In the digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education, creative projects, or simply to add the personal touch to your area, Can I Do My Own Family Trust Tax Return have become a valuable resource. Through this post, we'll take a dive deeper into "Can I Do My Own Family Trust Tax Return," exploring the benefits of them, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Can I Do My Own Family Trust Tax Return Below

Can I Do My Own Family Trust Tax Return

Can I Do My Own Family Trust Tax Return -

The usual deductions a simple or complex trust can claim on its tax return are for state tax paid trustee fees tax return preparer fees and the income distribution deduction Because a grantor trust is not

Living trusts have to file tax returns in most cases if they have 600 or more in income for a given tax year They may also have to file if the living trust is a grantor controlled trust or a revocable marital

The Can I Do My Own Family Trust Tax Return are a huge collection of printable documents that can be downloaded online at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and many more. The benefit of Can I Do My Own Family Trust Tax Return lies in their versatility and accessibility.

More of Can I Do My Own Family Trust Tax Return

How To Set Up A Family Trust 2022 Update

How To Set Up A Family Trust 2022 Update

You can send this tax return online instead of downloading the form you ll need to buy software for trust and estate Self Assessment tax returns to do this Find

General information for trusts Information to support your trust tax return lodgment administration and record keeping requirements Use these instructions to help you

The Can I Do My Own Family Trust Tax Return have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

customization: The Customization feature lets you tailor print-ready templates to your specific requirements whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them a useful aid for parents as well as educators.

-

Affordability: Access to numerous designs and templates saves time and effort.

Where to Find more Can I Do My Own Family Trust Tax Return

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

In some cases if the trust distributes all of its income to beneficiaries and does not retain any income it may not be required to file a tax return However the

You are correct You can lodge the return yourself if you are the trustee or director of the corporate trustee You can check out the trust return instructions for more information on

We've now piqued your curiosity about Can I Do My Own Family Trust Tax Return Let's find out where you can find these treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Can I Do My Own Family Trust Tax Return for a variety objectives.

- Explore categories such as decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free including flashcards, learning materials.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs covered cover a wide spectrum of interests, ranging from DIY projects to planning a party.

Maximizing Can I Do My Own Family Trust Tax Return

Here are some ways to make the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print out free worksheets and activities to enhance your learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Can I Do My Own Family Trust Tax Return are a treasure trove of useful and creative resources that can meet the needs of a variety of people and needs and. Their accessibility and flexibility make these printables a useful addition to each day life. Explore the endless world of Can I Do My Own Family Trust Tax Return today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can download and print these items for free.

-

Can I use free printables for commercial purposes?

- It's all dependent on the usage guidelines. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in Can I Do My Own Family Trust Tax Return?

- Certain printables might have limitations on use. Always read the terms and regulations provided by the designer.

-

How do I print Can I Do My Own Family Trust Tax Return?

- Print them at home using either a printer at home or in an in-store print shop to get better quality prints.

-

What software do I need to open printables free of charge?

- The majority of printed documents are with PDF formats, which can be opened using free software, such as Adobe Reader.

New Family Trust Tax Rules Will The Changes Impact You Invigor8

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Check more sample of Can I Do My Own Family Trust Tax Return below

