In this digital age, where screens dominate our lives and the appeal of physical printed items hasn't gone away. For educational purposes such as creative projects or just adding personal touches to your area, Can I Claim Cpa Membership Fees On Tax Return can be an excellent resource. For this piece, we'll take a dive through the vast world of "Can I Claim Cpa Membership Fees On Tax Return," exploring what they are, how they can be found, and how they can enhance various aspects of your lives.

Get Latest Can I Claim Cpa Membership Fees On Tax Return Below

Can I Claim Cpa Membership Fees On Tax Return

Can I Claim Cpa Membership Fees On Tax Return -

The Internal Revenue Service allows you to deduct any dues that are required by your profession such as bar dues or membership fees to a professional or trade organization from your

For the industry you work in you can claim a deduction for union fees subscriptions to trade business or professional associations payment of a bargaining agent s fee to a union for negotiations on a new enterprise agreement or award with your existing employer

Printables for free cover a broad assortment of printable resources available online for download at no cost. These resources come in many styles, from worksheets to coloring pages, templates and many more. The attraction of printables that are free is in their variety and accessibility.

More of Can I Claim Cpa Membership Fees On Tax Return

What Can I Claim For Leech Co

What Can I Claim For Leech Co

You can claim a deduction for the cost of renewing an annual practising certificate membership or accreditation if you need it to work in your field These include trade licences for plumbers electricians and carpenters crane hoist and scaffolding licences for construction workers

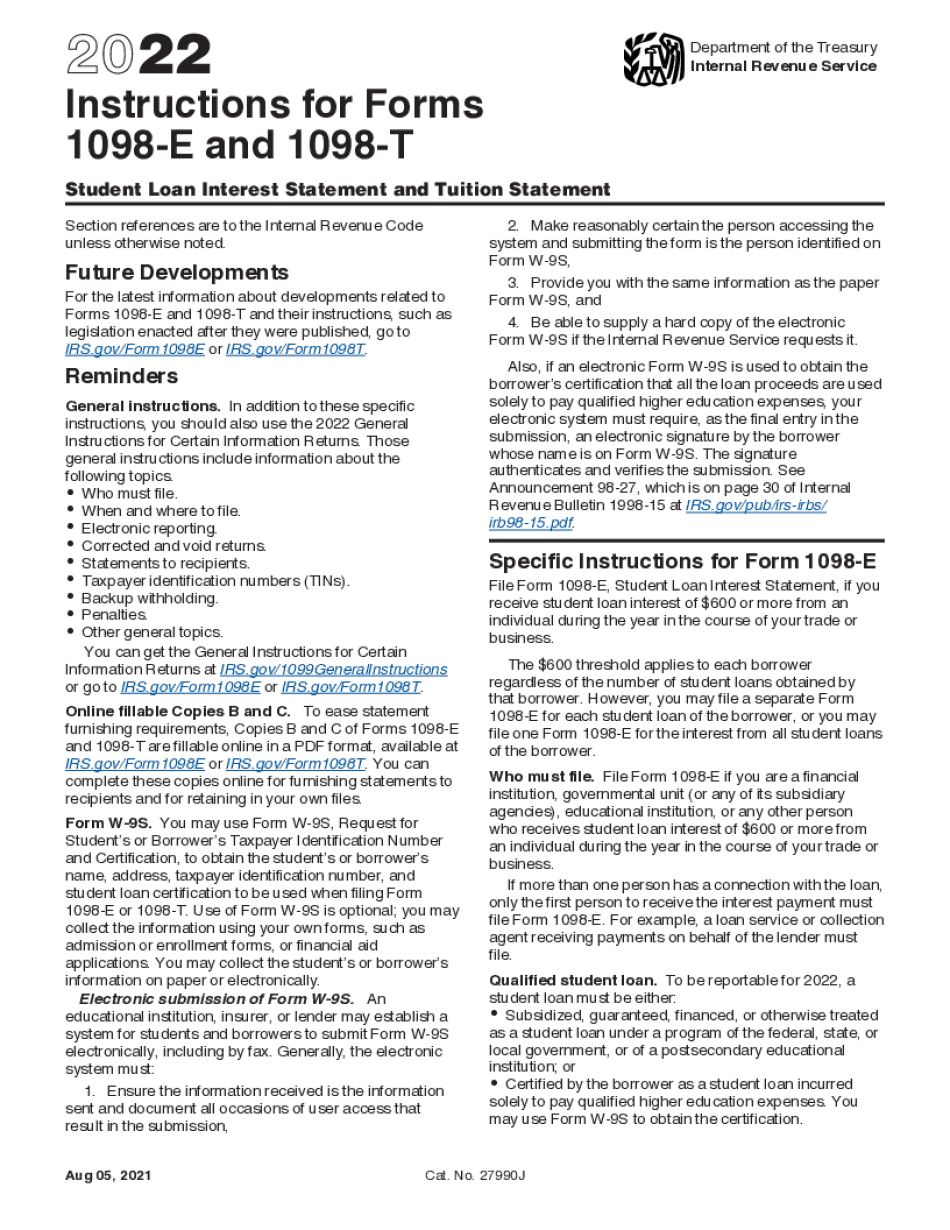

Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be deducted These fees include the cost of tax preparation software programs and tax publications

Can I Claim Cpa Membership Fees On Tax Return have risen to immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Modifications: They can make printables to fit your particular needs whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Education-related printables at no charge are designed to appeal to students of all ages, making them a vital resource for educators and parents.

