In this digital age, in which screens are the norm yet the appeal of tangible printed material hasn't diminished. Be it for educational use in creative or artistic projects, or simply to add an individual touch to the home, printables for free are now a vital resource. Through this post, we'll dive deeper into "Can You Deduct Interest Paid On Home Loan," exploring the benefits of them, where they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Can You Deduct Interest Paid On Home Loan Below

Can You Deduct Interest Paid On Home Loan

Can You Deduct Interest Paid On Home Loan -

Let s answer some common questions about deducting interest on home equity loans Can I deduct interest on a home equity loan in 2024 According to the Tax Cuts and Jobs Act home equity loan interest is tax

Since you re already at the cap you cannot deduct any interest on a home equity loan Prior to the TCJA you could deduct up to 1 million in home mortgage debt plus 100 000 in home

Can You Deduct Interest Paid On Home Loan encompass a wide range of downloadable, printable items that are available online at no cost. The resources are offered in a variety designs, including worksheets coloring pages, templates and more. The appeal of printables for free lies in their versatility and accessibility.

More of Can You Deduct Interest Paid On Home Loan

MP Finland Faces Corporate Tax catastrophe News Yle Uutiset

MP Finland Faces Corporate Tax catastrophe News Yle Uutiset

In most cases you can deduct all of your home mortgage interest How much you can deduct depends on the date of the mortgage the amount of the mortgage and how you use the mortgage proceeds

In most cases you can deduct your interest How much you can deduct depends on the date of the loan the amount of the loan and how you use the loan proceeds

The Can You Deduct Interest Paid On Home Loan have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: We can customize printables to fit your particular needs such as designing invitations planning your schedule or decorating your home.

-

Educational Use: These Can You Deduct Interest Paid On Home Loan cater to learners of all ages, making them a vital tool for parents and teachers.

-

It's easy: Instant access to the vast array of design and templates is time-saving and saves effort.

Where to Find more Can You Deduct Interest Paid On Home Loan

Can You Deduct Mortgage Interest On A Rental Property

Can You Deduct Mortgage Interest On A Rental Property

Despite provisions in the Tax Cut and Jobs Act TCJA home equity loan interest still may be deductible for some homeowners along with interest on home equity lines of credit HELOCs and

To deduct the interest paid on your home equity loan or your HELOC you ll need to itemize deductions at tax time using IRS Form 1040

After we've peaked your interest in Can You Deduct Interest Paid On Home Loan and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of goals.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets, flashcards, and learning tools.

- Ideal for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing Can You Deduct Interest Paid On Home Loan

Here are some ideas of making the most of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home and in class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Can You Deduct Interest Paid On Home Loan are an abundance of practical and innovative resources that can meet the needs of a variety of people and interests. Their access and versatility makes them a great addition to both professional and personal life. Explore the many options of Can You Deduct Interest Paid On Home Loan right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can print and download these resources at no cost.

-

Can I make use of free printables for commercial purposes?

- It's dependent on the particular rules of usage. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables could have limitations in their usage. Make sure you read the terms and conditions set forth by the author.

-

How can I print printables for free?

- Print them at home using your printer or visit an area print shop for better quality prints.

-

What software must I use to open printables for free?

- The majority of printables are in PDF format. They can be opened with free software, such as Adobe Reader.

Section 80EEA All You Need To Know About Deduction For Interest Paid

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Check more sample of Can You Deduct Interest Paid On Home Loan below

What Is A Tax Deduction with Pictures

Can I Deduct Interest On A Home Equity Loan YouTube

Can You Deduct Interest On A Second Mortgage In California

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

Can You Deduct Mortgage Interest When Your Name Is Not On Title

Can You Deduct Mortgage Interest On A Second Home Sand Hill

.png?format=1500w)

https://www.forbes.com › advisor › ho…

Since you re already at the cap you cannot deduct any interest on a home equity loan Prior to the TCJA you could deduct up to 1 million in home mortgage debt plus 100 000 in home

https://www.irs.gov › faqs › itemized-deductions...

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be deductible

Since you re already at the cap you cannot deduct any interest on a home equity loan Prior to the TCJA you could deduct up to 1 million in home mortgage debt plus 100 000 in home

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be deductible

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

Can I Deduct Interest On A Home Equity Loan YouTube

Can You Deduct Mortgage Interest When Your Name Is Not On Title

.png?format=1500w)

Can You Deduct Mortgage Interest On A Second Home Sand Hill

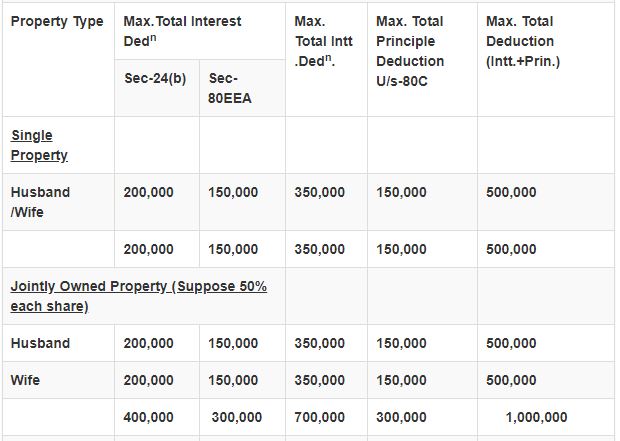

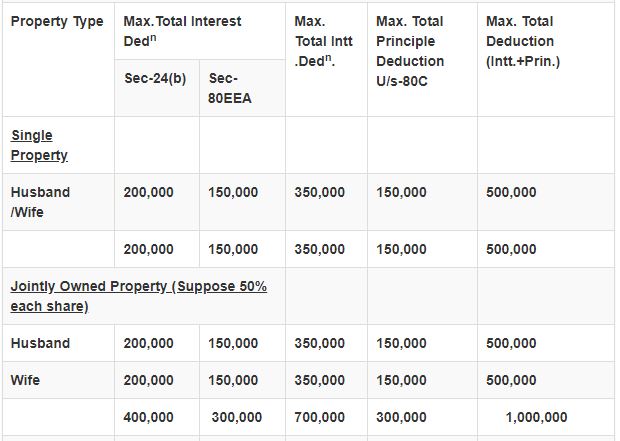

Home Loan Tax Benefits Interest On Home Loan Section 24 And

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Can You Deduct Mortgage Interest On A Second Home MoneyTips