In the digital age, with screens dominating our lives, the charm of tangible printed items hasn't gone away. For educational purposes for creative projects, simply to add an element of personalization to your home, printables for free are a great resource. We'll dive into the world "Can Personal Loan Interest Be Claimed On Taxes," exploring the different types of printables, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Can Personal Loan Interest Be Claimed On Taxes Below

Can Personal Loan Interest Be Claimed On Taxes

Can Personal Loan Interest Be Claimed On Taxes -

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances

Can Personal Loan Interest Be Claimed On Taxes provide a diverse assortment of printable content that can be downloaded from the internet at no cost. They are available in a variety of forms, including worksheets, coloring pages, templates and much more. The beauty of Can Personal Loan Interest Be Claimed On Taxes lies in their versatility and accessibility.

More of Can Personal Loan Interest Be Claimed On Taxes

At What Age Do You Not Have To File Taxes Hutchinson Whentry1987

At What Age Do You Not Have To File Taxes Hutchinson Whentry1987

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more deductions are available regarding home loans for purchasing a permanent dwelling and loans credits and other borrowing related to home repair

Updated on May 9 2023 Written by Eric Reed As a general rule you cannot deduct the interest that you pay on a personal or family loan The IRS considers these standard lending products with the same rules whether you borrow from a family member or the bank However there are some exceptions

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

customization: It is possible to tailor printed materials to meet your requirements, whether it's designing invitations planning your schedule or even decorating your home.

-

Educational Use: Education-related printables at no charge can be used by students of all ages. This makes them an essential device for teachers and parents.

-

An easy way to access HTML0: Quick access to various designs and templates cuts down on time and efforts.

Where to Find more Can Personal Loan Interest Be Claimed On Taxes

Can A Personal Loan Be Used To Consolidate Debt SME Connect

Can A Personal Loan Be Used To Consolidate Debt SME Connect

Loans themselves aren t tax deductible but the interest on them can be Like auto loans and credit cards personal loans don t generally qualify for tax deductible interest payments because a personal loan is typically used for personal reasons and personal expenses are rarely deductible

The IRS allows taxpayers to deduct interest on personal loan funds used for business purposes Personal loans can cover nearly any expense and are generally not considered taxable income

We've now piqued your interest in Can Personal Loan Interest Be Claimed On Taxes Let's look into where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety with Can Personal Loan Interest Be Claimed On Taxes for all goals.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast spectrum of interests, starting from DIY projects to planning a party.

Maximizing Can Personal Loan Interest Be Claimed On Taxes

Here are some innovative ways in order to maximize the use use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets for teaching at-home also in the classes.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Can Personal Loan Interest Be Claimed On Taxes are an abundance of useful and creative resources that meet a variety of needs and interests. Their access and versatility makes these printables a useful addition to the professional and personal lives of both. Explore the vast world of Can Personal Loan Interest Be Claimed On Taxes today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can download and print these files for free.

-

Do I have the right to use free printables for commercial uses?

- It depends on the specific terms of use. Always check the creator's guidelines before using their printables for commercial projects.

-

Are there any copyright violations with Can Personal Loan Interest Be Claimed On Taxes?

- Certain printables may be subject to restrictions on use. Be sure to check these terms and conditions as set out by the author.

-

How can I print Can Personal Loan Interest Be Claimed On Taxes?

- You can print them at home with the printer, or go to any local print store for better quality prints.

-

What program do I need in order to open printables free of charge?

- The majority of printed documents are in the format PDF. This can be opened with free software, such as Adobe Reader.

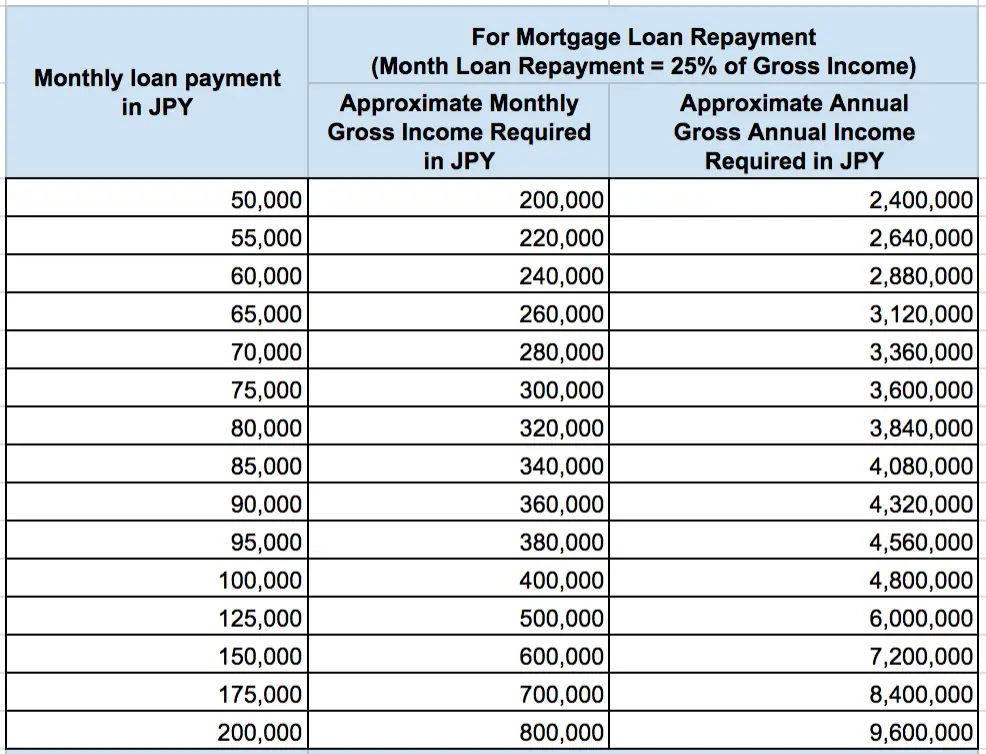

How To Determine Home Loan Amount Based On Income Loans Daily Digest

Can House Cleaning Expenses Be Claimed On Taxes Cleaning Services

Check more sample of Can Personal Loan Interest Be Claimed On Taxes below

SBI Personal Loan Interest Rate 2023 Get Instant Loan For Your Need

A Memorable Experience Memorable Chatter

InCred Personal Loan Interest Rate Processing Fee

Do You Have To Report PayPal Income To IRS On Tax Return MyBankTracker

Can Roof Repairs Be Claimed On Taxes In Ireland

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

https://www.forbes.com/.../are-personal-loans-taxable

Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances

https://cleartax.in/s/tax-benefits-on-personal-loan

No there is no specific tax relief on a personal loan However here are a few scenarios where you may be able to claim tax benefits on a personal loan Home Renovation Home purchase or construction Education Expenses Starting a business

Since personal loans are loans and not income they aren t considered taxable income and therefore you don t need to report them on your income taxes However there are some instances

No there is no specific tax relief on a personal loan However here are a few scenarios where you may be able to claim tax benefits on a personal loan Home Renovation Home purchase or construction Education Expenses Starting a business

Do You Have To Report PayPal Income To IRS On Tax Return MyBankTracker

A Memorable Experience Memorable Chatter

Can Roof Repairs Be Claimed On Taxes In Ireland

Did You Know Moving Expenses Can Be Tax Deductible Find Out If Your

Press Release How To Confirm Your Tax Information To Accept Goods

Tax Deductions Can Lawn Care Costs Be Claimed LawnHelpful

Tax Deductions Can Lawn Care Costs Be Claimed LawnHelpful

Letter Cpa Doc Template PdfFiller