In the age of digital, in which screens are the norm and the appeal of physical printed objects isn't diminished. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding an individual touch to the area, Business Miles Tax Deduction 2021 have proven to be a valuable resource. For this piece, we'll take a dive deeper into "Business Miles Tax Deduction 2021," exploring what they are, where to locate them, and how they can improve various aspects of your lives.

Get Latest Business Miles Tax Deduction 2021 Below

Business Miles Tax Deduction 2021

Business Miles Tax Deduction 2021 -

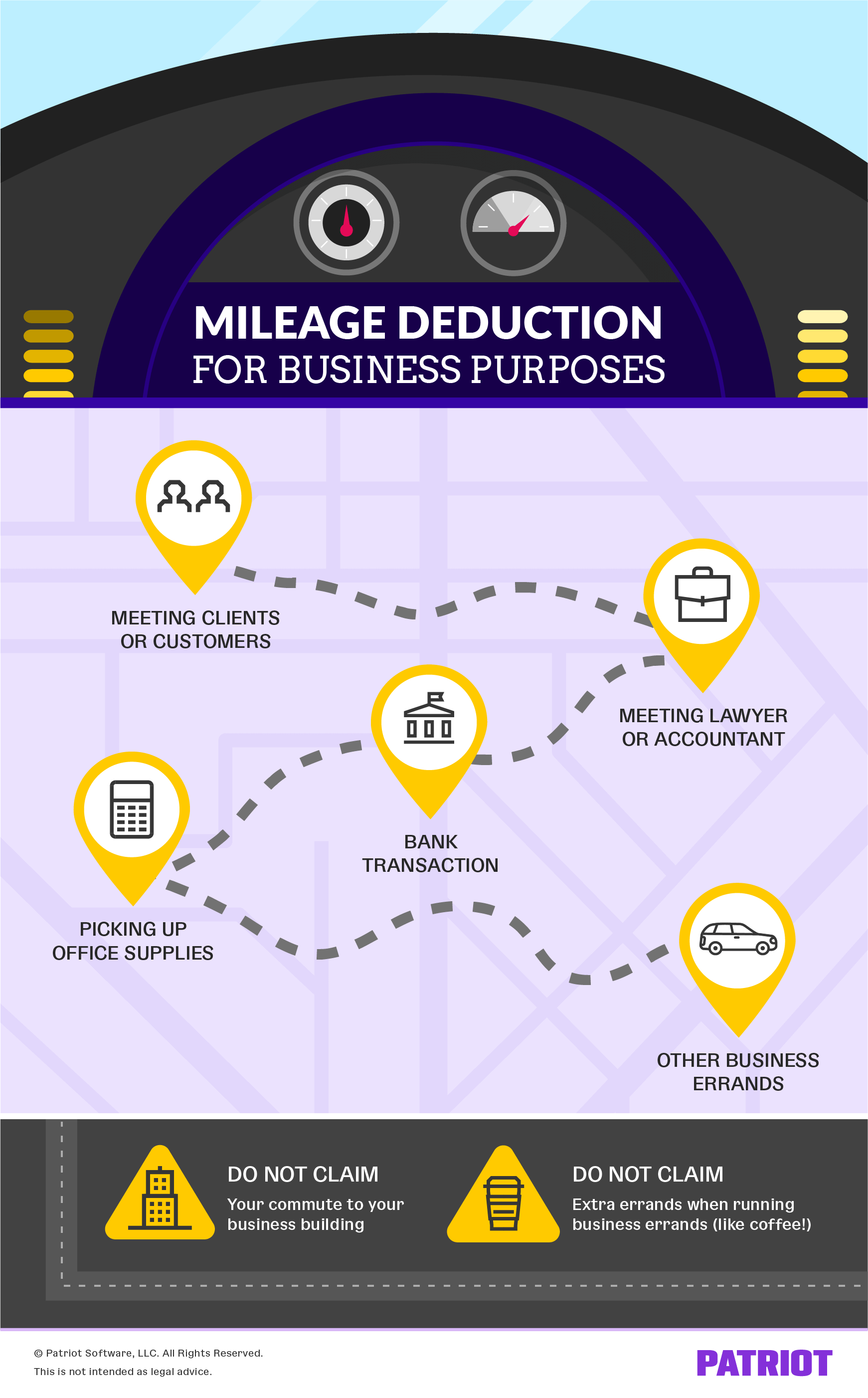

Effective Jan 1 2021 the optional standard mileage rate used in deducting the costs of operating an automobile for business will be 56 cents per mile down 1 5 cents from

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

Business Miles Tax Deduction 2021 offer a wide assortment of printable, downloadable documents that can be downloaded online at no cost. These printables come in different styles, from worksheets to templates, coloring pages, and many more. The beauty of Business Miles Tax Deduction 2021 is their flexibility and accessibility.

