In this age of electronic devices, with screens dominating our lives it's no wonder that the appeal of tangible printed materials isn't diminishing. Be it for educational use in creative or artistic projects, or just adding the personal touch to your home, printables for free have become a valuable source. Through this post, we'll take a dive deep into the realm of "Can You Deduct Mileage And Gas For Business," exploring what they are, where they are, and the ways that they can benefit different aspects of your lives.

Get Latest Can You Deduct Mileage And Gas For Business Below

Can You Deduct Mileage And Gas For Business

Can You Deduct Mileage And Gas For Business -

September 25 2015 Your Guide to Deducting Mileage versus Gas Receipts If you use your vehicle for business purposes you can either deduct the actual cost gas receipts or you can deduct the miles The IRS does not allow you to do both using both methods could result in an audit

Include gas oil repairs tires insurance registration fees licenses and depreciation or lease payments attributable to the portion of the total miles driven that are business miles Note Other car expenses for parking fees and tolls attributable to business use are separately deductible whether you use the standard mileage rate or

Printables for free include a vast assortment of printable content that can be downloaded from the internet at no cost. They are available in a variety of types, such as worksheets templates, coloring pages and more. The appeal of printables for free lies in their versatility and accessibility.

More of Can You Deduct Mileage And Gas For Business

Can You Deduct Gas On Taxes

Can You Deduct Gas On Taxes

You can deduct actual expenses or the standard mileage rate as well as business related tolls and parking fees If you rent a car you can deduct only the business use portion for the expenses Lodging and non entertainment related meals Dry cleaning and laundry Business calls while on your business trip

In short the answer is no The type of deduction method you choose will determine whether or not you can claim gasoline or mileage on your taxes not both If you use the actual expense method which adds up all costs related to the business use of your vehicle then claiming mileage is not an option

Can You Deduct Mileage And Gas For Business have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization: The Customization feature lets you tailor printing templates to your own specific requirements whether it's making invitations and schedules, or even decorating your house.

-

Educational value: Downloads of educational content for free are designed to appeal to students of all ages, making them a great tool for parents and educators.

-

The convenience of You have instant access various designs and templates helps save time and effort.

