In this age of electronic devices, where screens rule our lives but the value of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding an individual touch to your home, printables for free are now an essential source. We'll take a dive deep into the realm of "Bonus Tax Deduction Ontario," exploring their purpose, where they can be found, and ways they can help you improve many aspects of your daily life.

Get Latest Bonus Tax Deduction Ontario Below

Bonus Tax Deduction Ontario

Bonus Tax Deduction Ontario -

Verkko 7 helmik 2023 nbsp 0183 32 Using the periodic method the total amount the employee would pay in taxes would be 1 451 54 while the bonus method the tax paid would be 990 00 240 00 on their salary plus

Verkko 27 jouluk 2021 nbsp 0183 32 A company can grant the bonus and receive a deduction for the current tax year even if the bonus is not paid immediately The company has up to 179 days after the end of the

Bonus Tax Deduction Ontario offer a wide array of printable materials available online at no cost. They come in many styles, from worksheets to coloring pages, templates and many more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Bonus Tax Deduction Ontario

Bonus Deduction For Employee Training Proposal Mathews Tax Lawyers

Bonus Deduction For Employee Training Proposal Mathews Tax Lawyers

Verkko By quickly calculating our take home bonus you can make informed decisions about budgeting financial goals and potential tax implications In this article we ll explore

Verkko 1 tammik 2023 nbsp 0183 32 Canada Employment Amount Basic Personal amounts Ontario tax for 2023 Ontario indexing for 2023 Tax rates and income thresholds Chart 2 2023

Bonus Tax Deduction Ontario have gained a lot of popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: We can customize print-ready templates to your specific requirements when it comes to designing invitations making your schedule, or decorating your home.

-

Educational Worth: Free educational printables can be used by students of all ages, making them a useful aid for parents as well as educators.

-

The convenience of You have instant access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Bonus Tax Deduction Ontario

