In this age of technology, with screens dominating our lives however, the attraction of tangible, printed materials hasn't diminished. If it's to aid in education, creative projects, or simply to add an individual touch to your area, Can Farming Losses Be Offset Against Income have proven to be a valuable resource. In this article, we'll dive into the world of "Can Farming Losses Be Offset Against Income," exploring the benefits of them, where to find them and how they can add value to various aspects of your daily life.

Get Latest Can Farming Losses Be Offset Against Income Below

Can Farming Losses Be Offset Against Income

Can Farming Losses Be Offset Against Income -

The ability to offset trading losses from farming activities against other taxable income earned in either the same or preceding tax year can be a valuable relief particularly as farmers become more

The five year rule was introduced in 1967 specifically to prevent hobby farmers claiming to be farming and offsetting the losses against their other income thus generating a tax saving The theory

Can Farming Losses Be Offset Against Income provide a diverse range of printable, free material that is available online at no cost. These materials come in a variety of styles, from worksheets to coloring pages, templates and more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Can Farming Losses Be Offset Against Income

How Hemp Farming Losses Are Different Than Others Southwest Adjusters

How Hemp Farming Losses Are Different Than Others Southwest Adjusters

Passive activity loss rules are a set of tax regulations that prohibit taxpayers from using passive losses to offset earned or ordinary income The regulations prevent

The loss is set off against that self employment income Clearly if total income loss self employment income you end up using the entire loss for income

Can Farming Losses Be Offset Against Income have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: You can tailor printables to fit your particular needs such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Use: Education-related printables at no charge offer a wide range of educational content for learners of all ages, making these printables a powerful tool for teachers and parents.

-

The convenience of Fast access a plethora of designs and templates reduces time and effort.

Where to Find more Can Farming Losses Be Offset Against Income

SARS ADR1 FORM

SARS ADR1 FORM

First losses can only offset 80 of taxable income regardless of whether carried back or forward This means that it is no longer possible to completely eliminate

Once an s83 loss relief claim has been made the carried forward loss must be set off against the next available trading income Deadlines for making the claims S64 claims

Since we've got your interest in printables for free and other printables, let's discover where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Can Farming Losses Be Offset Against Income designed for a variety motives.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Can Farming Losses Be Offset Against Income

Here are some fresh ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Can Farming Losses Be Offset Against Income are an abundance of practical and innovative resources designed to meet a range of needs and preferences. Their availability and versatility make these printables a useful addition to each day life. Explore the world of Can Farming Losses Be Offset Against Income today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes, they are! You can download and print the resources for free.

-

Does it allow me to use free printables for commercial use?

- It's based on specific usage guidelines. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright violations with Can Farming Losses Be Offset Against Income?

- Some printables may contain restrictions on their use. Be sure to read the terms and conditions offered by the designer.

-

How do I print printables for free?

- You can print them at home with printing equipment or visit a print shop in your area for more high-quality prints.

-

What software do I require to view printables free of charge?

- The majority of printed documents are with PDF formats, which can be opened using free software such as Adobe Reader.

COVID 19 Chhattisgarh Villagers Turn To Mahua Collection To Offset

Yield Farming Update 1000 APY Still In Loss Why Yield Farming

Check more sample of Can Farming Losses Be Offset Against Income below

Set Off And Carry Forward Of Losses Rules Restrictions

Executive Income Protection Aviva Ireland

Things To Be Noted Before Filing Your Tax Returns Mint

Farming Losses Resulting Battles With The IRS AEGIS LAW

India Farmers Commit Suicide Over Crops Destroyed By Spring Rain

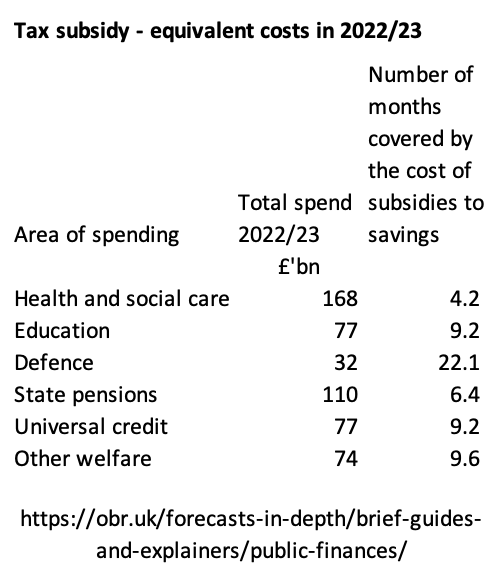

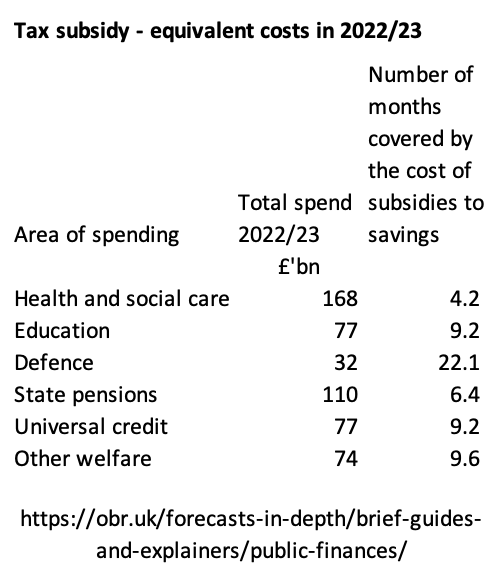

The Wealthiest 10 In The UK Get At Least 30bn A Year In Subsidies For

https://www.taxadvisermagazine.com/art…

The five year rule was introduced in 1967 specifically to prevent hobby farmers claiming to be farming and offsetting the losses against their other income thus generating a tax saving The theory

https://www.gov.uk/.../business-income-manual/bim85625

13 rowsBIM85625 Farming losses operation of five year rule S67 S70 Income Tax

The five year rule was introduced in 1967 specifically to prevent hobby farmers claiming to be farming and offsetting the losses against their other income thus generating a tax saving The theory

13 rowsBIM85625 Farming losses operation of five year rule S67 S70 Income Tax

Farming Losses Resulting Battles With The IRS AEGIS LAW

Executive Income Protection Aviva Ireland

India Farmers Commit Suicide Over Crops Destroyed By Spring Rain

The Wealthiest 10 In The UK Get At Least 30bn A Year In Subsidies For

Germany s FLNG Terminal Budget Triples Rigzone

Nischal Shardeum On Twitter Looks To Be Something New That Has

Nischal Shardeum On Twitter Looks To Be Something New That Has

When Did Laura Almanzo And Rose Move To Mansfield Missouri The