More of Business Miles Tax Deduction 2021

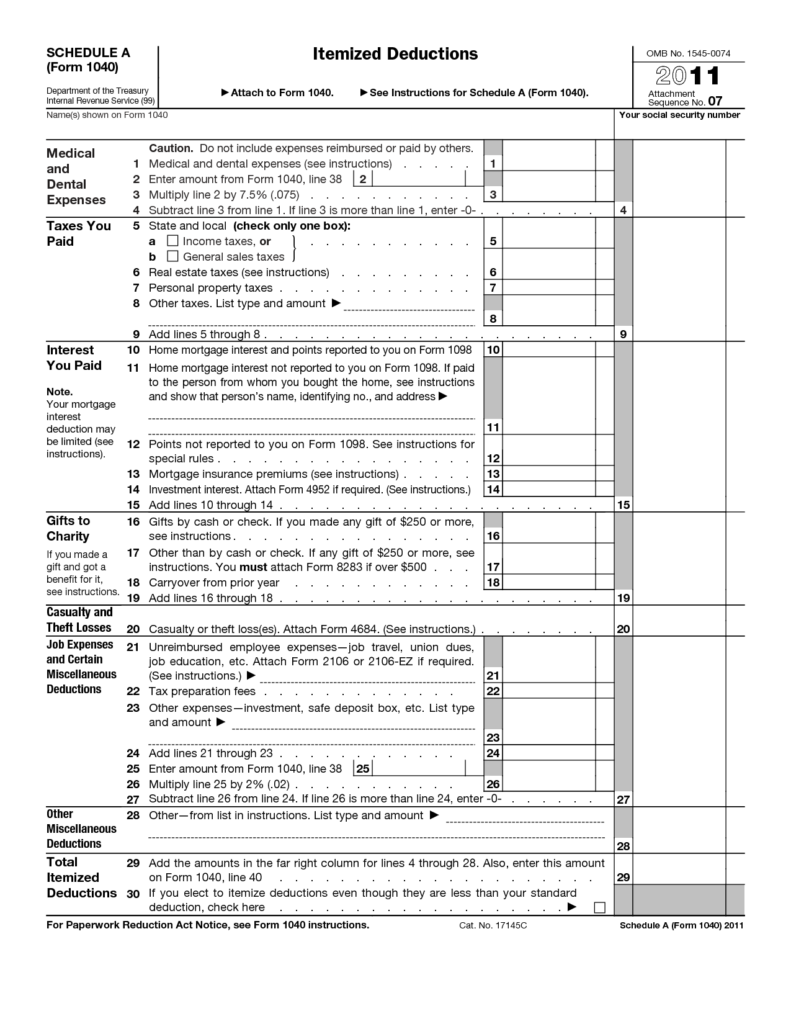

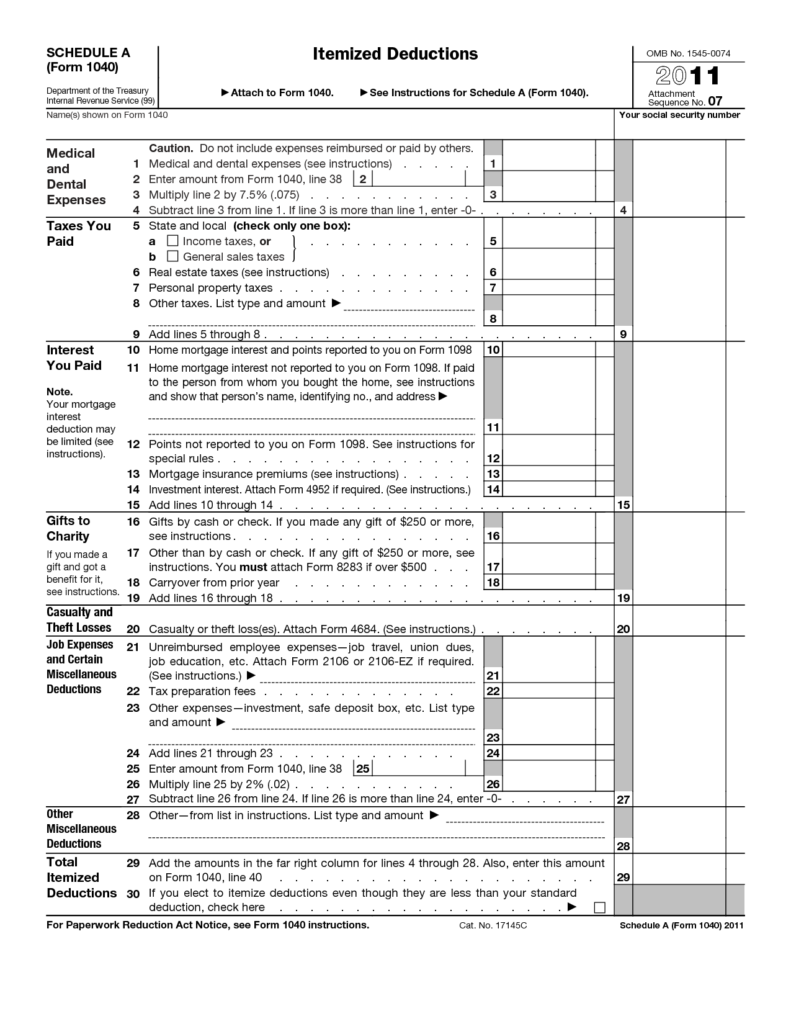

Business Mileage Deduction 101 How To Calculate For Taxes

Business Mileage Deduction 101 How To Calculate For Taxes

To compute the deduction for business use of your car using Standard Mileage method simply multiply your business miles by the amount per mile allotted by

That means the mileage deduction in 2022 2021 rate is different from previous years It includes factors like gasoline prices wear and tear and more There s no limit to the

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: The Customization feature lets you tailor printables to your specific needs, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational Value: Education-related printables at no charge offer a wide range of educational content for learners of all ages, making them a useful device for teachers and parents.

-

Affordability: Fast access an array of designs and templates helps save time and effort.

Where to Find more Business Miles Tax Deduction 2021

14 Tax Reduction Strategies For The Self Employed Morris D Angelo

14 Tax Reduction Strategies For The Self Employed Morris D Angelo

Contents What are business miles What are commuting miles How business vs commuting miles work The two ways to deduct business mileage How to track your miles What are

For 2021 the business standard mileage rate is 56 cents per mile a 1 5 cent decrease from the 57 5 cents rate for 2020 and the rate when an automobile is used to obtain medical care which may

After we've peaked your interest in Business Miles Tax Deduction 2021 We'll take a look around to see where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Business Miles Tax Deduction 2021 for various reasons.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free including flashcards, learning materials.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- The blogs covered cover a wide range of topics, that includes DIY projects to party planning.

Maximizing Business Miles Tax Deduction 2021

Here are some unique ways create the maximum value use of Business Miles Tax Deduction 2021:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets from the internet to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Business Miles Tax Deduction 2021 are an abundance of fun and practical tools that meet a variety of needs and preferences. Their availability and versatility make them a great addition to your professional and personal life. Explore the vast world of Business Miles Tax Deduction 2021 now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can download and print these files for free.

-

Do I have the right to use free printouts for commercial usage?

- It's based on specific conditions of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may have restrictions regarding their use. You should read the terms and conditions provided by the creator.

-

How do I print Business Miles Tax Deduction 2021?

- You can print them at home using any printer or head to an in-store print shop to get top quality prints.

-

What software do I require to view printables that are free?

- The majority of PDF documents are provided in the format of PDF, which can be opened using free software such as Adobe Reader.