Where to Find more Can You Deduct Mileage And Gas For Business

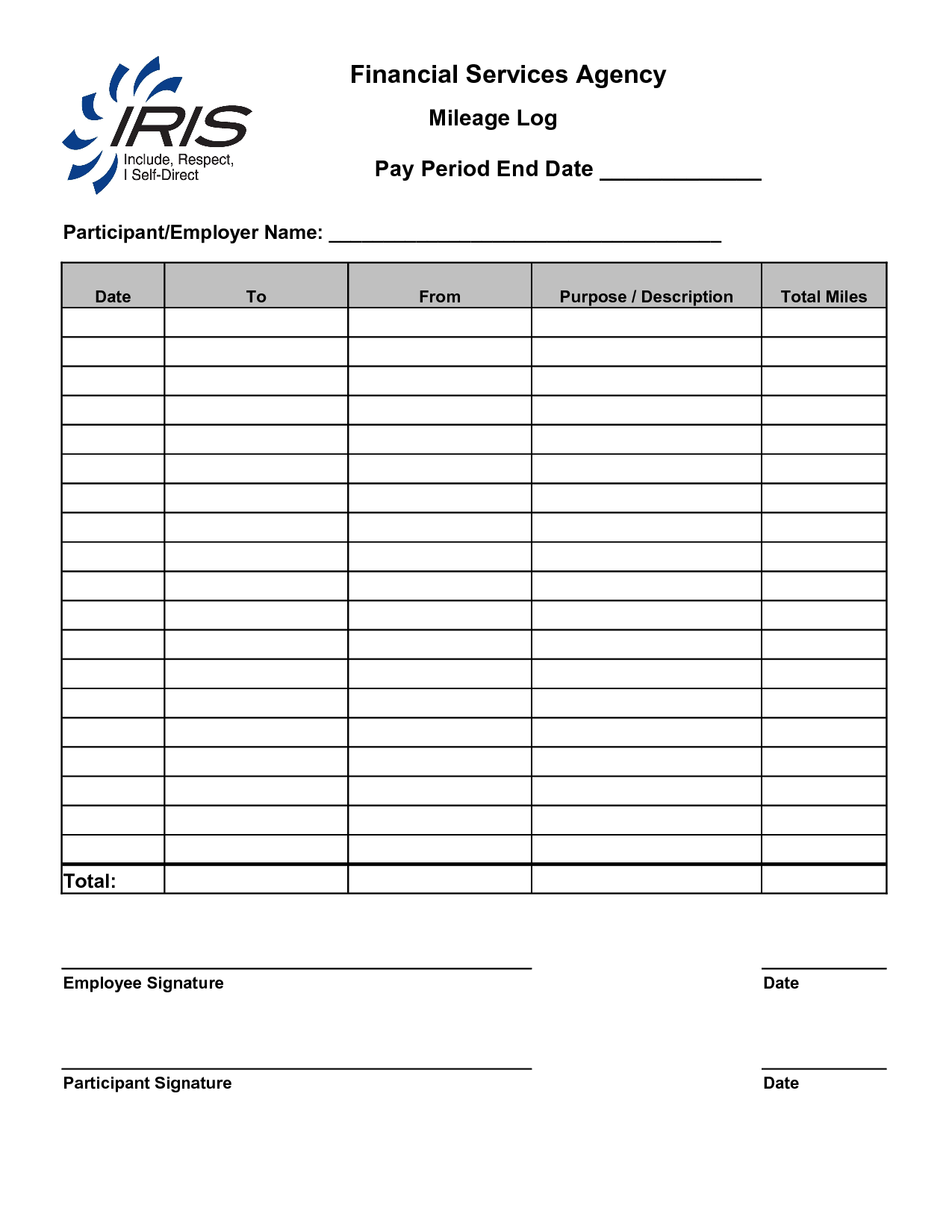

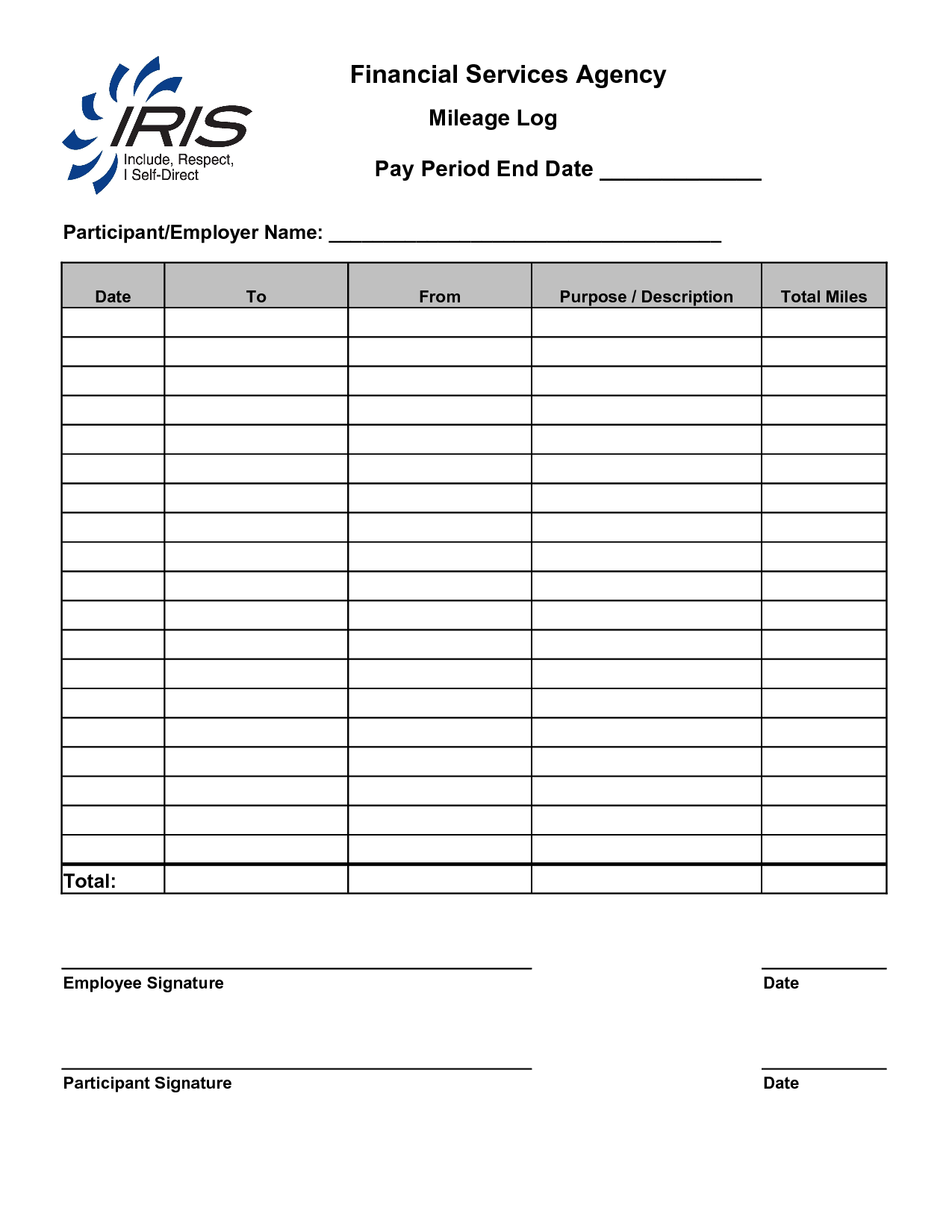

Tax Court Shows Why Real Mileage Logs Are Important CPA Practice Advisor

Tax Court Shows Why Real Mileage Logs Are Important CPA Practice Advisor

You can deduct your vehicle expenses in one of two ways Actual expenses method Using this method you must track all your car expenses including gas oil repairs insurance and depreciation and deduct the portion of your total car expenses that apply to business miles

Mileage reimbursement is tax deductible for employers and independent contractors Additionally it is not considered income to an employee and therefore is nontaxable Read related article

We've now piqued your interest in Can You Deduct Mileage And Gas For Business Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Can You Deduct Mileage And Gas For Business for different purposes.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically provide free printable worksheets, flashcards, and learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide array of topics, ranging all the way from DIY projects to party planning.

Maximizing Can You Deduct Mileage And Gas For Business

Here are some ideas create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Can You Deduct Mileage And Gas For Business are a treasure trove of creative and practical resources which cater to a wide range of needs and preferences. Their accessibility and flexibility make they a beneficial addition to both professional and personal lives. Explore the endless world of printables for free today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes, they are! You can print and download these tools for free.

-

Can I use the free printables for commercial uses?

- It depends on the specific rules of usage. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations regarding their use. Be sure to check the terms and conditions set forth by the author.

-

How do I print Can You Deduct Mileage And Gas For Business?

- Print them at home with the printer, or go to any local print store for the highest quality prints.

-

What software is required to open printables at no cost?

- The majority are printed in PDF format. They is open with no cost programs like Adobe Reader.

