In this day and age where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education, creative projects, or just adding a personal touch to your home, printables for free have proven to be a valuable source. For this piece, we'll dive to the depths of "Belgium Income Tax Deductions," exploring their purpose, where you can find them, and what they can do to improve different aspects of your lives.

Get Latest Belgium Income Tax Deductions Below

Belgium Income Tax Deductions

Belgium Income Tax Deductions -

The income tax rates follow a progressive scale ranging from 25 for individuals earning under 15 200 and reaching 50 for those surpassing 46 440 Furthermore municipal taxes usually deduct a portion of your income as an additional charge You can find out more about these costs and rates later in the article

In Belgium if your gross annual salary salaire brut is 45 984 or 3 832 per month the total amount of taxes and contributions that will be deducted from your salary is 16 424 This means that your net income or salary after tax salaire net will be 29 560 per year 2 463 per month or 568 per week

Printables for free cover a broad array of printable items that are available online at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and many more. The appeal of printables for free is in their versatility and accessibility.

More of Belgium Income Tax Deductions

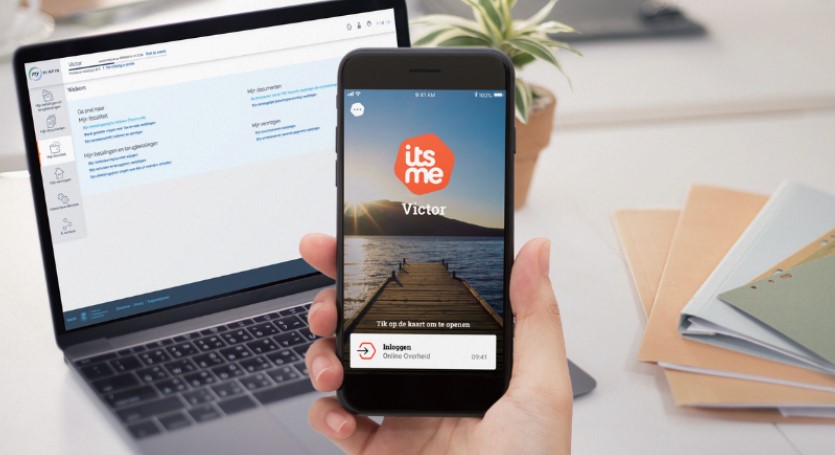

Filing Your Belgian Income Tax Return Online The Bulletin

Filing Your Belgian Income Tax Return Online The Bulletin

Taxes Income tax Professional income is taxed on its net amount In other words you must deduct from your gross salary social contributions actual or fixed rate professional costs the dependant spouse allowance and or assisting spouse deduction exemptions of an economic character fiscal measures to encourage investment and or employment

Estimated Breakdown Income Before Tax Income Tax Communal Tax average Social Security Contribution RSZ Special Social Security Contribution Total Tax Take Home Pay Total Deductions Average Tax Rate Summary Enter your employment income into our salary calculator above to estimate how taxes in Belgium may affect your finances

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

Flexible: It is possible to tailor the templates to meet your individual needs in designing invitations or arranging your schedule or decorating your home.

-

Educational Value: Printables for education that are free cater to learners of all ages, which makes them a valuable device for teachers and parents.

-

The convenience of You have instant access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Belgium Income Tax Deductions

Finally an Agreement Reached On The Reformation Of Belgian Corporate

Finally an Agreement Reached On The Reformation Of Belgian Corporate

Tax return Attention please make an appointment to go to any ofour offices Return 2023 Objection Non residents income tax Municipal tax Tax rates and income

Last reviewed 12 March 2024 Belgian residents and non residents are taxed on their employment income movable income property income and miscellaneous income Other taxes that may be relevant are gift and succession taxes see the Other taxes section for more information

If we've already piqued your interest in Belgium Income Tax Deductions and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Belgium Income Tax Deductions designed for a variety objectives.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free or flashcards as well as learning tools.

- The perfect resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide selection of subjects, that range from DIY projects to planning a party.

Maximizing Belgium Income Tax Deductions

Here are some ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to aid in learning at your home and in class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Belgium Income Tax Deductions are an abundance of innovative and useful resources catering to different needs and needs and. Their accessibility and versatility make them a fantastic addition to your professional and personal life. Explore the world of Belgium Income Tax Deductions right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can download and print these materials for free.

-

Can I use the free printing templates for commercial purposes?

- It's contingent upon the specific rules of usage. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables may contain restrictions on their use. Make sure to read the terms of service and conditions provided by the designer.

-

How can I print Belgium Income Tax Deductions?

- You can print them at home with printing equipment or visit a print shop in your area for more high-quality prints.

-

What software do I need to open Belgium Income Tax Deductions?

- A majority of printed materials are in the format of PDF, which is open with no cost software like Adobe Reader.

Belgium Salary Calculator 2023 Investomatica

How To Pay Taxes In Belgium As A Foreigner

Check more sample of Belgium Income Tax Deductions below

Employees In Belgium Pay Highest Income Taxes In 38 OECD Countries

Belgium Taxes Belgium Income Tax Belgium Currency 2021

Belgium Personal Income Tax Rate 2023 Take profit

Belgium TAXGURO

Paying 2017 2018 Income Tax In Belgium Read This Wise

PDF Comparaison Fiscalit France Luxembourg PDF T l charger Download

https://salaryaftertax.com/be

In Belgium if your gross annual salary salaire brut is 45 984 or 3 832 per month the total amount of taxes and contributions that will be deducted from your salary is 16 424 This means that your net income or salary after tax salaire net will be 29 560 per year 2 463 per month or 568 per week

https://taxsummaries.pwc.com/Belgium/Individual/...

Personal income tax PIT is calculated by determining the tax base and assessing the tax due on that base Taxation is charged on a sliding scale to successive portions of net taxable income For income year 2024 the federal tax rates range between nil and 50 see below

In Belgium if your gross annual salary salaire brut is 45 984 or 3 832 per month the total amount of taxes and contributions that will be deducted from your salary is 16 424 This means that your net income or salary after tax salaire net will be 29 560 per year 2 463 per month or 568 per week

Personal income tax PIT is calculated by determining the tax base and assessing the tax due on that base Taxation is charged on a sliding scale to successive portions of net taxable income For income year 2024 the federal tax rates range between nil and 50 see below

Belgium TAXGURO

Belgium Taxes Belgium Income Tax Belgium Currency 2021

Paying 2017 2018 Income Tax In Belgium Read This Wise

PDF Comparaison Fiscalit France Luxembourg PDF T l charger Download

How To File Your Income Taxes In Belgium In 2022 Expatica

Belgium Has The Highest Income Taxes In The Developed World

Belgium Has The Highest Income Taxes In The Developed World

France Poised To Levy World s Highest Income Tax Exceeding The