In the digital age, where screens rule our lives and the appeal of physical printed materials isn't diminishing. Be it for educational use and creative work, or just adding the personal touch to your area, Child Care Tax Credit Calculator 2023 have become a valuable source. Here, we'll take a dive in the world of "Child Care Tax Credit Calculator 2023," exploring their purpose, where you can find them, and how they can add value to various aspects of your life.

Get Latest Child Care Tax Credit Calculator 2023 Below

Child Care Tax Credit Calculator 2023

Child Care Tax Credit Calculator 2023 -

Verkko 2023 ChildDependent CareCredit The Child and Dependent Care Calculator or CAREucator is for tax year 2023 and is being updated Visit this page for the 2022 Child Care Calculator Additional 2023 Tax Calculators 2023 Tax Returns are due April 15 2024 and can be e filed until October 2024

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

Child Care Tax Credit Calculator 2023 include a broad array of printable materials online, at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and more. The attraction of printables that are free lies in their versatility and accessibility.

More of Child Care Tax Credit Calculator 2023

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

Verkko Attention This Child Tax Credit Calculator is for tax year 2023 and is being updated as information becomes available This CHILDucator will let you know if you qualify for the Child Tax Credit and or the Other Dependent Tax Credit on your 2023 Tax Return the amounts are also included

Verkko 16 lokak 2023 nbsp 0183 32 Total Employer Taxes 2 476 50 Total Cost before tax breaks 31 476 50 Since both parents work full time and their children are under 13 years of age they qualify for the Child Care Tax Credit Their income level translates to a 20 tax credit which they can take on 6 000 of their child care expenses

Child Care Tax Credit Calculator 2023 have gained a lot of popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

customization It is possible to tailor print-ready templates to your specific requirements when it comes to designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Impact: The free educational worksheets cater to learners of all ages. This makes them an essential tool for parents and educators.

-

Affordability: instant access an array of designs and templates helps save time and effort.

Where to Find more Child Care Tax Credit Calculator 2023

Tax Year 2021 Dependent Tax Credits And Deductions PriorTax Blog

Tax Year 2021 Dependent Tax Credits And Deductions PriorTax Blog

Verkko 30 tammik 2023 nbsp 0183 32 Finally if you have more than one child you could max out your Dependent Care FSA of 5 000 and still have 1 000 left to utilize the Dependent Care Tax Credit Next Steps

Verkko The Additional Child Tax Credit or ACTC up to 1 500 for qualifying individuals 1 600 for 2023 and 1 700 in 2024 The CTC and ODC are non refundable tax credits and the ACTC is a refundable tax credit that can be claimed on your next tax return

We've now piqued your interest in Child Care Tax Credit Calculator 2023 and other printables, let's discover where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Child Care Tax Credit Calculator 2023 designed for a variety motives.

- Explore categories like home decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching materials.

- Perfect for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a broad array of topics, ranging everything from DIY projects to planning a party.

Maximizing Child Care Tax Credit Calculator 2023

Here are some innovative ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Child Care Tax Credit Calculator 2023 are an abundance filled with creative and practical information designed to meet a range of needs and desires. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the vast world of Child Care Tax Credit Calculator 2023 today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes, they are! You can download and print the resources for free.

-

Can I make use of free printables for commercial use?

- It's determined by the specific usage guidelines. Always verify the guidelines provided by the creator before using printables for commercial projects.

-

Do you have any copyright issues with Child Care Tax Credit Calculator 2023?

- Certain printables could be restricted regarding usage. Be sure to review the conditions and terms of use provided by the creator.

-

How can I print Child Care Tax Credit Calculator 2023?

- Print them at home with printing equipment or visit the local print shops for the highest quality prints.

-

What software do I require to open printables at no cost?

- The majority of printed documents are in PDF format, which can be opened using free software like Adobe Reader.