-

Easy to use: You have instant access a variety of designs and templates, which saves time as well as effort.

Where to Find more Can I Claim Cpa Membership Fees On Tax Return

Can You Claim Franchise Fees On Tax How To Read Stock Charts For

Can You Claim Franchise Fees On Tax How To Read Stock Charts For

Yes she should be able to claim those fees if they are required Therefore I believe the membership fees would not count Not sure how far you can go back the wording is vague and says Claim the total of the following amounts related to your employment that you paid or

Employment related professional association dues or fees are allowable as tax deductions if they meet the guidelines established by the IRS Internal Revenue Service You must know how the dues will be utilized by the association to calculate what portion of the dues can be a tax

We hope we've stimulated your curiosity about Can I Claim Cpa Membership Fees On Tax Return we'll explore the places you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of motives.

- Explore categories like design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs are a vast range of topics, everything from DIY projects to party planning.

Maximizing Can I Claim Cpa Membership Fees On Tax Return

Here are some innovative ways to make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Can I Claim Cpa Membership Fees On Tax Return are a treasure trove of practical and innovative resources which cater to a wide range of needs and interests. Their accessibility and flexibility make them a great addition to both personal and professional life. Explore the many options of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can print and download these files for free.

-

Do I have the right to use free templates for commercial use?

- It depends on the specific rules of usage. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in Can I Claim Cpa Membership Fees On Tax Return?

- Some printables may contain restrictions on usage. Be sure to check the conditions and terms of use provided by the designer.

-

How can I print Can I Claim Cpa Membership Fees On Tax Return?

- Print them at home using either a printer at home or in a local print shop to purchase high-quality prints.

-

What software do I require to open Can I Claim Cpa Membership Fees On Tax Return?

- The majority of printed documents are in the format PDF. This is open with no cost software, such as Adobe Reader.

What Travel Costs Can I Claim As A Business Expense When I Travel Full

Learn How CPA Firm Will Increase Their Profits On Individual Tax

Check more sample of Can I Claim Cpa Membership Fees On Tax Return below

CPA Bermuda To Expand Membership

Can I Claim A Tax Deduction For My Gym Membership Juggernaut Advisory

Job Portal Savage Search Associates

Where To Put 1098 T On Tax Return H r Block Fill Online Printable

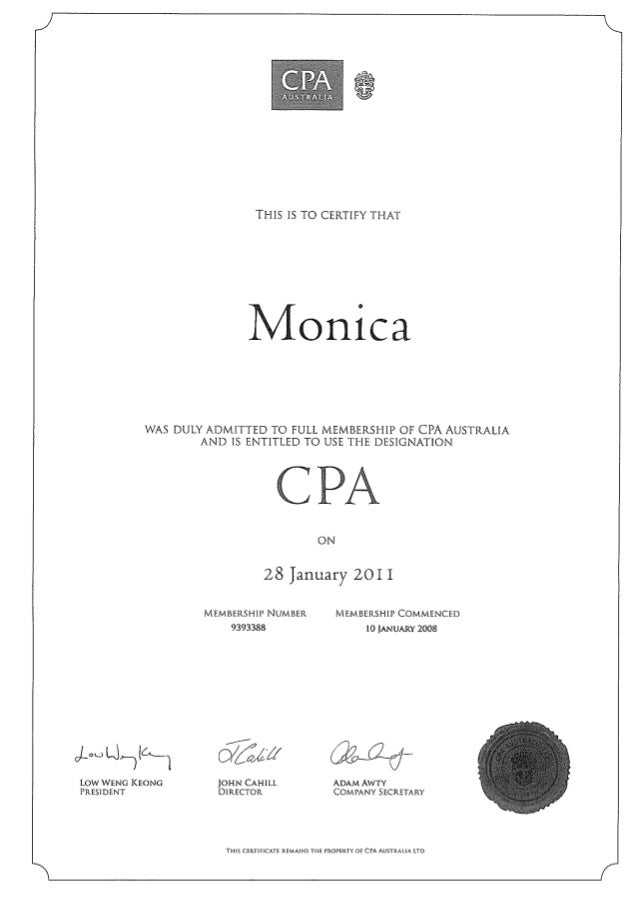

CPA Membership

Claiming Self Education Expenses On Your 2021 Tax Return Auditax

https://www.ato.gov.au/individuals-and-families/...

For the industry you work in you can claim a deduction for union fees subscriptions to trade business or professional associations payment of a bargaining agent s fee to a union for negotiations on a new enterprise agreement or award with your existing employer

https://www.canada.ca/en/revenue-agency/services/...

Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employment annual dues for membership in a trade union or an association of public servants professional board dues required under provincial or

For the industry you work in you can claim a deduction for union fees subscriptions to trade business or professional associations payment of a bargaining agent s fee to a union for negotiations on a new enterprise agreement or award with your existing employer

Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your employment annual dues for membership in a trade union or an association of public servants professional board dues required under provincial or

Where To Put 1098 T On Tax Return H r Block Fill Online Printable

Can I Claim A Tax Deduction For My Gym Membership Juggernaut Advisory

CPA Membership

Claiming Self Education Expenses On Your 2021 Tax Return Auditax

Donations And Membership Fees Form Tax Return Stock Photo Alamy

Calam o Claim Max COVID Rebates Risk Free 2023 Best ERC CPA Firm

Calam o Claim Max COVID Rebates Risk Free 2023 Best ERC CPA Firm

Can You Claim Hoa Fees On Taxes