Today, where screens have become the dominant feature of our lives and the appeal of physical printed materials isn't diminishing. In the case of educational materials project ideas, artistic or simply adding an extra personal touch to your home, printables for free are now a vital source. This article will dive into the world of "Can I Claim Child Care Credit If Married Filing Separately," exploring their purpose, where they can be found, and how they can enhance various aspects of your lives.

Get Latest Can I Claim Child Care Credit If Married Filing Separately Below

Can I Claim Child Care Credit If Married Filing Separately

Can I Claim Child Care Credit If Married Filing Separately -

If you re married but not filing jointly with your spouse you can claim the credit if You paid more than half the cost of maintaining a household for the year Both you and the qualifying person must have used the home as your main

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to

Printables for free include a vast array of printable material that is available online at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and many more. The benefit of Can I Claim Child Care Credit If Married Filing Separately is in their variety and accessibility.

More of Can I Claim Child Care Credit If Married Filing Separately

Can I Claim Child Care Expenses On My Tax Return

Can I Claim Child Care Expenses On My Tax Return

Generally to claim the credit as a married couple you must file married filing jointly However the primary custodial parent may claim the credit if the couple is legally separated

Learn how to claim the credit for child and dependent care expenses on your 2021 tax return Find out who qualifies as a dependent what expenses are eligible and how to complete Form

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Modifications: This allows you to modify printables to fit your particular needs for invitations, whether that's creating them making your schedule, or even decorating your home.

-

Education Value Free educational printables cater to learners from all ages, making them a vital tool for parents and educators.

-

An easy way to access HTML0: Access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Can I Claim Child Care Credit If Married Filing Separately

CYC Ministries Frequently Asked Questions

CYC Ministries Frequently Asked Questions

If you re married filing separately the child tax credit amount qualify for is reduced from what you would receive if you had filed jointly Couples that are married filing separately receive a reduced credit that is equal to half of the

A It has nothing to do with claiming children If you are married you may only file as Married Filing jointly MFJ or Married Filing Separately MFS You may not use Single

Since we've got your curiosity about Can I Claim Child Care Credit If Married Filing Separately, let's explore where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection in Can I Claim Child Care Credit If Married Filing Separately for different needs.

- Explore categories like home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs are a vast range of interests, that range from DIY projects to party planning.

Maximizing Can I Claim Child Care Credit If Married Filing Separately

Here are some new ways how you could make the most of Can I Claim Child Care Credit If Married Filing Separately:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print worksheets that are free to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Can I Claim Child Care Credit If Married Filing Separately are an abundance of innovative and useful resources for a variety of needs and hobbies. Their accessibility and flexibility make them an essential part of both professional and personal life. Explore the endless world that is Can I Claim Child Care Credit If Married Filing Separately today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes, they are! You can print and download these items for free.

-

Can I download free printables for commercial use?

- It's based on the usage guidelines. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Can I Claim Child Care Credit If Married Filing Separately?

- Certain printables might have limitations regarding their use. Be sure to review the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with your printer or visit a print shop in your area for better quality prints.

-

What program do I need in order to open printables free of charge?

- The majority of PDF documents are provided in the format PDF. This is open with no cost software like Adobe Reader.

Can I Refile If Married Filing Separately JacAnswers

Should I Pay My Old Daycare Provider Or Let Her Take Me To Court

Check more sample of Can I Claim Child Care Credit If Married Filing Separately below

