In this age of technology, where screens rule our lives and the appeal of physical printed objects hasn't waned. For educational purposes as well as creative projects or simply adding an individual touch to the space, Can You Take The Residential Energy Credit On A Second Home have become a valuable source. This article will take a dive deep into the realm of "Can You Take The Residential Energy Credit On A Second Home," exploring the benefits of them, where they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Can You Take The Residential Energy Credit On A Second Home Below

Can You Take The Residential Energy Credit On A Second Home

Can You Take The Residential Energy Credit On A Second Home -

Qualifying clean energy purchases like new solar panels for a taxpayer s residence can qualify them for the Residential Clean Energy Credit What are the 2 home energy tax

You can claim the credit for solar wind and geothermal equipment installed in your principal residence as well as any other home you use as a residence Fuel cell equipment qualifies for the credit only if it is

Can You Take The Residential Energy Credit On A Second Home encompass a wide variety of printable, downloadable material that is available online at no cost. These materials come in a variety of types, like worksheets, templates, coloring pages and more. One of the advantages of Can You Take The Residential Energy Credit On A Second Home is in their versatility and accessibility.

More of Can You Take The Residential Energy Credit On A Second Home

The 10 000 Hour Rule

The 10 000 Hour Rule

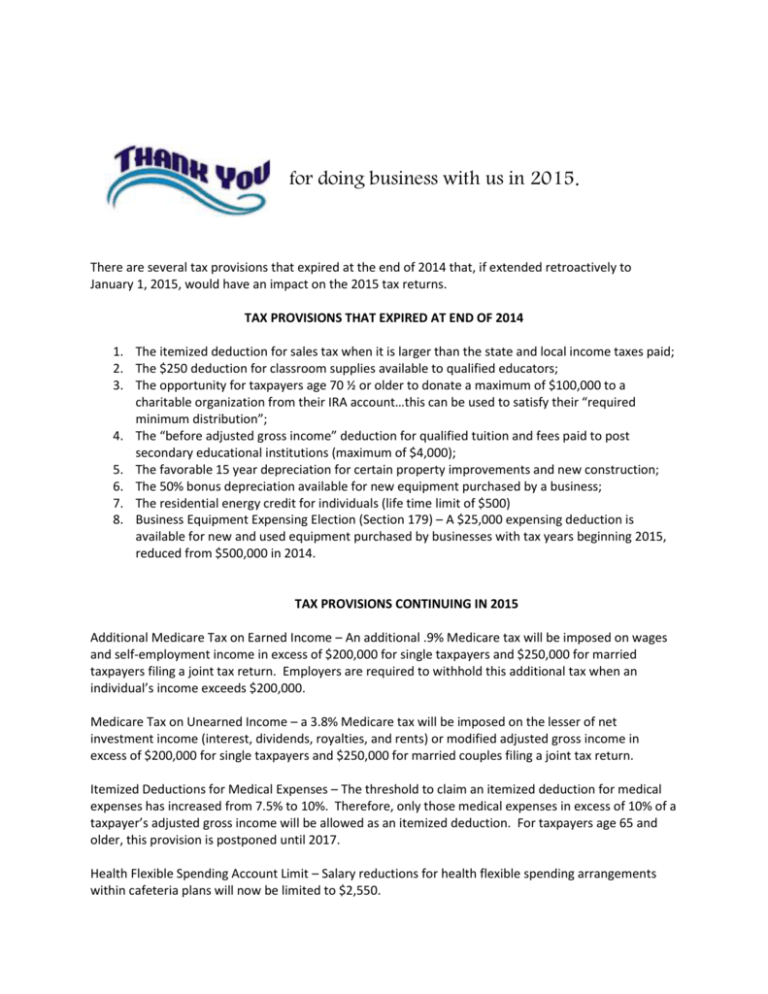

The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement credit The following discussion applies to qualifying

Q4 May a taxpayer carry forward unused credits to another tax year added December 22 2022 A4 The rules vary by credit Under the Energy Efficient Home

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

customization: The Customization feature lets you tailor printed materials to meet your requirements whether it's making invitations making your schedule, or decorating your home.

