In the digital age, where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. If it's to aid in education and creative work, or simply adding an extra personal touch to your area, Can You Deduct Mortgage Interest Paid For Someone Else have become an invaluable resource. With this guide, you'll dive in the world of "Can You Deduct Mortgage Interest Paid For Someone Else," exploring what they are, where to find them, and the ways that they can benefit different aspects of your lives.

Get Latest Can You Deduct Mortgage Interest Paid For Someone Else Below

Can You Deduct Mortgage Interest Paid For Someone Else

Can You Deduct Mortgage Interest Paid For Someone Else -

Deducting Mortgage Interest When Your Name Is Not on the Deed Tax law has an amazing break for unconventional homeowners You can deduct your mortgage interest payments

As the homeowner you can deduct the interest from that mortgage payment s That s right Because your name is on the mortgage and you re legally responsible for the debt you can deduct the mortgage interest no

Can You Deduct Mortgage Interest Paid For Someone Else include a broad assortment of printable, downloadable materials available online at no cost. They come in many styles, from worksheets to coloring pages, templates and much more. One of the advantages of Can You Deduct Mortgage Interest Paid For Someone Else is their flexibility and accessibility.

More of Can You Deduct Mortgage Interest Paid For Someone Else

How To Deduct Mortgage Interest InterestProTalk

How To Deduct Mortgage Interest InterestProTalk

No There is no specific mortgage interest deduction unmarried couples can take A general rule of thumb is the person paying the expense gets to take the deduction In your situation each

Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence

Can You Deduct Mortgage Interest Paid For Someone Else have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Customization: There is the possibility of tailoring the design to meet your needs whether you're designing invitations to organize your schedule or even decorating your home.

-

Educational Impact: Downloads of educational content for free provide for students from all ages, making them a valuable tool for teachers and parents.

-

Easy to use: Fast access the vast array of design and templates can save you time and energy.

Where to Find more Can You Deduct Mortgage Interest Paid For Someone Else

Can You Deduct Mortgage Interest On A Rental Property YouTube

Can You Deduct Mortgage Interest On A Rental Property YouTube

In most instances interest can be deducted only by the person or entity that is legally responsible for the debt Therefore an individual who has entered into the financial arrangement described above cannot deduct the interest since he

Deduct home mortgage interest that wasn t reported to you on Form 1098 on Schedule A Form 1040 line 8b If you paid home mortgage interest to the person from whom you bought your home show that person s name address

Since we've got your curiosity about Can You Deduct Mortgage Interest Paid For Someone Else Let's see where you can find these elusive gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Can You Deduct Mortgage Interest Paid For Someone Else to suit a variety of reasons.

- Explore categories like interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free including flashcards, learning materials.

- Perfect for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs are a vast selection of subjects, ranging from DIY projects to planning a party.

Maximizing Can You Deduct Mortgage Interest Paid For Someone Else

Here are some innovative ways how you could make the most of Can You Deduct Mortgage Interest Paid For Someone Else:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use printable worksheets from the internet for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Can You Deduct Mortgage Interest Paid For Someone Else are an abundance with useful and creative ideas that meet a variety of needs and pursuits. Their access and versatility makes them an invaluable addition to your professional and personal life. Explore the endless world that is Can You Deduct Mortgage Interest Paid For Someone Else today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Can You Deduct Mortgage Interest Paid For Someone Else really completely free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free printouts for commercial usage?

- It's contingent upon the specific conditions of use. Be sure to read the rules of the creator before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables may contain restrictions on usage. You should read the terms and conditions offered by the author.

-

How can I print Can You Deduct Mortgage Interest Paid For Someone Else?

- You can print them at home using your printer or visit a print shop in your area for higher quality prints.

-

What software is required to open Can You Deduct Mortgage Interest Paid For Someone Else?

- Most printables come in PDF format. They can be opened using free programs like Adobe Reader.

Deduct Mortgage Interest Conner Ash

48 Can I Deduct Mortgage Interest On A Second Home WendaMathias

Check more sample of Can You Deduct Mortgage Interest Paid For Someone Else below

How To Deduct Mortgage Interest What Qualifies And How To File

Can You Deduct Mortgage Interest 2019 YouTube

Can You Deduct Mortgage Interest On Investment Property Commercial

Can I Deduct Mortgage Interest TurboTax Support Video YouTube

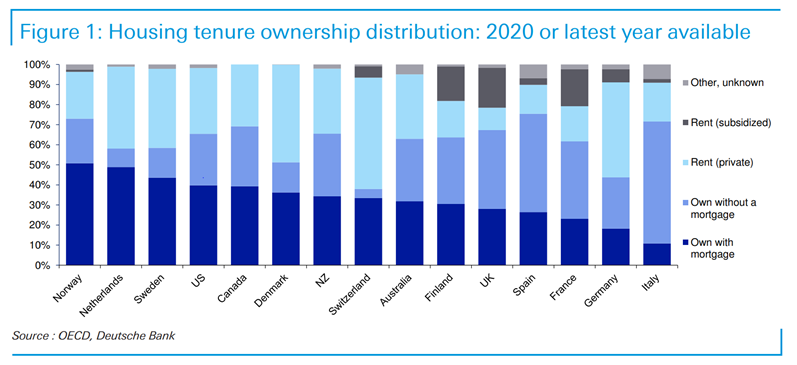

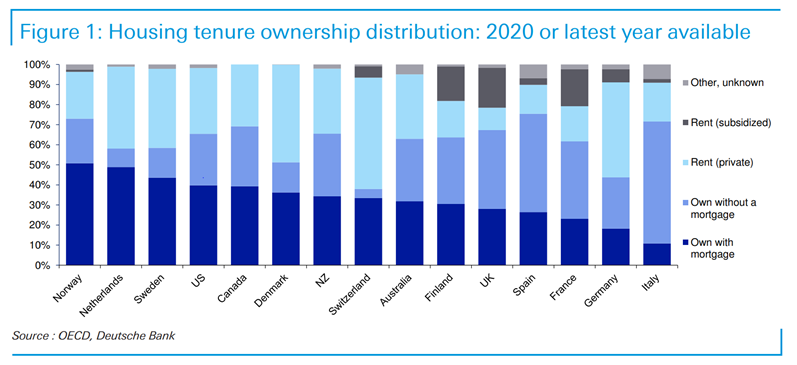

Dominika Langenmayr On Twitter Guess Which Country Allows You To

Can You Deduct Mortgage Interest When Your Name Is Not On Title

https://moneytips.com/mortgages/mana…

As the homeowner you can deduct the interest from that mortgage payment s That s right Because your name is on the mortgage and you re legally responsible for the debt you can deduct the mortgage interest no

https://www.weekand.com/home-garden/article/can...

If someone is paying your home s mortgage for you and you re not living in the home you could consider rewarding that person For example if your mortgage is paid by

As the homeowner you can deduct the interest from that mortgage payment s That s right Because your name is on the mortgage and you re legally responsible for the debt you can deduct the mortgage interest no

If someone is paying your home s mortgage for you and you re not living in the home you could consider rewarding that person For example if your mortgage is paid by

Can I Deduct Mortgage Interest TurboTax Support Video YouTube

Can You Deduct Mortgage Interest 2019 YouTube

Dominika Langenmayr On Twitter Guess Which Country Allows You To

Can You Deduct Mortgage Interest When Your Name Is Not On Title

Can You Deduct Mortgage Payments From Rental Income For Tax

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

Can You Deduct Your RV Travel Trailer Or Boat Mortgage Interest On

TaxAudit You Can Deduct Mortgage Interest Maybe Sweet Captcha