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

Child Care Tax Credit Dates Librus

Check more sample of Child Care Tax Credit Calculator 2023 below

Government Announces New Child Care Tax Credit North Bay News

What Is The Child Care Tax Credit And How Do You Claim It

Earned Income Credit 2022 Calculator INCOMEBAU

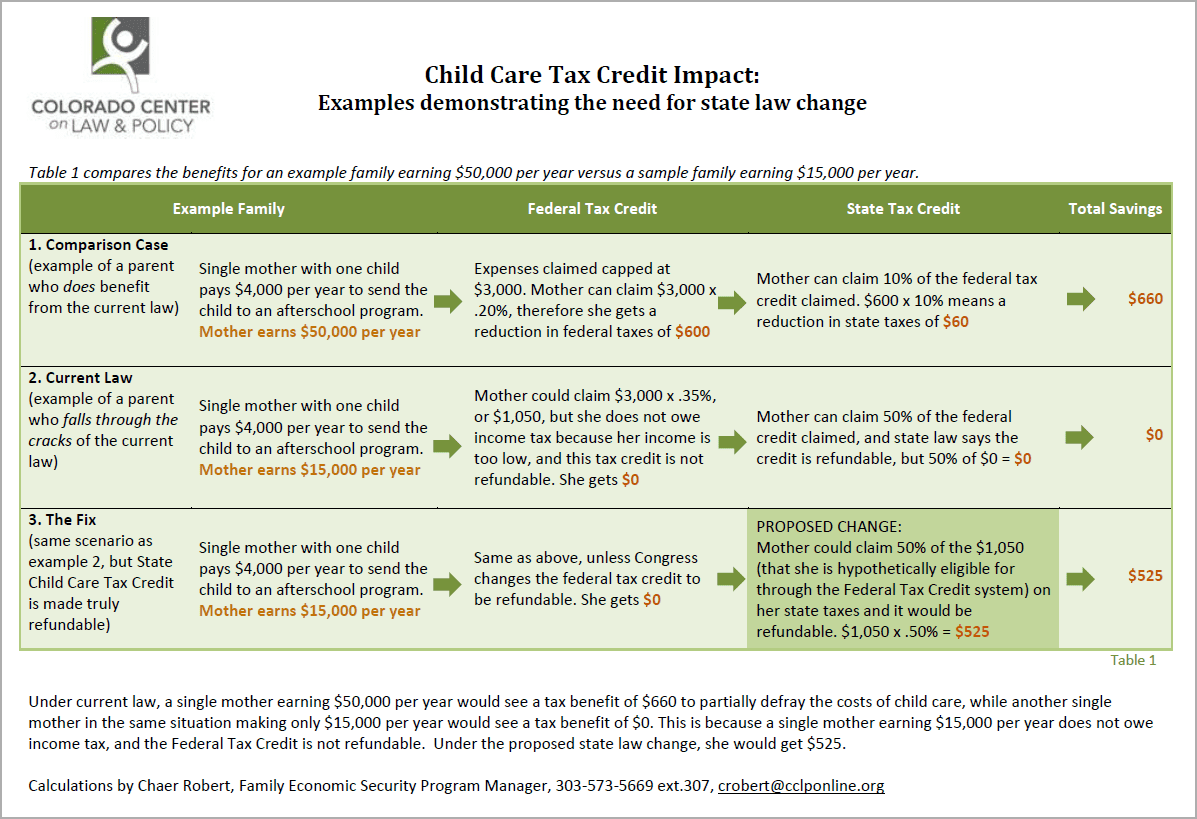

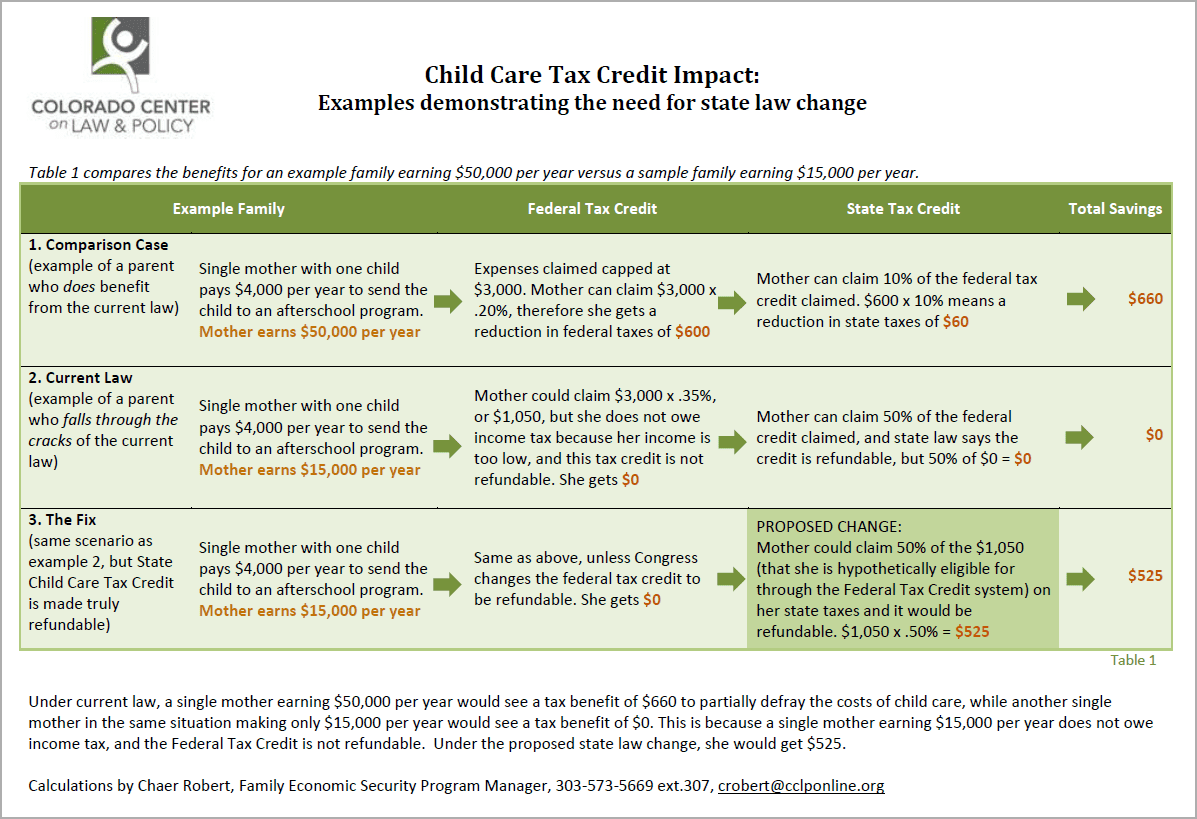

Fixing The Child Care Tax Credit EOPRTF CCLP

Child Tax Credits Calculator CALCULATORUK HJW

Credit Calculators

https://www.nerdwallet.com/.../taxes/child-and-dependent-care-tax-credit

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

https://internettaxconnection.com/try

Verkko 15 lokak 2023 nbsp 0183 32 The child tax credit is a credit that can reduce your Federal tax bill by up to 2 000 for every qualifying child The child tax credit calculator will show you exactly how much you can claim this year It s combined with a dependent s calculator so you can also add other dependents in your household

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the maximum

Verkko 15 lokak 2023 nbsp 0183 32 The child tax credit is a credit that can reduce your Federal tax bill by up to 2 000 for every qualifying child The child tax credit calculator will show you exactly how much you can claim this year It s combined with a dependent s calculator so you can also add other dependents in your household

Fixing The Child Care Tax Credit EOPRTF CCLP

What Is The Child Care Tax Credit And How Do You Claim It

Child Tax Credits Calculator CALCULATORUK HJW

Credit Calculators

Bipartisan Bill To Improve Child Care Tax Credit Introduced In Senate

Child Care Tax Credit Calculator Slobodnakultura

Child Care Tax Credit Calculator Slobodnakultura

Understanding The Child Care Tax Credit What Kinds Of Expenses Qualify