Google Sheets Mileage Log Template

The Musician s Guide To Mileage Part 1 Finance For Musicians

Check more sample of Can You Deduct Mileage And Gas For Business below

When Can You Deduct Mileage Peavy And Associates PC

Can You Deduct Your Gas And Oil Expenses If You Use Your Car For

Why Small Business Owners Should Deduct Their Mileage and How To Do It

How You Can Deduct Mileage Driven For Business On Your Tax Return

Can You Deduct Your Gas And Oil Expenses If You Use Your Car For

Download The Business Mileage Tracking Log From Vertex42 Business

https://www.irs.gov/taxtopics/tc510

Include gas oil repairs tires insurance registration fees licenses and depreciation or lease payments attributable to the portion of the total miles driven that are business miles Note Other car expenses for parking fees and tolls attributable to business use are separately deductible whether you use the standard mileage rate or

https://www.thebalancemoney.com/business-mileage...

A You can deduct the actual expenses that you pay and as long as you keep contemporaneous at the time records for these expenses You must have proof that you pay the gas maintenance and insurance and you need substantial records to support your business use

Include gas oil repairs tires insurance registration fees licenses and depreciation or lease payments attributable to the portion of the total miles driven that are business miles Note Other car expenses for parking fees and tolls attributable to business use are separately deductible whether you use the standard mileage rate or

A You can deduct the actual expenses that you pay and as long as you keep contemporaneous at the time records for these expenses You must have proof that you pay the gas maintenance and insurance and you need substantial records to support your business use

How You Can Deduct Mileage Driven For Business On Your Tax Return

Can You Deduct Your Gas And Oil Expenses If You Use Your Car For

Can You Deduct Your Gas And Oil Expenses If You Use Your Car For

Download The Business Mileage Tracking Log From Vertex42 Business

Free Mileage Log Template IRS Compliant Excel PDF

18 Mileage Expense Worksheets Worksheeto

18 Mileage Expense Worksheets Worksheeto

Deduct All Of The Mileage You re Entitled To But Not More Symphona