In this age of technology, in which screens are the norm and the appeal of physical printed objects isn't diminished. Whatever the reason, whether for education and creative work, or simply to add a personal touch to your home, printables for free have proven to be a valuable source. We'll take a dive into the sphere of "Can I Get Income Tax Benefit On Under Construction Property," exploring what they are, where you can find them, and how they can enrich various aspects of your daily life.

Get Latest Can I Get Income Tax Benefit On Under Construction Property Below

Can I Get Income Tax Benefit On Under Construction Property

Can I Get Income Tax Benefit On Under Construction Property -

As far as tax benefits are concerned you will not get any benefit during the construction period for servicing the home loan Tax benefits for interest and loan repayments begin only from

You can get the under construction property tax benefit of Rs 1 5 Lakh per financial year on your paid home loan principal amount However you can claim this benefit only after getting possession of the property

Can I Get Income Tax Benefit On Under Construction Property include a broad array of printable items that are available online at no cost. These printables come in different designs, including worksheets templates, coloring pages, and many more. The appeal of printables for free is in their versatility and accessibility.

More of Can I Get Income Tax Benefit On Under Construction Property

Income Tax Benefit On Second Home Loan Complete Guide

Income Tax Benefit On Second Home Loan Complete Guide

You can claim tax benefits on a Home Loan under construction property up to Rs 2 Lakh under Section 24B and up to 1 5 Lakh under Section 80C of the Income Tax Act Read more here

A home loan borrower can claim Income Tax exemption on interest payments of up to Rs 2 lakh and another Rs 1 5 lakh under Section 80 C towards the principal repayment

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or costly software.

-

Flexible: You can tailor print-ready templates to your specific requirements such as designing invitations or arranging your schedule or decorating your home.

-

Educational Impact: Education-related printables at no charge provide for students from all ages, making them a vital tool for teachers and parents.

-

Easy to use: Quick access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Can I Get Income Tax Benefit On Under Construction Property

To Tables

To Tables

Say you bought an under construction property and have not moved in yet but you are paying the EMIs In this case your eligibility to claim interest on the home loan as a deduction begins only upon completion of construction or immediately if you buy a fully constructed property

Income tax filing Yes you can claim tax deduction for under construction property Here s how to do it Maintaining proof of interest payments during the construction phase is crucial for

Now that we've piqued your interest in Can I Get Income Tax Benefit On Under Construction Property, let's explore where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Can I Get Income Tax Benefit On Under Construction Property to suit a variety of uses.

- Explore categories like design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free Flashcards, worksheets, and other educational materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- These blogs cover a wide variety of topics, all the way from DIY projects to planning a party.

Maximizing Can I Get Income Tax Benefit On Under Construction Property

Here are some ideas create the maximum value of Can I Get Income Tax Benefit On Under Construction Property:

1. Home Decor

- Print and frame stunning artwork, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets for free for teaching at-home and in class.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Can I Get Income Tax Benefit On Under Construction Property are an abundance of useful and creative resources that satisfy a wide range of requirements and needs and. Their access and versatility makes them an invaluable addition to both professional and personal lives. Explore the many options of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Can I Get Income Tax Benefit On Under Construction Property truly completely free?

- Yes, they are! You can print and download these items for free.

-

Can I utilize free printables for commercial uses?

- It's based on specific terms of use. Be sure to read the rules of the creator before utilizing printables for commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may have restrictions on usage. Make sure you read the terms and conditions offered by the creator.

-

How can I print Can I Get Income Tax Benefit On Under Construction Property?

- Print them at home using any printer or head to an area print shop for superior prints.

-

What program do I need to run printables for free?

- Many printables are offered in the format PDF. This can be opened with free software like Adobe Reader.

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

BOOK KEEPING SERVICES income Tax And Individuals

Check more sample of Can I Get Income Tax Benefit On Under Construction Property below

