In this age of electronic devices, when screens dominate our lives and the appeal of physical printed material hasn't diminished. Whatever the reason, whether for education such as creative projects or just adding an extra personal touch to your home, printables for free have proven to be a valuable resource. We'll dive to the depths of "Can You Claim 80c Deduction On Under Construction Property," exploring the benefits of them, where they are available, and what they can do to improve different aspects of your daily life.

Get Latest Can You Claim 80c Deduction On Under Construction Property Below

Can You Claim 80c Deduction On Under Construction Property

Can You Claim 80c Deduction On Under Construction Property -

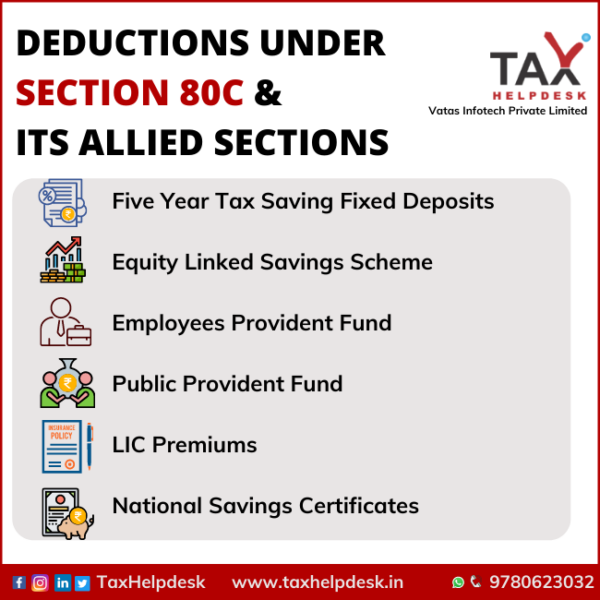

Under Section 80C of the Income Tax Act a borrower can claim tax exemption on the payments made towards stamp duty and registration charges However once again one

Under Construction House Tax Benefits Under Section 80C Since the under construction stage of the house is well defined and no principal amount is owed

Can You Claim 80c Deduction On Under Construction Property provide a diverse assortment of printable documents that can be downloaded online at no cost. They come in many styles, from worksheets to templates, coloring pages, and more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Can You Claim 80c Deduction On Under Construction Property

Tax Information Deductions On Section 80C 80CCC 80CCD

Tax Information Deductions On Section 80C 80CCC 80CCD

Since the property is rented out he can claim the entire interest as a deduction Also prakash can claim a deduction for principal repayment of Rs 1 50 000 Rs 1 68 000 or

Maximum Limit Taxpayers can claim a deduction of up to a maximum of 1 5 lakh per financial year under Section 80C This deduction limit encompasses

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: It is possible to tailor printables to your specific needs whether you're designing invitations planning your schedule or decorating your home.

-

Educational Impact: Education-related printables at no charge cater to learners of all ages, making them an invaluable device for teachers and parents.

-

Accessibility: Fast access numerous designs and templates cuts down on time and efforts.

Where to Find more Can You Claim 80c Deduction On Under Construction Property

80C Deduction

80C Deduction

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCD 1 80CCD 1B 80CCC Find out the deduction under section 80c for FY 2020

Payments made towards the cost of purchase construction of new residential house property during the previous year are eligible for deduction under section 80C The following payments qualify for

After we've peaked your interest in Can You Claim 80c Deduction On Under Construction Property we'll explore the places you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection and Can You Claim 80c Deduction On Under Construction Property for a variety uses.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning tools.

- Great for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs with templates and designs for free.

- The blogs covered cover a wide range of topics, including DIY projects to planning a party.

Maximizing Can You Claim 80c Deduction On Under Construction Property

Here are some ways to make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Print worksheets that are free to reinforce learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable planners with to-do lists, planners, and meal planners.

Conclusion

Can You Claim 80c Deduction On Under Construction Property are an abundance of creative and practical resources which cater to a wide range of needs and passions. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the vast world of Can You Claim 80c Deduction On Under Construction Property right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes you can! You can print and download these items for free.

-

Can I use the free templates for commercial use?

- It's all dependent on the usage guidelines. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Certain printables might have limitations on usage. Be sure to read the terms and condition of use as provided by the creator.

-

How do I print Can You Claim 80c Deduction On Under Construction Property?

- Print them at home with either a printer at home or in a local print shop to purchase better quality prints.

-

What program do I require to view Can You Claim 80c Deduction On Under Construction Property?

- Most PDF-based printables are available with PDF formats, which can be opened using free software like Adobe Reader.

Section 80C Deduction Investment When To Claim

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

Check more sample of Can You Claim 80c Deduction On Under Construction Property below

Stamp Duty And Registration Charges Deduction U s 80C

Section 80C Deduction Under Section 80C In India Paisabazaar

![]()

GST On Under Construction Property Quick Guide InstaFiling

Can I Claim My Daughter s Admission Fee Under Section 80C

80C TO 80U DEDUCTIONS LIST PDF

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

https://tax2win.in/guide/under-construction-property-tax-benefit

Under Construction House Tax Benefits Under Section 80C Since the under construction stage of the house is well defined and no principal amount is owed

https://taxguru.in/income-tax/claim-deduction...

If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C

Under Construction House Tax Benefits Under Section 80C Since the under construction stage of the house is well defined and no principal amount is owed

If the loan is taken jointly then each of the loan holders can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment u s 80C

Can I Claim My Daughter s Admission Fee Under Section 80C

Section 80C Deduction Under Section 80C In India Paisabazaar

80C TO 80U DEDUCTIONS LIST PDF

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

GST On Under Construction Property 2023 Rates India s Leading

Section 80C Deduction New Income Tax Regime Vs Old Tax Regime FY 2022

Section 80C Deduction New Income Tax Regime Vs Old Tax Regime FY 2022

Section 80C Deduction New Income Tax Regime Vs Old Tax Regime FY 2022