2022 Tax Brackets Irs Calculator

Free Mileage Log Template IRS Compliant Excel PDF

Check more sample of Business Miles Tax Deduction 2021 below

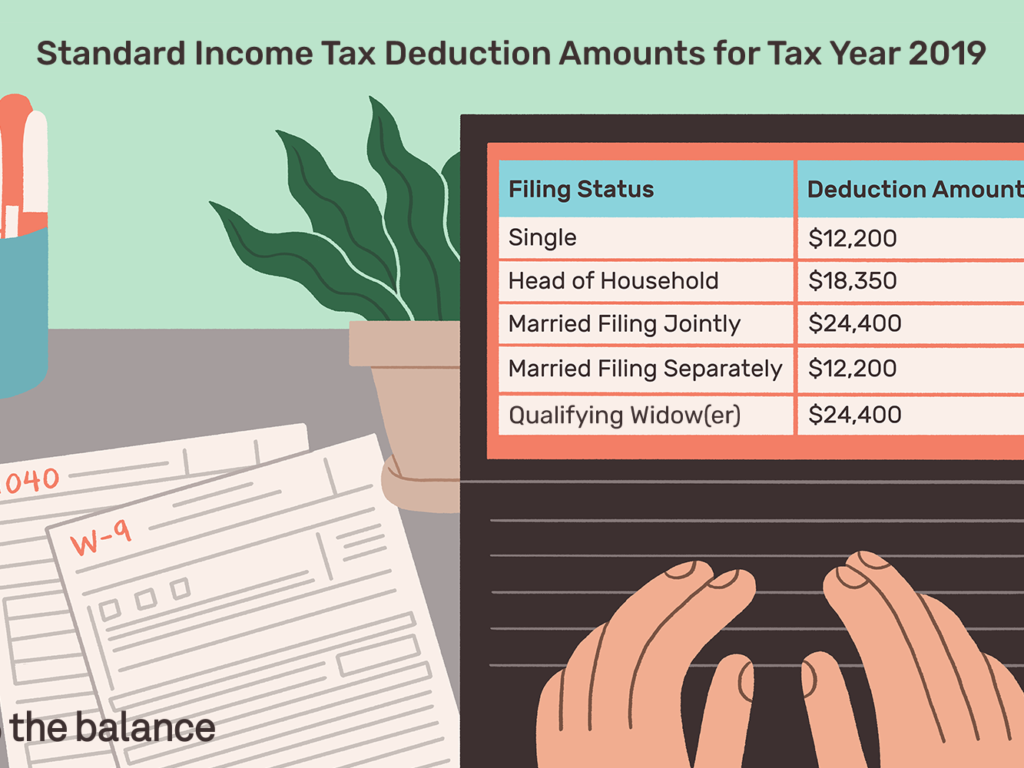

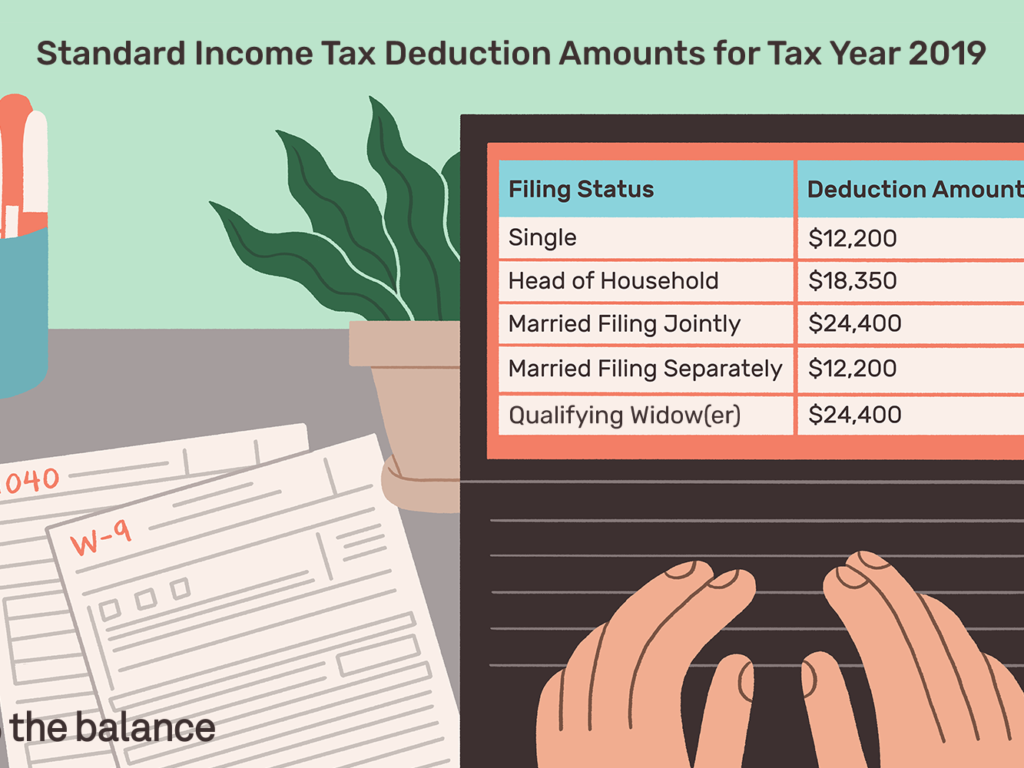

Standard Deduction For 2021 Taxes Standard Deduction 2021

2022 Federal Tax Income Tables Secure 2022

24 Vehicle Lease Mileage Tracker Sample Excel Templates

Standard Deduction 2020 Self Employed Standard Deduction 2021

Home Office Deduction Worksheet Excel Printable Word Searches

Standard Income Tax Deduction For 2020 Standard Deduction 2021

https://www.irs.gov/tax-professionals/standard-mileage-rates

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

https://www.irs.gov/pub/irs-drop/n-21-02.pdf

PURPOSE This notice provides the optional 2021 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business

