In this age of technology, with screens dominating our lives The appeal of tangible printed objects isn't diminished. In the case of educational materials project ideas, artistic or just adding a personal touch to your home, printables for free are now a useful resource. For this piece, we'll dive into the world of "Can I Take A Tax Deduction For Working From Home," exploring what they are, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Can I Take A Tax Deduction For Working From Home Below

Can I Take A Tax Deduction For Working From Home

Can I Take A Tax Deduction For Working From Home -

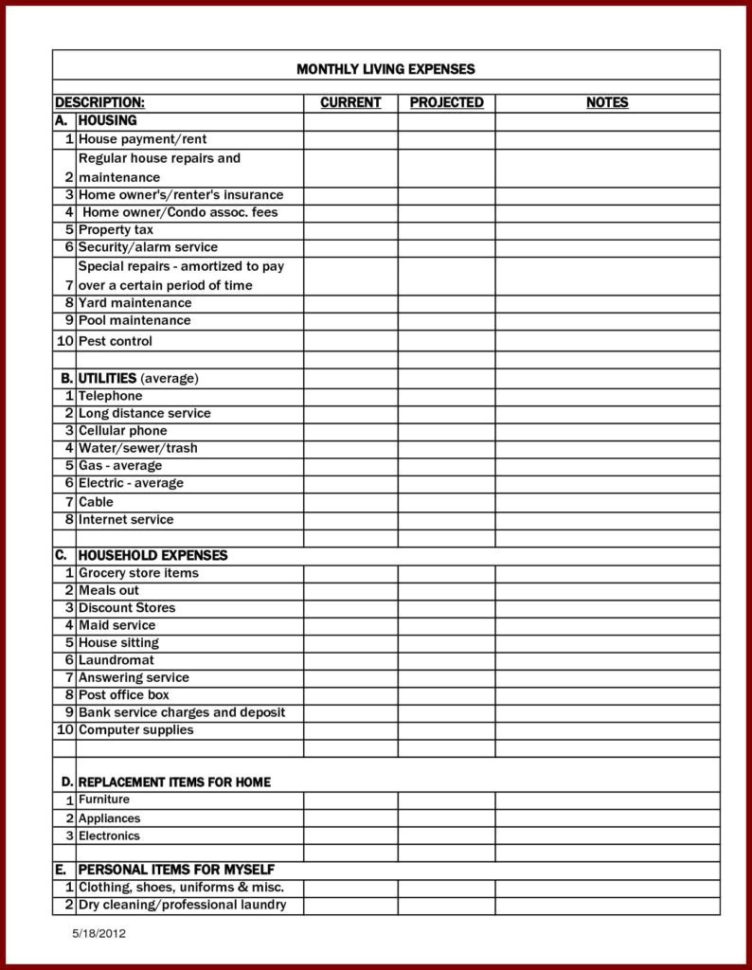

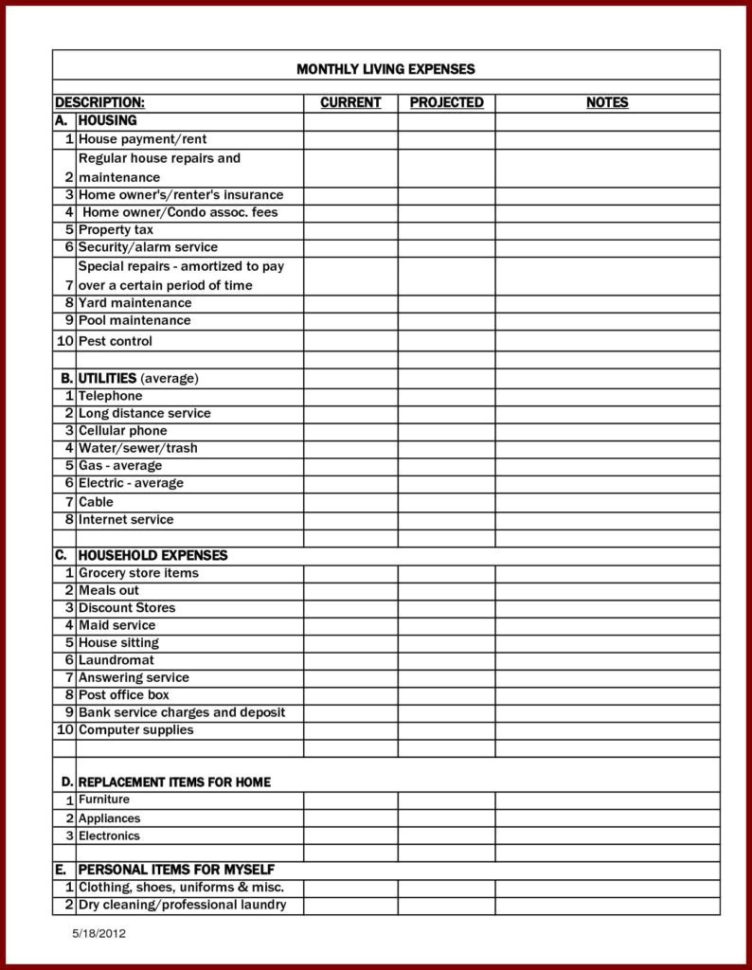

What is the home office deduction and how does it work The home office deduction may be one of the biggest work from home expenses a self employed person can take since you can take a deduction that is a portion of your home mortgage interest or rent property taxes homeowners insurance utilities and depreciation based on the

When you are a recipient of wage income you are given this deduction automatically The standard amount is 750 The amount cannot be higher than the sum of your wage income per year

Can I Take A Tax Deduction For Working From Home cover a large variety of printable, downloadable material that is available online at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and much more. The appealingness of Can I Take A Tax Deduction For Working From Home is in their variety and accessibility.

More of Can I Take A Tax Deduction For Working From Home

Home Office Tax Deduction For Small Businesses MileIQ

Home Office Tax Deduction For Small Businesses MileIQ

The home office deduction is a nice tax break but it s only available to the self employed

Can you claim work from home tax deductions If you re an employee you can claim certain job related expenses as a tax deduction but only for tax years prior to 2018 For tax year 2018 and on unreimbursed expenses and home office tax deductions are typically no longer available to employees

Can I Take A Tax Deduction For Working From Home have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Flexible: We can customize printed materials to meet your requirements when it comes to designing invitations, organizing your schedule, or even decorating your home.

-

Educational Worth: Free educational printables are designed to appeal to students of all ages, making them an invaluable source for educators and parents.

