In this age of electronic devices, where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. In the case of educational materials such as creative projects or simply to add an individual touch to the area, Can I Get A Tax Credit For Working From Home are a great resource. This article will take a dive through the vast world of "Can I Get A Tax Credit For Working From Home," exploring their purpose, where to locate them, and how they can improve various aspects of your lives.

Get Latest Can I Get A Tax Credit For Working From Home Below

Can I Get A Tax Credit For Working From Home

Can I Get A Tax Credit For Working From Home -

Form T777S for 2020 2021 and 2022 only Use Option 2 Detailed method on Form T777S to claim your home office expenses if you are claiming the actual amount paid as a result of working from home and are not claiming any other employment expenses on line 22900 filing a 2020 2021 or 2022 tax year return Steps Confirm you

You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time you work from home because of

Can I Get A Tax Credit For Working From Home include a broad assortment of printable, downloadable resources available online for download at no cost. They come in many kinds, including worksheets templates, coloring pages and more. The value of Can I Get A Tax Credit For Working From Home is their versatility and accessibility.

More of Can I Get A Tax Credit For Working From Home

Here s Your Chance To Earn A Tax Credit For Saving Toward Retirement

Here s Your Chance To Earn A Tax Credit For Saving Toward Retirement

So who gets to take work from home tax deductions Well the IRS reserves them for self employed independent contractors In other words if you work full time as a freelancer or have a side hustle that requires an office you qualify to deduct a portion of your home s expenses

Work from home WFH tax deductions are business expenses that you can subtracted from revenue to lower your tax bill But these deductions almost exclusively apply to those who own

The Can I Get A Tax Credit For Working From Home have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization: You can tailor printed materials to meet your requirements when it comes to designing invitations making your schedule, or even decorating your home.

-

Educational Worth: Downloads of educational content for free cater to learners of all ages, making them an essential source for educators and parents.

-

Affordability: Fast access many designs and templates can save you time and energy.

Where to Find more Can I Get A Tax Credit For Working From Home

Enterprise Value Check Your Credit Score Ev Charging Stations Tax

Enterprise Value Check Your Credit Score Ev Charging Stations Tax

Eligible employees who worked from home in 2023 will be required to use the detailed method to claim home office expenses The temporary flat rate method does not apply to the 2023 tax year Who can claim Date modified 2024 02 02 How work from home expense calculations have been updated for the 2022 tax year

Currently W 2 employees can t deduct home office expenses but independent contractors or anyone who is self employed can deduct the costs of having a dedicated workspace at home Taxes can be

Now that we've piqued your curiosity about Can I Get A Tax Credit For Working From Home Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Can I Get A Tax Credit For Working From Home suitable for many applications.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free with flashcards and other teaching tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide range of interests, including DIY projects to planning a party.

Maximizing Can I Get A Tax Credit For Working From Home

Here are some fresh ways create the maximum value use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free for teaching at-home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Can I Get A Tax Credit For Working From Home are an abundance of creative and practical resources that cater to various needs and passions. Their accessibility and flexibility make them a fantastic addition to any professional or personal life. Explore the plethora that is Can I Get A Tax Credit For Working From Home today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can print and download these materials for free.

-

Are there any free printables for commercial uses?

- It's all dependent on the terms of use. Always check the creator's guidelines before using their printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables might have limitations regarding their use. You should read the terms of service and conditions provided by the designer.

-

How can I print Can I Get A Tax Credit For Working From Home?

- You can print them at home using a printer or visit a local print shop for superior prints.

-

What program do I require to view Can I Get A Tax Credit For Working From Home?

- The majority are printed in PDF format. These can be opened using free software, such as Adobe Reader.