17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

PURPOSE This notice provides the optional 2021 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business

Standard Deduction 2020 Self Employed Standard Deduction 2021

2022 Federal Tax Income Tables Secure 2022

Home Office Deduction Worksheet Excel Printable Word Searches

Standard Income Tax Deduction For 2020 Standard Deduction 2021

Easily Calculate Your Business Mileage Tax Deduction YouTube

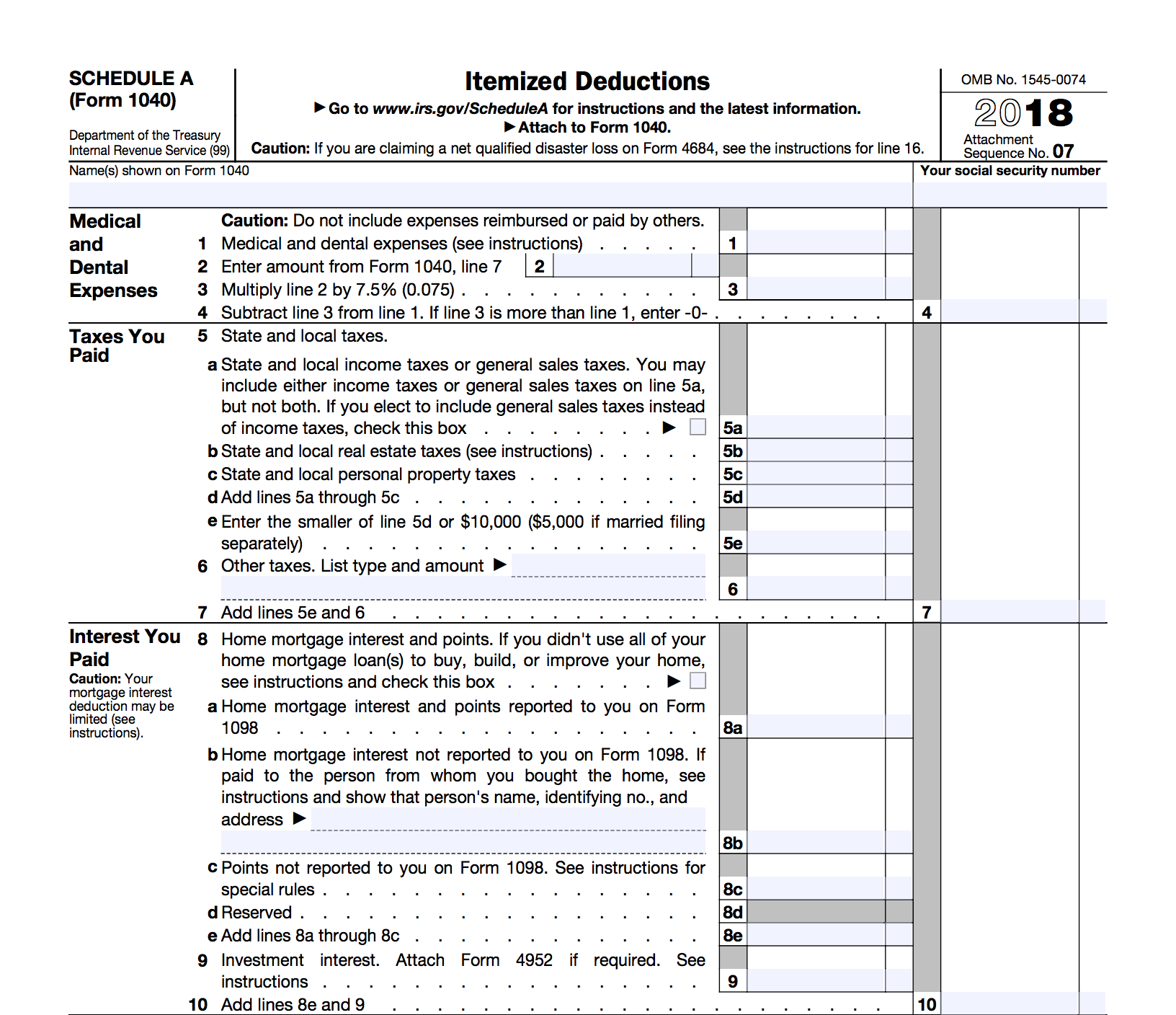

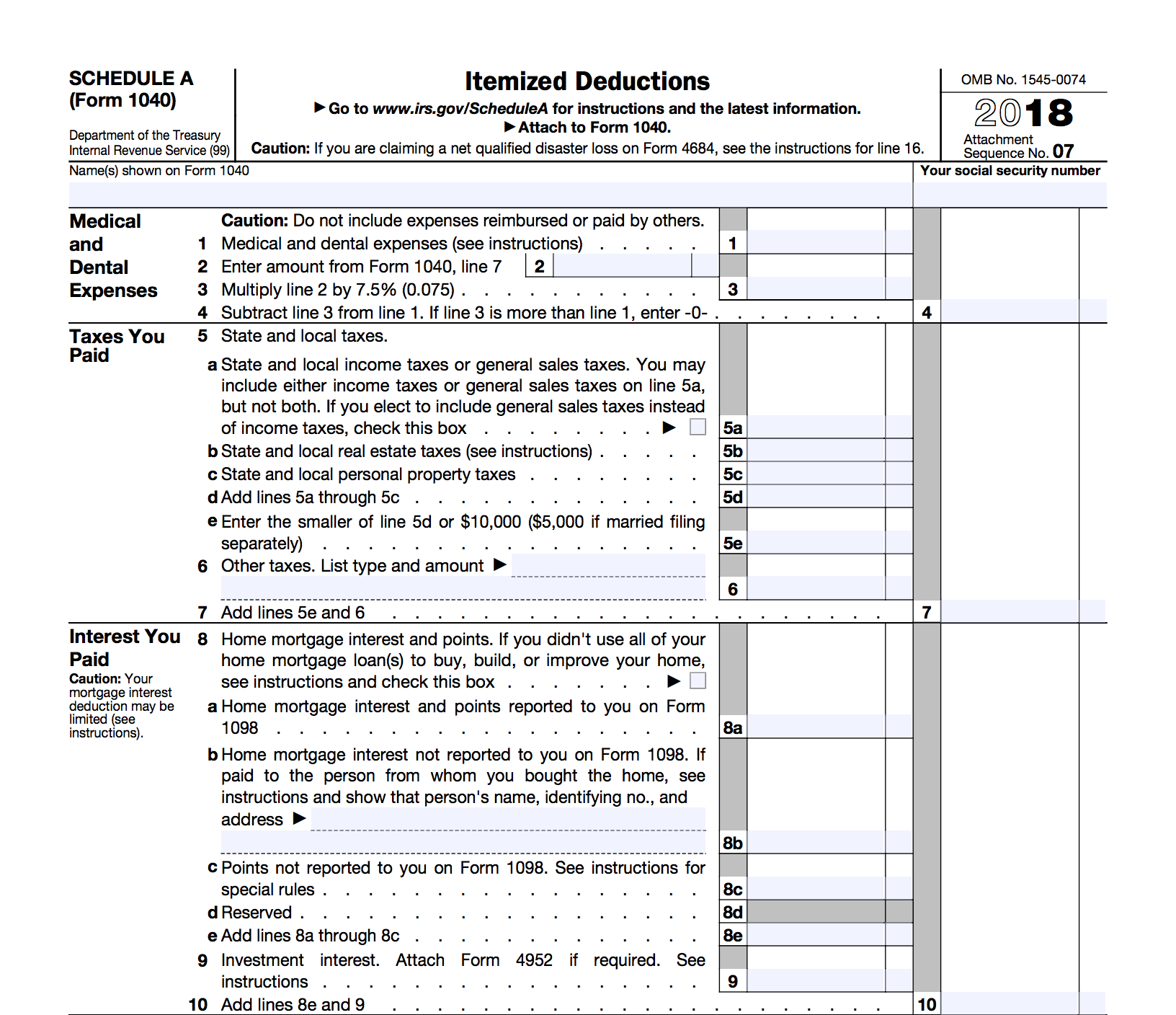

1040 Standard Deduction 2020 Standard Deduction 2021

1040 Standard Deduction 2020 Standard Deduction 2021

Document Miles Etsy