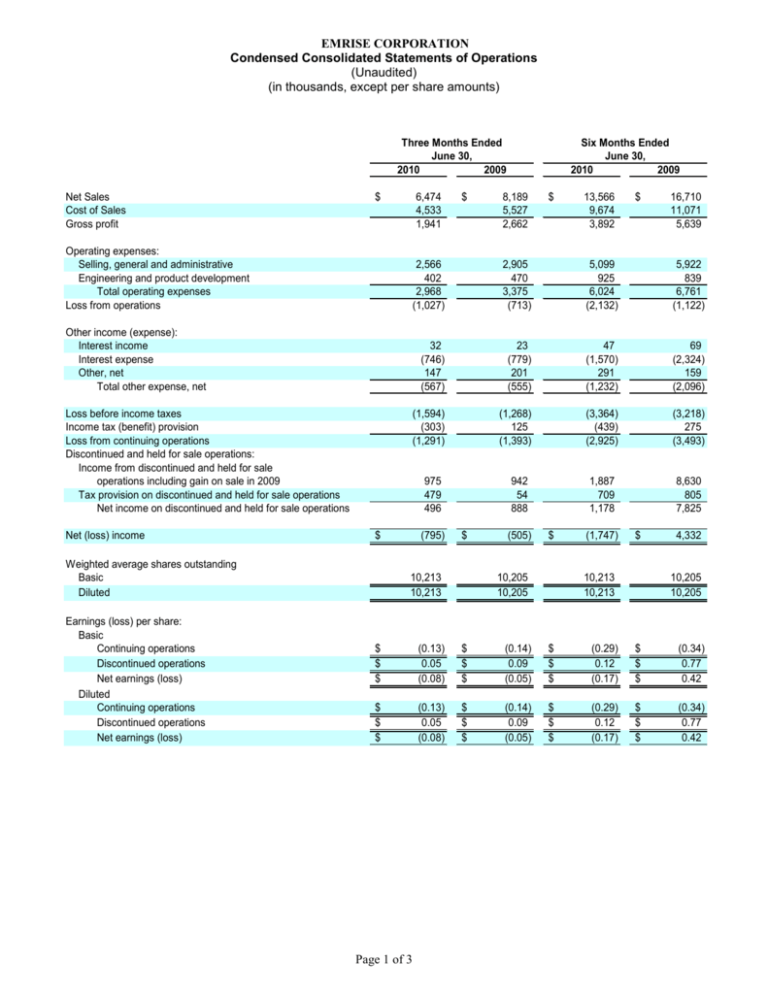

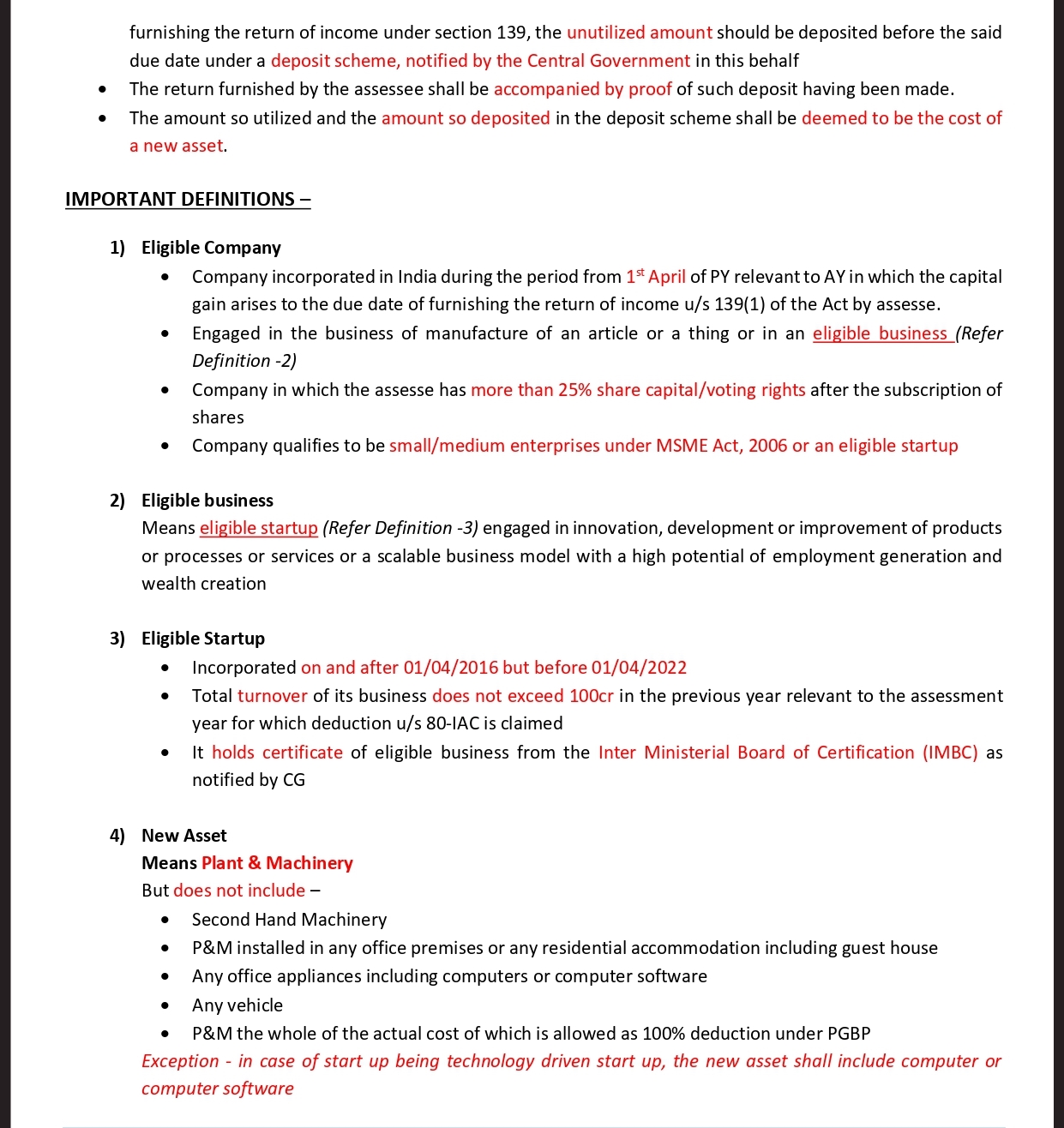

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

GST On Under Construction Property Quick Guide InstaFiling

How Is GST Calculated On Under construction Property Example Archives

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

Pin On Subjects For Reference

https://www.magicbricks.com/blog/avail-tax...

You can get the under construction property tax benefit of Rs 1 5 Lakh per financial year on your paid home loan principal amount However you can claim this benefit only after getting possession of the property

https://cleartax.in/s/case-study-deduction-for-pre-construction-interest

Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only after the construction is completed and that too over a period of 5 years

You can get the under construction property tax benefit of Rs 1 5 Lakh per financial year on your paid home loan principal amount However you can claim this benefit only after getting possession of the property

Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only after the construction is completed and that too over a period of 5 years

How Is GST Calculated On Under construction Property Example Archives

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

You Can Claim Income Tax Benefit On Interest For Home Loan Taken From

Pin On Subjects For Reference

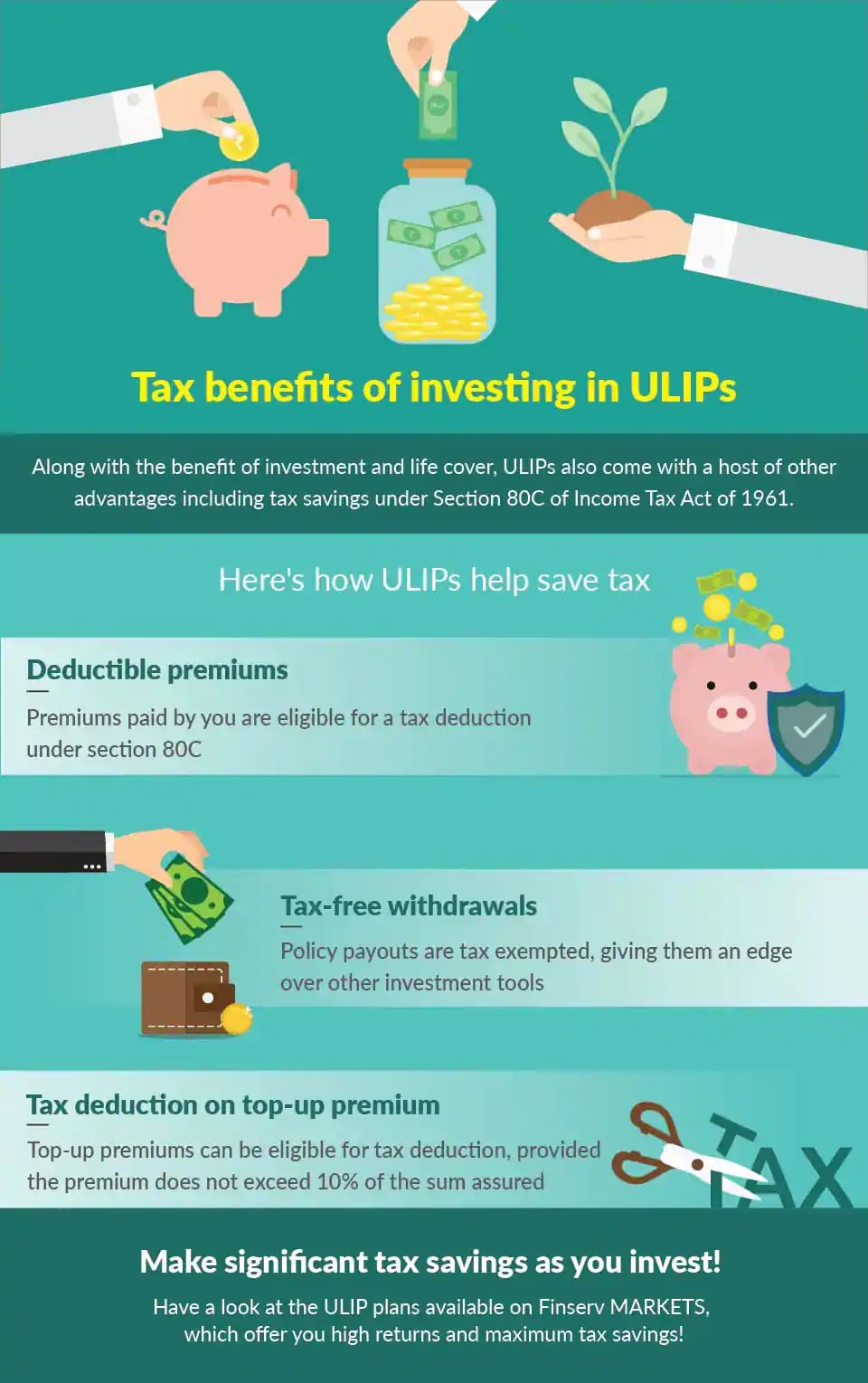

Know Everything About The Tax Benefits Of ULIPs

Home Loan Tax Benefits Calculator Excel Video FinCalC Blog

Home Loan Tax Benefits Calculator Excel Video FinCalC Blog

How To Get Tax Benefit On Under Construction Property Stroymaster