How To Claim Child Benefit In 2022

Wow Married Filing Separately May Be The Tax Year 2020 Strategy

What Is Child Care Expenses March 2023 Smartstartga

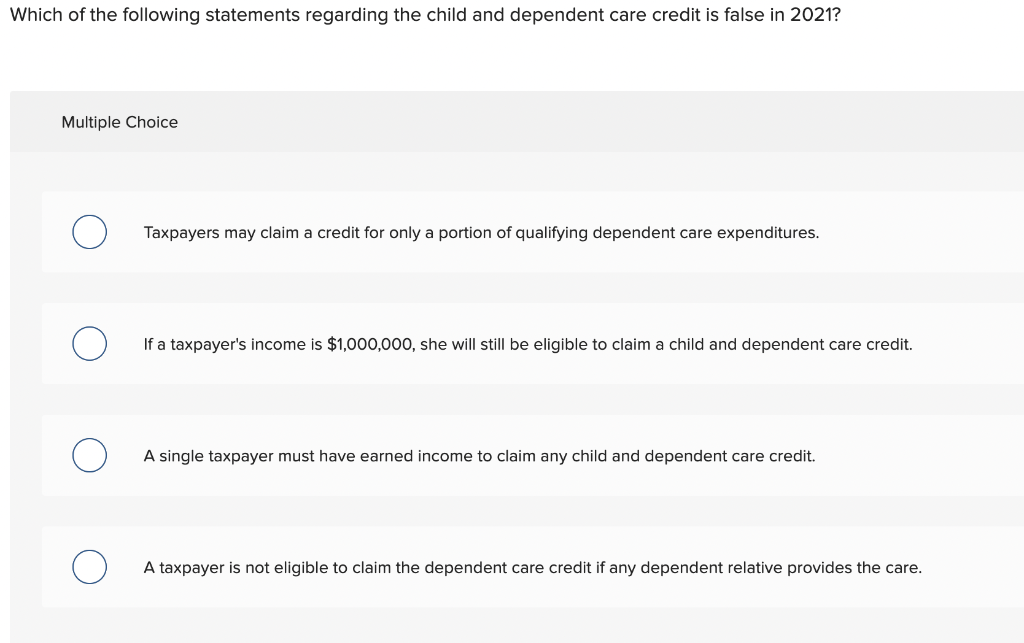

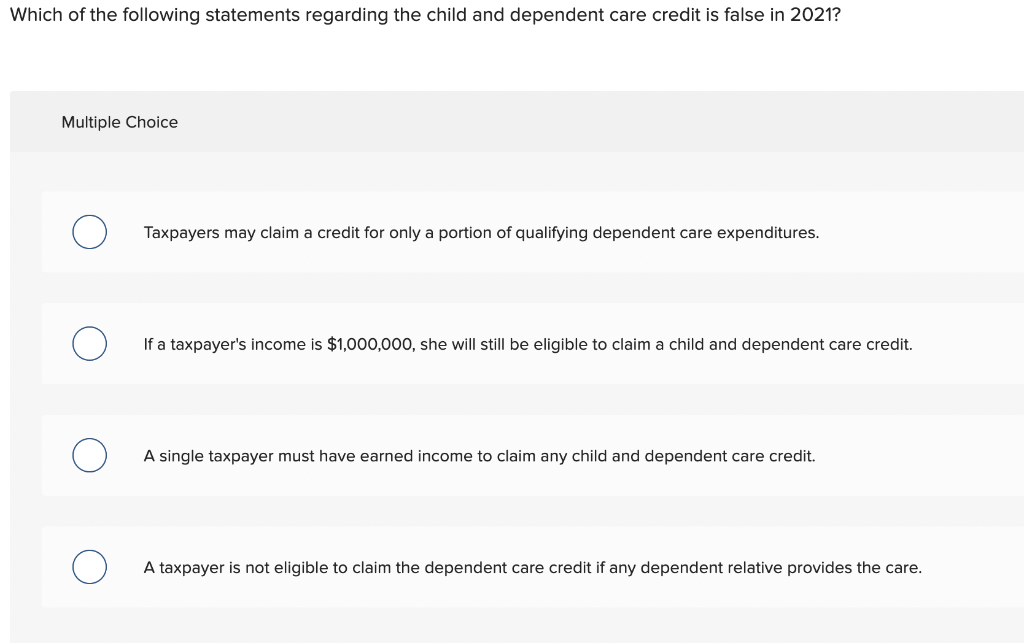

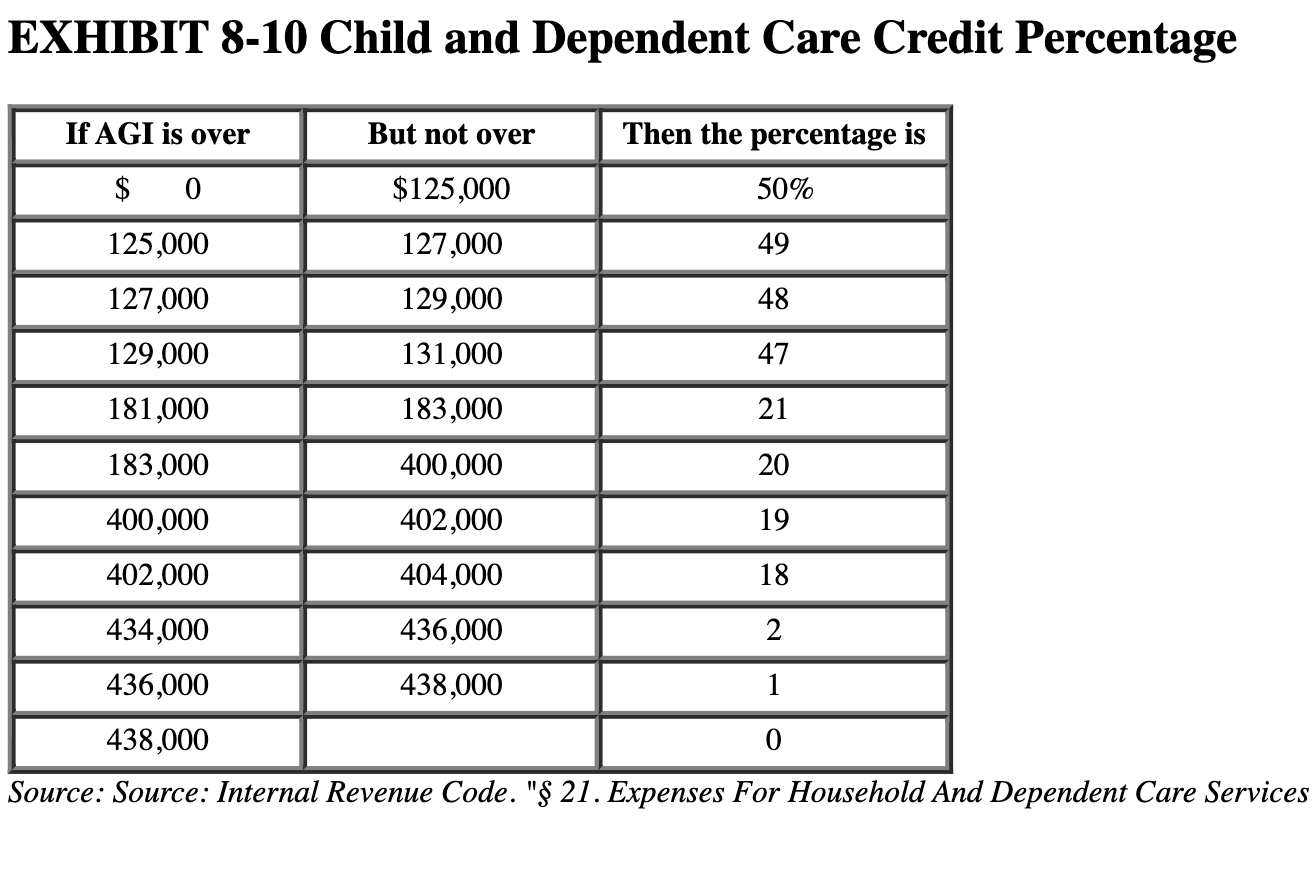

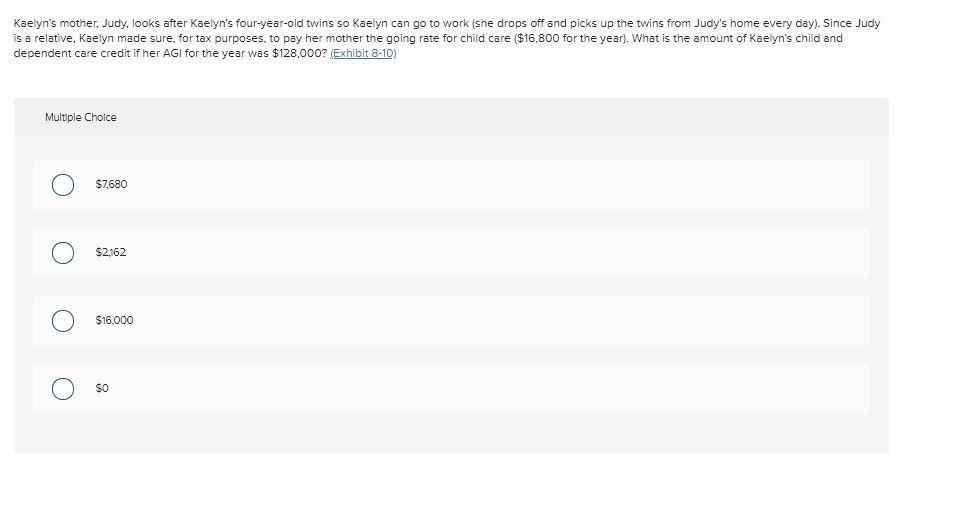

Solved EXHIBIT 8 10 Child And Dependent Care Credit Chegg

Can I Claim Child Tax Credit If Married Filing Separately YouTube

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