-

Educational Benefits: Downloads of educational content for free cater to learners of all ages, making them a great resource for educators and parents.

-

An easy way to access HTML0: immediate access a variety of designs and templates, which saves time as well as effort.

Where to Find more Can You Take The Residential Energy Credit On A Second Home

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

Y ou can claim the Residential Energy Efficiency Property Credit for solar wind and geothermal equipment in both your principal residence and a second home But fuel cell

Here s the IRS form you can use to claim a home energy tax credit Form 5965 Residential Energy Credits File this form with an itemized list of your purchases to claim the tax credit for your eco friendly investments in the tax year they re

Since we've got your curiosity about Can You Take The Residential Energy Credit On A Second Home and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Can You Take The Residential Energy Credit On A Second Home for all goals.

- Explore categories such as decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free including flashcards, learning materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs are a vast range of topics, including DIY projects to party planning.

Maximizing Can You Take The Residential Energy Credit On A Second Home

Here are some creative ways of making the most of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets for teaching at-home also in the classes.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Can You Take The Residential Energy Credit On A Second Home are a treasure trove with useful and creative ideas that cater to various needs and preferences. Their accessibility and versatility make them an essential part of the professional and personal lives of both. Explore the world of Can You Take The Residential Energy Credit On A Second Home and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes, they are! You can download and print these files for free.

-

Can I use free templates for commercial use?

- It's determined by the specific rules of usage. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download Can You Take The Residential Energy Credit On A Second Home?

- Certain printables may be subject to restrictions concerning their use. Be sure to check the terms and conditions set forth by the designer.

-

How do I print Can You Take The Residential Energy Credit On A Second Home?

- You can print them at home using your printer or visit an in-store print shop to get top quality prints.

-

What program do I need to run Can You Take The Residential Energy Credit On A Second Home?

- The majority of printables are in the PDF format, and can be opened using free software such as Adobe Reader.

Hecht Group How Much Money Do You Need For A Down Payment On A

Can You Deduct Mortgage Interest On A Second Home Sand Hill

.png?format=1500w)

Check more sample of Can You Take The Residential Energy Credit On A Second Home below

Stamp Duty On A Second Home Your Guide

Tax Changes For 2023 National Institute Of Transition Planning Inc

2015 Tax Tables Merskin Merskin

How To Avoid Stamp Duty On Second Home Accounting Firms

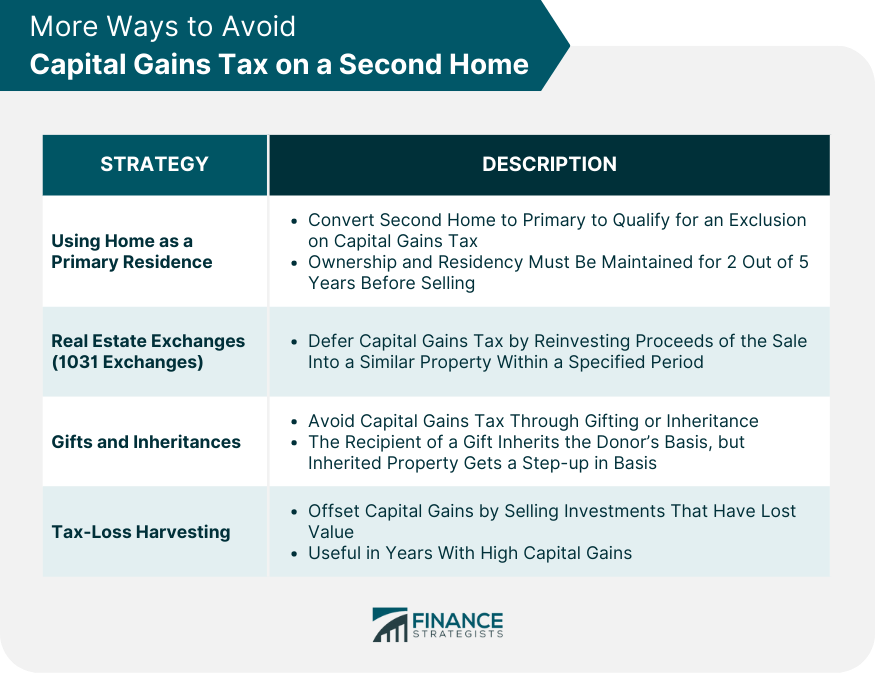

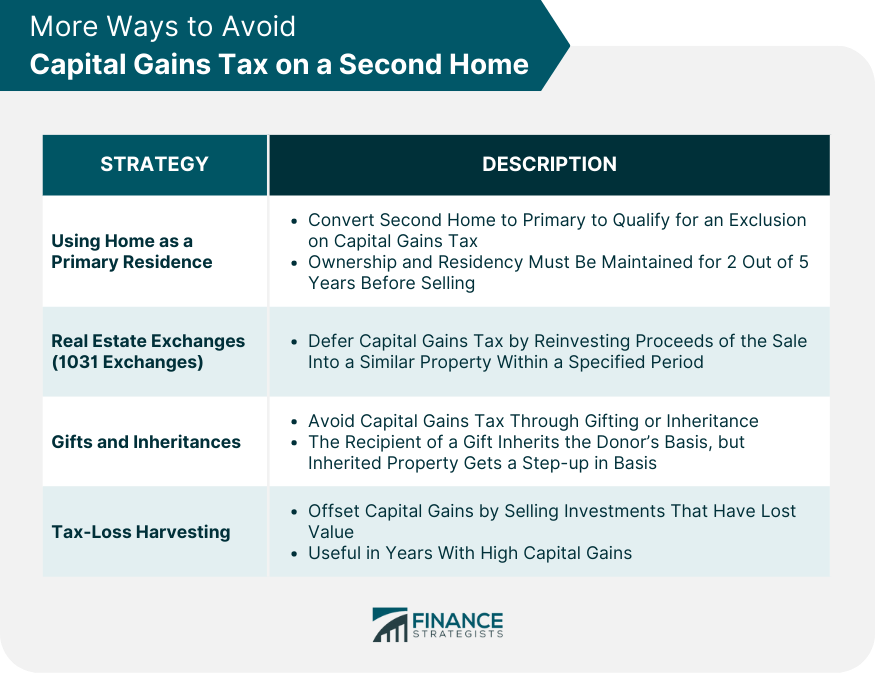

How To Avoid Capital Gains Tax On A Second Home

Is Crypto Taxed As Capital Gains Exploring The Basics Of

https://turbotax.intuit.com › tax-tips › h…

You can claim the credit for solar wind and geothermal equipment installed in your principal residence as well as any other home you use as a residence Fuel cell equipment qualifies for the credit only if it is

https://tax.thomsonreuters.com › blog › …

Use Form 5695 to figure and take the residential energy efficient property credit IRC Sec 179D provides an accelerated cost recovery deduction for energy efficient commercial building EECB property for the year placed in

You can claim the credit for solar wind and geothermal equipment installed in your principal residence as well as any other home you use as a residence Fuel cell equipment qualifies for the credit only if it is

Use Form 5695 to figure and take the residential energy efficient property credit IRC Sec 179D provides an accelerated cost recovery deduction for energy efficient commercial building EECB property for the year placed in

How To Avoid Stamp Duty On Second Home Accounting Firms

Tax Changes For 2023 National Institute Of Transition Planning Inc

How To Avoid Capital Gains Tax On A Second Home

Is Crypto Taxed As Capital Gains Exploring The Basics Of

Residential Clean Energy Credit Limit Worksheet 2022 Printable Word

Claim Energy Credit Dreameddesigned

Claim Energy Credit Dreameddesigned

Inflation Reduction Act Of 2022 Part 1 MPC Certified Public Accountants