Today, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed materials hasn't faded away. Whatever the reason, whether for education and creative work, or just adding an element of personalization to your home, printables for free can be an excellent source. We'll dive deeper into "Can You Claim Interest Paid On Mortgage On Your Taxes," exploring what they are, how to locate them, and ways they can help you improve many aspects of your lives.

Get Latest Can You Claim Interest Paid On Mortgage On Your Taxes Below

Can You Claim Interest Paid On Mortgage On Your Taxes

Can You Claim Interest Paid On Mortgage On Your Taxes -

You can usually deduct the interest you pay on a mortgage for your main home or a second home but there are some restrictions The maximum amount of debt eligible for the deduction was 1 million prior to

You may be wondering whether you can claim a credit for mortgage payments or at least the interest paid on mortgages on your income tax return But the Canada Revenue Agency CRA looks at your

Can You Claim Interest Paid On Mortgage On Your Taxes encompass a wide array of printable material that is available online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages, and many more. One of the advantages of Can You Claim Interest Paid On Mortgage On Your Taxes lies in their versatility and accessibility.

More of Can You Claim Interest Paid On Mortgage On Your Taxes

Homeownership Provides Tax Benefits

Homeownership Provides Tax Benefits

Your mortgage interest is tax deductible if you use your property to generate rental income Come tax time you would use the rental income and expenses line 8710 on Form T776 to claim your rental income according to

You can deduct the interest from your mortgage payments when you file a tax return but only if the loan is secured by your home Also the loan proceeds must have been used to buy build or improve your main home and

Can You Claim Interest Paid On Mortgage On Your Taxes have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

customization They can make printing templates to your own specific requirements when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Use: Educational printables that can be downloaded for free offer a wide range of educational content for learners from all ages, making them a useful instrument for parents and teachers.

-

Accessibility: Instant access to the vast array of design and templates saves time and effort.

Where to Find more Can You Claim Interest Paid On Mortgage On Your Taxes

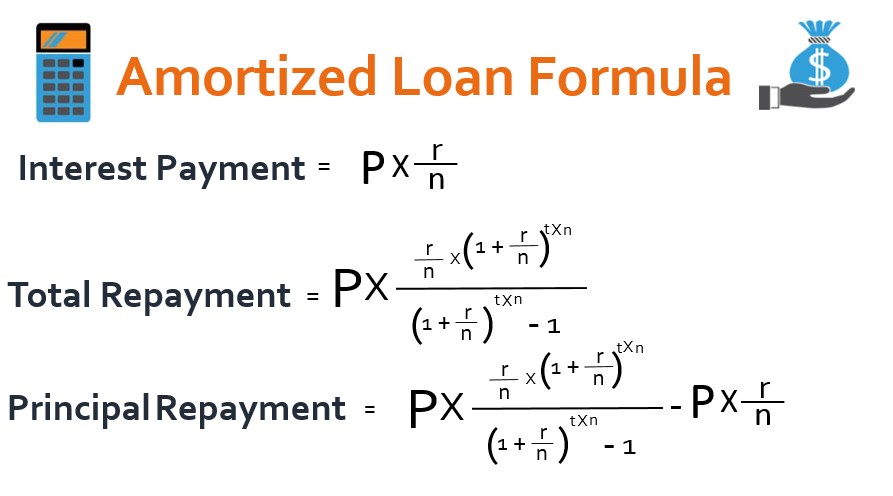

Calculation Time Value Of Money Interest Paid On Mortgage

Calculation Time Value Of Money Interest Paid On Mortgage

For some Canadians that could means claiming the interest paid on mortgage payments But your eligibility for a mortgage interest tax deduction depends on a number of

You can claim a tax deduction for the interest on the first 750 000 of your mortgage 375 000 if married filing separately HELOCs are no longer eligible for the deduction unless the proceeds are used to buy

Now that we've piqued your interest in printables for free Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of Can You Claim Interest Paid On Mortgage On Your Taxes suitable for many motives.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets, flashcards, and learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates, which are free.

- These blogs cover a broad selection of subjects, that includes DIY projects to party planning.

Maximizing Can You Claim Interest Paid On Mortgage On Your Taxes

Here are some unique ways how you could make the most use of Can You Claim Interest Paid On Mortgage On Your Taxes:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use free printable worksheets to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable planners checklists for tasks, as well as meal planners.

Conclusion

Can You Claim Interest Paid On Mortgage On Your Taxes are an abundance of creative and practical resources designed to meet a range of needs and desires. Their accessibility and versatility make them an essential part of any professional or personal life. Explore the vast world of Can You Claim Interest Paid On Mortgage On Your Taxes to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can download and print the resources for free.

-

Can I download free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations on usage. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using either a printer at home or in the local print shops for higher quality prints.

-

What software will I need to access printables free of charge?

- Many printables are offered in the format PDF. This can be opened using free software, such as Adobe Reader.

Michael Saylor Imgflip

How To Calculate The Total Cost Amount Of Interest Paid On Mortgage

Check more sample of Can You Claim Interest Paid On Mortgage On Your Taxes below

Visualizing Total Interest Paid On Mortgage In Every State

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

How To Calculate Interest Rate Repayments Haiper

Claim Interest Paid On Education Loan From The Employer Under Section

How To Calculate Your Monthly Mortgage Payment Given The Principal

How To Calculate Interest On Loan Haiper

https://turbotax.intuit.ca/tips/tax-tip-clai…

You may be wondering whether you can claim a credit for mortgage payments or at least the interest paid on mortgages on your income tax return But the Canada Revenue Agency CRA looks at your

https://www.irs.gov/publications/p936

In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

You may be wondering whether you can claim a credit for mortgage payments or at least the interest paid on mortgages on your income tax return But the Canada Revenue Agency CRA looks at your

In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

Claim Interest Paid On Education Loan From The Employer Under Section

Jennifer Garner Reacts To Ben Affleck Saying Their Divorce Is His

How To Calculate Your Monthly Mortgage Payment Given The Principal

How To Calculate Interest On Loan Haiper

How To Report Interest On A Sole Proprietorship Loan Icsid

How To Calculate Interest Home Loan Haiper

How To Calculate Interest Home Loan Haiper

How To Calculate Interest Rate Based On Interest Amount Haiper