https://ttlc.intuit.com › community › taxes › discussion › ...

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to

https://www.irs.gov › instructions

Learn how to claim the credit for child and dependent care expenses or exclude dependent care benefits from your income in 2023 Find out who is a qualifying person what

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to

Learn how to claim the credit for child and dependent care expenses or exclude dependent care benefits from your income in 2023 Find out who is a qualifying person what

Solved EXHIBIT 8 10 Child And Dependent Care Credit Chegg

Wow Married Filing Separately May Be The Tax Year 2020 Strategy

Can I Claim Child Tax Credit If Married Filing Separately YouTube

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Solved Kaelyn s Mother Judy Looks After Kaelyn s Chegg

State Withholding Tax Form 2023 Printable Forms Free Online

State Withholding Tax Form 2023 Printable Forms Free Online

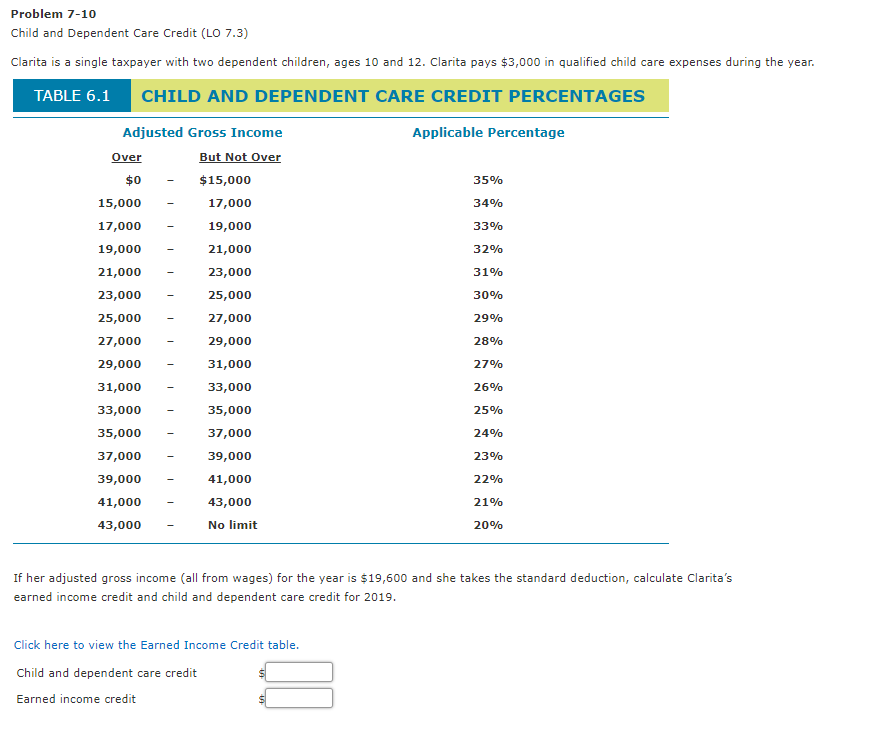

Solved Problem 7 10 Child And Dependent Care Credit LO 7 3 Chegg