Electric Cars In Illinois OsVehicle

What Does The EV Tax Credit Overhaul Mean For Car Shoppers Cars

Check more sample of Can I Get A Tax Credit For Working From Home below

All You Need To Know About Electric Vehicle Tax Credits CarGurus

Claiming Tax Relief For Working From Home Backhouse Solicitors

BMW Electric Plug in Hybrid Vehicle Tax Credit Update For 2023

Federal Tax Credit For Electric Cars FAQ Wesley Chapel Honda

Where Can I See What Health Insurance Plans Are Available To Me Will I

Explained The Updated EV Tax Credit Rules Elektriken

https://www.gov.uk/tax-relief-for-employees/working-at-home

You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time you work from home because of

https://smartasset.com/taxes/work-from-home-tax-deductions

Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only be written off if they exceed 2 of adjustable gross income

You cannot claim tax relief if you choose to work from home This includes if your employment contract lets you work from home some or all of the time you work from home because of

Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions Also work from home expenses can only be written off if they exceed 2 of adjustable gross income

Federal Tax Credit For Electric Cars FAQ Wesley Chapel Honda

Claiming Tax Relief For Working From Home Backhouse Solicitors

Where Can I See What Health Insurance Plans Are Available To Me Will I

Explained The Updated EV Tax Credit Rules Elektriken

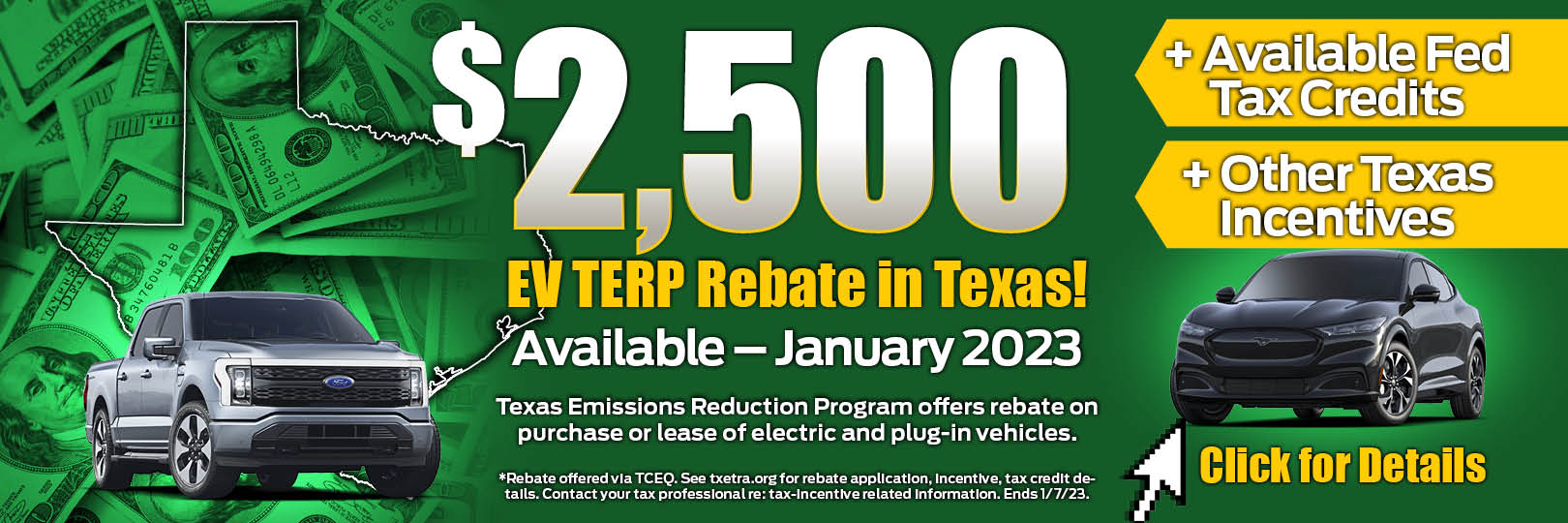

Planet Ford EV Plug in Hybrid Vehicle Rebate Program Randall Reed s

Kentucky Farmers Get A Tax Credit When They Give Produce To A Food Bank

Kentucky Farmers Get A Tax Credit When They Give Produce To A Food Bank

Ato Tax Declaration Form Printable Printable Forms Free Online