New Family Trust Tax Rules Will The Changes Impact You Fiskl Advisory

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

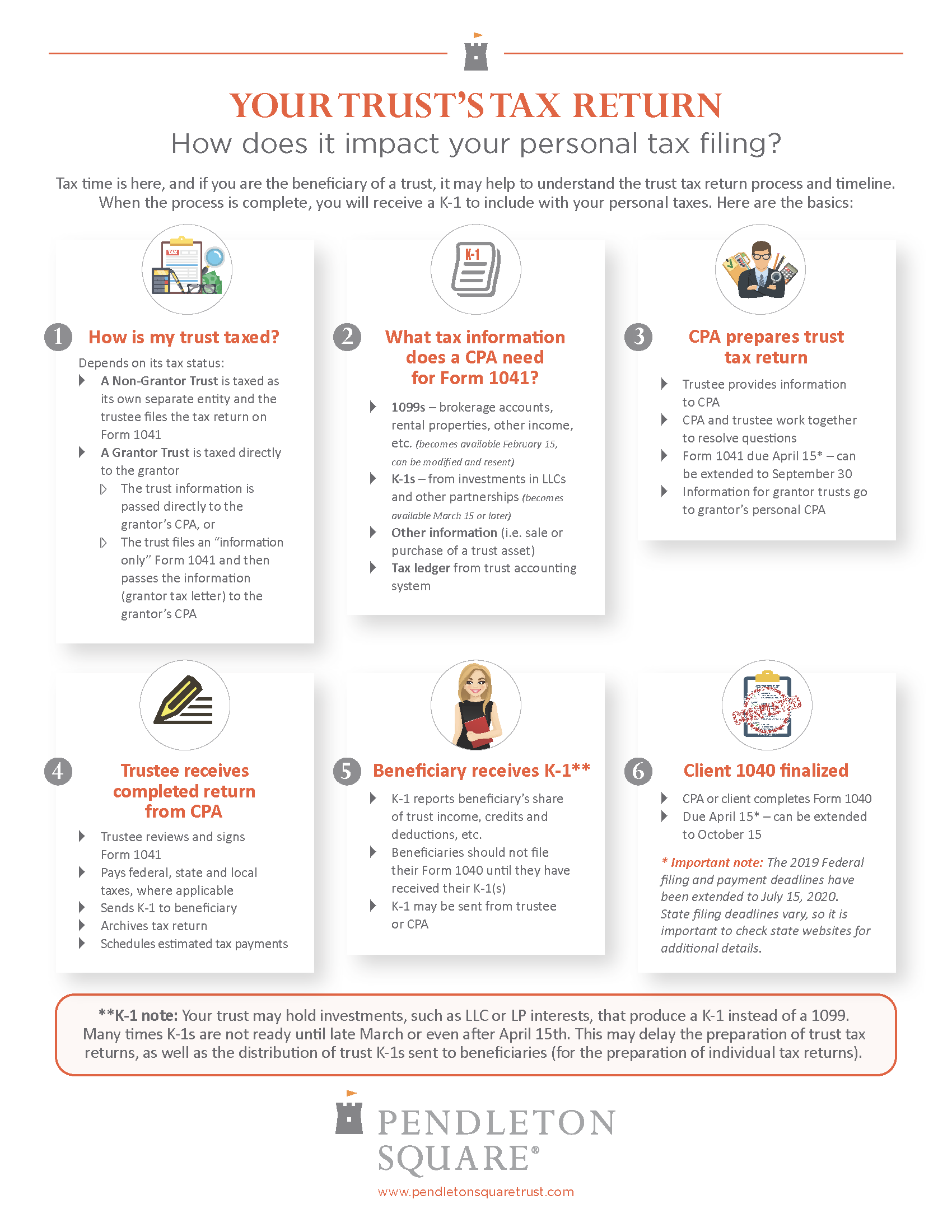

A PRIMER ON TRUST TAX RETURNS Pendleton Square Trust

2014 Trust Tax Return Checklist

Trust Tax Return Sydney Tax Agent

Estate Trust Tax Return Tips For The Clients FTGC

https://smartasset.com/estate-planning/does-a...

Living trusts have to file tax returns in most cases if they have 600 or more in income for a given tax year They may also have to file if the living trust is a grantor controlled trust or a revocable marital

https://www.ato.gov.au/.../trusts/trusts-registering-and-reporting-for-tax

A trust should have its own tax file number TFN which the trustee uses in lodging income tax returns for the trust A trust is also entitled to an Australian business

Living trusts have to file tax returns in most cases if they have 600 or more in income for a given tax year They may also have to file if the living trust is a grantor controlled trust or a revocable marital

A trust should have its own tax file number TFN which the trustee uses in lodging income tax returns for the trust A trust is also entitled to an Australian business

2014 Trust Tax Return Checklist

Family Trust Tax Changes Are Coming Beyond Advisors CFO Service

Trust Tax Return Sydney Tax Agent

Estate Trust Tax Return Tips For The Clients FTGC

Family Trusts 2020 Trust Tax Returns Wealth Accountants Gold Coast

Trust Tax Returns Adelaide Nextgen Accounts Family Unit

Trust Tax Returns Adelaide Nextgen Accounts Family Unit

The Family Trust Tax Rate Explained Set Ups Benefits 2022