earned Income Tax Credit Turbotax Yabtio

https://turbotax.intuit.ca/tips/12-bc-tax-credits...

The BC sales tax credit is a tax benefit designed to help low income individuals and families offset the provincial sales tax they pay on eligible goods and services You can claim the BC sales tax credit if you were a BC resident on December 31 of the tax year and met any of these requirements

https://www2.gov.bc.ca/.../personal/credits/sales-tax

You re eligible to claim the sales tax credit for a tax year if you were a resident of B C on December 31 of the tax year and you Were 19 years of age or older or Had a spouse or common law partner or Were a parent For 2013 and later years you can claim up to 75 for yourself and 75 for your cohabiting spouse or common law partner

The BC sales tax credit is a tax benefit designed to help low income individuals and families offset the provincial sales tax they pay on eligible goods and services You can claim the BC sales tax credit if you were a BC resident on December 31 of the tax year and met any of these requirements

You re eligible to claim the sales tax credit for a tax year if you were a resident of B C on December 31 of the tax year and you Were 19 years of age or older or Had a spouse or common law partner or Were a parent For 2013 and later years you can claim up to 75 for yourself and 75 for your cohabiting spouse or common law partner

Pre i Mokra ov Letm Income Tax Calculator Bc Norma Kamera Drevo

TurboTax 2022 Form 1040 Earned Income Credit EIC YouTube

Canadian Sales Tax Registration Requirements Crowe Soberman LLP

Earned Income Tax Credit Turbotax Yabtio

Reverse Sales Tax Calculator Bc Dishy Microblog Gallery Of Photos

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey

BC Sales Tax Credit Eligibility Criteria More Gateway Surrey