In this digital age, when screens dominate our lives and the appeal of physical printed items hasn't gone away. For educational purposes, creative projects, or just adding a personal touch to your home, printables for free are now an essential source. Through this post, we'll take a dive to the depths of "Business Solar Tax Credit Form," exploring the benefits of them, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Business Solar Tax Credit Form Below

Business Solar Tax Credit Form

Business Solar Tax Credit Form -

Laid out in Section 48 of the U S tax code the business ITC provides an incentive for investing in clean energy by giving you credit on your taxes equal to a percentage of the cost of your solar panel system

Information about Form 3468 Investment Credit including recent updates related forms and instructions on how to file Use this form to claim the investment credit

Business Solar Tax Credit Form include a broad assortment of printable materials that are accessible online for free cost. They are available in numerous forms, like worksheets templates, coloring pages and more. The great thing about Business Solar Tax Credit Form is in their variety and accessibility.

More of Business Solar Tax Credit Form

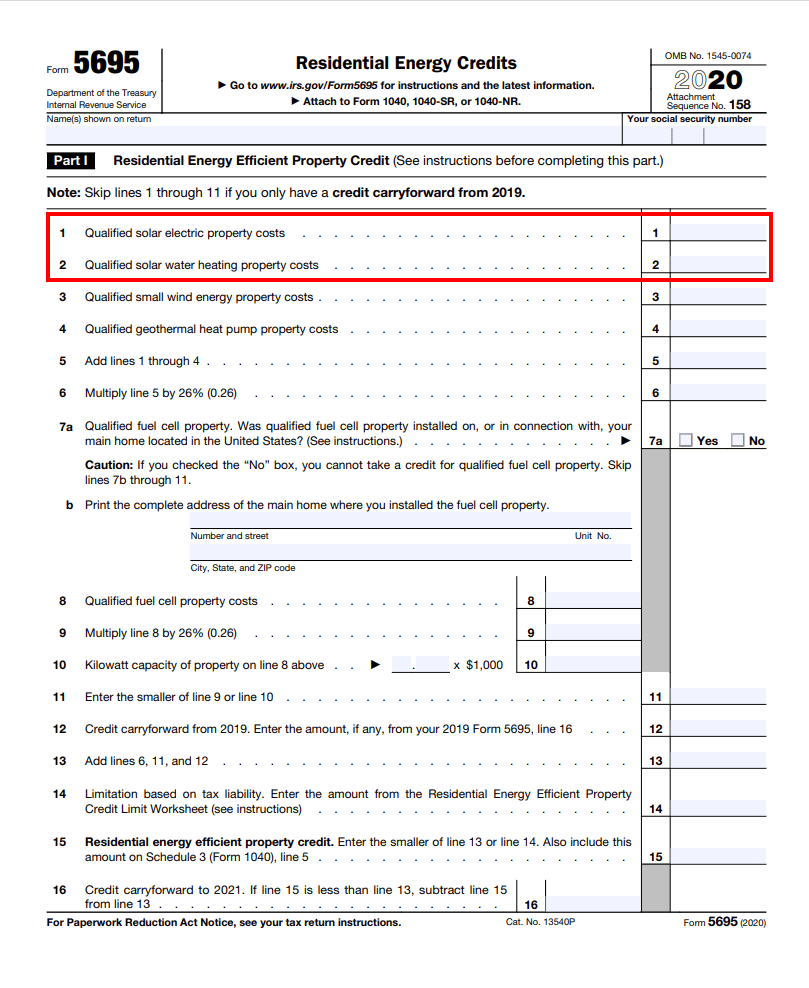

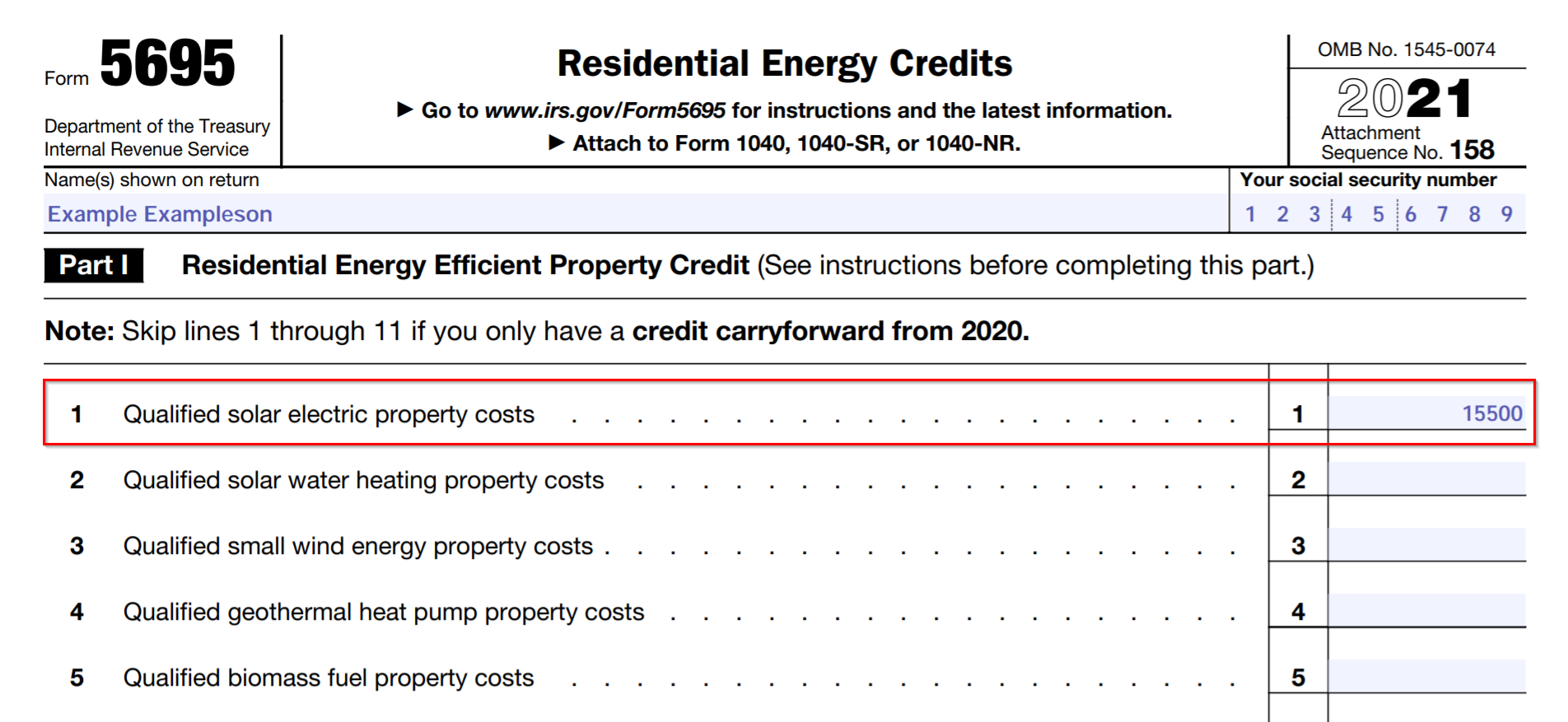

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

The solar tax credit can help make new solar projects financially viable for your company These upgrades can provide long term energy cost savings for your business but often involve large up front payments

Technology neutral tax credit for investment in facilities that generate clean electricity and qualified energy storage technologies Replaces 48 for facilities that begin construction and are placed in service after 2024 Credit Amount 6 of qualified investment basis 30 if PWA requirements met 1 4 5 6

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Personalization The Customization feature lets you tailor print-ready templates to your specific requirements such as designing invitations to organize your schedule or even decorating your home.

-

Education Value Education-related printables at no charge provide for students from all ages, making them a great tool for parents and teachers.

-

An easy way to access HTML0: Fast access various designs and templates helps save time and effort.

Where to Find more Business Solar Tax Credit Form

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The ITC is a 30 percent tax credit for individuals installing solar systems on residential property under Section 25D of the tax code The Section 48 commercial credit can be applied to both customer sited commercial solar

The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic PV system that is placed in service during the tax year 1 Other types of renewable energy are also eligible for the ITC but are beyond the scope of this guidance