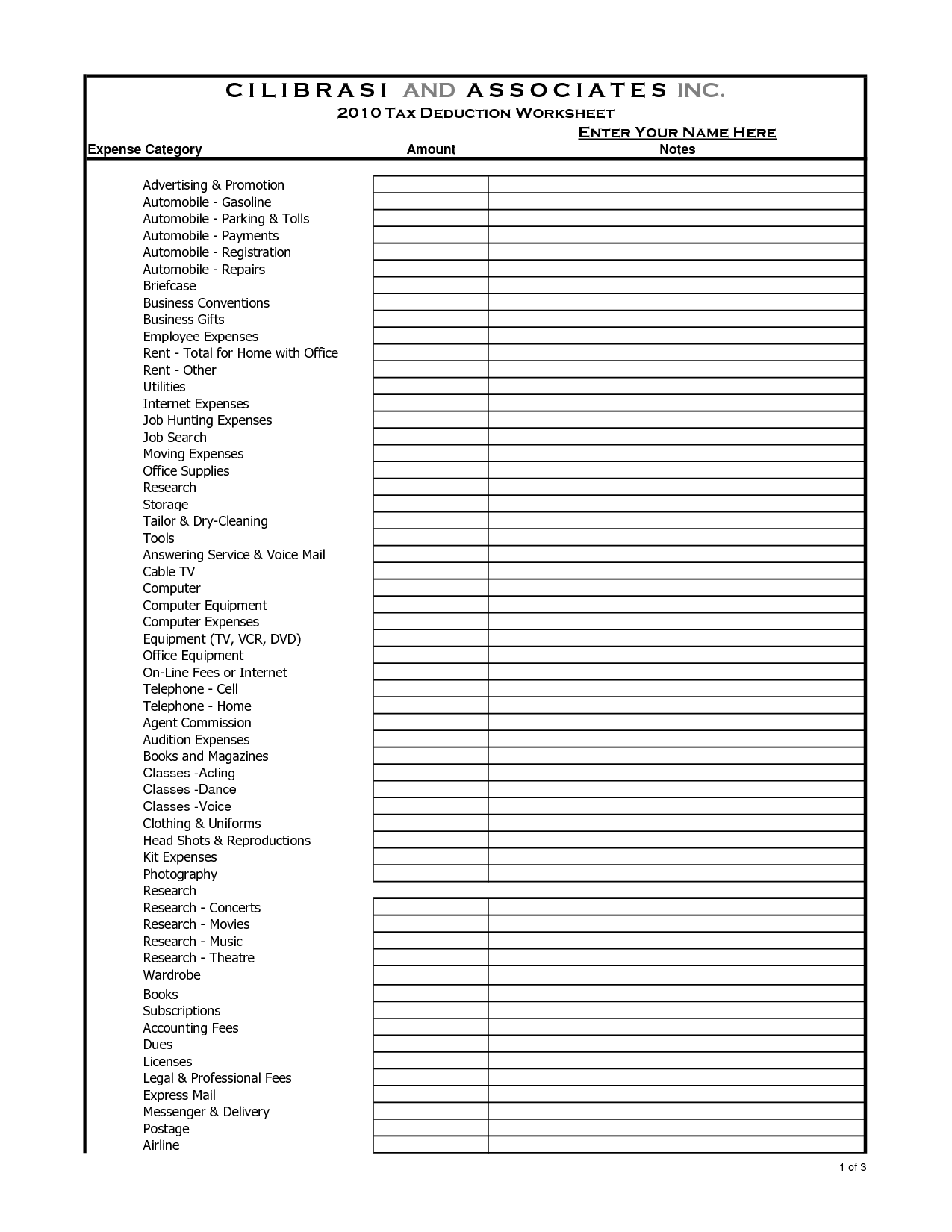

16 Tax Organizer Worksheet Worksheeto

16 Tax Organizer Worksheet Worksheeto

Verkko Calculate payroll deductions and contributions Learn about CPP contributions EI premiums and income tax deductions how to calculate the deductions on the amounts

Verkko Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 52 000 Federal tax deduction 7 175 Provincial tax deduction 3 282

After we've peaked your curiosity about Bonus Tax Deduction Ontario Let's find out where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Bonus Tax Deduction Ontario for different needs.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free as well as flashcards and other learning tools.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs covered cover a wide range of interests, including DIY projects to party planning.

Maximizing Bonus Tax Deduction Ontario

Here are some ways of making the most of Bonus Tax Deduction Ontario:

1. Home Decor

- Print and frame stunning artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to build your knowledge at home and in class.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Bonus Tax Deduction Ontario are a treasure trove of creative and practical resources that meet a variety of needs and desires. Their accessibility and versatility make them an invaluable addition to your professional and personal life. Explore the vast array of Bonus Tax Deduction Ontario right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can download and print the resources for free.

-

Can I use the free printables for commercial uses?

- It is contingent on the specific rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright violations with Bonus Tax Deduction Ontario?

- Some printables may contain restrictions in their usage. Be sure to read the terms and regulations provided by the creator.

-

How do I print Bonus Tax Deduction Ontario?

- You can print them at home with either a printer at home or in an in-store print shop to get high-quality prints.

-

What program is required to open printables for free?

- The majority are printed in PDF format, which can be opened using free programs like Adobe Reader.

20 Bonus Tax Deduction On Your Training PRAXIS Australia

Bonus 20 Tax Deduction On Worx Inductions Boost Your Safety

Check more sample of Bonus Tax Deduction Ontario below

Figure Out Tax Deductions Paycheck XantheNavy

Toronto Parents Pay The Most For Child Care In The Country What Are

Performance Based Christmas Bonus When Is It Subject For Tax Deduction

20 Bonus Tax Deduction On Training Allara Learning Australia

Simple But Useful Ways To Become A Better Student And Kill It This

Printable Itemized Deductions Worksheet

https://filingtaxes.ca/why-are-bonuses-taxe…

Verkko 27 jouluk 2021 nbsp 0183 32 A company can grant the bonus and receive a deduction for the current tax year even if the bonus is not paid immediately The company has up to 179 days after the end of the

https://ca.indeed.com/hire/c/info/canada-bonus-tax-calculator

Verkko To calculate tax on a bonus you first need to determine which income tax brackets the employee falls under According to Revenue Canada these are Canada s federal

Verkko 27 jouluk 2021 nbsp 0183 32 A company can grant the bonus and receive a deduction for the current tax year even if the bonus is not paid immediately The company has up to 179 days after the end of the

Verkko To calculate tax on a bonus you first need to determine which income tax brackets the employee falls under According to Revenue Canada these are Canada s federal

20 Bonus Tax Deduction On Training Allara Learning Australia

Toronto Parents Pay The Most For Child Care In The Country What Are

Simple But Useful Ways To Become A Better Student And Kill It This

Printable Itemized Deductions Worksheet

8 Tax Preparation Organizer Worksheet Worksheeto

How Are Bonuses Taxed with Bonus Calculator Minafi

How Are Bonuses Taxed with Bonus Calculator Minafi

Paystub Finance And Budget