-

Simple: You have instant access the vast array of design and templates, which saves time as well as effort.

Where to Find more Can I Take A Tax Deduction For Working From Home

Working From Home Deduction Changes

Working From Home Deduction Changes

If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as mortgage interest insurance utilities repairs and depreciation for that area You need to figure out the percentage of your home devoted to your business activities utilities repairs and depreciation

Home sales If you re a homeowner and you take the home office deduction using the actual expenses method it could cancel out your ability to avoid capital gains tax on home sales People who sell

We hope we've stimulated your interest in printables for free Let's see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of purposes.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers as well as students who require additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- The blogs are a vast range of interests, that includes DIY projects to party planning.

Maximizing Can I Take A Tax Deduction For Working From Home

Here are some creative ways ensure you get the very most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Utilize free printable worksheets to enhance learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Can I Take A Tax Deduction For Working From Home are a treasure trove of creative and practical resources that satisfy a wide range of requirements and needs and. Their accessibility and versatility make they a beneficial addition to your professional and personal life. Explore the vast array of printables for free today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes you can! You can print and download these items for free.

-

Do I have the right to use free printables for commercial use?

- It's contingent upon the specific terms of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues when you download Can I Take A Tax Deduction For Working From Home?

- Some printables may have restrictions regarding usage. Make sure to read the terms and conditions offered by the author.

-

How can I print Can I Take A Tax Deduction For Working From Home?

- You can print them at home using a printer or visit the local print shop for top quality prints.

-

What program is required to open printables at no cost?

- Most printables come in the format PDF. This is open with no cost software like Adobe Reader.

13 Car Expenses Worksheet Worksheeto

Claiming Tax Relief For Working From Home Backhouse Solicitors

Check more sample of Can I Take A Tax Deduction For Working From Home below

How Americans Can Claim Up To 1 500 Tax Break For Working From Home

Can You Take A Tax Deduction For Working From Home Wallpaper

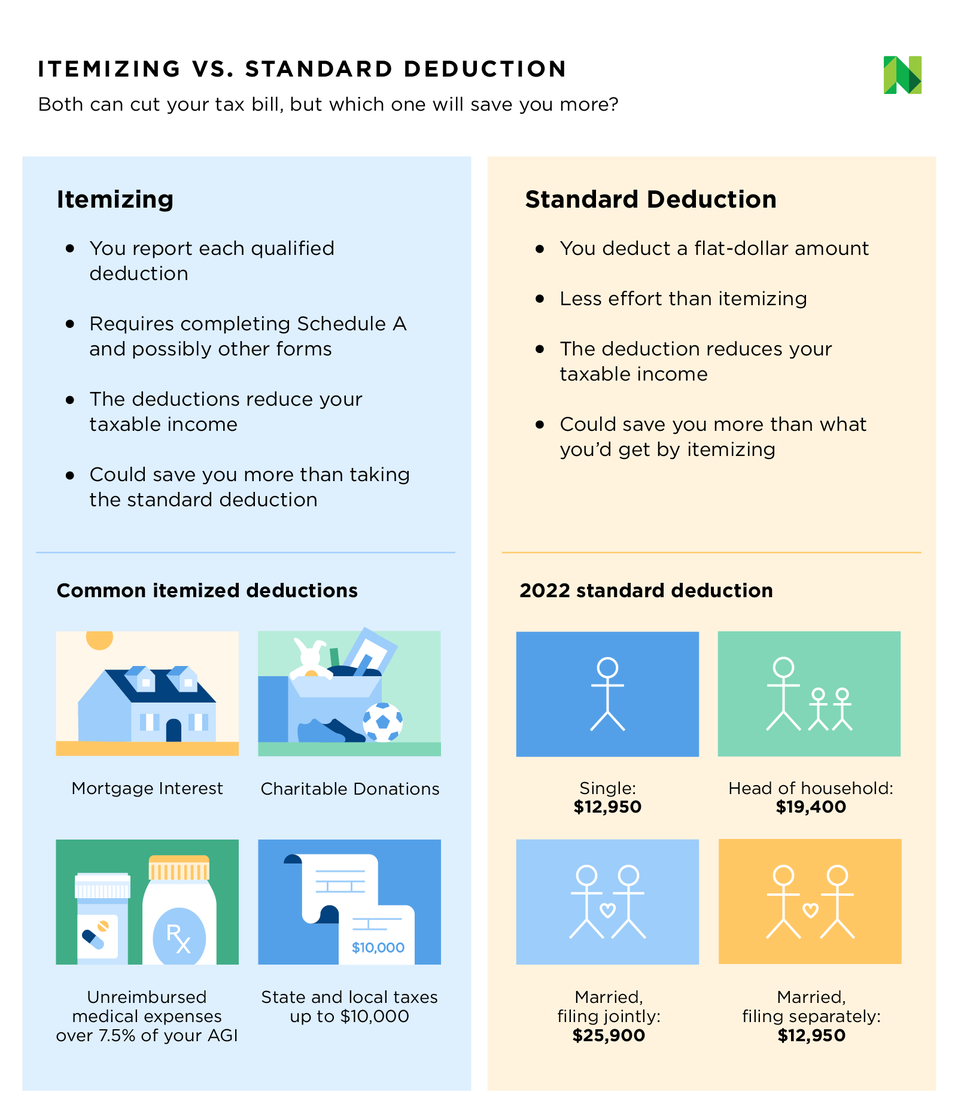

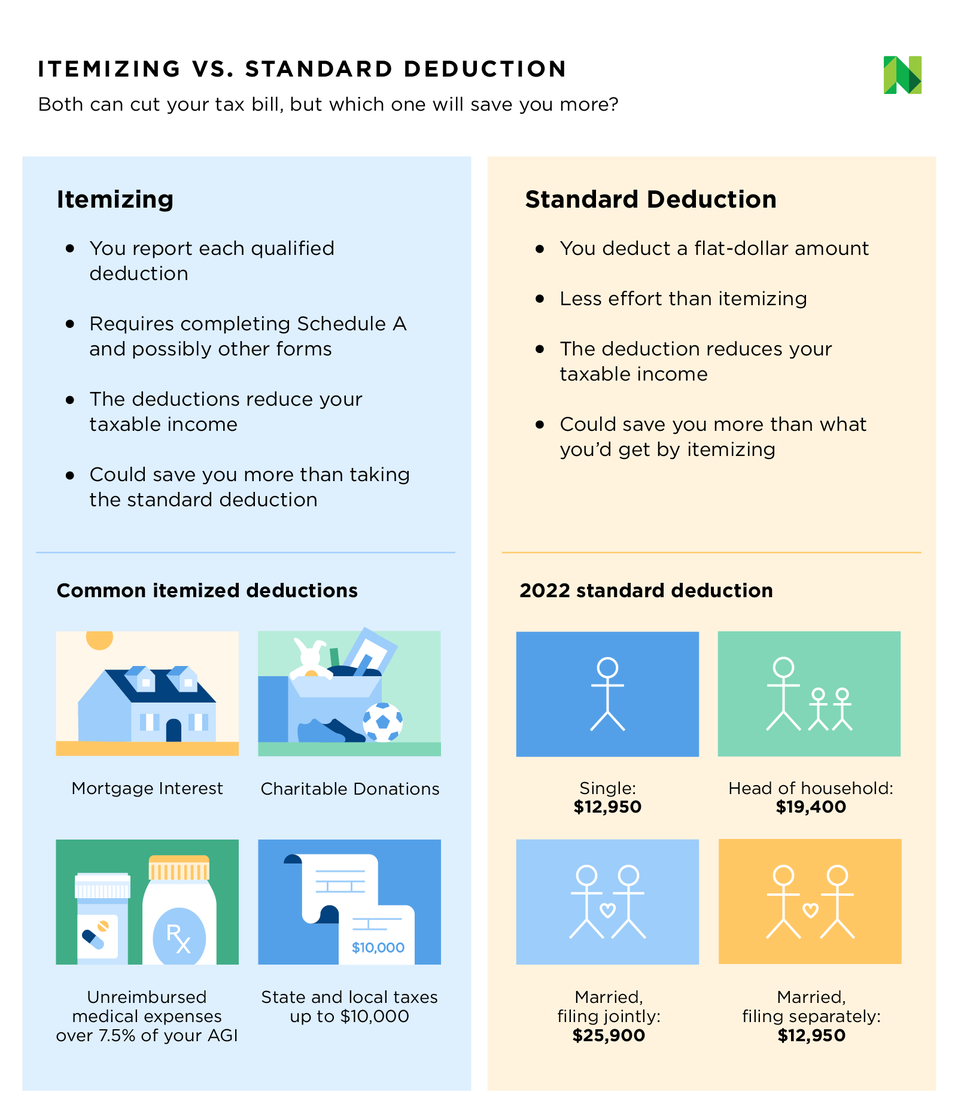

Standard Deduction Vs Itemized Deduction Which Should I Choose Ramsey

Self Employed Tax Deductions Worksheet Db excel

Changes For Claiming A Deduction For Working From Home Expenses

Itemized Deductions Definition Who Should Itemize NerdWallet 2023

https://www.vero.fi/en/individuals/deductions/what-can-I-deduct

When you are a recipient of wage income you are given this deduction automatically The standard amount is 750 The amount cannot be higher than the sum of your wage income per year

https://smartasset.com/taxes/work-from-home-tax-deductions

The 2017 tax reform law ended the ability for most taxpayers to deduct expenses for working from home just in time for millions more people to begin working from in response to the Covid pandemic Nowadays only a few select groups of salaried home based workers can still deduct relevant expenses However even if you re not

When you are a recipient of wage income you are given this deduction automatically The standard amount is 750 The amount cannot be higher than the sum of your wage income per year

The 2017 tax reform law ended the ability for most taxpayers to deduct expenses for working from home just in time for millions more people to begin working from in response to the Covid pandemic Nowadays only a few select groups of salaried home based workers can still deduct relevant expenses However even if you re not

Self Employed Tax Deductions Worksheet Db excel

Can You Take A Tax Deduction For Working From Home Wallpaper

Changes For Claiming A Deduction For Working From Home Expenses

Itemized Deductions Definition Who Should Itemize NerdWallet 2023

Everything About The Work From Home Tax Deduction

Working from home Tax Deduction Extended Into Current Financial Year

Working from home Tax Deduction Extended Into Current Financial Year

10 2014 Itemized Deductions Worksheet Worksheeto