We've now piqued your interest in Business Solar Tax Credit Form Let's look into where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Business Solar Tax Credit Form for various motives.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free or flashcards as well as learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad range of topics, everything from DIY projects to planning a party.

Maximizing Business Solar Tax Credit Form

Here are some new ways to make the most of Business Solar Tax Credit Form:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home (or in the learning environment).

3. Event Planning

- Design invitations, banners, and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars or to-do lists. meal planners.

Conclusion

Business Solar Tax Credit Form are an abundance of creative and practical resources that can meet the needs of a variety of people and needs and. Their access and versatility makes them an essential part of both professional and personal lives. Explore the vast collection that is Business Solar Tax Credit Form today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly are they free?

- Yes they are! You can download and print these materials for free.

-

Are there any free printables for commercial use?

- It's dependent on the particular terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright concerns when using Business Solar Tax Credit Form?

- Certain printables may be subject to restrictions concerning their use. Check the terms and regulations provided by the creator.

-

How can I print printables for free?

- Print them at home with a printer or visit any local print store for more high-quality prints.

-

What software do I need in order to open printables free of charge?

- The majority are printed with PDF formats, which is open with no cost software such as Adobe Reader.

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Irs Solar Tax Credit 2022 Form

Check more sample of Business Solar Tax Credit Form below

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

NJ Solar Tax Credit Explained

Tax Credit ITC Sungenia Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Solar Tax Credit Calculator NikiZsombor

Irish Andrew

https://www.irs.gov/forms-pubs/about-form-3468

Information about Form 3468 Investment Credit including recent updates related forms and instructions on how to file Use this form to claim the investment credit

https://www.energy.gov/sites/default/files/2024-02/...

This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for businesses nonprofits and other entities that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation

Information about Form 3468 Investment Credit including recent updates related forms and instructions on how to file Use this form to claim the investment credit

This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for businesses nonprofits and other entities that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

NJ Solar Tax Credit Explained

Solar Tax Credit Calculator NikiZsombor

Irish Andrew

How To File Solar Tax Credit IRS Form 5695 Green Ridge Solar

Step By Step Guide Filing Your Federal Solar Tax Credit

Step By Step Guide Filing Your Federal Solar Tax Credit

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar