In this digital age, where screens have become the dominant feature of our lives but the value of tangible printed materials isn't diminishing. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding some personal flair to your area, Child Care Rebate In Tax Return have become a valuable source. For this piece, we'll take a dive into the world "Child Care Rebate In Tax Return," exploring the different types of printables, where to find them, and what they can do to improve different aspects of your life.

Get Latest Child Care Rebate In Tax Return Below

Child Care Rebate In Tax Return

Child Care Rebate In Tax Return - Child Care Benefit In Tax Return, Child Care Rebate Tax Return, How Much Do You Get Back In Taxes For Child Care, How Much Rebate For Child Care

Web 13 janv 2022 nbsp 0183 32 For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from

Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care Subsidy

Printables for free cover a broad array of printable material that is available online at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages, and many more. The appealingness of Child Care Rebate In Tax Return is in their variety and accessibility.

More of Child Care Rebate In Tax Return

Child Care Rebate Income Tax Return 2022 Carrebate

Child Care Rebate Income Tax Return 2022 Carrebate

Web 19 ao 251 t 2022 nbsp 0183 32 To receive this payment you must Have a dependent child or full time secondary school student from 16 19 who isn t receiving a pension payment or benefit

Web 12 f 233 vr 2022 nbsp 0183 32 What does that mean In brief for the 2021 tax year you could get up to 4 000 back for one child and 8 000 back for care of two or more In prior years the

Child Care Rebate In Tax Return have garnered immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

customization There is the possibility of tailoring the templates to meet your individual needs whether you're designing invitations making your schedule, or even decorating your house.

-

Educational Worth: Downloads of educational content for free can be used by students of all ages, which makes them an invaluable resource for educators and parents.

-

Affordability: Instant access to a plethora of designs and templates saves time and effort.

Where to Find more Child Care Rebate In Tax Return

Childcare Tax Rebate Google Docs

Childcare Tax Rebate Google Docs

Web 2 d 233 c 2022 nbsp 0183 32 If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of up to 35 percent of qualifying expenses of 3 000 1 050 for one child or dependent or up to 6 000 2 100 for two or more children or dependents

Web 29 mai 2023 nbsp 0183 32 For 2022 this credit is worth up to 20 to 35 of up to 3 000 of child care or similar costs for a child under 13 or up to 6 000 for 2 or more dependents The exact

We hope we've stimulated your curiosity about Child Care Rebate In Tax Return We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Child Care Rebate In Tax Return for a variety reasons.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing including flashcards, learning materials.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- These blogs cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Child Care Rebate In Tax Return

Here are some new ways create the maximum value use of Child Care Rebate In Tax Return:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets from the internet to build your knowledge at home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Child Care Rebate In Tax Return are a treasure trove of practical and innovative resources for a variety of needs and preferences. Their access and versatility makes them an invaluable addition to any professional or personal life. Explore the plethora that is Child Care Rebate In Tax Return today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really completely free?

- Yes, they are! You can download and print these items for free.

-

Are there any free printables for commercial purposes?

- It's all dependent on the usage guidelines. Always consult the author's guidelines before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations regarding their use. You should read these terms and conditions as set out by the author.

-

How can I print printables for free?

- Print them at home with any printer or head to a print shop in your area for superior prints.

-

What program is required to open printables at no cost?

- Most printables come with PDF formats, which can be opened with free software like Adobe Reader.

Child Care Rebate Income Tax Return 2022 Carrebate

Child Care Expenses Tax Credit Colorado Free Download

Check more sample of Child Care Rebate In Tax Return below

Child Care Expenses Tax Credit Colorado Free Download

Form For Daycare Tax Fill Online Printable Fillable Blank PdfFiller

Child Care Rebate Tax Brackets 2023 Carrebate

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

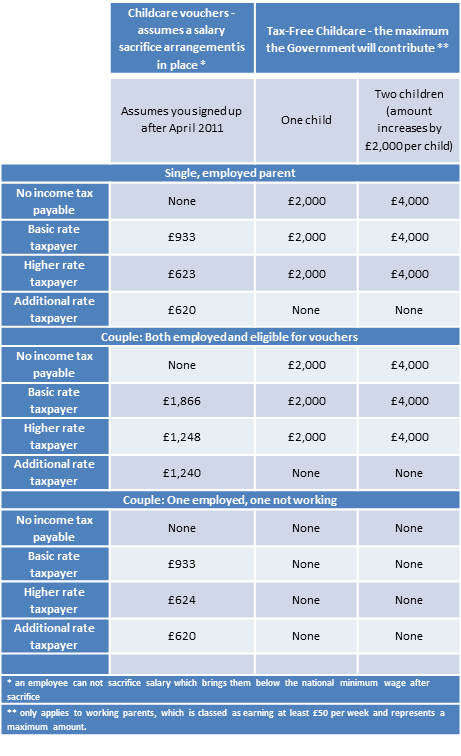

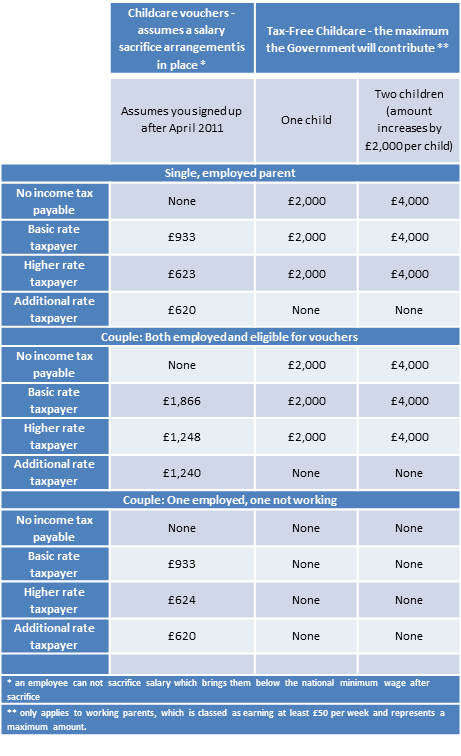

New Tax free Childcare Is It The End Of Salary Sacrifice For

https://www.servicesaustralia.gov.au/balancing-child-care-subsidy

Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care Subsidy

https://www.irs.gov/newsroom/understanding-the-child-and-dependent...

Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

Web If you got Family Tax Benefit or Child Care Subsidy and you or your partner are not required to lodge a tax return you need to tell us When we balance your Child Care Subsidy

Web 2 mars 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Form For Daycare Tax Fill Online Printable Fillable Blank PdfFiller

Child Care Tax Rebate Payment Dates 2022 2023 Carrebate

New Tax free Childcare Is It The End Of Salary Sacrifice For

New Child Care Rebate Calculator 2023 Carrebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Pin On Childcare Providers